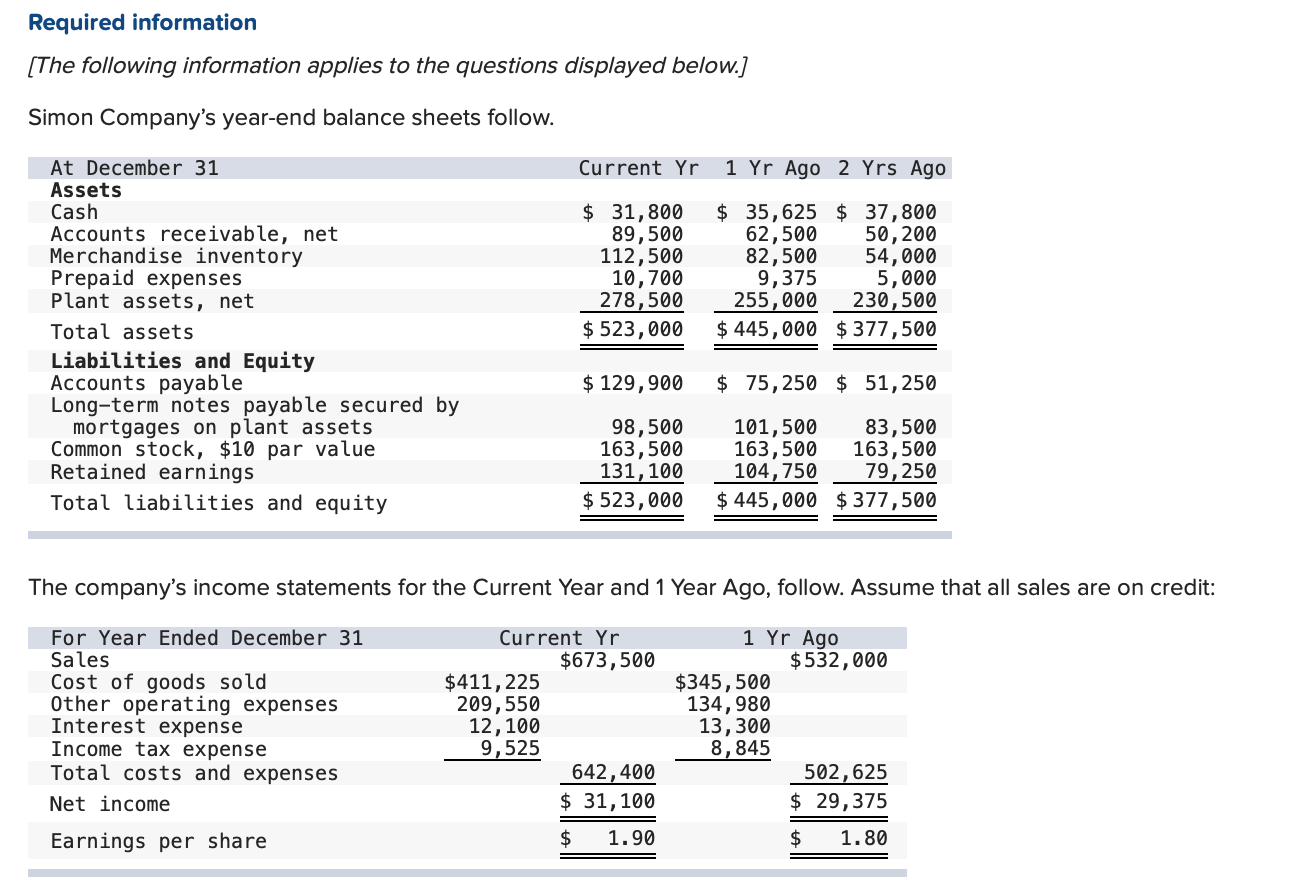

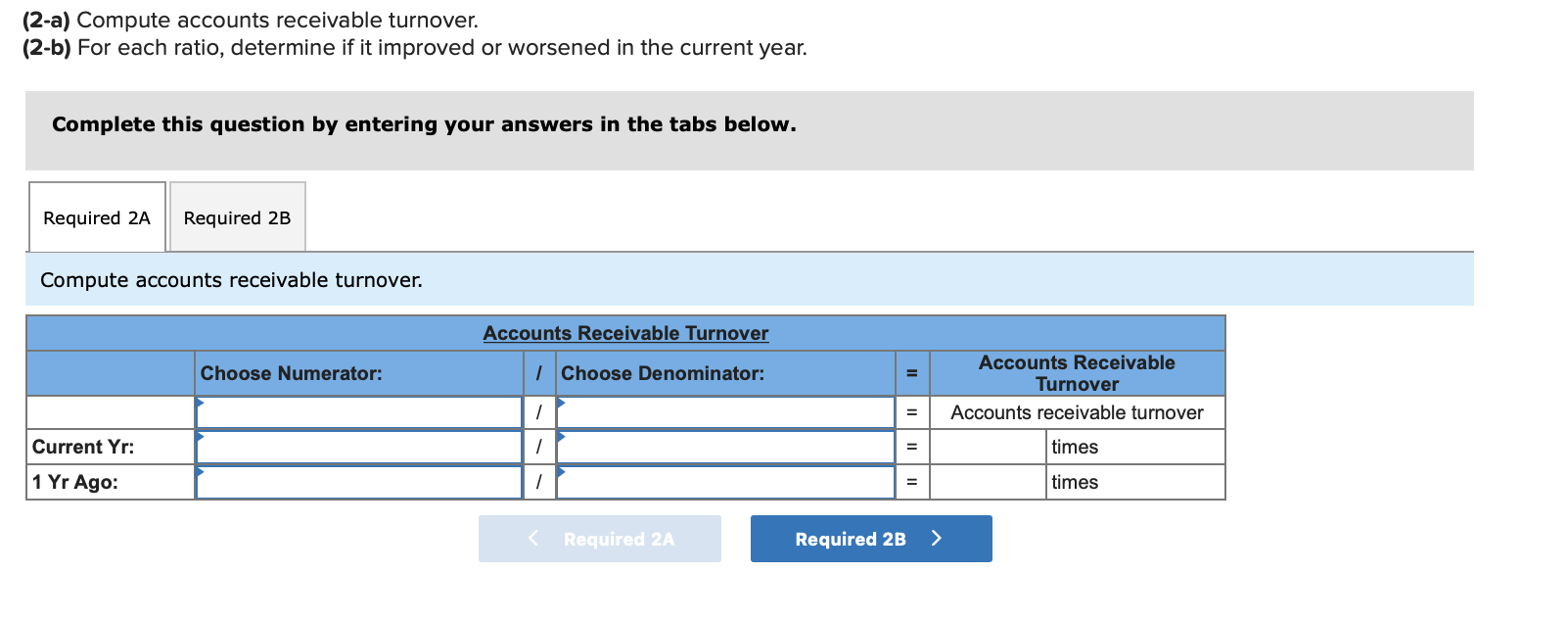

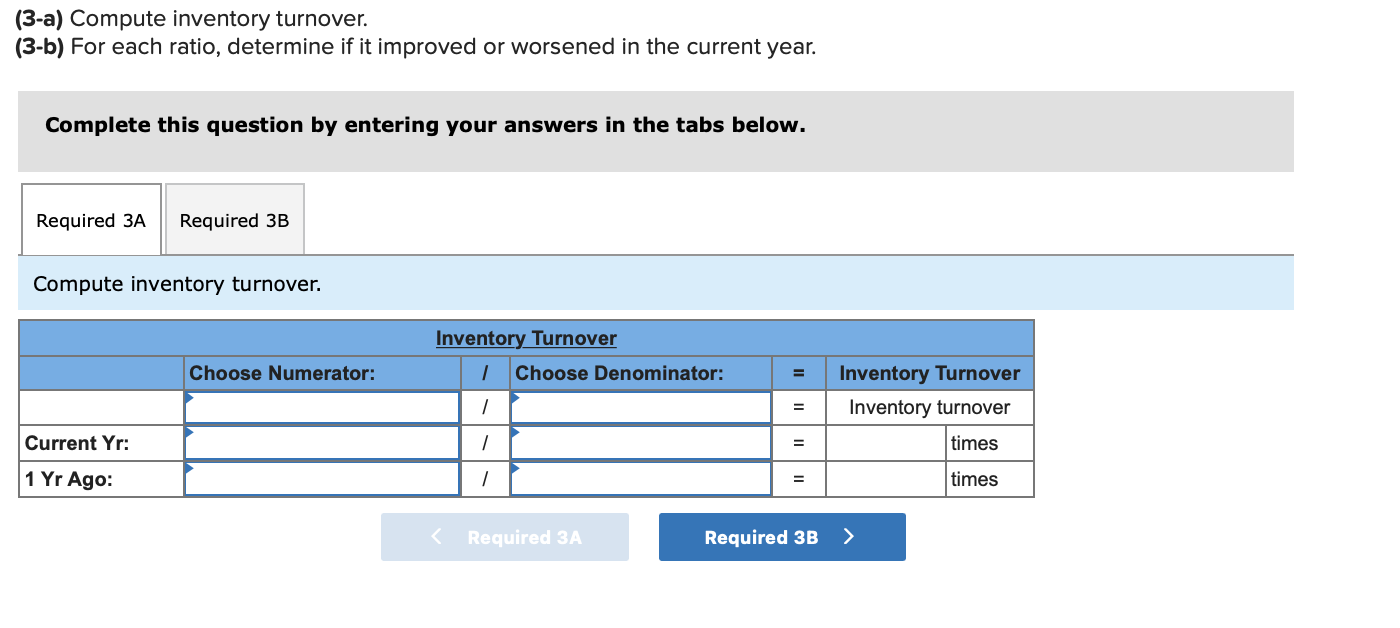

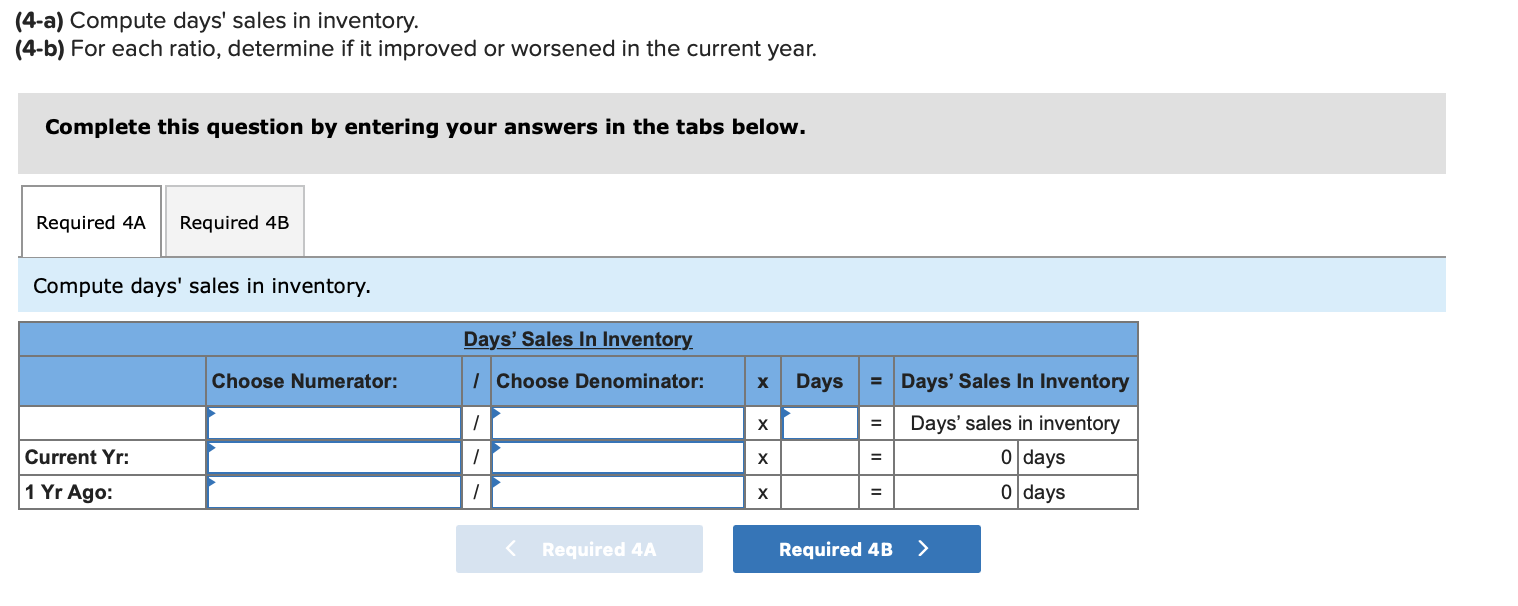

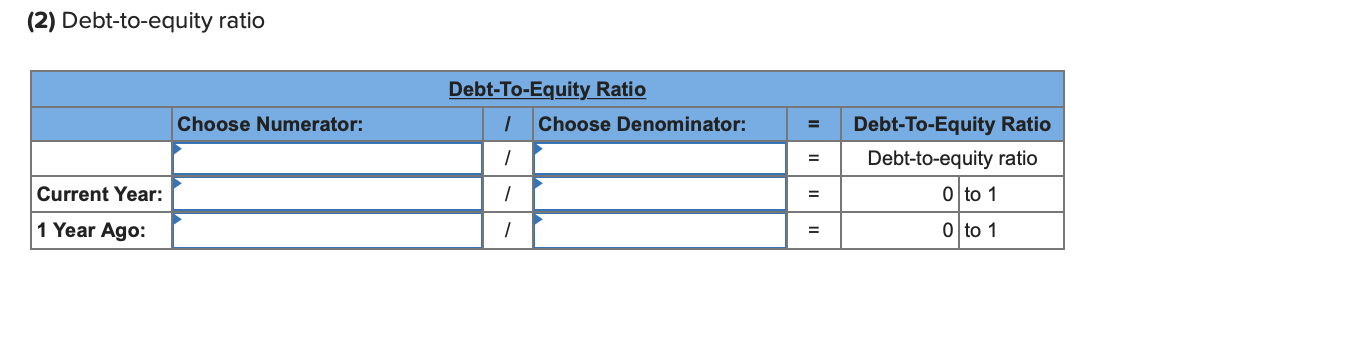

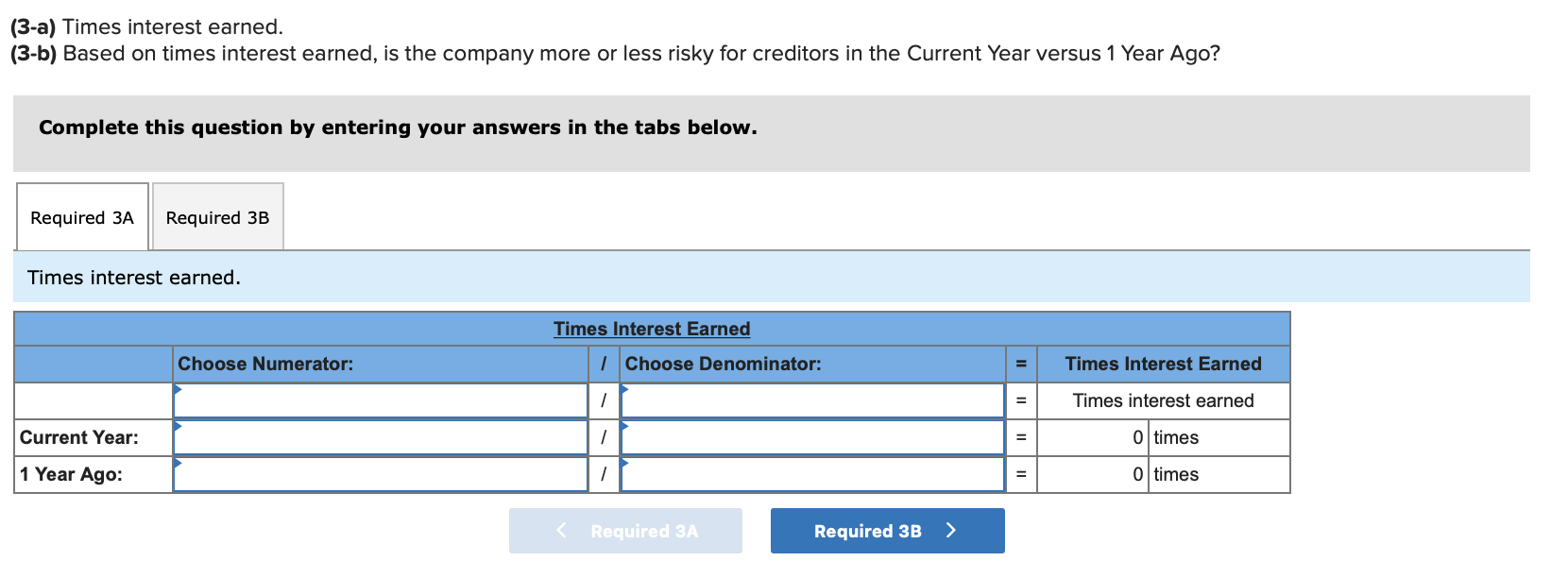

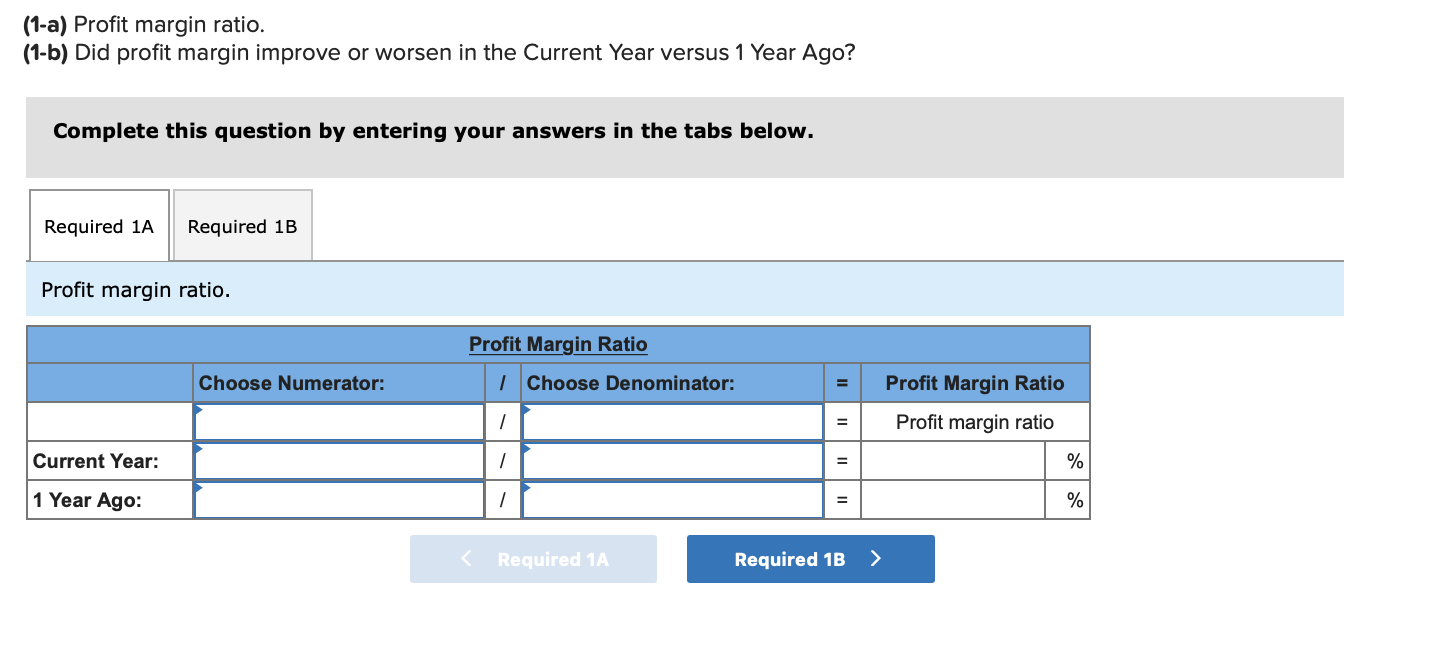

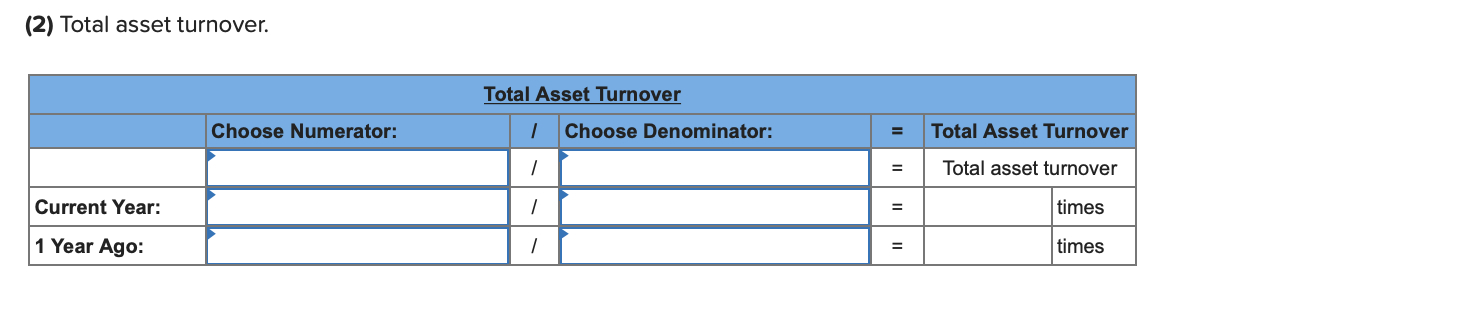

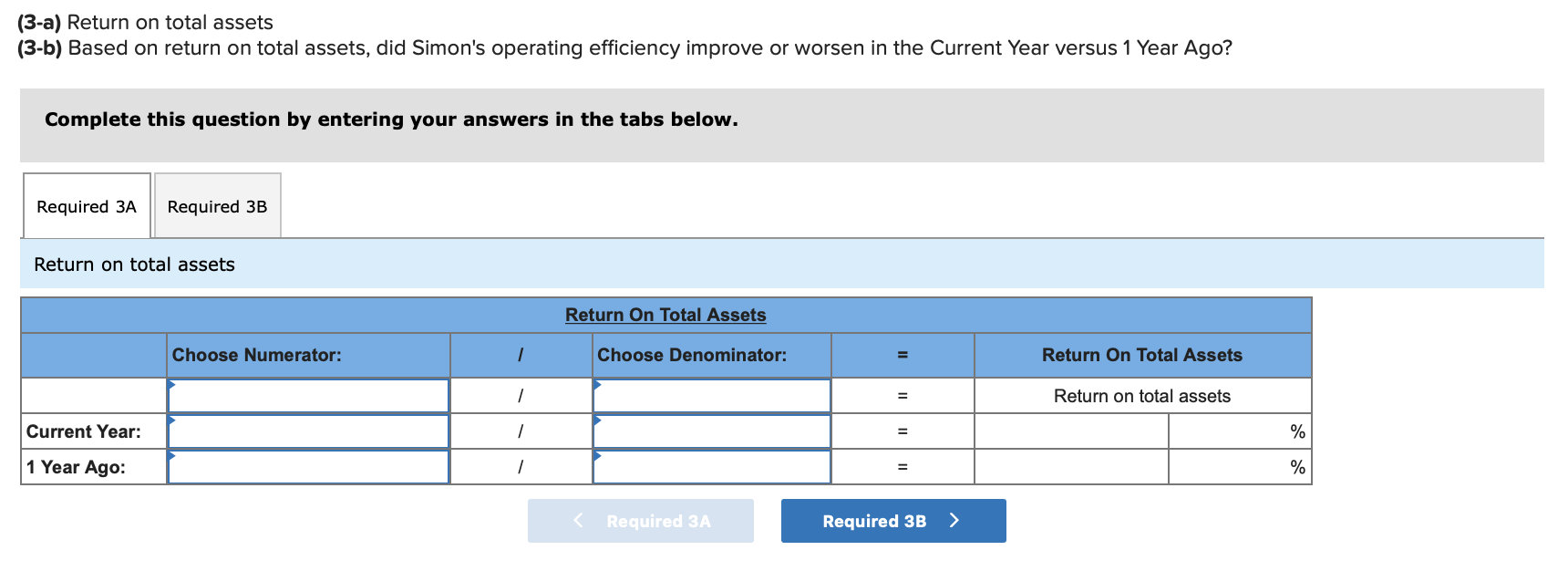

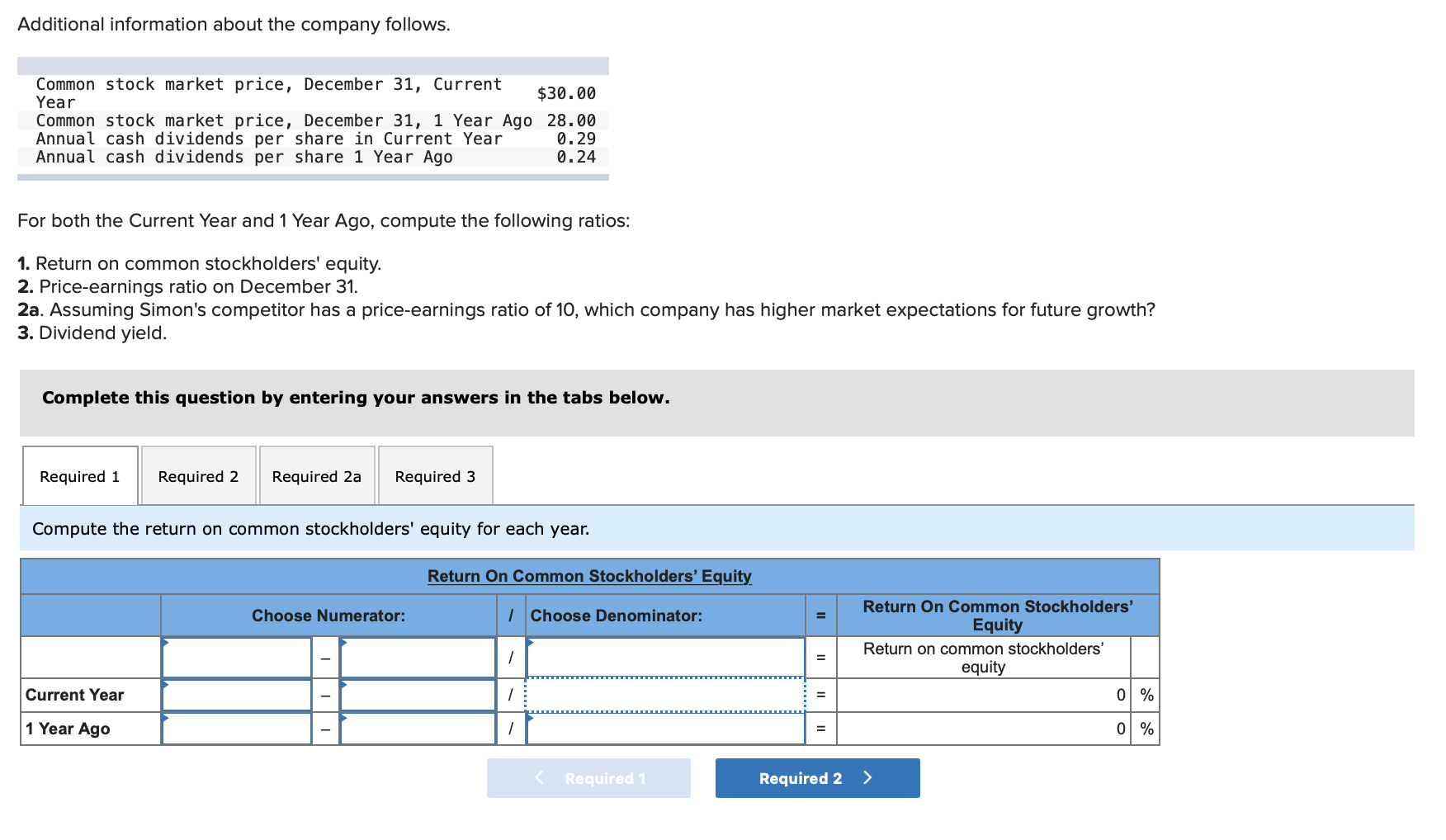

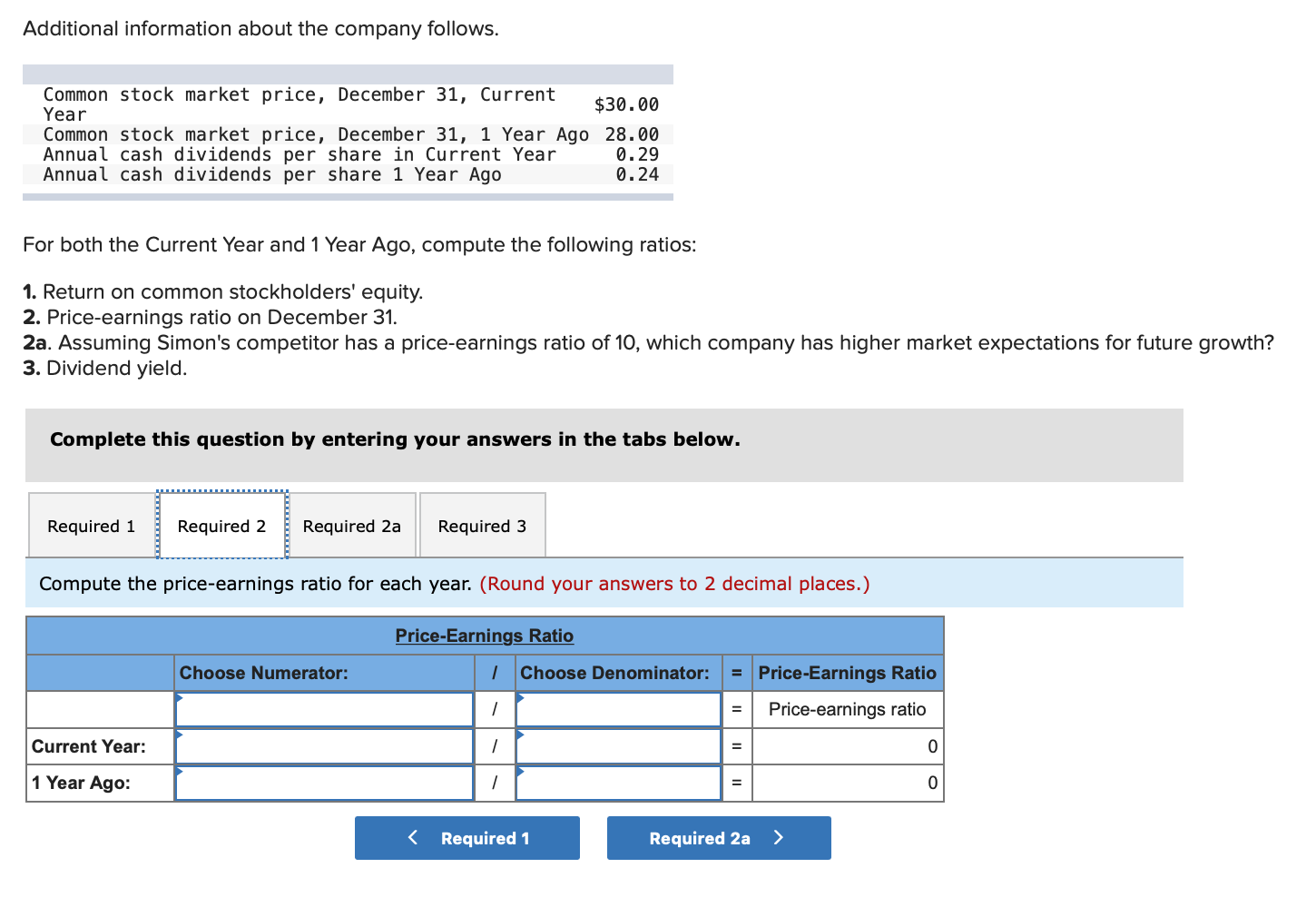

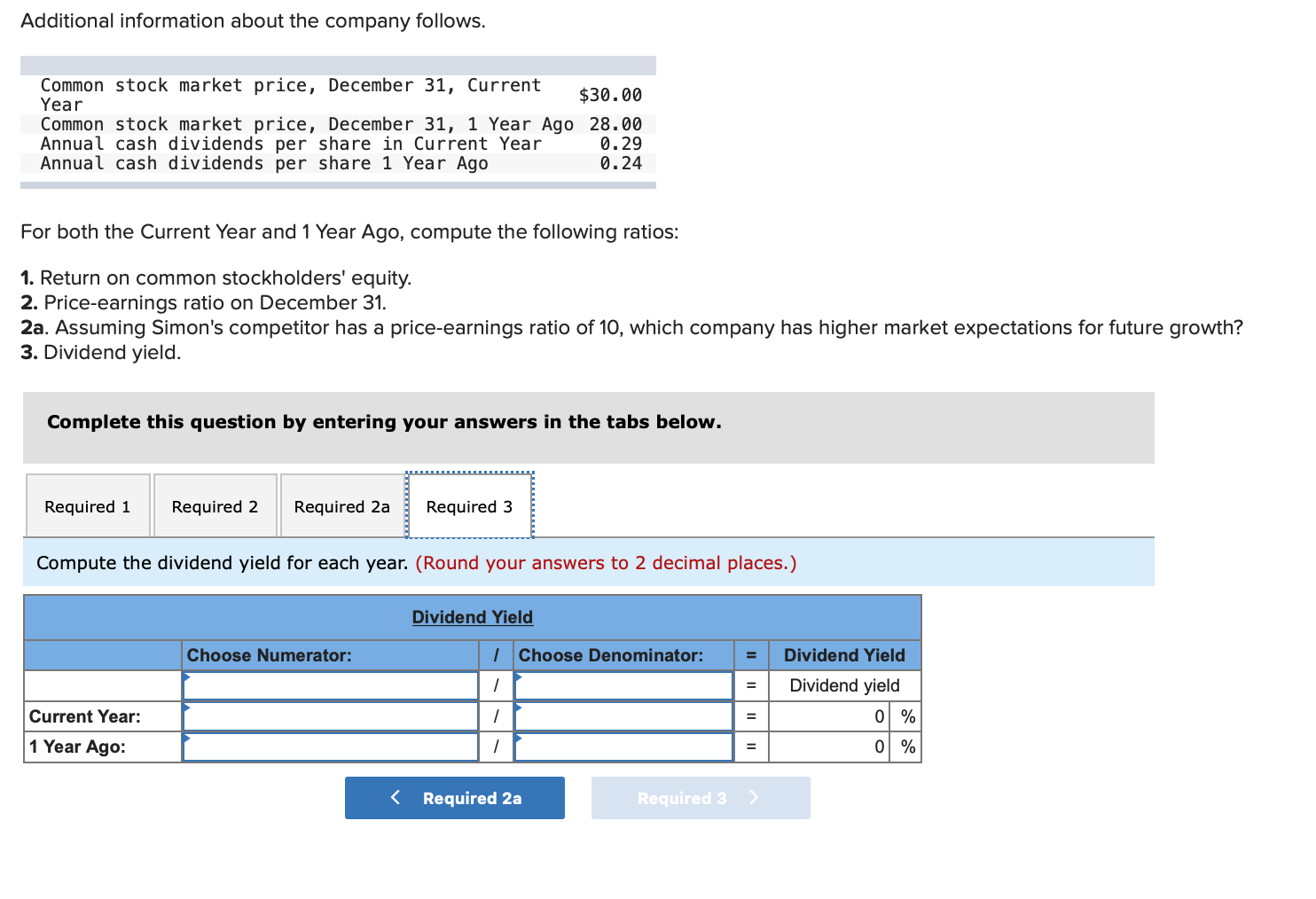

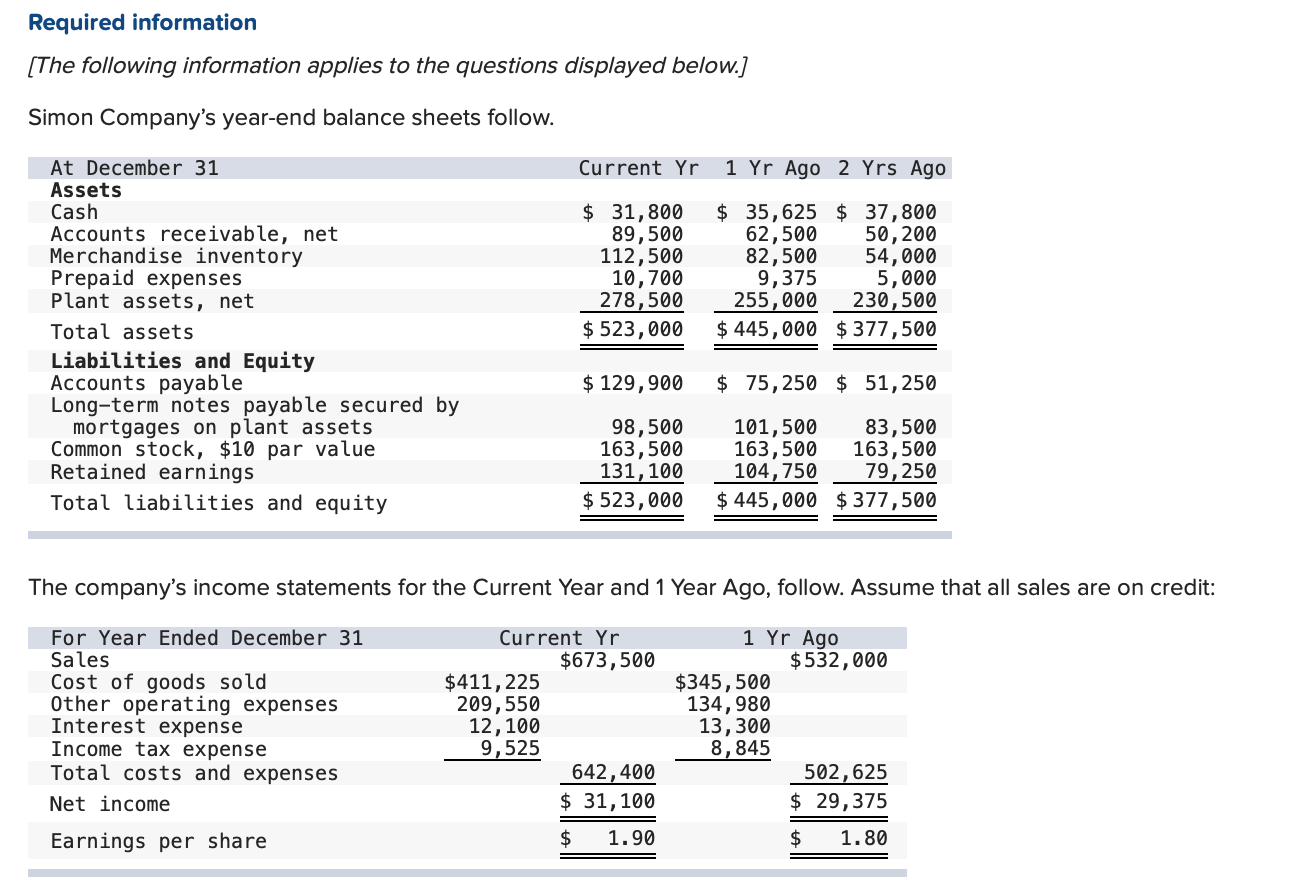

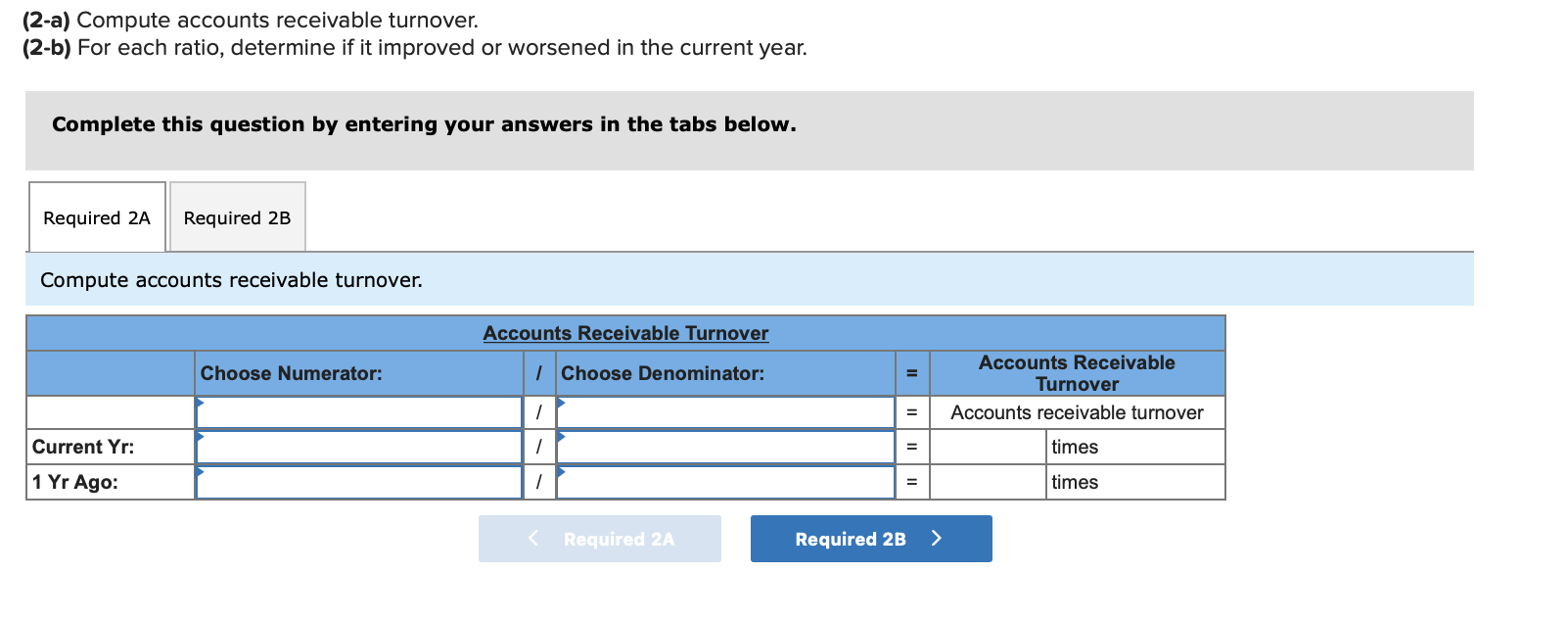

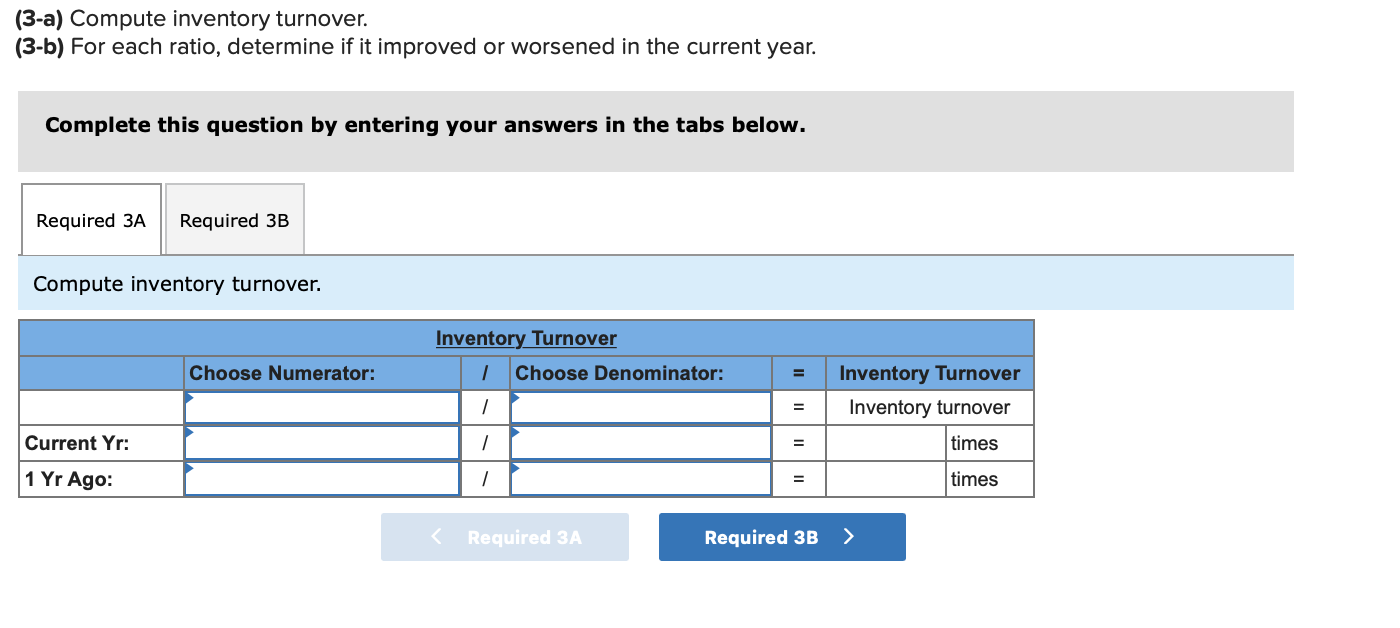

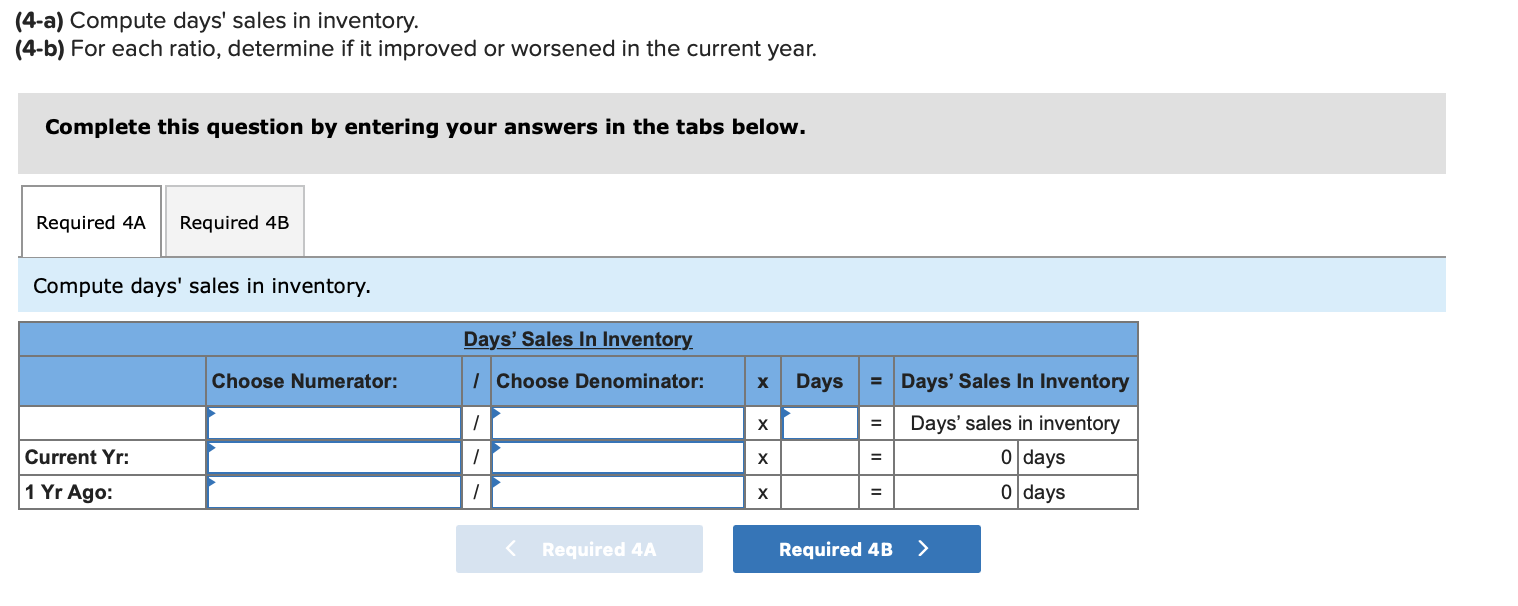

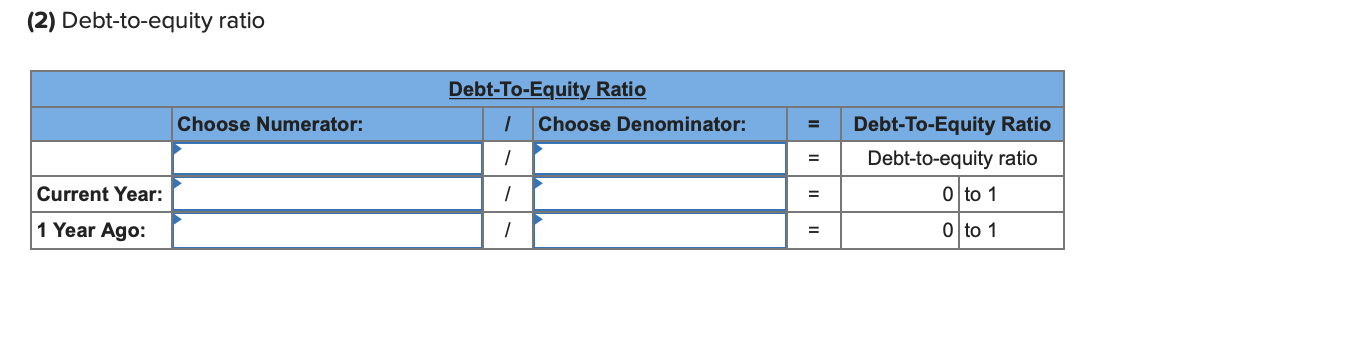

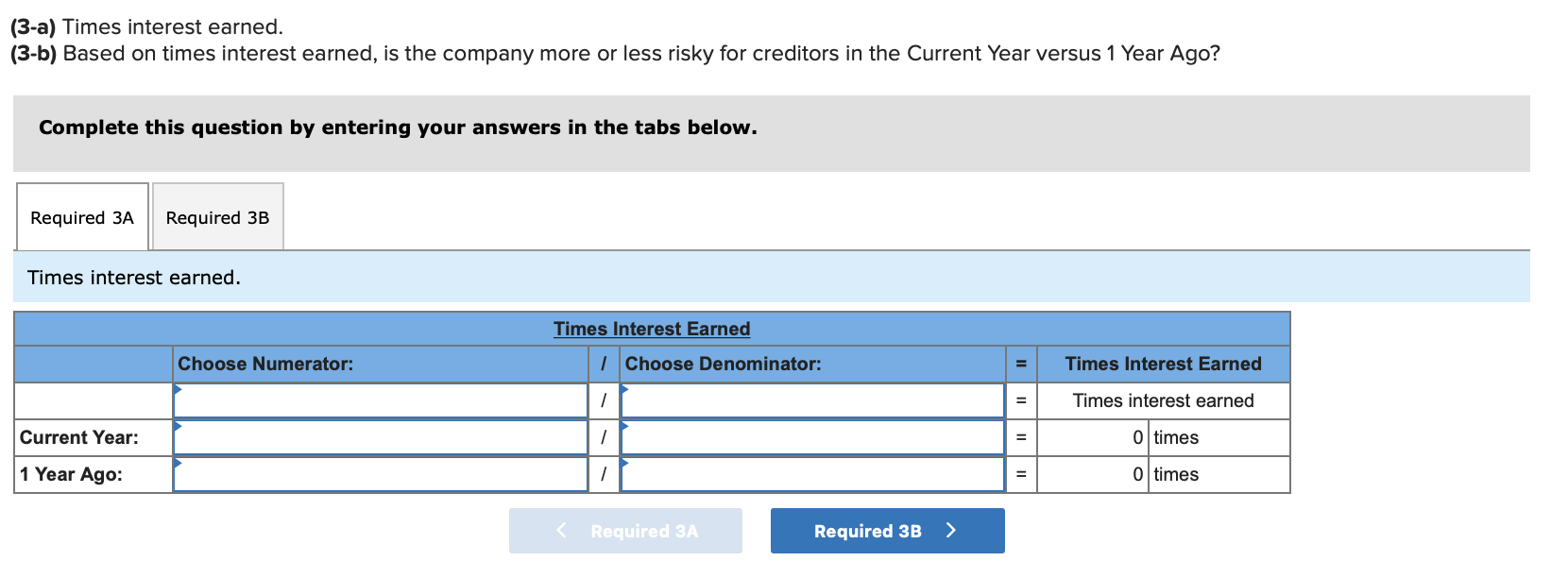

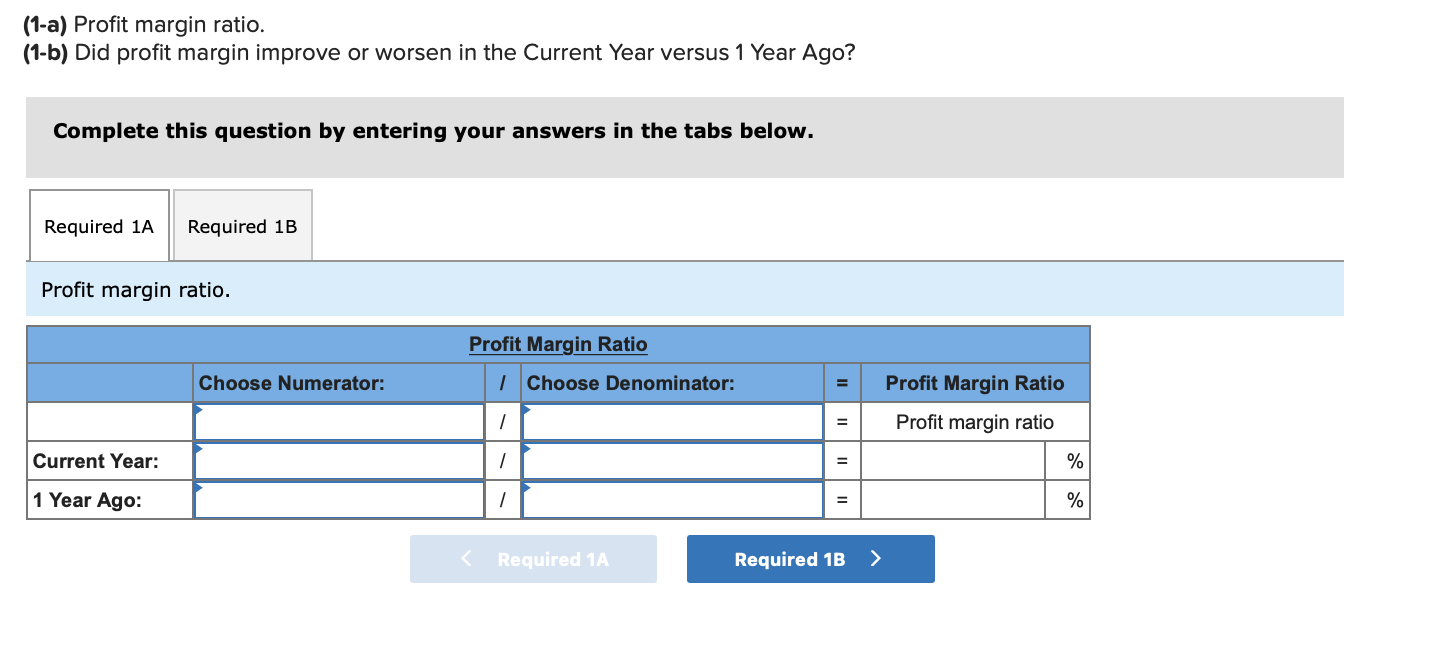

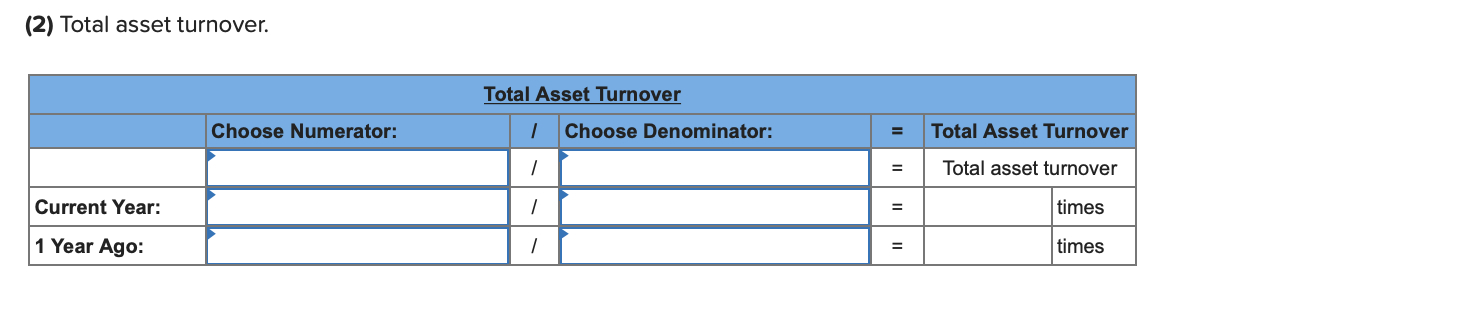

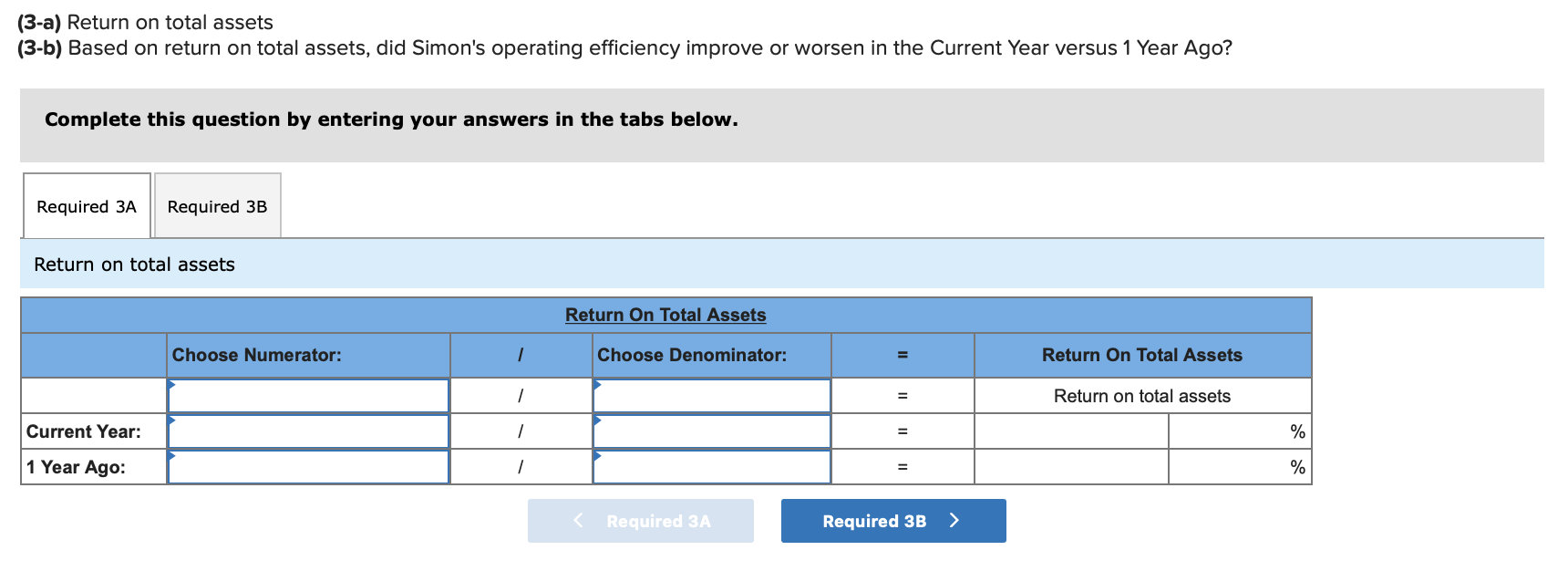

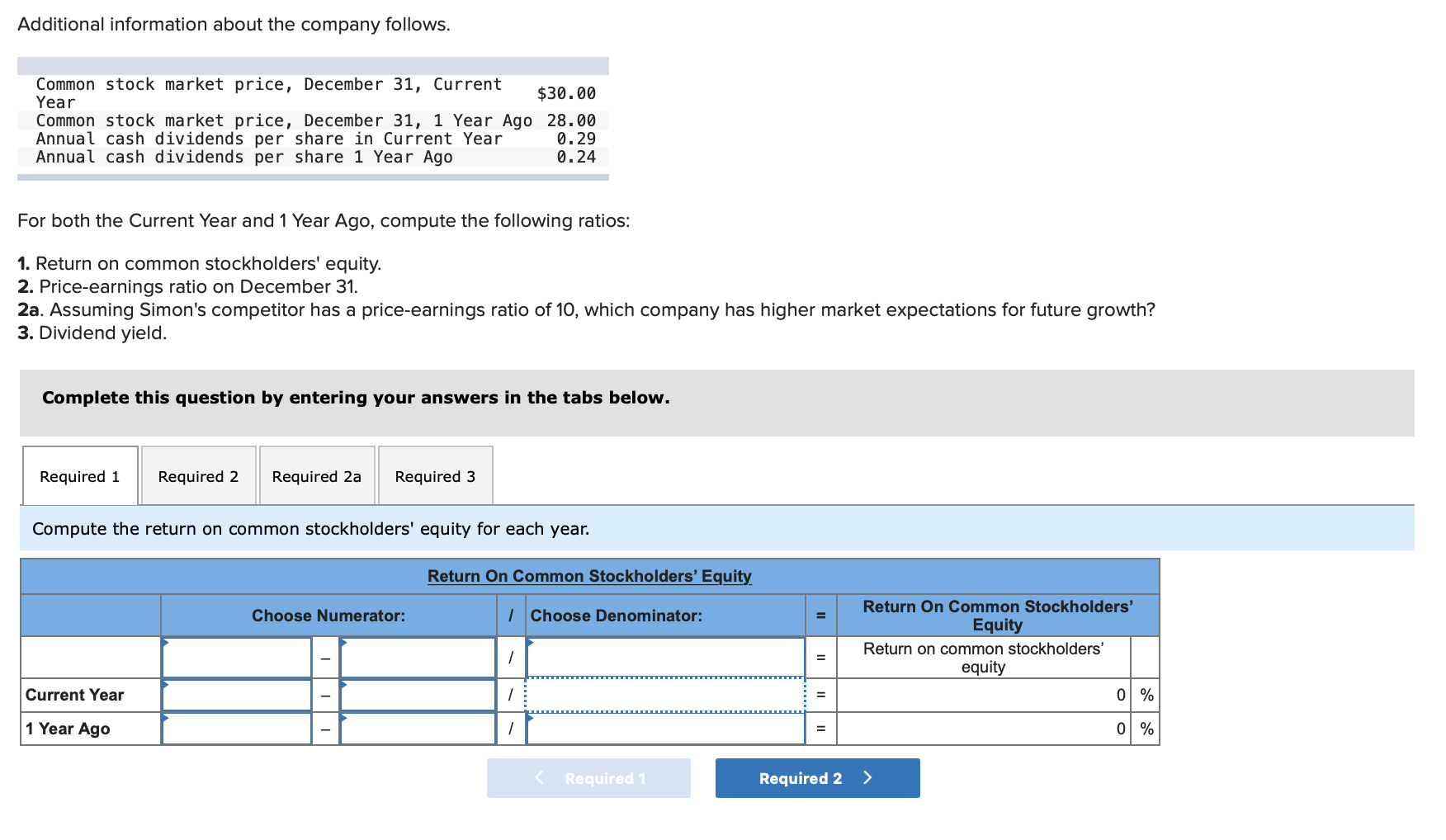

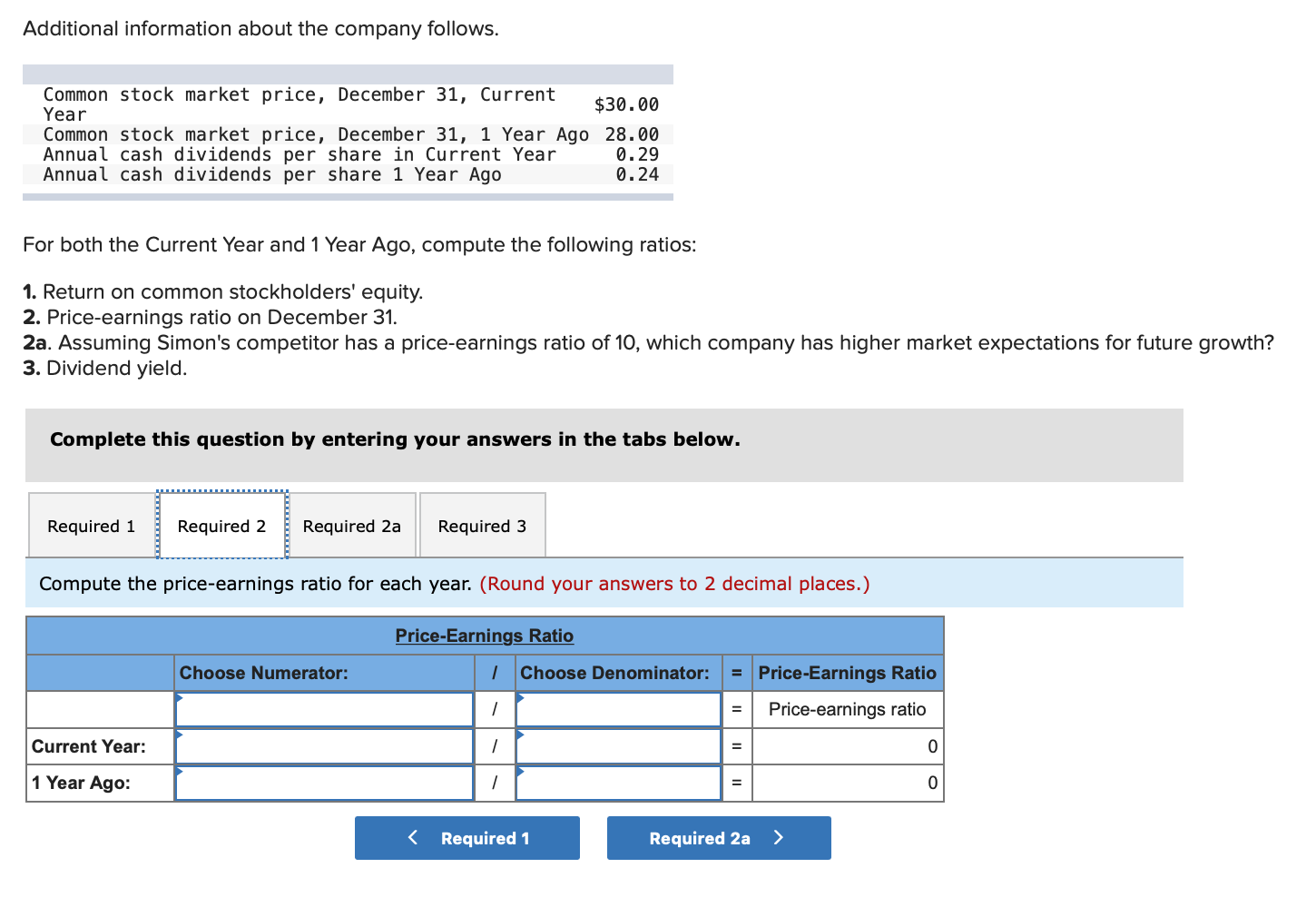

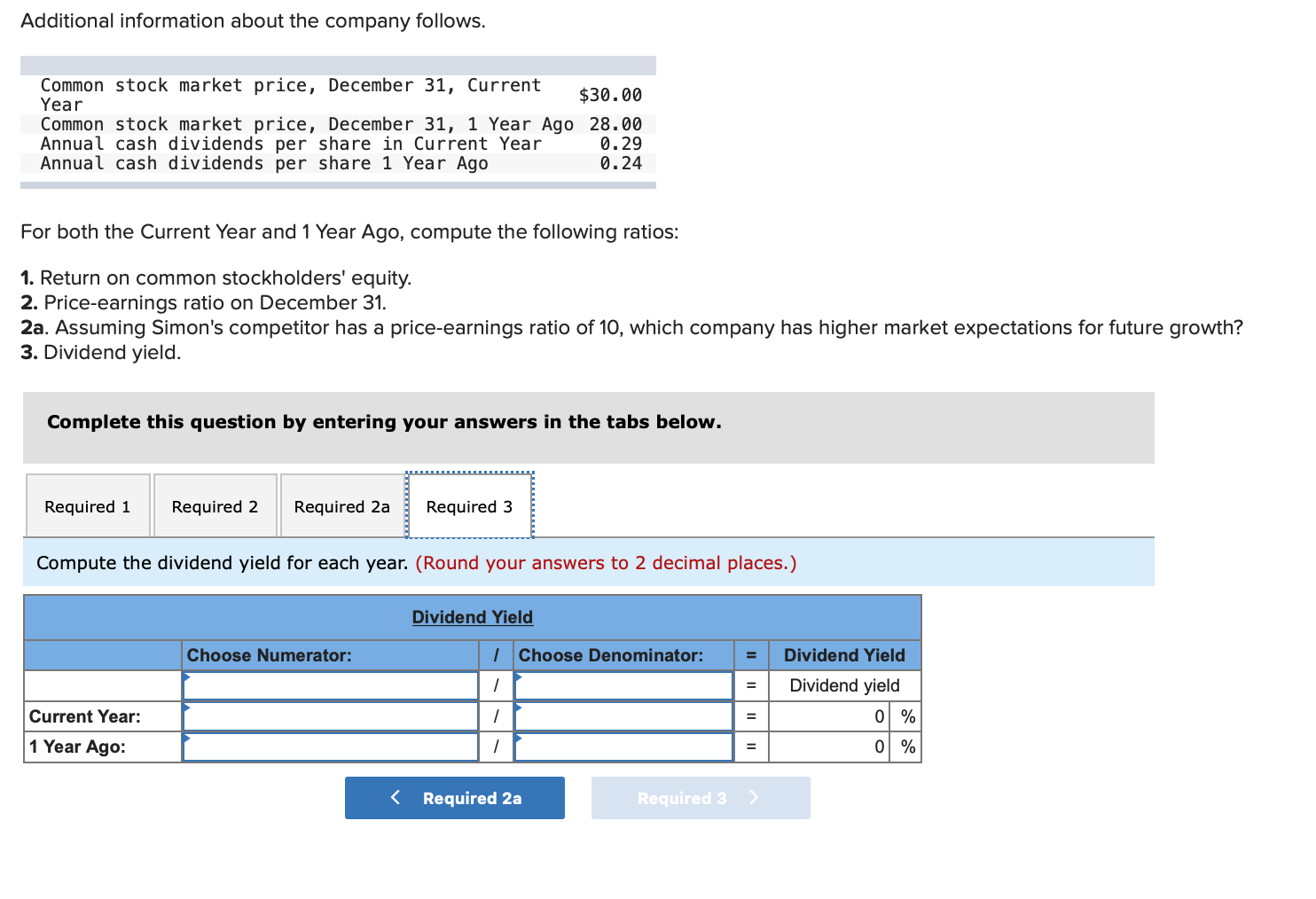

Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,800 89,500 112,500 10,700 278,500 $ 523,000 $ 35,625 $ 37,800 62,500 50,200 82,500 54,000 9,375 5,000 255,000 230,500 $ 445,000 $377,500 $ 129,900 $ 75,250 $ 51,250 98,500 163,500 131, 100 $ 523,000 101,500 83,500 163,500 163,500 104,750 79, 250 $ 445,000 $ 377,500 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $673,500 $411, 225 209,550 12,100 9,525 642,400 $ 31, 100 $ 1.90 1 Yr Ago $532,000 $345,500 134,980 13, 300 8,845 502,625 $ 29,375 $ 1.80 (2-a) Compute accounts receivable turnover. (2-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 2A Required 2B Compute accounts receivable turnover. Accounts Receivable Turnover Choose Numerator: 1 Choose Denominator: Accounts Receivable Turnover Accounts receivable turnover 1 = Current Yr: 1 = times 1 Yr Ago: 1 = times (3-a) Compute inventory turnover. (3-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute inventory turnover. Inventory Turnover Choose Numerator: 1 Choose Denominator: Inventory Turnover Inventory turnover / Current Yr: 1 times 1 Yr Ago: times (2) Debt-to-equity ratio Debt-To-Equity Ratio 1 Choose Denominator: Choose Numerator: 1 Debt-To-Equity Ratio Debt-to-equity ratio o to 1 Current Year: 1 1 Year Ago: 1 0 to 1 (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 3A Required 3B Times interest earned. Times Interest Earned Choose Numerator: | Choose Denominator: Times Interest Earned / Times interest earned Current Year / 0 times 1 Year Ago: / o times Required 3A Required 3B > (1-a) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Profit margin ratio. Profit Margin Ratio Choose Numerator: | Choose Denominator: Profit Margin Ratio Profit margin ratio 1 Current Year: / = % 1 Year Ago: 1 = % Required 1A Required 1B (2) Total asset turnover. Total Asset Turnover Choose Numerator: 1 Choose Denominator: Total Asset Turnover / Total asset turnover Current Year: / times 1 Year Ago: 1 times (3-a) Return on total assets (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 3A Required 3B Return on total assets Return On Total Assets Choose Numerator: Choose Denominator: Return On Total Assets / Return on total assets Current Year: / % 1 Year Ago: / % Required 3A Required 3B > Additional information about the company follows. Common stock market price, December 31, Current $30.00 Year Common stock market price, December 31, 1 Year Ago 28.00 Annual cash dividends per share in Current Year 0.29 Annual cash dividends per share 1 Year Ago 0.24 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator: 1 Choose Denominator: Return On Common Stockholders' Equity Return on common stockholders' equity 0 % / Current Year 1 1 Year Ago / = 0 % Additional information about the company follows. Common stock market price, December 31, Current Year $30.00 Common stock market price, December 31, 1 Year Ago 28.00 Annual cash dividends per share in Current Year 0.29 Annual cash dividends per share 1 Year Ago 0.24 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2. Required 2a Required 3 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Choose Numerator: 1 Choose Denominator: = Price-Earnings Ratio Price-earnings ratio 1 = Current Year: / = 0 1 Year Ago: 1 0 Additional information about the company follows. Common stock market price, December 31, Current Year $30.00 Common stock market price, December 31, 1 Year Ago 28.00 Annual cash dividends per share in Current Year 0.29 Annual cash dividends per share 1 Year Ago 0.24 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Choose Numerator: Dividend Yield I Choose Denominator: 1 Dividend yield 0 % Current Year: / 1 Year Ago: 1 0 %