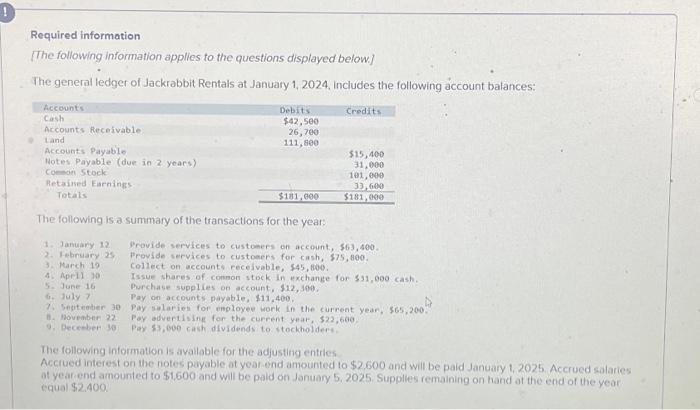

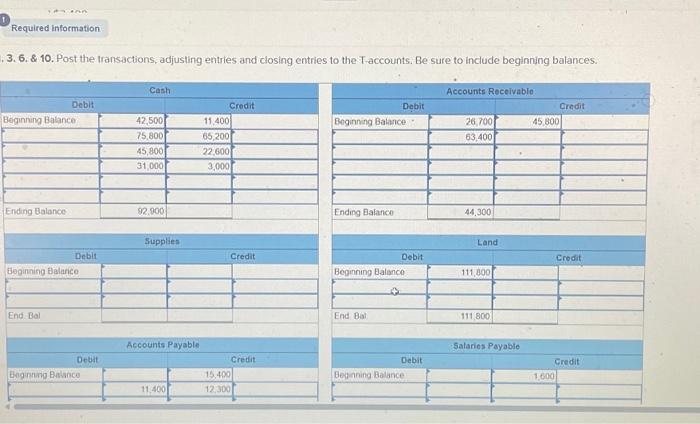

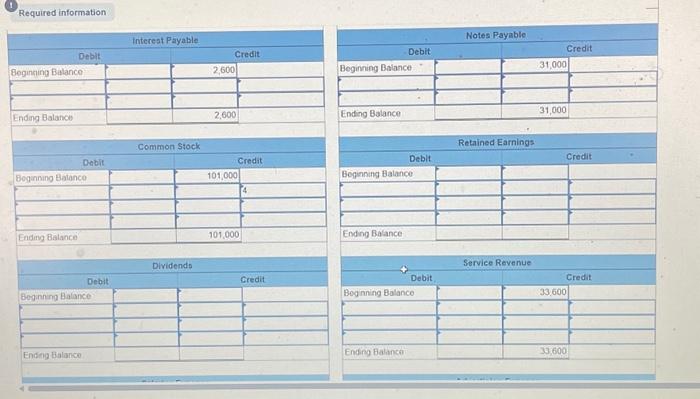

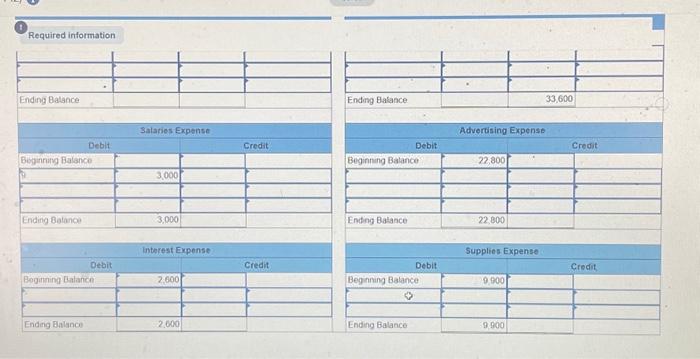

Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Grovide services to customers on account, 563,400 . 2. Febinuary 25 Provide services to custoners for cash, 575 , 800. 3. March 19 collect on account receivable, 545,600 . 4. April 70 Issue shares of common stock in exchange for 531,000 cash. 5. Juse 16 Purchase supplies on account, $12,190. 6. July ? Pay on accounts payable, $11,400. 7. Septeaber 30 Pay siaries for enployee work in the current year, 565,200 . 1. novenber 22 Por advertlsing for the current yetar, 322,60e. 9. Decesber 39 pay 53,600 cash dividends to stockholders. The following information is avalloble for the adjusting entries Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025. Accrued salaries at yearend amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. (1) Required information Ending Balance 101,000 Beganning Balance Ending Balance Dividende Required information Required information [The following information applies to the questions displayed below.] The general ledger of Jackrabbit Rentals at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 12 Grovide services to customers on account, 563,400 . 2. Febinuary 25 Provide services to custoners for cash, 575 , 800. 3. March 19 collect on account receivable, 545,600 . 4. April 70 Issue shares of common stock in exchange for 531,000 cash. 5. Juse 16 Purchase supplies on account, $12,190. 6. July ? Pay on accounts payable, $11,400. 7. Septeaber 30 Pay siaries for enployee work in the current year, 565,200 . 1. novenber 22 Por advertlsing for the current yetar, 322,60e. 9. Decesber 39 pay 53,600 cash dividends to stockholders. The following information is avalloble for the adjusting entries Accrued interest on the notes payable at yeat end amounted to $2.600 and will be paid January 1,2025. Accrued salaries at yearend amounted to $1,600 and will be paid on January 5, 2025. Supplies remaining on hand at the end of the year equal $2.400 3. 6. \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. (1) Required information Ending Balance 101,000 Beganning Balance Ending Balance Dividende Required information