Question

Required information [The following information applies to the questions displayed below.] Marks Consulting experienced the following transactions for 2018, its first year of operations, and

Required information

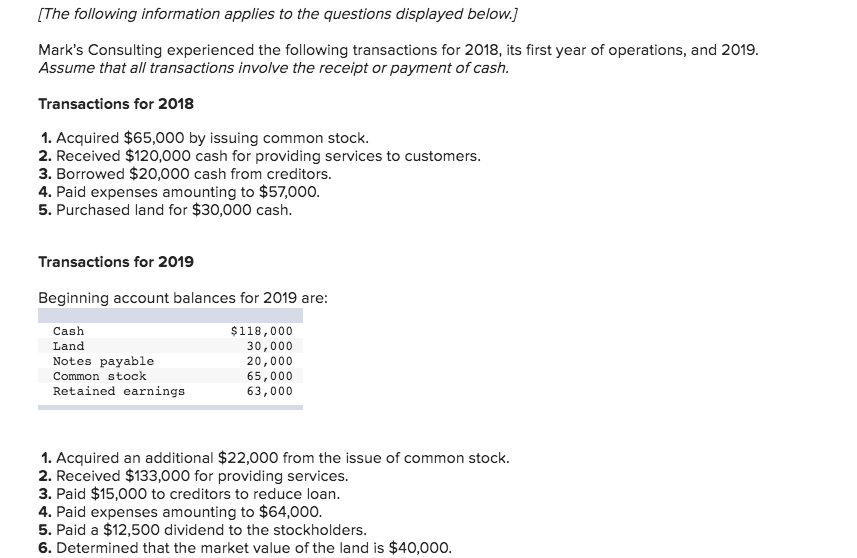

[The following information applies to the questions displayed below.] Marks Consulting experienced the following transactions for 2018, its first year of operations, and 2019. Assume that all transactions involve the receipt or payment of cash. Transactions for 2018

-

Acquired $65,000 by issuing common stock.

-

Received $120,000 cash for providing services to customers.

-

Borrowed $20,000 cash from creditors.

-

Paid expenses amounting to $57,000.

-

Purchased land for $30,000 cash.

Transactions for 2019 Beginning account balances for 2019 are:

| Cash | $ | 118,000 | |

| Land | 30,000 | ||

| Notes payable | 20,000 | ||

| Common stock | 65,000 | ||

| Retained earnings | 63,000 | ||

-

Acquired an additional $22,000 from the issue of common stock.

-

Received $133,000 for providing services.

-

Paid $15,000 to creditors to reduce loan.

-

Paid expenses amounting to $64,000.

-

Paid a $12,500 dividend to the stockholders.

-

Determined that the market value of the land is $40,000.

Required

-

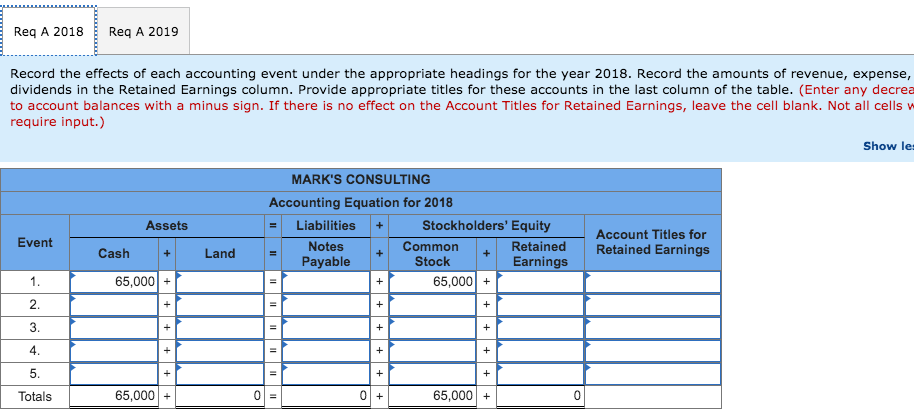

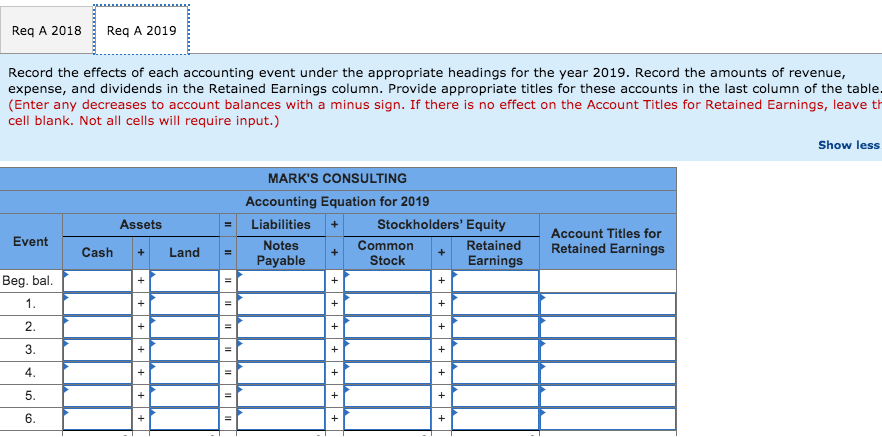

Record the effects of each accounting event under the appropriate headings for each year. Record the amounts of revenue, expense, and dividends in the Retained Earnings column. Provide appropriate titles for these accounts in the last column of the table.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started