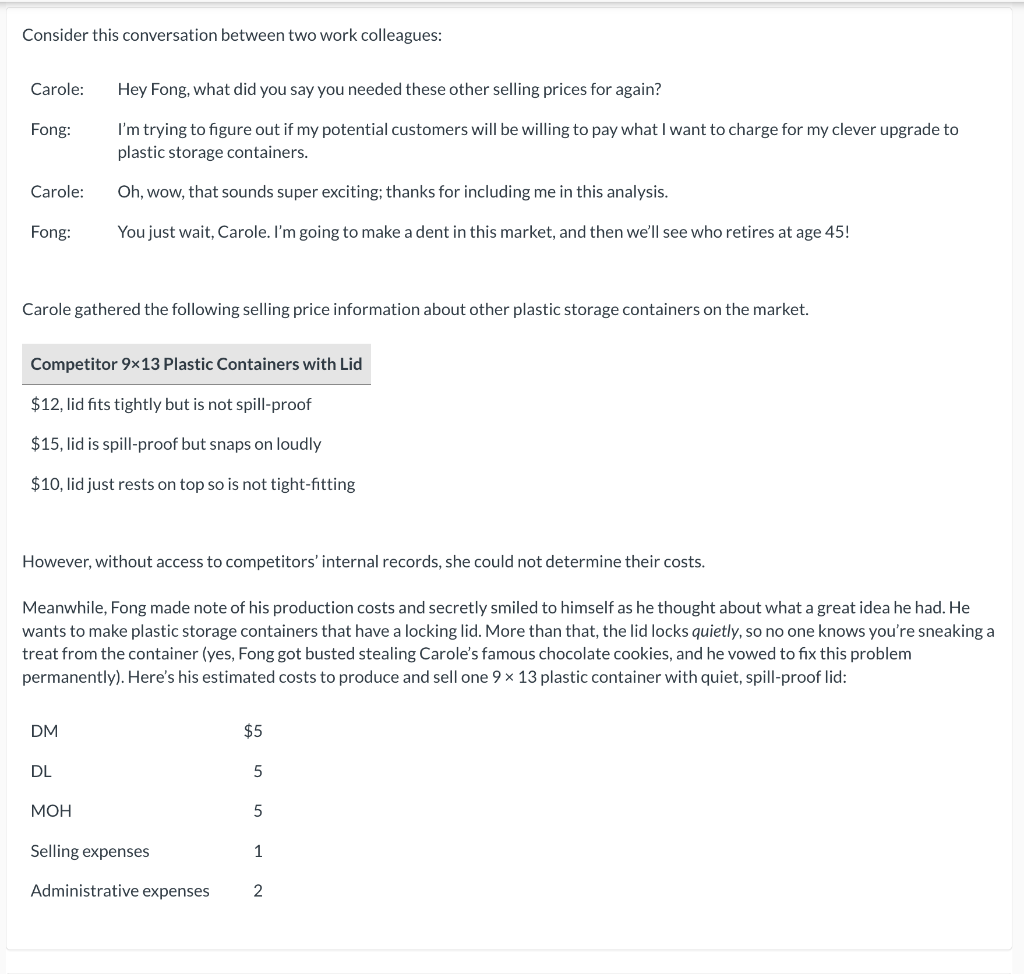

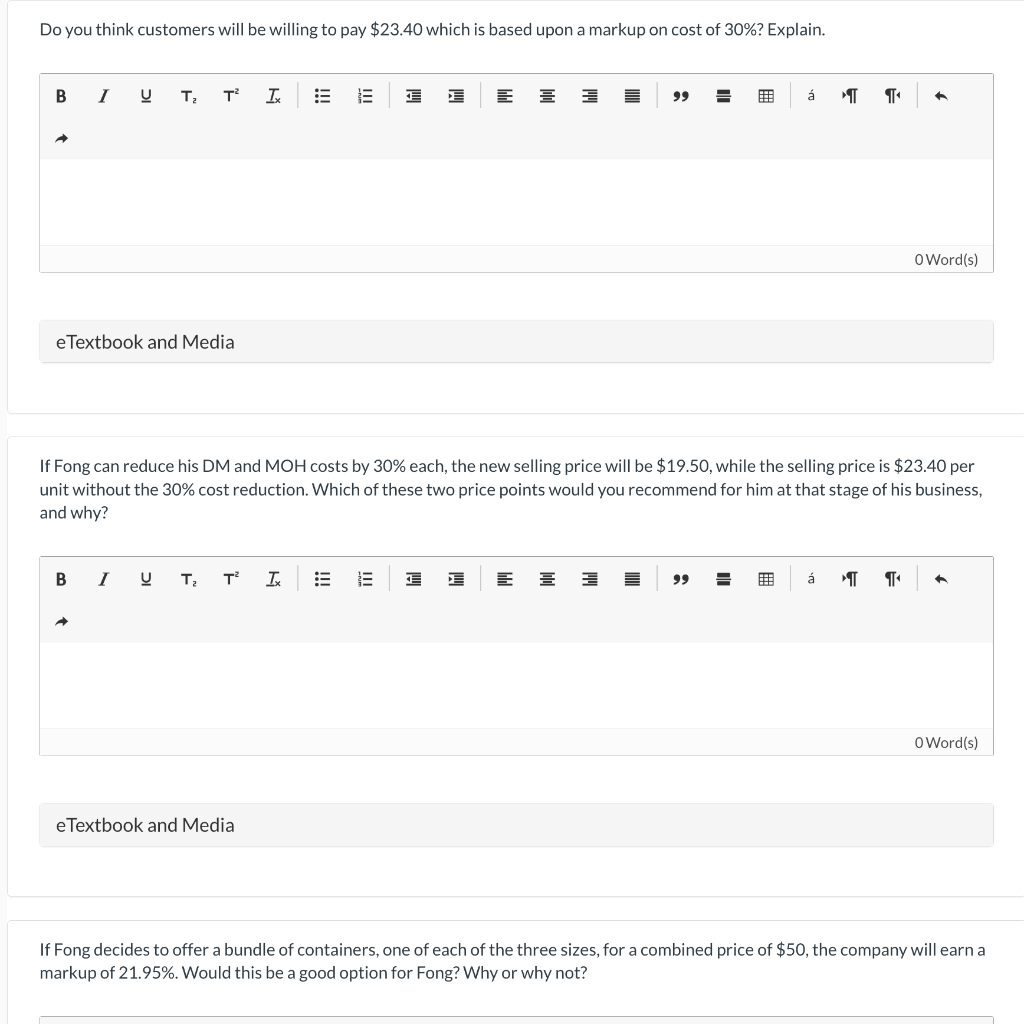

Consider this conversation between two work colleagues: Carole: Hey Fong, what did you say you needed these other selling prices for again? Fong: I'm trying to figure out if my potential customers will be willing to pay what I want to charge for my clever upgrade to plastic storage containers. Carole: Oh, wow, that sounds super exciting; thanks for including me in this analysis. Fong: You just wait, Carole. I'm going to make a dent in this market, and then we'll see who retires at age 45 ! Carole gathered the following selling price information about other plastic storage containers on the market. However, without access to competitors' internal records, she could not determine their costs. Meanwhile, Fong made note of his production costs and secretly smiled to himself as he thought about what a great idea he had. He wants to make plastic storage containers that have a locking lid. More than that, the lid locks quietly, so no one knows you're sneaking a treat from the container (yes, Fong got busted stealing Carole's famous chocolate cookies, and he vowed to fix this problem permanently). Here's his estimated costs to produce and sell one 913 plastic container with quiet, spill-proof lid: Do you think customers will be willing to pay $23.40 which is based upon a markup on cost of 30% ? Explain. eTextbook and Media If Fong can reduce his DM and MOH costs by 30% each, the new selling price will be $19.50, while the selling price is $23.40 per unit without the 30% cost reduction. Which of these two price points would you recommend for him at that stage of his business, and why? eTextbook and Media If Fong decides to offer a bundle of containers, one of each of the three sizes, for a combined price of $50, the company will earn a markup of 21.95%. Would this be a good option for Fong? Why or why not? If Fong decides to offer a bundle of containers, one of each of the three sizes, for a combined price of $50, the company will earn a markup of 21.95%. Would this be a good option for Fong? Why or why not? After one year, when his product costs went down as expected in part (b), a potential client offered Fong $15.50 each for 200 of the 913 containers. Fong has available capacity to take on this special order, but he is cautious of doing so, worried that others will expect the same deal. Assume 40% of the MOH costs are variable and 20% of the administrative costs are variable. No new selling expenses would be incurred for this special order. Qualitatively, is this special order a good idea? Explain