Answered step by step

Verified Expert Solution

Question

1 Approved Answer

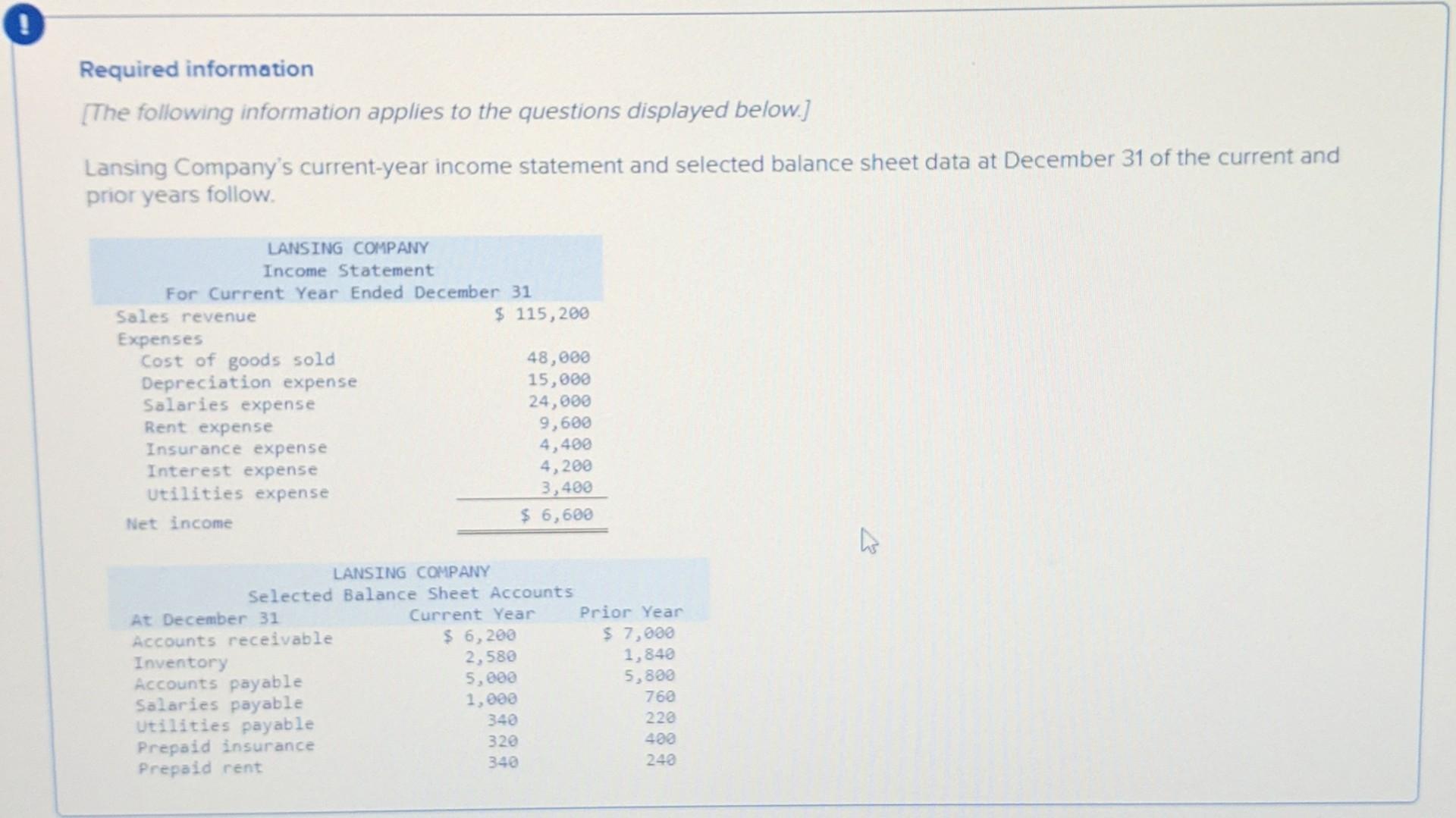

Required information [The following information applies to the questions displayed below.] Lansing Company's current-year income statement and selected balance sheet data at December 31 of

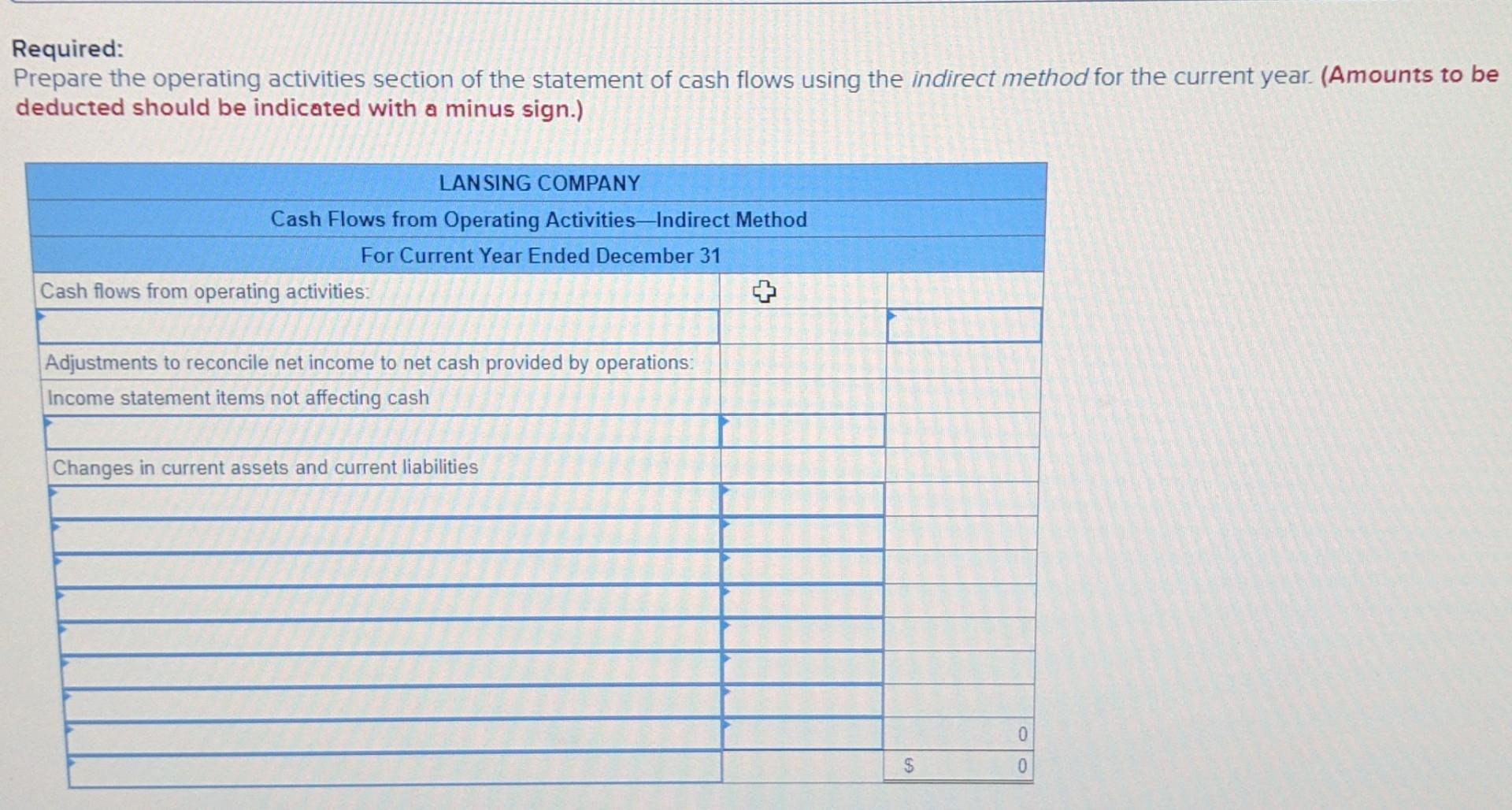

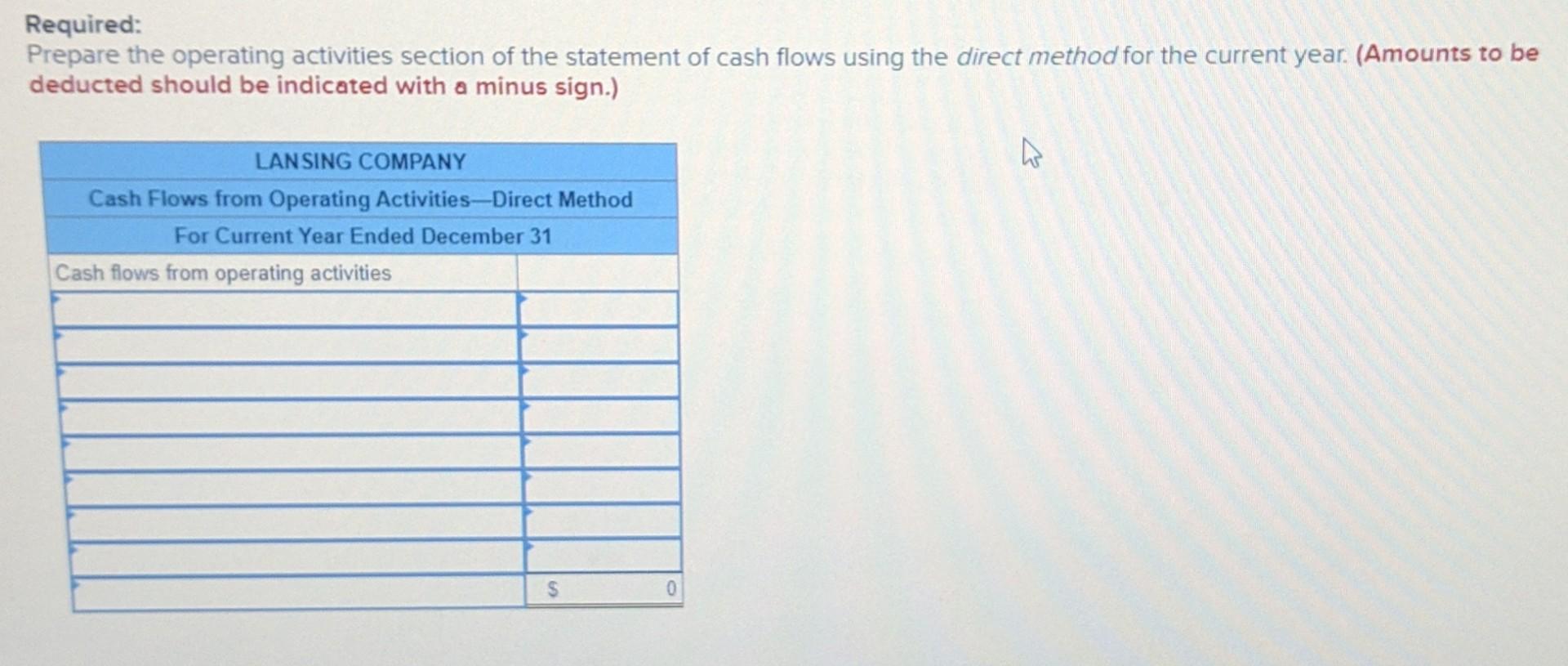

Required information [The following information applies to the questions displayed below.] Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and prior years follow LANSING COMPANY Income Statement For Current Year Ended December 31 Sales revenue $ 115,200 Expenses Cost of goods sold 48,000 Depreciation expense 15,000 Salaries expense 24,000 Rent expense 9,600 Insurance expense 4,400 Interest expense 4,200 Utilities expense 3,400 Net income $ 6,600 LANSING COMPANY Selected Balance Sheet Accounts At December 31 Current Year Prior Year Accounts receivable $ 6, 200 $ 7,000 Inventory 2,580 1,840 Accounts payable 5,000 5,800 Salaries payable 1,000 760 Utilities payable 340 222 Prepaid insurance 320 400 Prepaid rent 340 243 Required: Prepare the operating activities section of the statement of cash flows using the indirect method for the current year. (Amounts to be deducted should be indicated with a minus sign.) LANSING COMPANY Cash Flows from Operating ActivitiesIndirect Method For Current Year Ended December 31 Cash flows from operating activities: Adjustmer to reconcile net income to net cash provided by operations: Income statement items not affecting cash Changes in current assets and current liabilities 0 $ 0 Required: Prepare the operating activities section of the statement of cash flows using the direct method for the current year. (Amounts to be deducted should be indicated with a minus sign.) LANSING COMPANY Cash Flows from Operating Activities-Direct Method For Current Year Ended December 31 Cash flows from operating activities S 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started