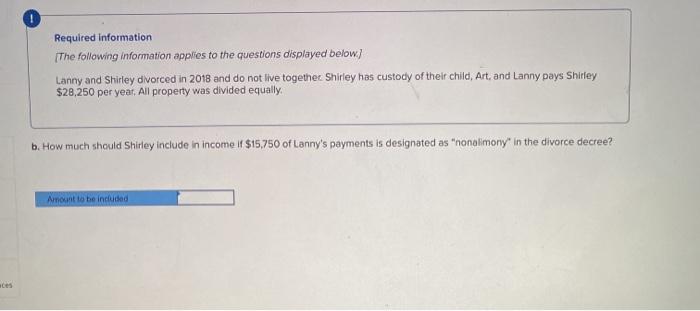

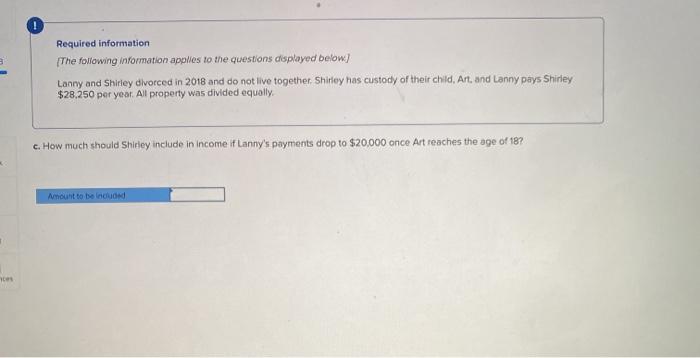

Required information {The following information applies to the questions displayed below.) Larry purchased an annuity from an insurance company that promises to pay him $7.000 per month for the rest of his life. Larry paid $735,840 for the annuity. Larry is in good health and is 72 years old. Larry received the first annulty payment of $7,000 this month. Use the expected number of payments in Exhibit 5-1 for this problem a. How much of the first payment should Larry include in gross income? Amount to be included $ 4,550 Required information The following information applies to the questions displayed below.) Larry purchased an annuity from an insurance company that promises to pay him $7,000 per month for the rest of his life. Larry paid $735,840 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $7,000 this month. Use the expected number of payments in Exhibit 5.1 for this problem b. If Larry lives more than 15 years after purchasing the annuity, how much of each additional payment should he include in gross Income? Amount to be included Required information The following information applies to the questions displayed below) Larry purchased an annuity from an insurance company that promises to pay him $7000 per month for the rest of his life. Larry paid $735,840 for the annuity, Larry is in good health and is 72 years old. Larry received the first annuity payment of $7,000 this month. Use the expected number of payments in Exhibit 5.1 for this problem c. What are the tax consequences if Larry dies just after he receives the 100th payment? Required information The following information applies to the questions displayed below.) Lanny and Shirley divorced in 2018 and do not live together. Shirley has custody of their child, Art, and Lanny pays Shirley $28,250 per year. All property was divided equally a. How much should Shirley include in income if Lanny's payments are made in cash but will cease if Shirley dies or remarles? Amount to be included Required information The following information applies to the questions displayed below) Lanny and Shirley divorced in 2018 and do not live together Shirley has custody of their child, Art, and Lanny pays Shirley $28,250 per year, All property was divided equally, b. How much should Shirley include in income if $15,750 of Lanny's payments is designated as "nonalimony" in the divorce decree? Amount to be included Required information The following information applies to the questions displayed below! Lanny and Shirley divorced in 2018 and do not live together. Shirley has custody of their child, Art, and Lanny pays Shirley $28.250 per year. All property was divided equally c. How much should Shirley include in Income if Lanny's payments drop to $20,000 once Art reaches the age of 18? Amount to be included