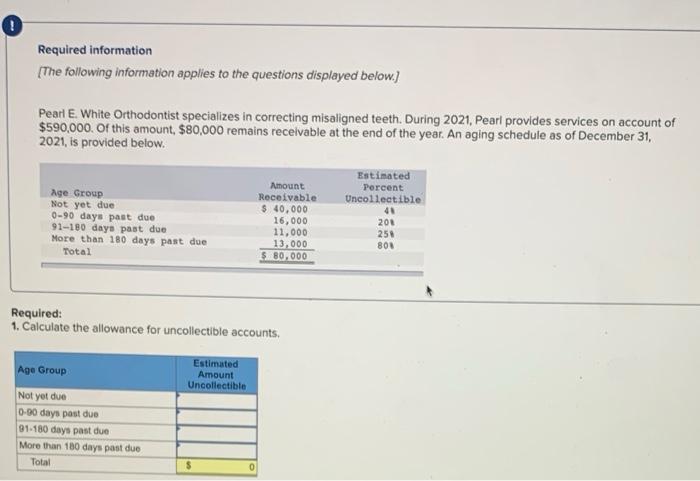

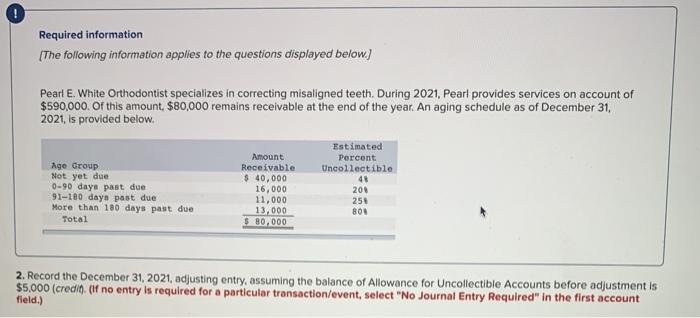

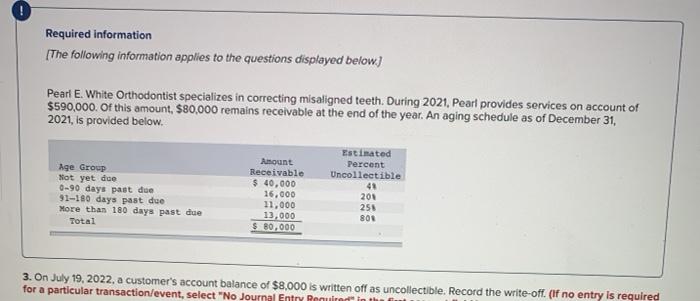

Required information {The following information applies to the questions displayed below.) Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $590,000. Of this amount, $80,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021, is provided below. Age Group Not yet due 0-90 days past due 91-180 days past due More than 180 days past due Total Amount Receivable $ 40,000 16,000 11,000 13,000 $ 80,000 Estimated Percent Uncollectible 40 200 258 80N Required: 1. Calculate the allowance for uncollectible accounts. Estimated Amount Uncollectible Age Group Not yet due 0-90 days past due 91.180 days past due More than 100 days past due Total $ 0 Required information The following information applies to the questions displayed below.) Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $590,000 of this amount, $80,000 remains receivable at the end of the year. An aging schedule as of December 31 2021, is provided below. Age Group Not yet due 0-90 days past due 91-100 days past due More than 180 days past due Total Amount Receivable $ 40,000 16,000 11,000 13,000 $ 80,000 Estimated Percent Uncollectible 40 200 250 808 2. Record the December 31, 2021. adjusting entry, assuming the balance of Allowance for Uncollectible Accounts before adjustment is $5,000 (credio. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Required information [The following information applies to the questions displayed below) Pearl E. White Orthodontist specializes in correcting misaligned teeth. During 2021, Pearl provides services on account of $590,000. Of this amount, $80,000 remains receivable at the end of the year. An aging schedule as of December 31, 2021, is provided below. Estimated Percent Uncollectible Age Group Not yet de 0-90 days past due 91-180 days past due More than 180 days past due Total Amount Receivable $ 40,000 16.000 11,000 13,000 $ 80,000 201 255 800 3. On July 19, 2022. a customer's account balance of $8,000 is written off as uncollectible. Record the write-off. (If no entry is required for a particular transaction/event, select "No Journal Entry Prouinc