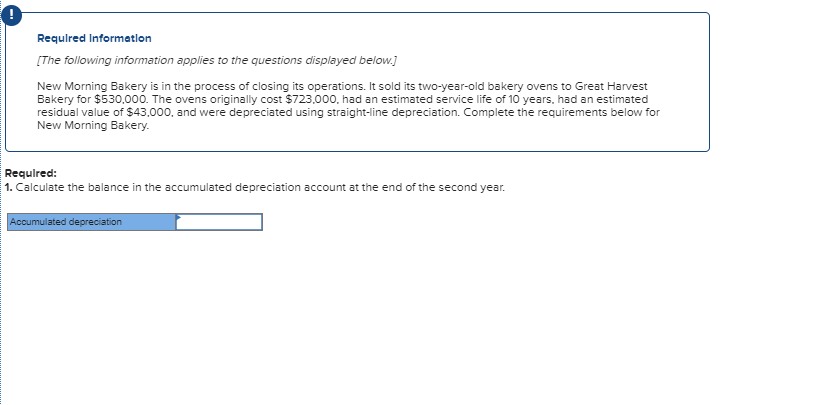

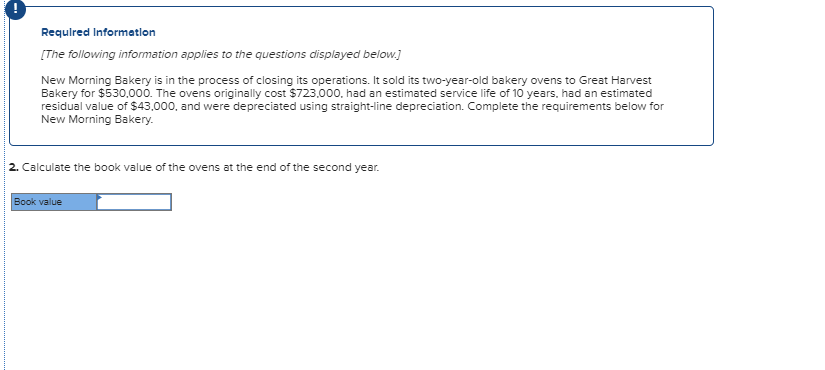

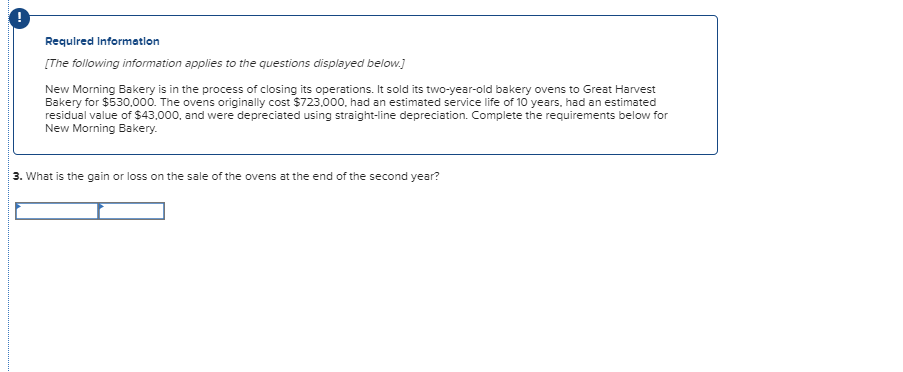

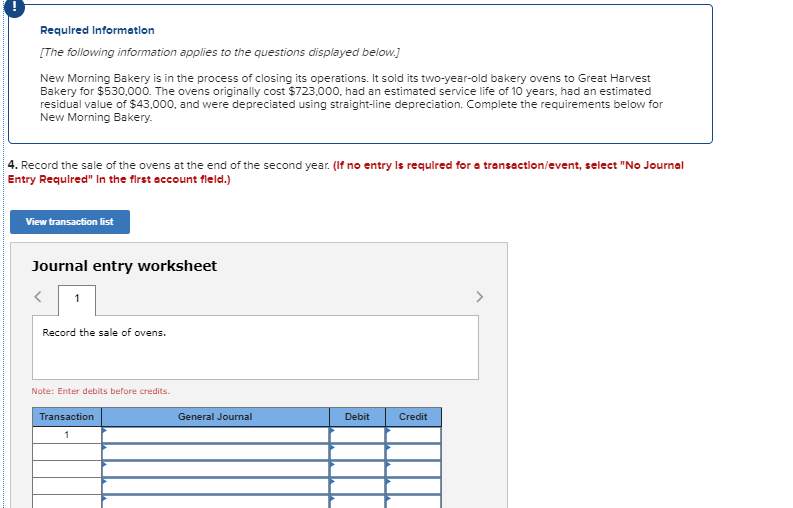

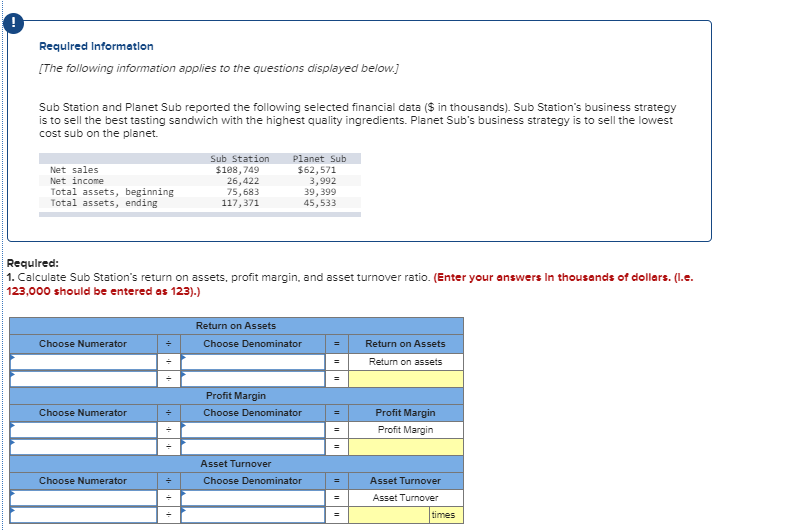

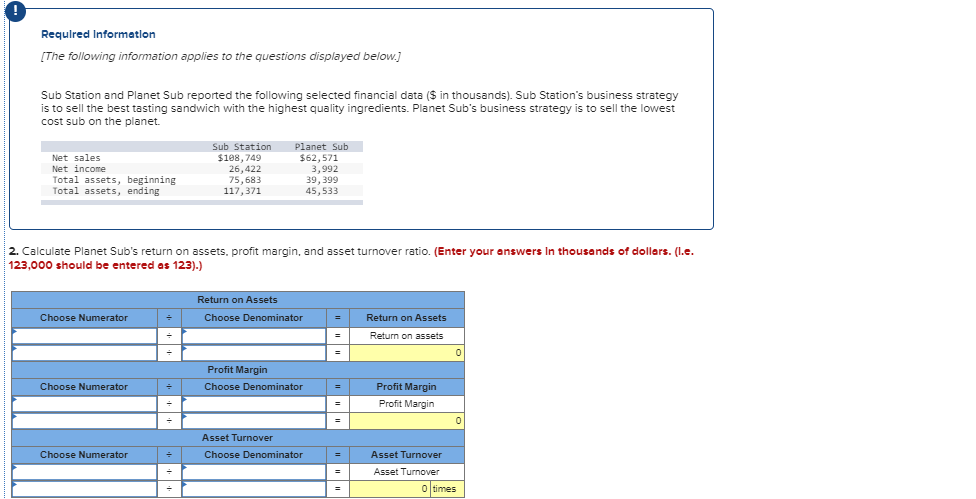

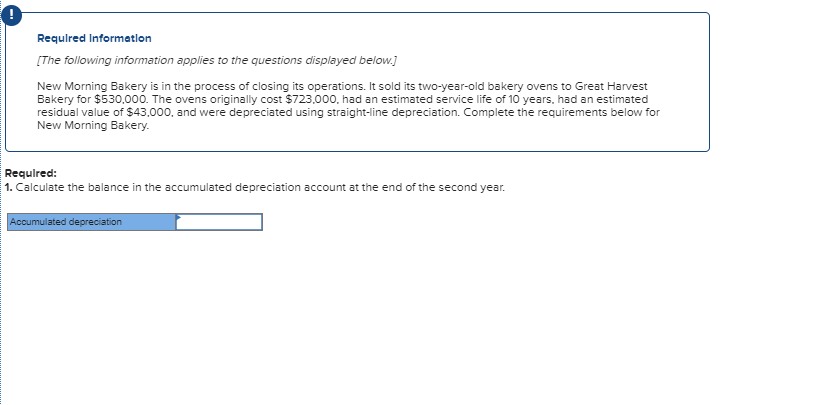

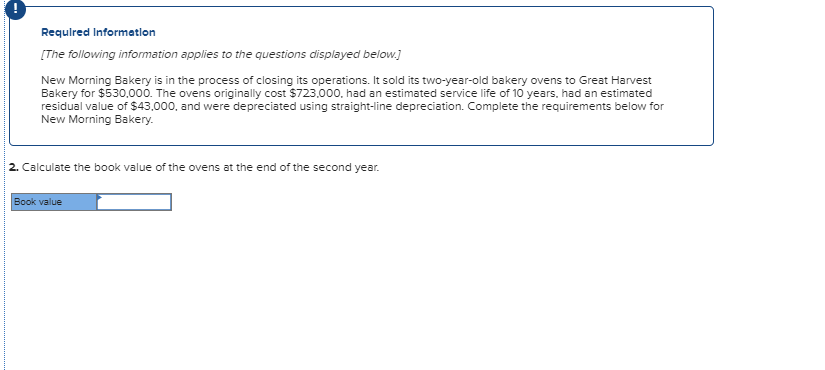

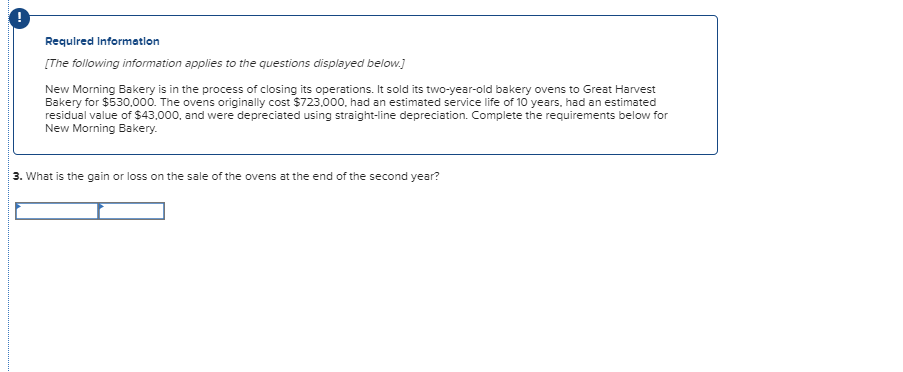

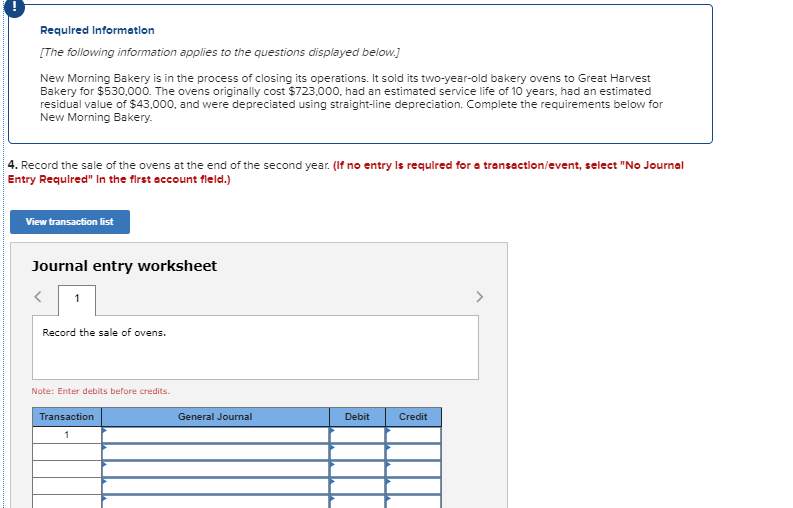

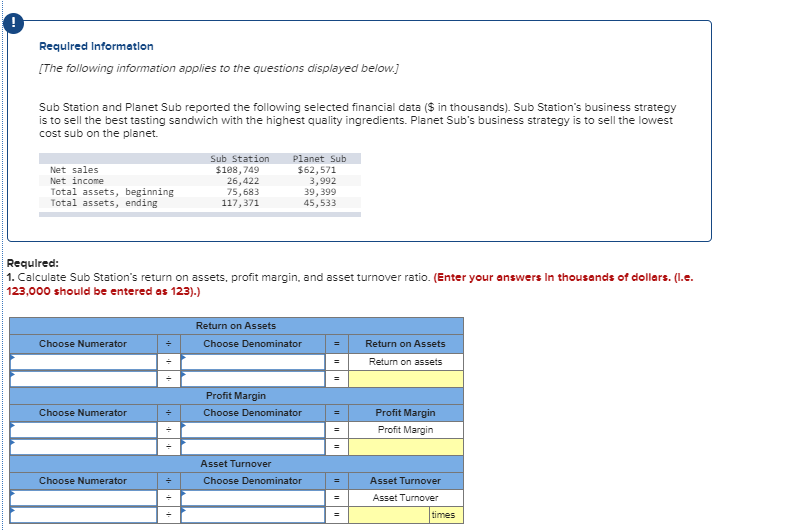

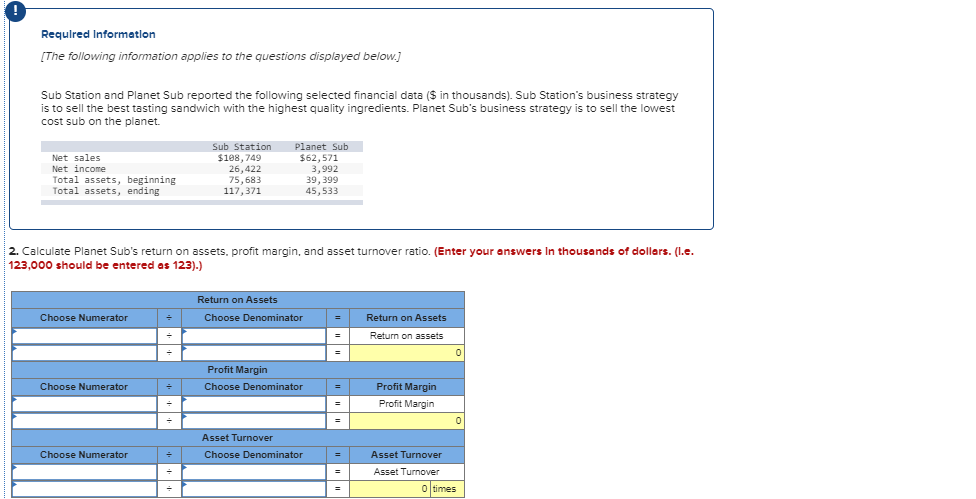

Required Information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $530,000. The ovens originally cost $723.000, had an estimated service life of 10 years, had an estimated residual value of $43.000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery Required: 1. Calculate the balance in the accumulated depreciation account at the end of the second year. Accumulated depreciation Required Information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $530,000. The ovens originally cost $723.000, had an estimated service life of 10 years, had an estimated residual value of $43.000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery 2. Calculate the book value of the ovens at the end of the second year. Book value O Required Information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $530,000. The ovens originally cost $723.000, had an estimated service life of 10 years, had an estimated residual value of $43.000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery 3. What is the gain or loss on the sale of the ovens at the end of the second year? Required Information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $530,000. The ovens originally cost $723.000, had an estimated service life of 10 years, had an estimated residual value of $43.000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery 4. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) View transaction list Journal entry worksheet Record the sale of ovens. Note: Enter debits before credits. Transaction General Journal Debit Credit Required Information [The following information applies to the questions displayed below.] Sub Station and Planet Sub reported the following selected financial data ($ in thousands). Sub Station's business Strategy is to sell the best tasting sandwich with the highest quality ingredients. Planet Sub's business strategy is to sell the lowest cost sub on the planet. Net sales Net income Total assets, beginning Total assets, ending Sub Station $108,749 26,422 75,683 117, 371 Planet Sub $62,571 3,992 39, 399 45,533 Required: 1. Calculate Sub Station's return on assets, profit margin, and asset turnover ratio(Enter your answers in thousands of dollars. (l.e. 123,000 should be entered as 123).) Return on Assets Choose Denominator Choose Numerator Return on Assets Return on assets = Profit Margin Choose Denominator Choose Numerator Profit Margin Profit Margin Asset Turnover Choose Denominator Choose Numerator Asset Turnover Asset Turnover = times Required Information [The following information applies to the questions displayed below.] Sub Station and Planet Sub reported the following selected financial data ($ in thousands). Sub Station's business strategy is to sell the best tasting sandwich with the highest quality ingredients. Planet Sub's business strategy is to sell the lowest cost sub on the planet. Net sales Net income Total assets, beginning Total assets, ending Sub Station $108,749 26,422 75,683 117,371 Planet Sub $62,571 3,992 39,399 45,533 2. Calculate Planet Sub's return on assets.profit margin, and asset turnover ratio. (Enter your answers in thousands of dollars. (I.e. 123,000 should be entered as 123).) Return on Assets Choose Denominator Choose Numerator Return on Assets Return on assets 0 Profit Margin Choose Denominator Choose Numerator Profit Margin Profit Margin = = 0 Asset Turnover Choose Denominator Choose Numerator Asset Turnover = Asset Turnover 0 times =