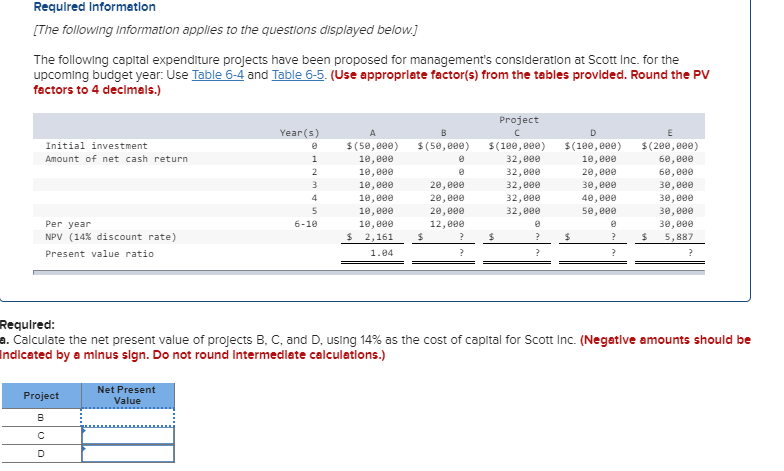

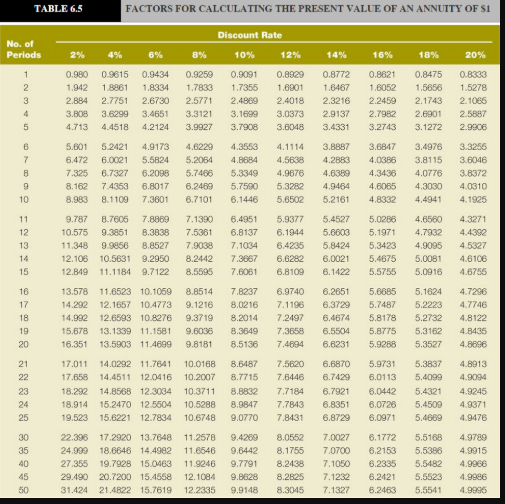

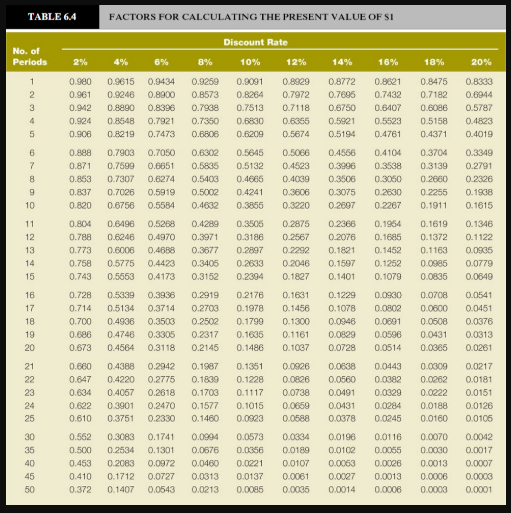

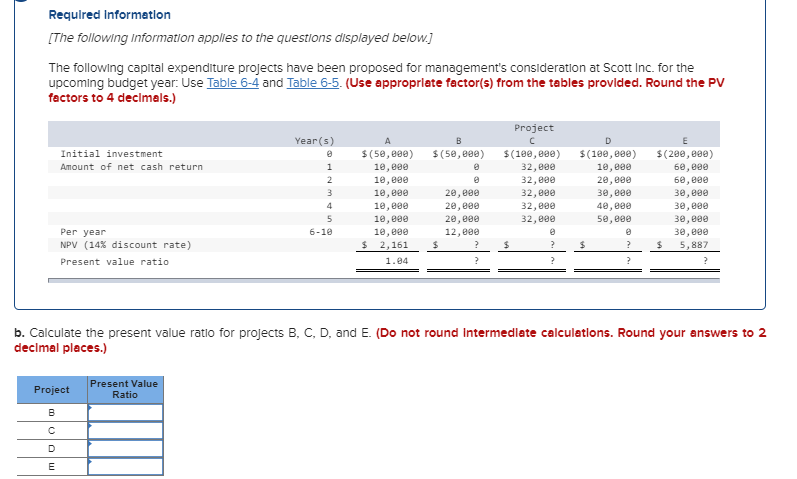

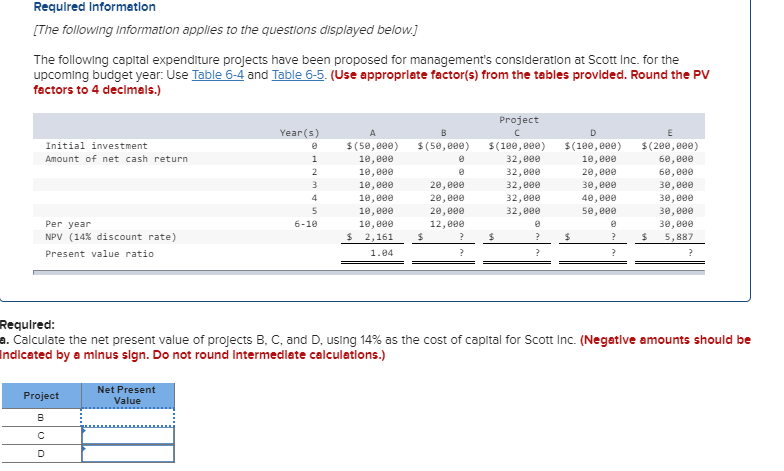

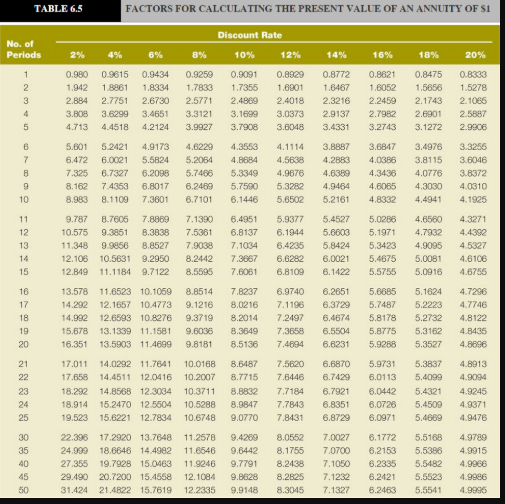

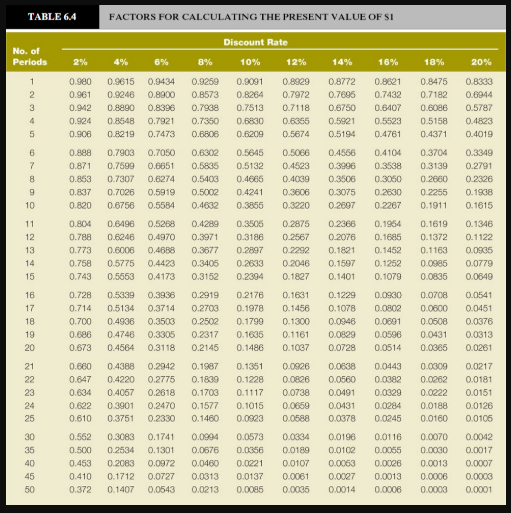

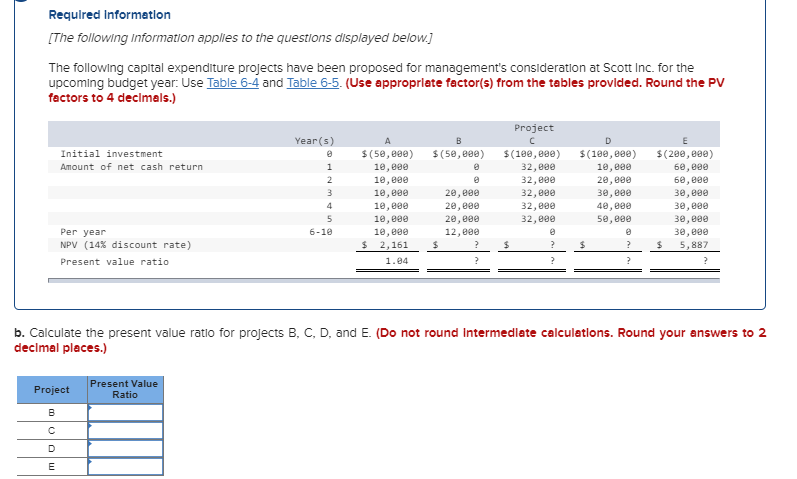

Required Information [The following Information applies to the questions displayed below.) The following capital expenditure projects have been proposed for management's consideration at Scott Inc. for the upcoming budget year: Use Table 6-4 and Table 6-5. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Project Year(s) $ (50,880) Initial investment Amount of net cash return $(50,880) 10,888 10, eee 10,000 10,000 10, 10,000 $ 2,161 1.04 20,000 20,000 20, eee 12,000 $(189,880) 32,eee 32,000 32,000 32,000 32,800 $(189,880) 10,80 20,eee 30,000 40,000 5e,eee $(280, 800) 60,000 60,000 30,000 30, eee 30,eee 30,000 $ 5,887 6-10 Per year NPV (14% discount rate) Present value ratio $ Required: a. Calculate the net present value of projects B, C, and D, using 14% as the cost of capital for Scott Inc. (Negative amounts should be Indicated by a minus sign. Do not round Intermediate calculations.) Project Net Present Value TABLE 65 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUITY OF SI Discount Rate No. of Periods 12% 14% 16% 18% 20% 2% 0.980 1.942 2.884 3.808 4.713 4% 0.9615 1.8861 2.7751 3.6299 4.4518 6% 8% 0.9434 0.9259 1.8334 1.7833 2.67302.5771 3.4651 3.3121 4.2124 3.9927 10% 0.9091 1.7356 2.4889 3.1699 3.7908 0.8929 0.8772 1.690116467 2.4018 2.3216 3.0373 2.9137 3.6048 3.4331 0.8821 1.6052 2.2459 2.7982 3.2743 0.8475 0.8333 1.56561 5278 2.1743 2.1086 2.6901 2.5887 3.1272 2.9906 4 5.801 6.472 7.325 8.162 8.983 5.24214.91734.62294.3553 4.1114 6.0021 5.5824 5.2054 4.8684 4.5638 6.7327 6.2098 5.7456 5.3349 4 .9676 7.4353 6.8017 6.2489 5.7590 5.3282 8.11097.3601 6.7101 6.14465.6502 3.8887 4.28B3 4.6389 4.9464 5.2161 3.6847 .0386 4.3436 4.6065 4.8332 3.4976 3.8115 4.0776 4.3030 4.4941 3.3256 3.6046 3.8372 4.0310 4. 1925 9.787 10.575 11.348 12.106 12.849 8.7606 9.3851 9.9856 10.5631 11.1184 7.8889 8.3838 8.8527 9.2950 9.7122 7.1390 7.5361 7.9038 8.2442 8.5595 6.4951 6.6137 7.1034 7.3667 7.6061 5.9377 6.1944 6,4235 6.6282 6.8109 5.4527 5.6603 5.8424 6.0021 6.1422 5.0286 4,6560 5.1971 4.7932 5.34234.9095 5.4675 5.0081 5.5756 5.0916 4.3271 4.4392 4.5327 4.6106 4.6756 13.578 14.292 14.992 15.678 16.351 17.011 17.658 18.292 18.914 19.523 22.396 24.999 27.356 29.490 31.424 11.6523 10.1069 8.8514 12.1657 10.4773 9.1216 12.6593 10.8276 9.3719 13.1339 11.1581 9.6036 13.5903 11.46999.8181 14.0292 11.7641 10.0168 14.4511 12.0416 10.2007 14.8568 12.3034 10.3711 15.2470 12.5604 10.5288 15.6221 12.7834 10.6748 17.2920 13.7848 11.2578 18.6646 14.4982 11.6546 19.7928 15.046311.9246 20.7200 15.4558 12.1084 21.4822 15.7619 12.2335 7.8237 6.9740 6.2651 5.6685 8.0216 7.1196 6.37295.7487 8.2014 7.24976.4674 5.8178 8.3649 7.3658 6.5504 5.8775 8.5136 7.4894 6.6231 5.9288 8.6487 7.5620 6.6870 5.9731 8.7715 7.5446 6.74296 .0113 8.1832 7.7184 6.7921 6.0442 8.9847 7.78436 .8351 6.0726 9.07707.8431 6.87296.0971 9.4269 8.0552 7.0027 6.1772 9.84428 .1755 7.0700 6.2153 9.77918.2438 7.1060 6.2335 9.8628 8.2825 7.1232 6.2421 9.9148 8.3045 7.1327 5.2463 5.1624 5.2223 5.2732 5.3162 5.3527 5.3837 5.4099 5.4321 5.4509 5.4889 5.5168 5.5386 5.5482 5.5523 5.5541 4.7296 4.7746 4.8122 4.8435 4.8696 4.8913 4.9094 4.9245 4.9371 4.9476 4.9789 4.9915 4.9966 .9986 4.9906 4 TABLE 64 FACTORS FOR CALCULATING THE PRESENT VALUE OF SI No. of Periods Discount Rate 10% 12% 6% 8% 14% 16% 10% 20% 0 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.647 0.634 0.622 0.610 0.562 0.500 0.453 0.410 0.372 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5653 0.5339 0.5134 0.4936 0.4746 0.4564 0.4388 0.4220 0.4067 0.3901 0.3751 0.3083 0.2534 0.2083 0.1712 0.1407 0.9434 0.9259 0.8900 0.8573 0.8396 0.7938 0.7921 0.7350 0.7473 0.6806 0.7050 0.6302 0.6651 0.5835 0.6274 0.5403 0.59190.5002 0.5584 0.4632 0.5268 0.4289 0.4970 0.3971 0.4688 0.3677 0.4423 0.3406 0.4173 0.3152 0.3936 0.2919 0.3714 0.2703 0.3503 0.2502 0.3305 0.2317 0.3118 0.2145 0.2942 0.1987 0.2775 0.1839 0.2618 0.1703 0.2470 0.1577 0.2330 0.1460 0.1741 0.0994 0.1301 0.0576 0.0972 0.0460 0.0727 0.0313 0.0543 0.0213 0.9091 0.8929 0.8772 0.8264 0.7972 0.7095 0.7513 0.7118 0.6750 0.5830 0.6365 0.5921 0.62090.5674 0.5194 0.5645 0.5066 0.4556 0.5132 0.4523 0.3996 0.4665 0.40390.3506 0.4241 0.3606 0.3075 0.3855 0.3220 0.2697 .3506 0.2875 0.2366 0.3186 0.2567 0.2076 0.2897 0.2292 0.1821 0.2633 0 2046 0.1597 0.2394 0.1827 0.1401 0.2176 0.1631 0.1229 0.1978 0.1456 0.1078 0.1799 0.1300 0.0946 0.1636 0.1161 0.0829 0.1486 0.1007 0.0728 0.1351 0.0926 0.0638 0.1228 0.0826 0.0560 0.1117 0.0738 0.0491 0.1015 0.0659 0.0431 0.0923 0.0688 0.0378 0.0573 0.0034 0.0196 0.0366 0.0189 0.0102 0.0221 0.0107 0.0063 0.0137 0.0061 0.0027 0.0085 0.0035 0.0014 0.8821 0.8475 0.8333 0.7432 0.7182 0.8944 0.6407 0.6086 0.5787 0.5523 0.5158 0.4823 0.4761 0.4104 0.3704 0.3349 0.3538 0.3139 0.2791 0.3060 02660 0.2326 0.2630 0.2255 0.15638 0.2267 0.1911 0.1615 0.1964 0.1619 0.1346 0.1685 0.1372 0.1122 0.1452 0.1103 0. 035 0.1252 0.0086 0.0779 0.1079 0.0836 0.0549 .0930 0.0708 0.0541 0.0802 0.0600 0.0451 0.0691 0.0508 0.0376 0.0596 0.0431 0.0313 0.0514 0.0366 0.0261 0.0443 0.0009 0.0217 0.0382 0.0262 0.0181 0.0329 0.0222 0.0151 0.0284 0.0188 0.0126 0.0245 0.0160 0.0106 0.0116 0.0070 0.0042 0.0055 0.0030 0.0017 0.0026 0.00130.0007 0.00130.0006 0.0003 0.0006 0.0003 0.0001 0 Required Information [The following information applies to the questions displayed below.] The following capital expenditure projects have been proposed for management's consideration at Scott Inc. for the upcoming budget year: Use Table 6-4 and Table 6-5. (Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.) Project Year(s) Initial investment Amount of net cash return AB $(50,880) $(50,880) 10,880 10,000 10,000 20,000 10,000 20, eee 10, eee 20,800 10, 12, eee $ 2,161 1.04 $(180, 880) 32, eee 32, 32,800 32, 32,eee $(188,880) 10,000 20, eee 30,000 40,eee 5e,eee m hun $(280, 880) 60,000 60,000 30,000 30,eee 30,000 30, eee $ 5,887 6-10 Per year NPV (14% discount rate) Present value ratio b. Calculate the present value ratio for projects B, C, D, and E. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Project Present Value Ratio