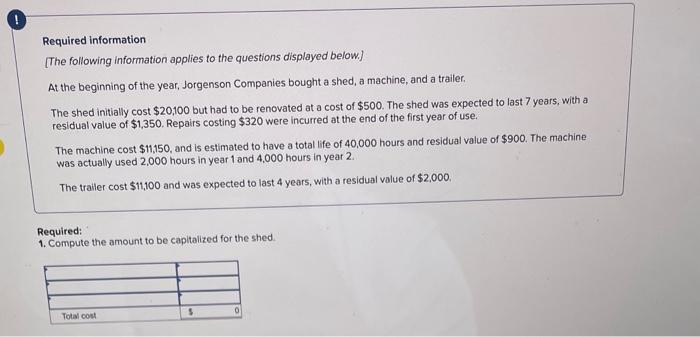

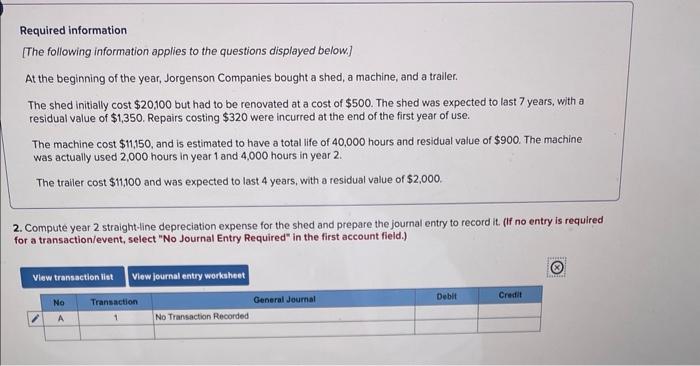

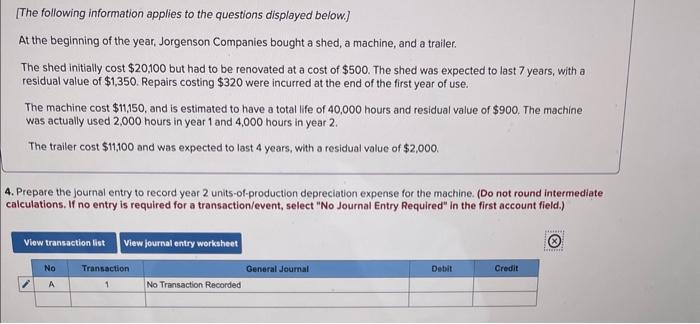

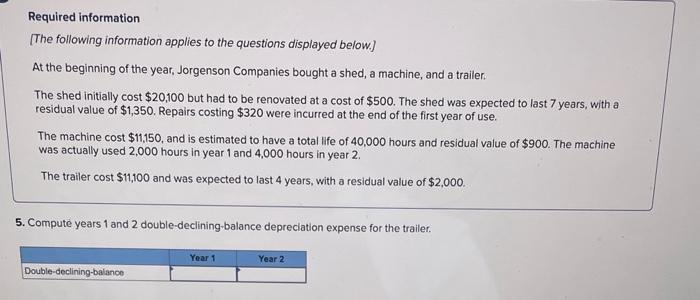

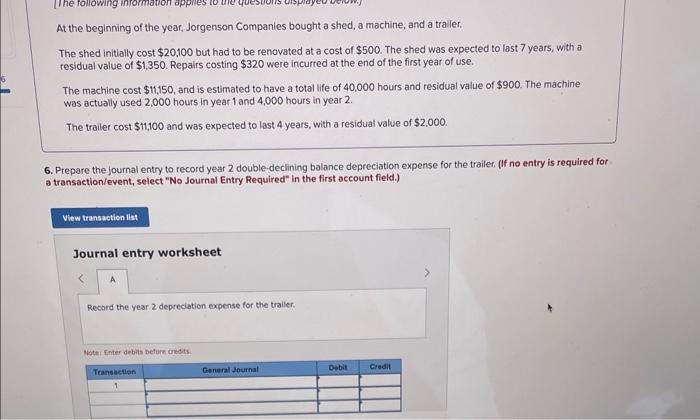

Required information [The following information applies to the questions displayed below.] At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a trailer. The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurred at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years, with a residual volue of $2,000. Required: 1. Compute the amount to be capltalized for the shed. Required information [The following information applies to the questions displayed belowi] At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a trailer. The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurred at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years, with a residual value of $2,000. 2. Compute year 2 straight-line depreciation expense for the shed and prepare the journal entry to record it. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information [The following information applies to the questions displayed below.] At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a trailer The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurred at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years. with a residual value of $2,000. 3. Compute year 2 units-of-production depreciation expense for the machine. (Do not round intermedlate calculations.) [The following information applies to the questions displayed below.] At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a trailer: The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurred at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years, with a residual value of $2,000. . Prepare the journal entry to record year 2 units-of-production depreciation expense for the machine. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required information [The following information applies to the questions displayed below.] At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a trailer. The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurred at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years, with a residual value of $2,000. 5. Compute years 1 and 2 double-declining-balance depreciation expense for the trailer. At the beginning of the year, Jorgenson Companies bought a shed, a machine, and a traller. The shed initially cost $20,100 but had to be renovated at a cost of $500. The shed was expected to last 7 years, with a residual value of $1,350. Repairs costing $320 were incurted at the end of the first year of use. The machine cost $11,150, and is estimated to have a total life of 40,000 hours and residual value of $900. The machine was actually used 2,000 hours in year 1 and 4,000 hours in year 2 . The trailer cost $11,100 and was expected to last 4 years, with a residual value of $2,000. 6. Prepare the Journal entry to record year 2 double-declining balance depreciation expense for the trailer. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)