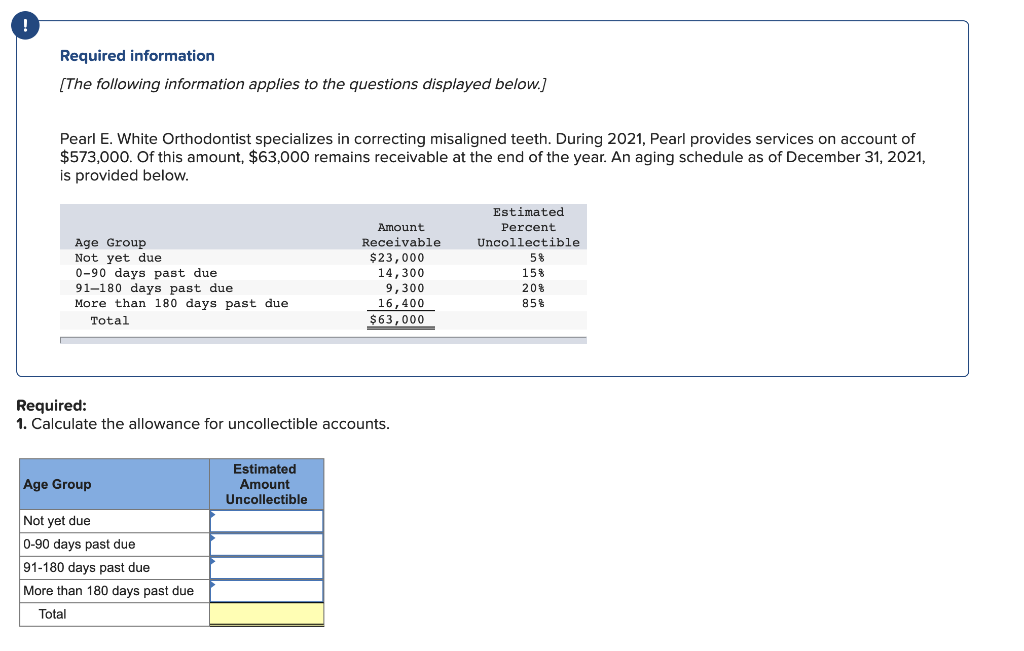

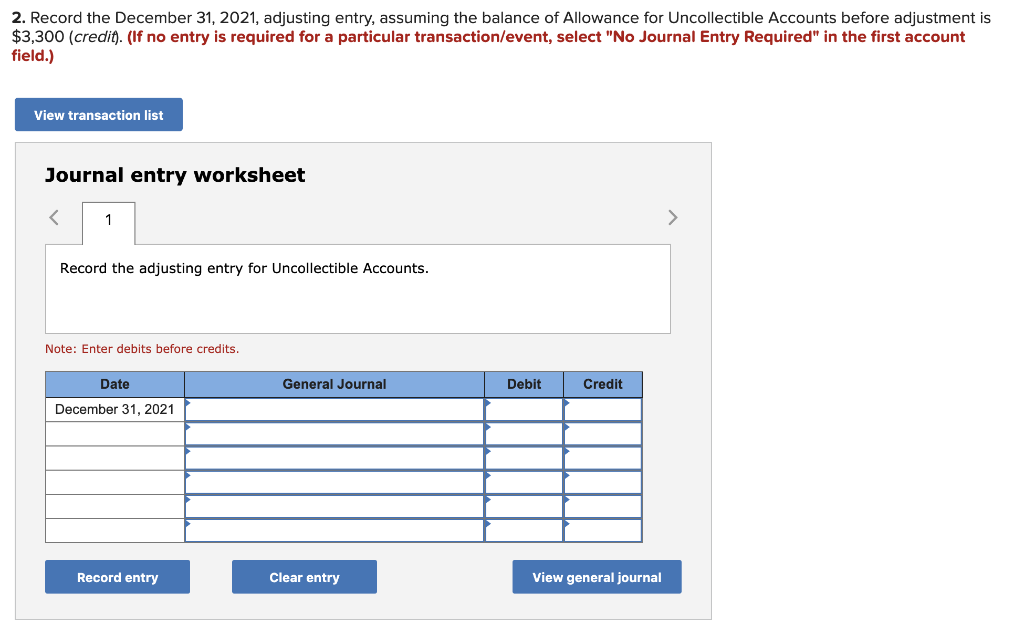

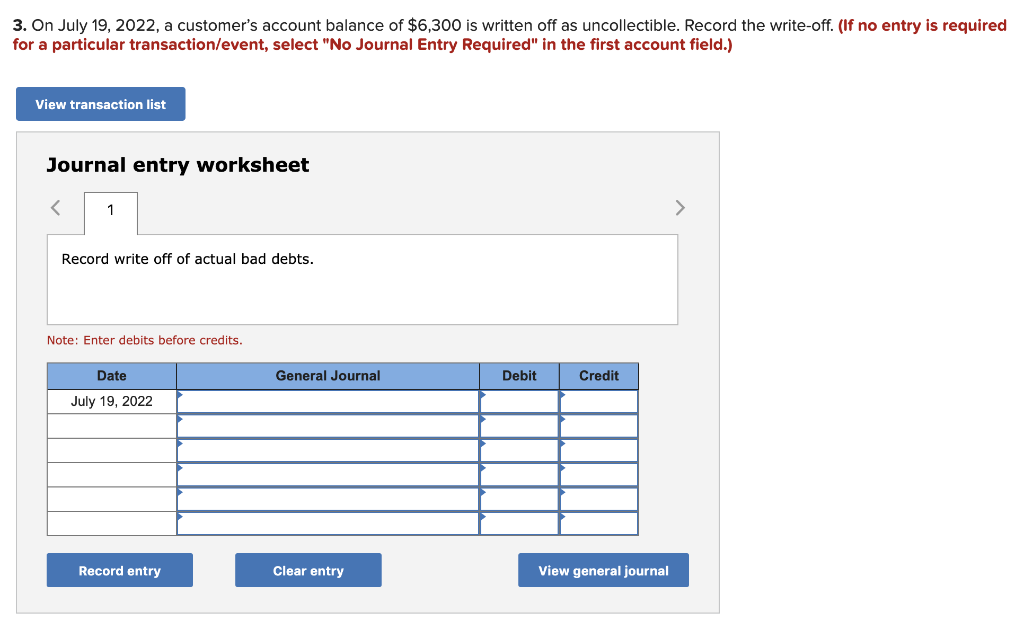

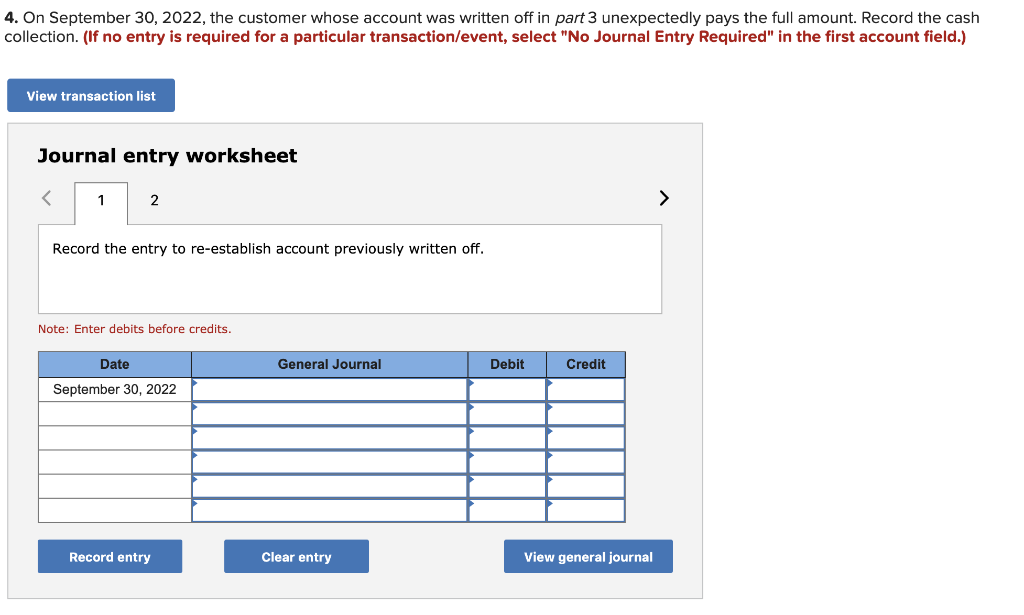

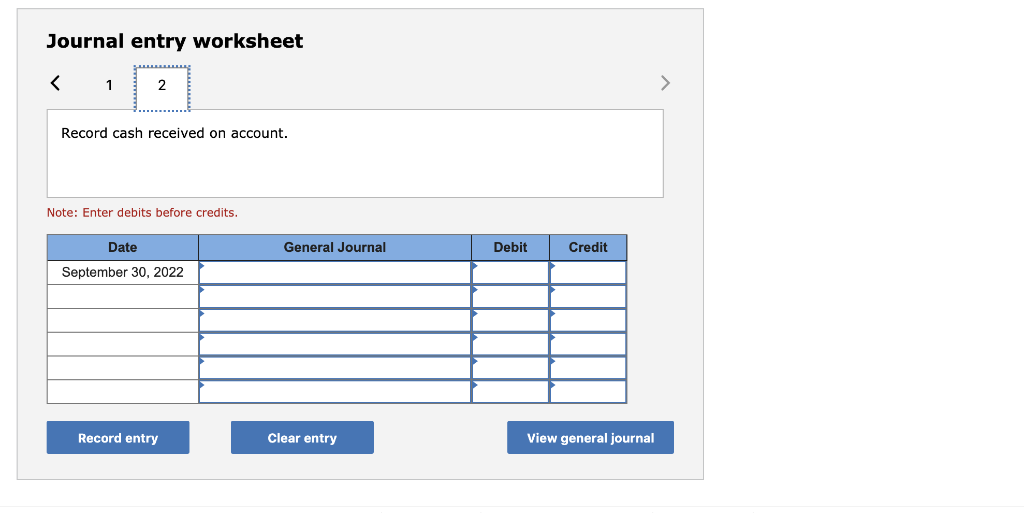

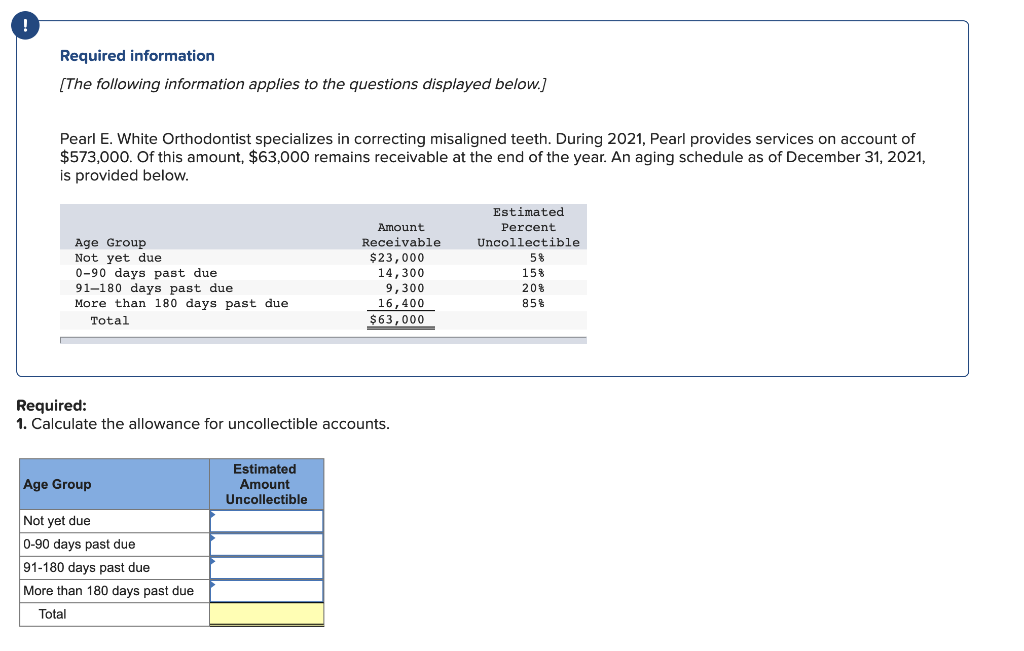

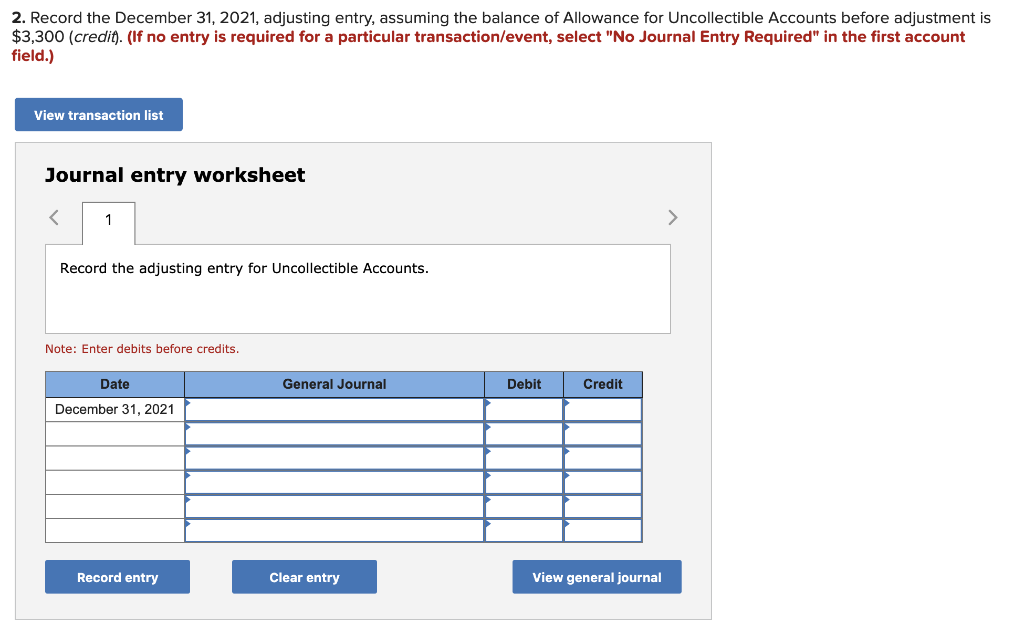

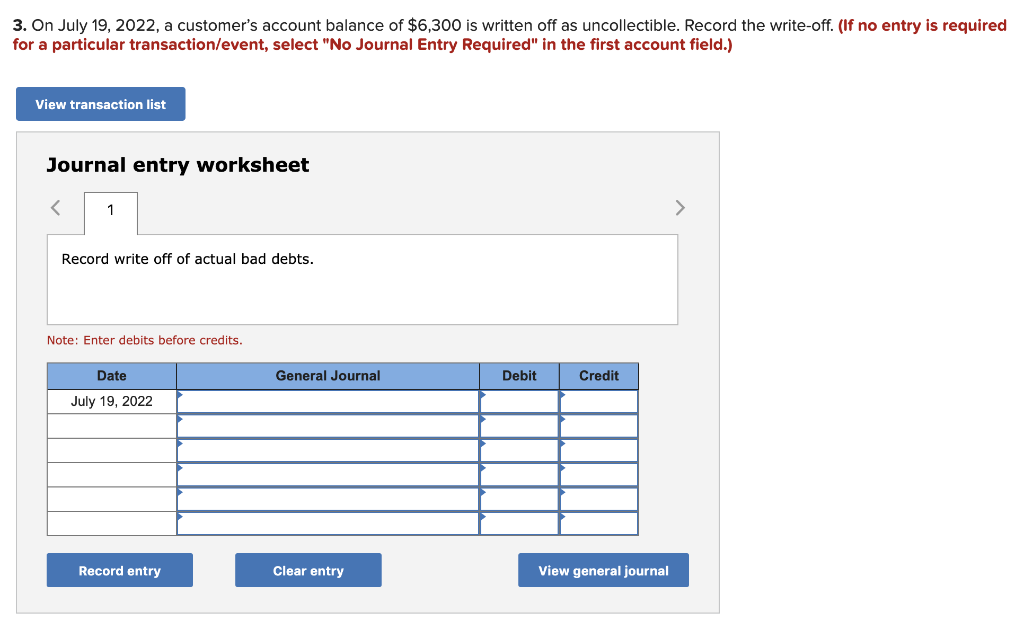

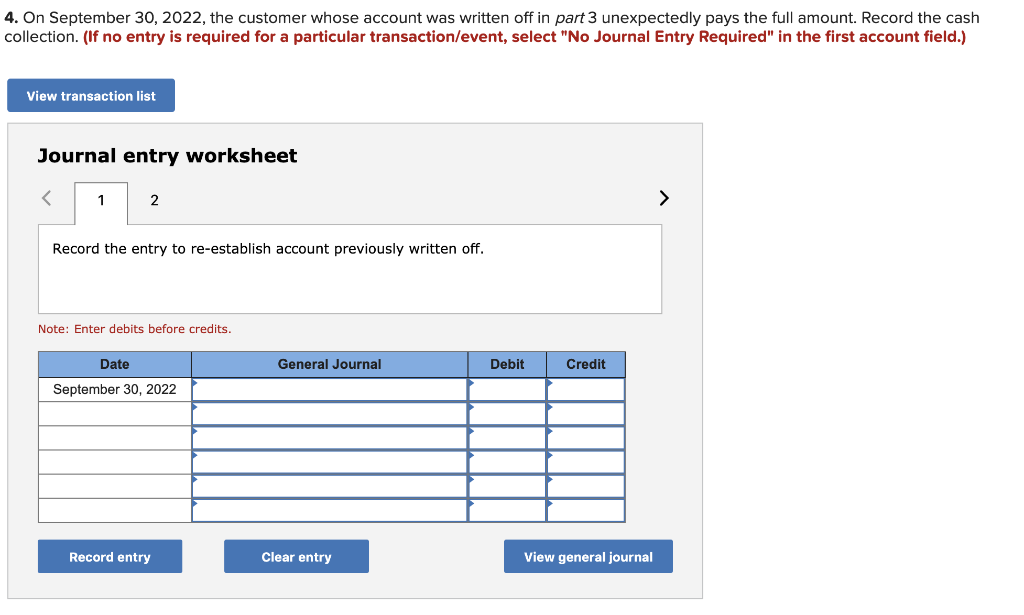

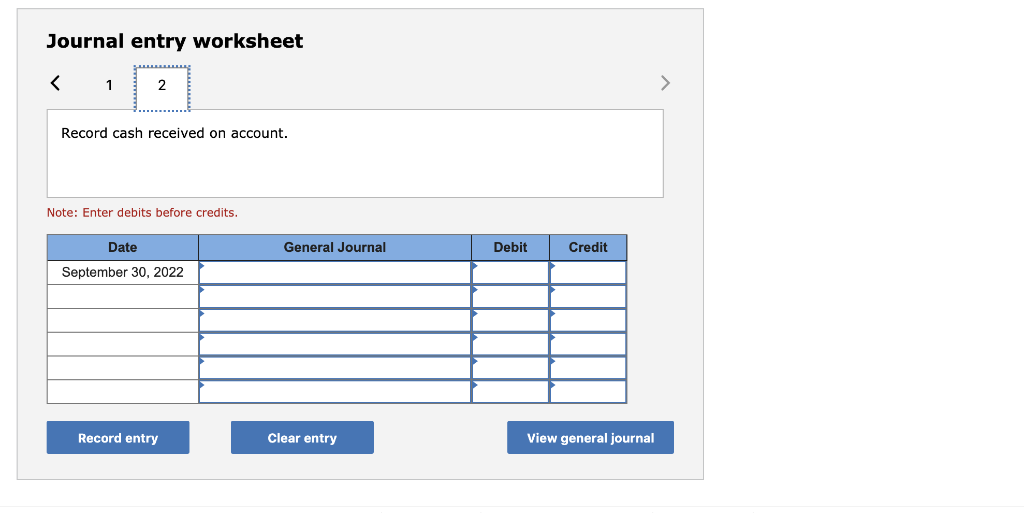

Required information [The following information applies to the questions displayed below.] Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $573,000. Of this amount, $63,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021, is provided below Estimated Percent Uncollectible Amount Receivable $23,000 14,300 9,300 16,400 $63,000 Age Group Not yet due 0-90 days past due 91-180 days past due More than 180 days past due 58 15% 20% 85% Total Required 1. Calculate the allowance for uncollectible accounts Estimated Amount Uncollectible Age Group Not yet due 0-90 days past due 91-180 days past due More than 180 days past due Total 2. Record the December 31, 2021, adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $3,300 (credit. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. Credit Date General Journal Debit December 31, 2021 View general journal Record entry Clear entry 3. On July 19, 2022, a customer's account balance of $6,300 is written off as uncollectible. Record the write-off. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record write off of actual bad debts. Note: Enter debits before credits. Date General Journal Debit Credit July 19, 2022 View general journal Record entry Clear entry 4. On September 30, 2022, the customer whose account was written off in part 3 unexpectedly pays the full amount. Record the cash collection. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list ournal entry worksheet Record the entry to re-establish account previously written off. Note: Enter debits before credits Date General Journal Debit Credit September 30, 2022 Record entry Clear entry View general journal Journal entry worksheet 2 Record cash received on account. Note: Enter debits before credits. Date General Journal Debit Credit September 30, 2022 Record entry Clear entry View general journal