Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following Information applies to the questions displayed below) Reba Dixon is a fifth-grade school teacher who earned o salary of $38.400 in

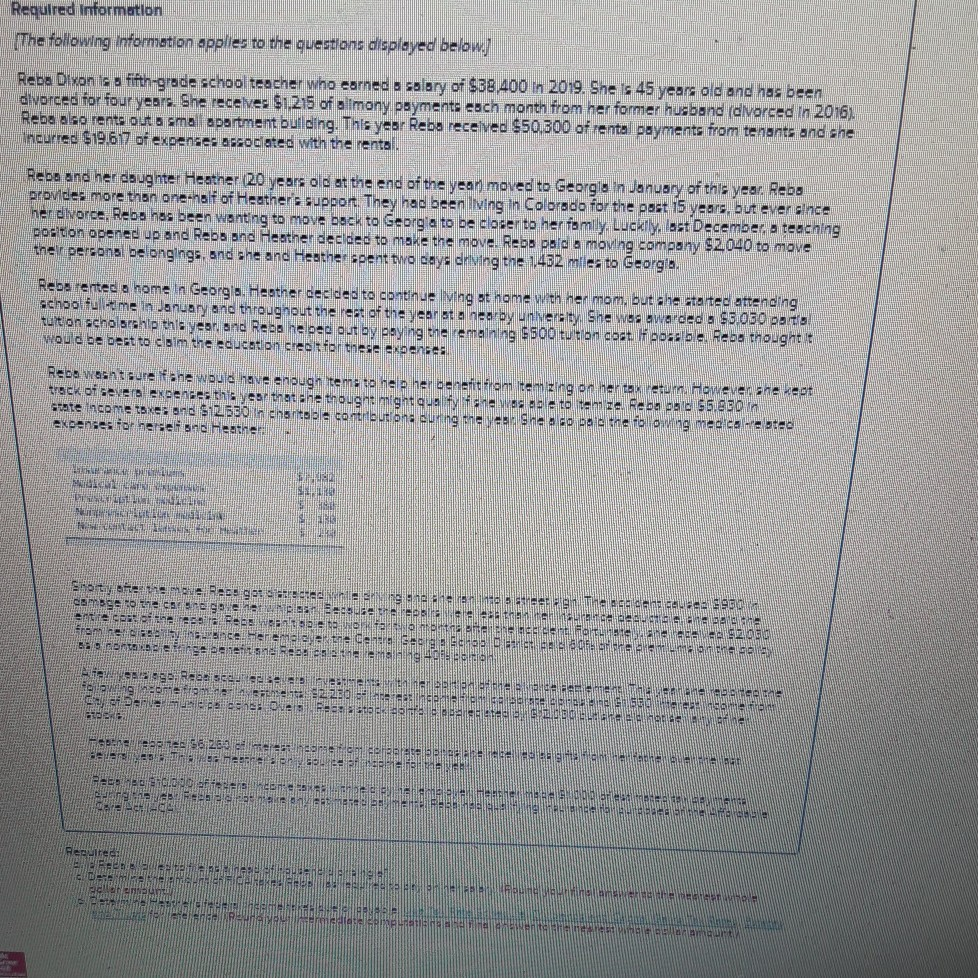

Required information [The following Information applies to the questions displayed below) Reba Dixon is a fifth-grade school teacher who earned o salary of $38.400 in 2019. She is 45 years old and has been divorced for four years. She receives $1.215 of ollmony payments esch month from her former husband divorced in 2016). Rebe also rents out a small apartment building. This year Reba received $50.300 of rental payments from tenants and she incurred $19.617 of expenses associated with the rental. Reba and her daughter Heather 20 years old at the end of the yean moved to Georglen January of this year. Rebe provides more than one-half of Heather's support. They had been living in Colorado for the post 15 years, but ever once her divorce. Reba hos been wanting to move back to Georgia to be closer to her family. Luckily, lost December, teaching position opened up and Rebo and Heather decided to make the move. Rebo podo moving company $2,040 to move the persons belongings, and she and Heather spent two days drying the 1,482 miles to Georgia. Reba rented a home in George Heather decided to continue ving at home with her mom, but she started attending school full-time in January and throughout the rest of the year at a nearby university. She was awarded : $3.030 porto tution scholarship this year, and Rebane ped out by paying the remaining $500 tution cost li posebe, Reba thought would be best to claim the education creat for these expenses Rebe wantsure fane would have enough items to hep her benefit from itemizing on the tasetum. However one weet track of severe expenses this year that she thought might quo fy #sre wosebeto tem ze. Redo ao 55.880 in state income taxes and $12.50 inchartebe contributions during the year she . co bele tre folosing medicale oteo expenses for herse and Heather ME M ER SI ICH Short over og mere cadeau esger generate the enother pees want to hear a Szola framleis ancelheremedy the degree Beige benefits Realthg 40 eigabe seen investeente home from the 200 m Det een toebehoren DERE en 58260 h. er der ENCORE BABE Boffee enementen Pea meeneeee Reguite EN EEN CARRERAS WASCO dan med NEAU ALLAH Permediate ALESSAGE GALA Required information [The following Information applies to the questions displayed below) Reba Dixon is a fifth-grade school teacher who earned o salary of $38.400 in 2019. She is 45 years old and has been divorced for four years. She receives $1.215 of ollmony payments esch month from her former husband divorced in 2016). Rebe also rents out a small apartment building. This year Reba received $50.300 of rental payments from tenants and she incurred $19.617 of expenses associated with the rental. Reba and her daughter Heather 20 years old at the end of the yean moved to Georglen January of this year. Rebe provides more than one-half of Heather's support. They had been living in Colorado for the post 15 years, but ever once her divorce. Reba hos been wanting to move back to Georgia to be closer to her family. Luckily, lost December, teaching position opened up and Rebo and Heather decided to make the move. Rebo podo moving company $2,040 to move the persons belongings, and she and Heather spent two days drying the 1,482 miles to Georgia. Reba rented a home in George Heather decided to continue ving at home with her mom, but she started attending school full-time in January and throughout the rest of the year at a nearby university. She was awarded : $3.030 porto tution scholarship this year, and Rebane ped out by paying the remaining $500 tution cost li posebe, Reba thought would be best to claim the education creat for these expenses Rebe wantsure fane would have enough items to hep her benefit from itemizing on the tasetum. However one weet track of severe expenses this year that she thought might quo fy #sre wosebeto tem ze. Redo ao 55.880 in state income taxes and $12.50 inchartebe contributions during the year she . co bele tre folosing medicale oteo expenses for herse and Heather ME M ER SI ICH Short over og mere cadeau esger generate the enother pees want to hear a Szola framleis ancelheremedy the degree Beige benefits Realthg 40 eigabe seen investeente home from the 200 m Det een toebehoren DERE en 58260 h. er der ENCORE BABE Boffee enementen Pea meeneeee Reguite EN EEN CARRERAS WASCO dan med NEAU ALLAH Permediate ALESSAGE GALA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started