Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began operations on May

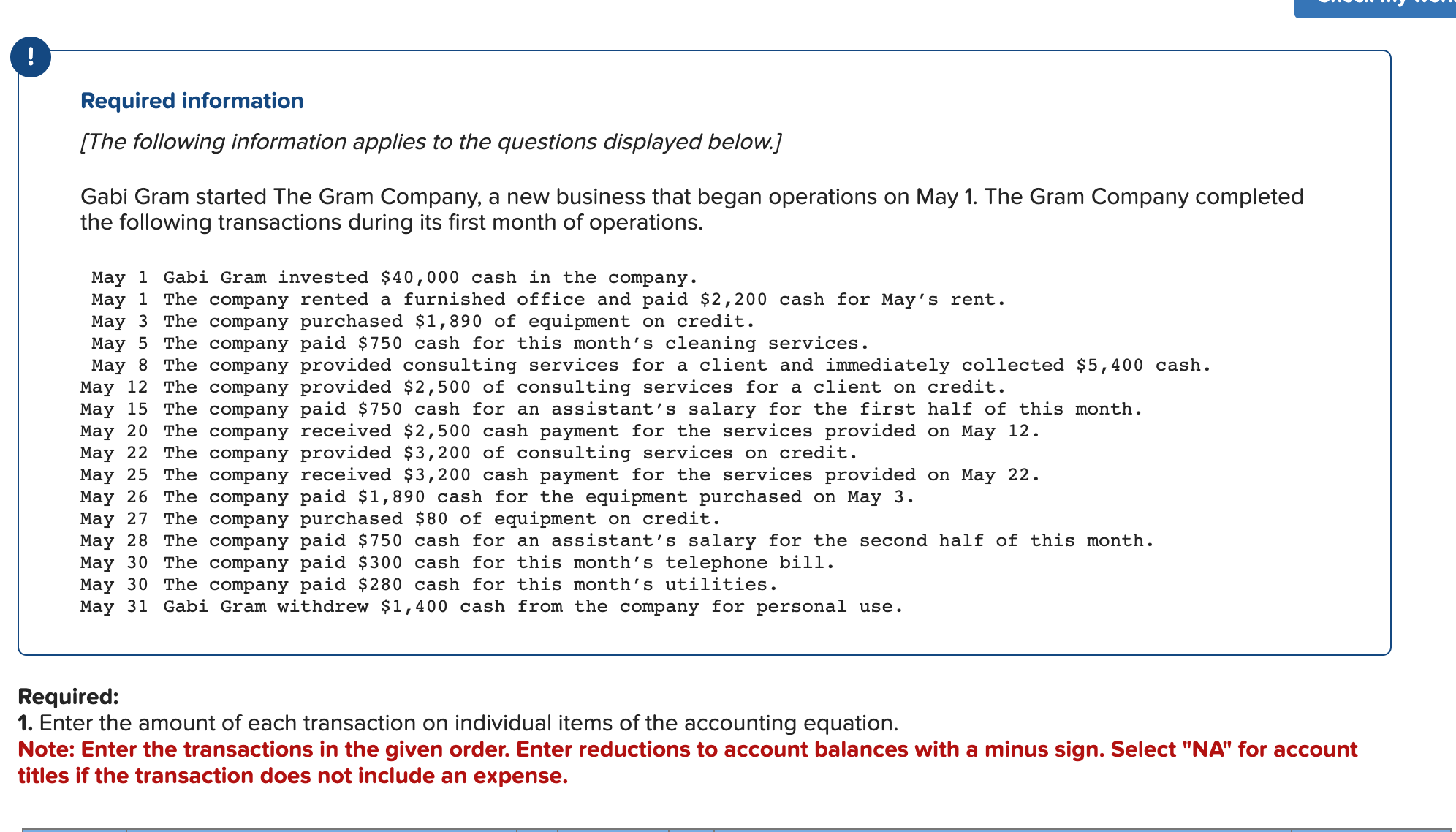

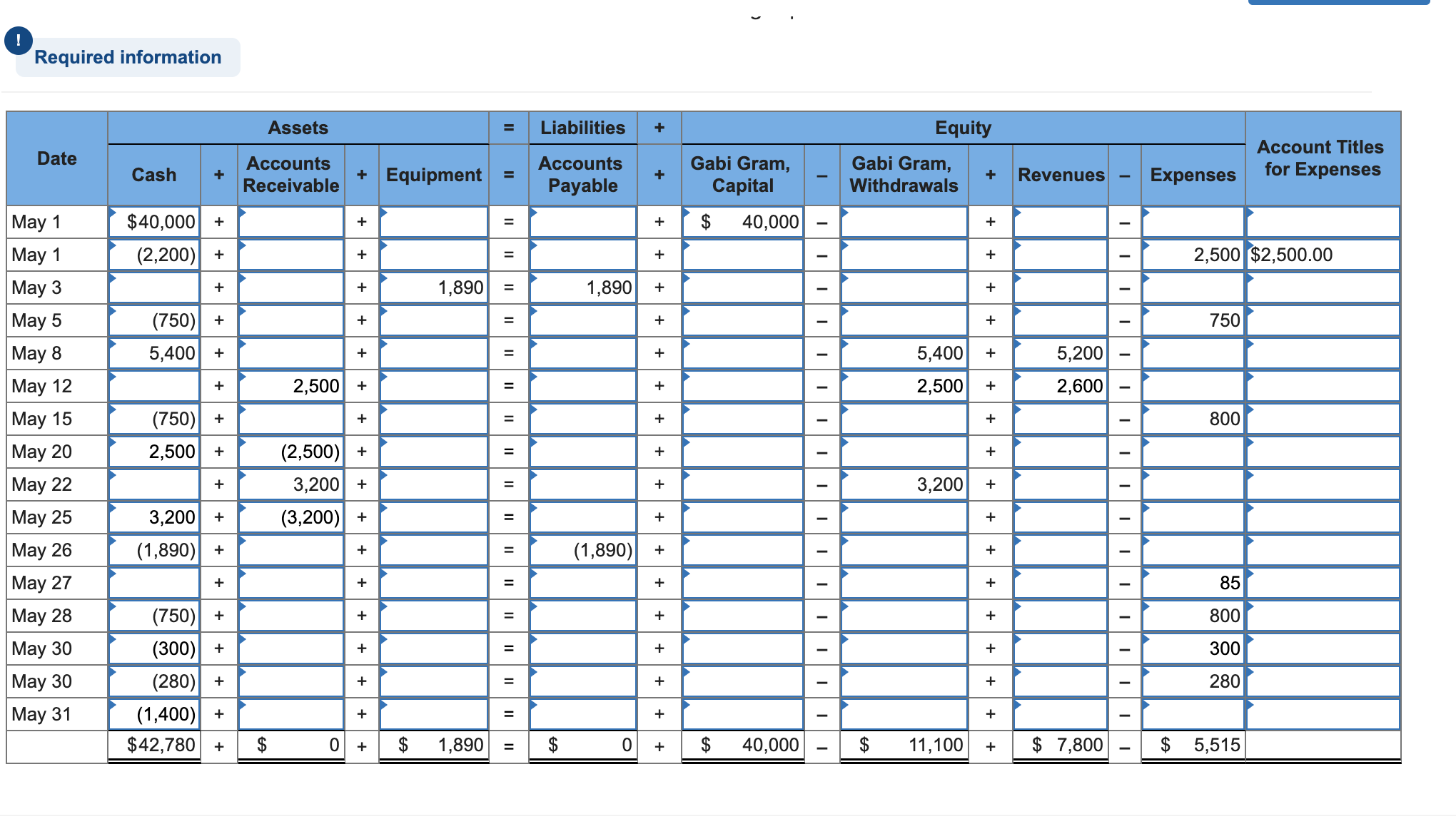

Required information [The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 Gabi Gram invested $40,000 cash in the company. May 1 The company rented a furnished office and paid $2,200 cash for May's rent. May 3 The company purchased $1,890 of equipment on credit. May 5 The company paid $750 cash for this month's cleaning services. May 8 The company provided consulting services for a client and immediately collected $5,400 cash. May 12 The company provided $2,500 of consulting services for a client on credit. May 15 The company paid $750 cash for an assistant's salary for the first half of this month. May 20 The company received $2,500 cash payment for the services provided on May 12 . May 22 The company provided $3,200 of consulting services on credit. May 25 The company received $3,200 cash payment for the services provided on May 22 . May 26 The company paid $1,890 cash for the equipment purchased on May 3 . May 27 The company purchased $80 of equipment on credit. May 28 The company paid $750 cash for an assistant's salary for the second half of this month. May 30 The company paid $300 cash for this month's telephone bill. May 30 The company paid $280 cash for this month's utilities. May 31 Gabi Gram withdrew $1,400 cash from the company for personal use. Required: 1. Enter the amount of each transaction on individual items of the accounting equation. Note: Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" for account titles if the transaction does not include an expense. (!) Required information \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multicolumn{5}{|c|}{ Assets } & \multirow{2}{*}{==} & \multirow{2}{*}{LiabilitiesAccountsPayable} & \multirow{2}{*}{++} & \multicolumn{7}{|c|}{ Equity } & \multirow{2}{*}{AccountTitlesforExpenses} \\ \hline & Cash & + & AccountsReceivable & + & Equipment & & & & GabiGram,Capital & - & GabiGram,Withdrawals & + & Revenues & - & Expenses & \\ \hline May 1 & $40,000 & + & & + & . & = & 1 & + & $40,000 & - & & + & & - & & \\ \hline May 1 & (2,200) & + & ? & + & & = & & + & & - & & + & & - & 2,500 & $2,500.00 \\ \hline May 3 & & + & & + & 1,890 & = & 1,890 & + & & - & & + & & - & & \\ \hline May 5 & (750) & + & P & + & & = & . & + & & - & . & + & & - & 750 & \\ \hline May 12 & & + & 2,500 & + & . & = & & + & & - & 2,500 & + & 2,600 & - & & \\ \hline May 15 & (750) & + & p & + & & = & & + & & - & & + & & - & 800 & \\ \hline May 20 & 2,500 & + & (2,500) & + & & = & & + & & - & & + & & - & & \\ \hline May 22 & & + & 3,200 & + & . & = & & + & & - & 3,200 & + & & - & & \\ \hline May 25 & 3,200 & + & (3,200) & + & & = & & + & & - & & + & & - & & \\ \hline May 26 & (1,890) & + & & + & & = & (1,890) & + & & - & & + & & - & & \\ \hline May 28 & (750) & + & & + & & = & & + & & - & & + & & - & 800 & \\ \hline May 30 & (300) & + & & + & & = & & + & & - & & + & & - & 300 & \\ \hline May 30 & (280) & + & & + & & = & & + & & - & & + & & - & 280 & \\ \hline \multirow[t]{2}{*}{ May 31} & (1,400) & + & & + & & = & & + & & - & & + & & - & & \\ \hline & $42,780 & + & $ & + & 1,890 & = & $ & + & 40,000 & - & 11,100 & + & $7,800 & - & $5,515 & \\ \hline \end{tabular}

Required information [The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 Gabi Gram invested $40,000 cash in the company. May 1 The company rented a furnished office and paid $2,200 cash for May's rent. May 3 The company purchased $1,890 of equipment on credit. May 5 The company paid $750 cash for this month's cleaning services. May 8 The company provided consulting services for a client and immediately collected $5,400 cash. May 12 The company provided $2,500 of consulting services for a client on credit. May 15 The company paid $750 cash for an assistant's salary for the first half of this month. May 20 The company received $2,500 cash payment for the services provided on May 12 . May 22 The company provided $3,200 of consulting services on credit. May 25 The company received $3,200 cash payment for the services provided on May 22 . May 26 The company paid $1,890 cash for the equipment purchased on May 3 . May 27 The company purchased $80 of equipment on credit. May 28 The company paid $750 cash for an assistant's salary for the second half of this month. May 30 The company paid $300 cash for this month's telephone bill. May 30 The company paid $280 cash for this month's utilities. May 31 Gabi Gram withdrew $1,400 cash from the company for personal use. Required: 1. Enter the amount of each transaction on individual items of the accounting equation. Note: Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" for account titles if the transaction does not include an expense. (!) Required information \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multicolumn{5}{|c|}{ Assets } & \multirow{2}{*}{==} & \multirow{2}{*}{LiabilitiesAccountsPayable} & \multirow{2}{*}{++} & \multicolumn{7}{|c|}{ Equity } & \multirow{2}{*}{AccountTitlesforExpenses} \\ \hline & Cash & + & AccountsReceivable & + & Equipment & & & & GabiGram,Capital & - & GabiGram,Withdrawals & + & Revenues & - & Expenses & \\ \hline May 1 & $40,000 & + & & + & . & = & 1 & + & $40,000 & - & & + & & - & & \\ \hline May 1 & (2,200) & + & ? & + & & = & & + & & - & & + & & - & 2,500 & $2,500.00 \\ \hline May 3 & & + & & + & 1,890 & = & 1,890 & + & & - & & + & & - & & \\ \hline May 5 & (750) & + & P & + & & = & . & + & & - & . & + & & - & 750 & \\ \hline May 12 & & + & 2,500 & + & . & = & & + & & - & 2,500 & + & 2,600 & - & & \\ \hline May 15 & (750) & + & p & + & & = & & + & & - & & + & & - & 800 & \\ \hline May 20 & 2,500 & + & (2,500) & + & & = & & + & & - & & + & & - & & \\ \hline May 22 & & + & 3,200 & + & . & = & & + & & - & 3,200 & + & & - & & \\ \hline May 25 & 3,200 & + & (3,200) & + & & = & & + & & - & & + & & - & & \\ \hline May 26 & (1,890) & + & & + & & = & (1,890) & + & & - & & + & & - & & \\ \hline May 28 & (750) & + & & + & & = & & + & & - & & + & & - & 800 & \\ \hline May 30 & (300) & + & & + & & = & & + & & - & & + & & - & 300 & \\ \hline May 30 & (280) & + & & + & & = & & + & & - & & + & & - & 280 & \\ \hline \multirow[t]{2}{*}{ May 31} & (1,400) & + & & + & & = & & + & & - & & + & & - & & \\ \hline & $42,780 & + & $ & + & 1,890 & = & $ & + & 40,000 & - & 11,100 & + & $7,800 & - & $5,515 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started