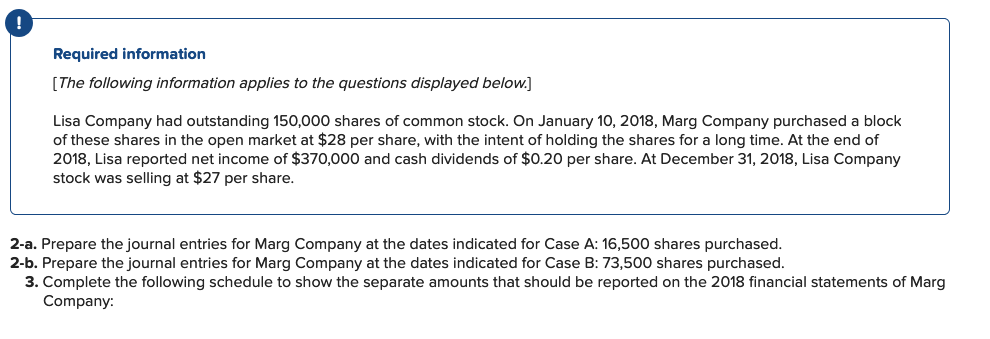

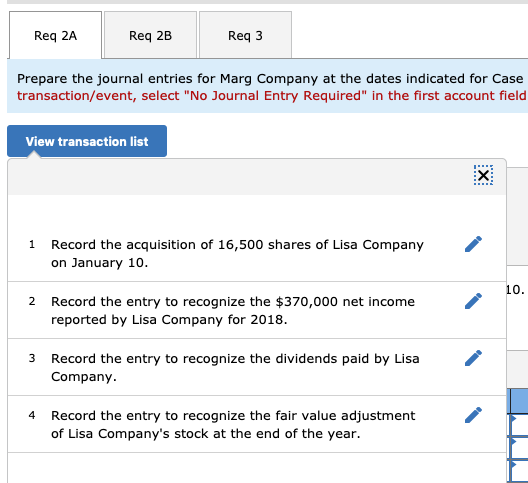

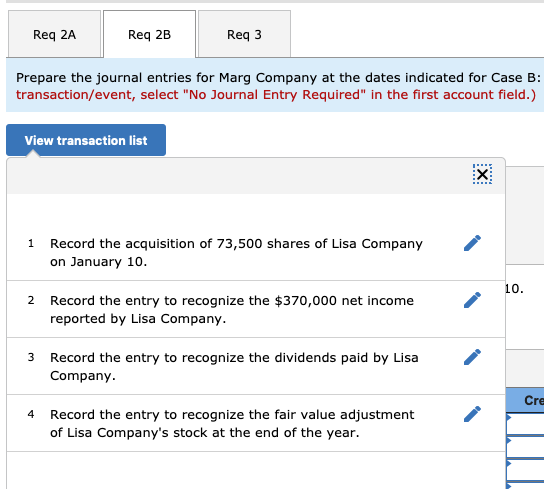

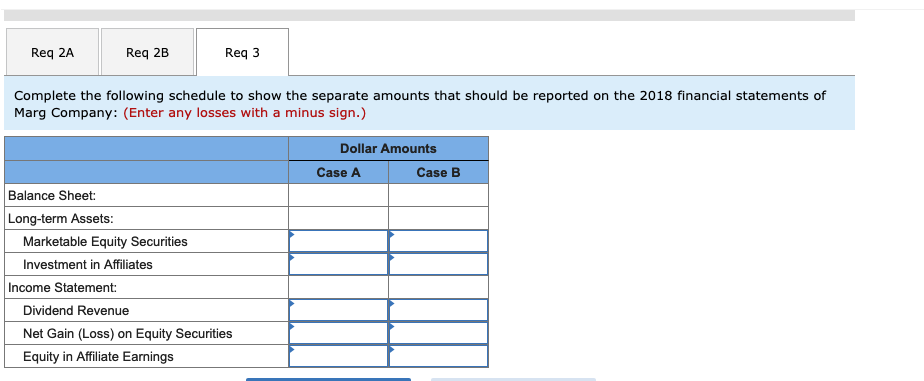

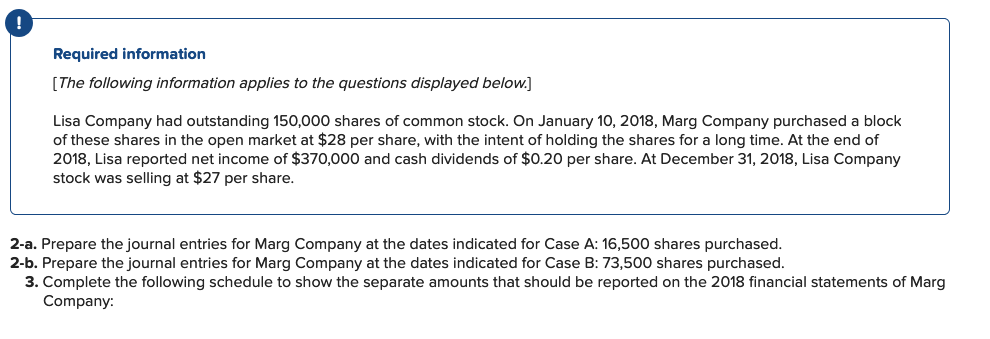

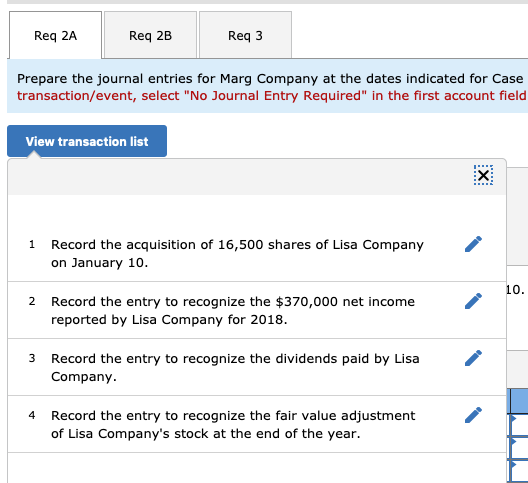

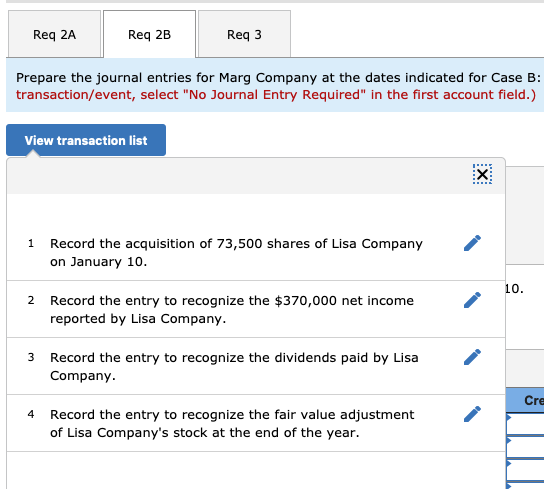

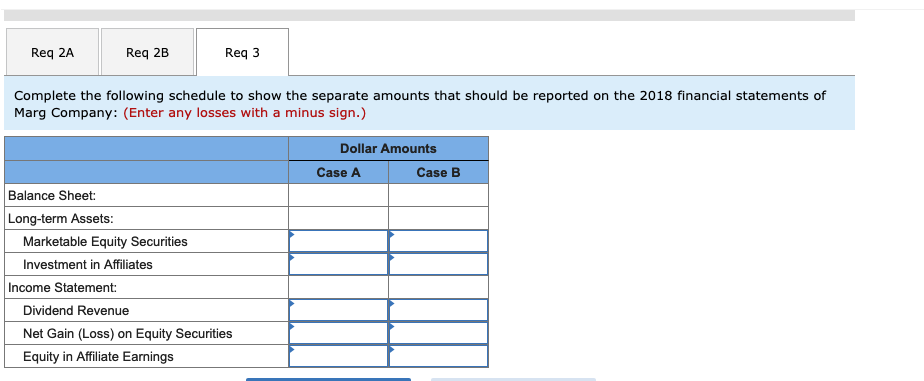

Required information The following information applies to the questions displayed below.] Lisa Company had outstanding 150,000 shares of common stock. On January 10, 2018, Marg Company purchased a block of these shares in the open market at $28 per share, with the intent of holding the shares for a long time. At the end of 2018, Lisa reported net income of $370,000 and cash dividends of $0.20 per share. At December 31, 2018, Lisa Company stock was selling at $27 per share. 2-a. Prepare the journal entries for Marg Company at the dates indicated for Case A: 16,500 shares purchased. 2-b. Prepare the journal entries for Marg Company at the dates indicated for Case B: 73,500 shares purchased. 3. Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Marg Company: Req 2A Req 2B Req 3 Prepare the journal entries for Marg Company at the dates indicated for Case transaction/event, select "No Journal Entry Required" in the first account field View transaction list Record the acquisition of 16,500 shares of Lisa Company on January 10. 1 0 Record the entry to recognize the $370,000 net income reported by Lisa Company for 2018 2 Record the entry to recognize the dividends paid by Lisa 3 Company Record the entry to recognize the fair value adjustment of Lisa Company's stock at the end of the year 4 EX Req 2A Req 3 Req 2B Prepare the journal entries for Marg Company at the dates indicated for Case B transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Record the acquisition of 73,500 shares of Lisa Company on January 10. 0. Record the entry to recognize the $370,000 net income reported by Lisa Company Record the entry to recognize the dividends paid by Lisa Company 3 Cre Record the entry to recognize the fair value adjustment of Lisa Company's stock at the end of the year 4 EX Req 2A Req 2B Req 3 Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Marg Company: (Enter any losses with a minus sign.) Dollar Amounts Case A Case B Balance Sheet: Long-term Assets: Marketable Equity Securities Investment in Affiliates Income Statement Dividend Revenue Net Gain (Loss) on Equity Securities Equity in Affiliate Earnings