Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Campbell Company began operations on January 1, Year 1, by issuing common stock for

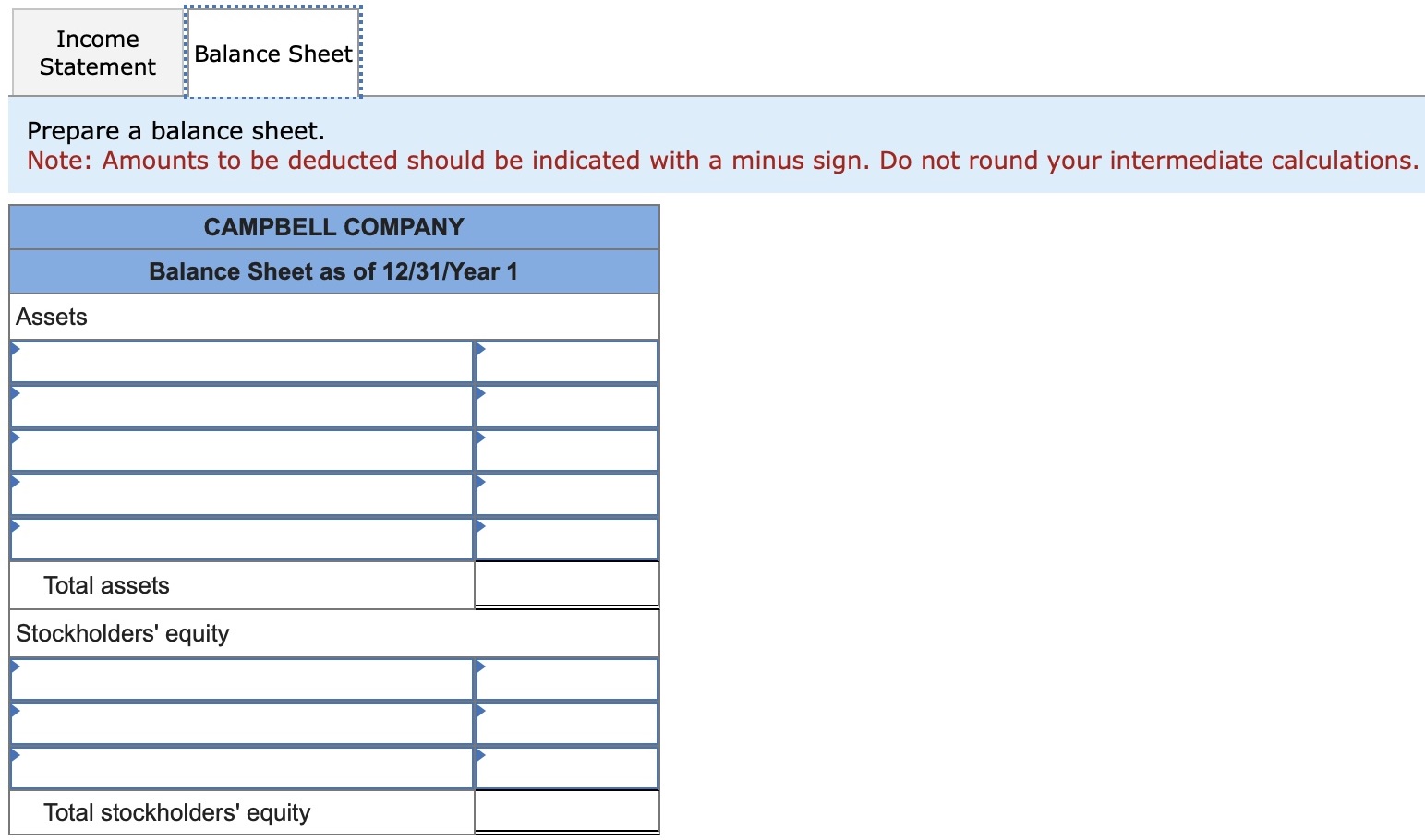

Required information [The following information applies to the questions displayed below.] Campbell Company began operations on January 1, Year 1, by issuing common stock for $39,000 cash. During Year 1 , Campbell received $70,000 cash from revenue and incurred costs that required $50,000 of cash payments. Prepare a GAAP-based income statement and balance sheet for Campbell Company for Year 1 under the following scenario: c. Campbell is a manufacturing company. The $50,000 was paid to purchase the following items: (1) Paid $3,100 cash to purchase materials that were used to make products during the year. (2) Paid $2,590 cash for wages of factory workers who made products during the year. (3) Paid $25,410 cash for salaries of sales and administrative employees. (4) Paid $18,900 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a four-year life and a $2,100 salvage value. The company uses straight-line depreciation. (5) During Year 1, Campbell started and completed 2,300 units of product. The revenue was earned when Campbell sold 1,850 units of product to its customers. Prepare a balance sheet. Note: Amounts to be deducted should be indicated with a minus sign. Do not round your intermediate calculations Prepare an Income Statement. Note: Do not round your intermediate calculations

Required information [The following information applies to the questions displayed below.] Campbell Company began operations on January 1, Year 1, by issuing common stock for $39,000 cash. During Year 1 , Campbell received $70,000 cash from revenue and incurred costs that required $50,000 of cash payments. Prepare a GAAP-based income statement and balance sheet for Campbell Company for Year 1 under the following scenario: c. Campbell is a manufacturing company. The $50,000 was paid to purchase the following items: (1) Paid $3,100 cash to purchase materials that were used to make products during the year. (2) Paid $2,590 cash for wages of factory workers who made products during the year. (3) Paid $25,410 cash for salaries of sales and administrative employees. (4) Paid $18,900 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a four-year life and a $2,100 salvage value. The company uses straight-line depreciation. (5) During Year 1, Campbell started and completed 2,300 units of product. The revenue was earned when Campbell sold 1,850 units of product to its customers. Prepare a balance sheet. Note: Amounts to be deducted should be indicated with a minus sign. Do not round your intermediate calculations Prepare an Income Statement. Note: Do not round your intermediate calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started