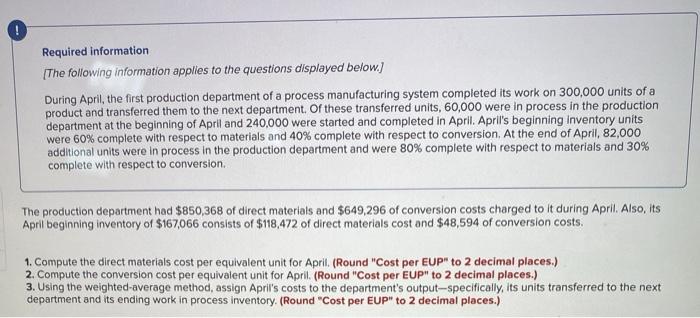

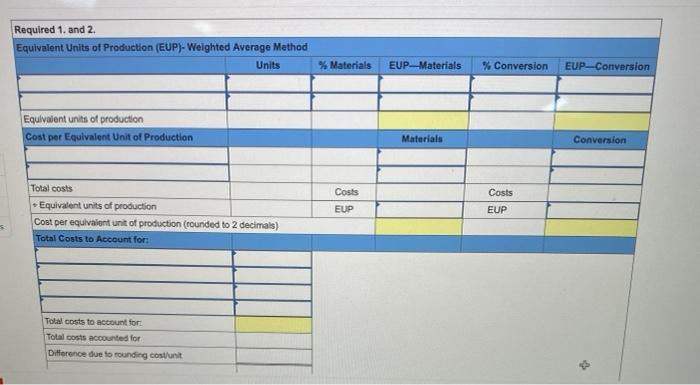

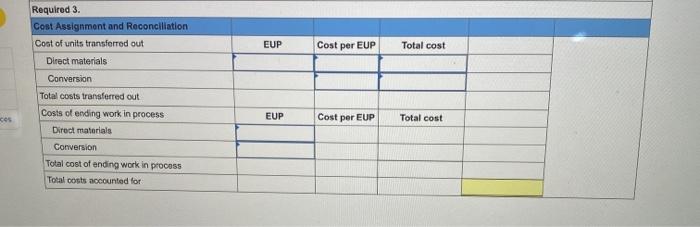

Required information [The following information applies to the questions displayed below.) During April, the first production department of a process manufacturing system completed its work on 300,000 units of a product and transferred them to the next department of these transferred units, 60,000 were in process in the production department at the beginning of April and 240,000 were started and completed in April. April's beginning inventory units were 60% complete with respect to materials and 40% complete with respect to conversion. At the end of April, 82,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion The production department had $850,368 of direct materials and $649,296 of conversion costs charged to it during April. Also, its April beginning inventory of $167,066 consists of $118,472 of direct materials cost and $48,594 of conversion costs. 1. Compute the direct materials cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) 2. Compute the conversion cost per equivalent unit for April. (Round "Cost per EUP" to 2 decimal places.) 3. Using the weighted-average method, assign April's costs to the department's output-specifically, its units transferred to the next department and its ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Required 1 and 2 Equivalent Units of Production (EUP)-Weighted Average Method Units % Materials EUP Materials % Conversion EUP-Conversion Equivalent units of production Cost per Equivalent Unit of Production Materials Conversion Costs EUP Costs EUP Total costs - Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total Costs to Account for: Total costs to account for: Total costs accounted for Difference due to rounding costruit Required 3. Cost Assignment and Reconciliation Cost of units transferred out Direct materials Conversion EUP Cost per EUP Total cost cos EUP Cost per EUP Total cost Total costs transferred out Costs of ending work in process Direct materials Conversion Total cost of ending work in process Total costs accounted for