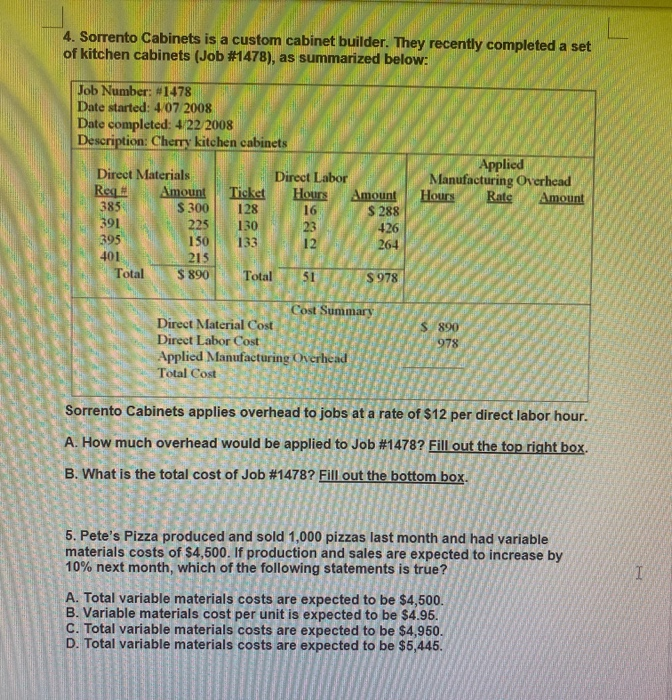

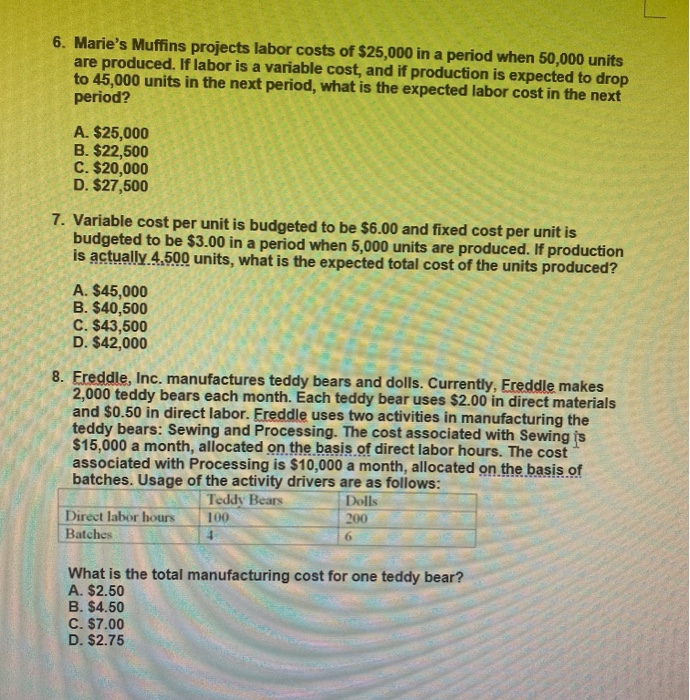

4. Sorrento Cabinets is a custom cabinet builder. They recently completed a set of kitchen cabinets (Job #1478), as summarized below: Job Number: #1478 Date started: 4/07/2008 Date completed: 4/22 2008 Description: Cherry kitchen cabinets Direct Materials Rege Amount 385 391 225 Applied Manufacturing Overhead Hours Rate Amount Direct Labor Ticket Hours Amount 128 13023 $ 300 $ 288 150 13312 395 $890 Total 51 $ 978 Cost Summary EF Direct Material Cost Direet Labor Cost Applied Manufacturing Oberhead Total Cost Sorrento Cabinets applies overhead to jobs at a rate of $12 per direct labor hour. A. How much overhead would be applied to Job #1478? Fill out the top right box. B. What is the total cost of Job #1478? Fill out the bottom box. 5. Pete's Pizza produced and sold 1,000 pizzas last month and had variable materials costs of $4,500. If production and sales are expected to increase by 10% next month, which of the following statements is true? A. Total variable materials costs are expected to be $4,500. B. Variable materials cost per unit is expected to be $4.95. C. Total variable materials costs are expected to be $4,950. D. Total variable materials costs are expected to be $5,445. 6. Marie's Muffins projects labor costs of $25,000 in a period when 50,000 units are produced. If labor is a variable cost, and if production is expected to drop to 45,000 units in the next period, what is the expected labor cost in the next period? A. $25,000 B. $22,500 C. $20,000 D. $27,500 7. Variable cost per unit is budgeted to be $6.00 and fixed cost per unit is budgeted to be $3.00 in a period when 5,000 units are produced. If production is actually 4.500 units, what is the expected total cost of the units produced? A. $45,000 B. $40,500 C. $43,500 D. $42,000 8. Freddle, Inc. manufactures teddy bears and dolls. Currently, Freddle makes 2,000 teddy bears each month. Each teddy bear uses $2.00 in direct materials and $0.50 in direct labor. Ereddle uses two activities in manufacturing the teddy bears: Sewing and Processing. The cost associated with Sewing is $15,000 a month, allocated on the basis of direct labor hours. The cost associated with Processing is $10,000 a month, allocated on the basis of batches. Usage of the activity drivers are as follows: Teddy Bears Dolls Direct labor hours 1200 Batches 100 ar? What is the total manufacturing cost for one teddy bear? A. $2.50 B. $4.50 C. $7.00 D. $2.75