Answered step by step

Verified Expert Solution

Question

1 Approved Answer

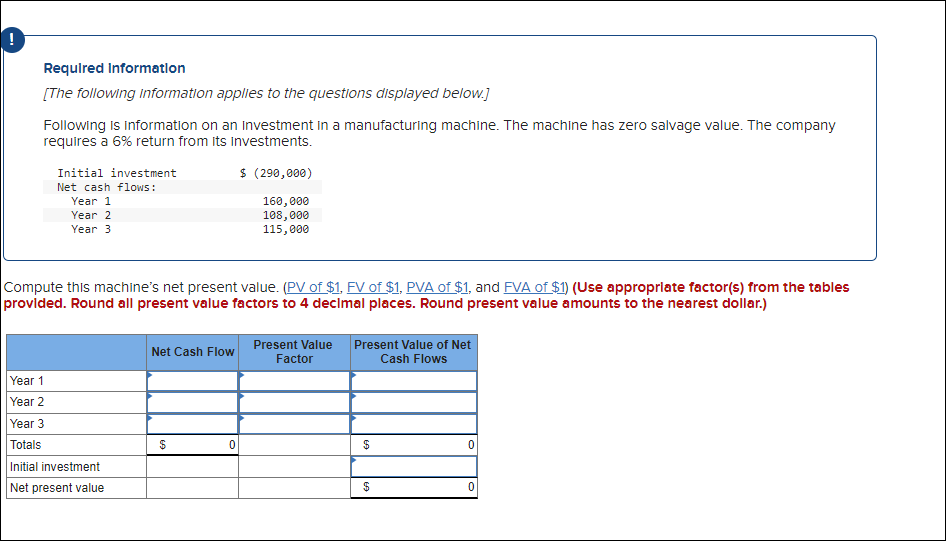

Required Information [The following information applies to the questions displayed below.] Following is information on an Investment in a manufacturing machine. The machine has zero

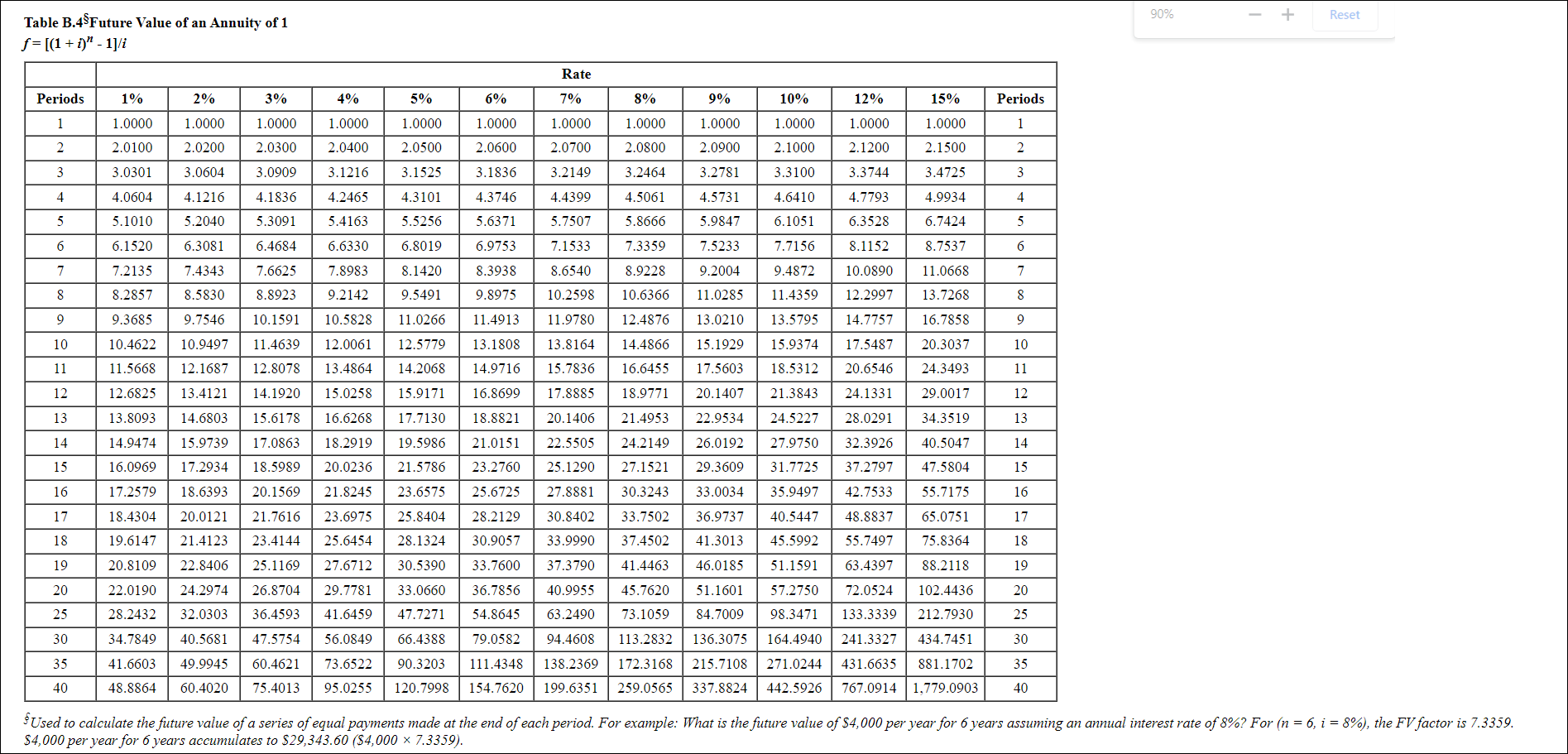

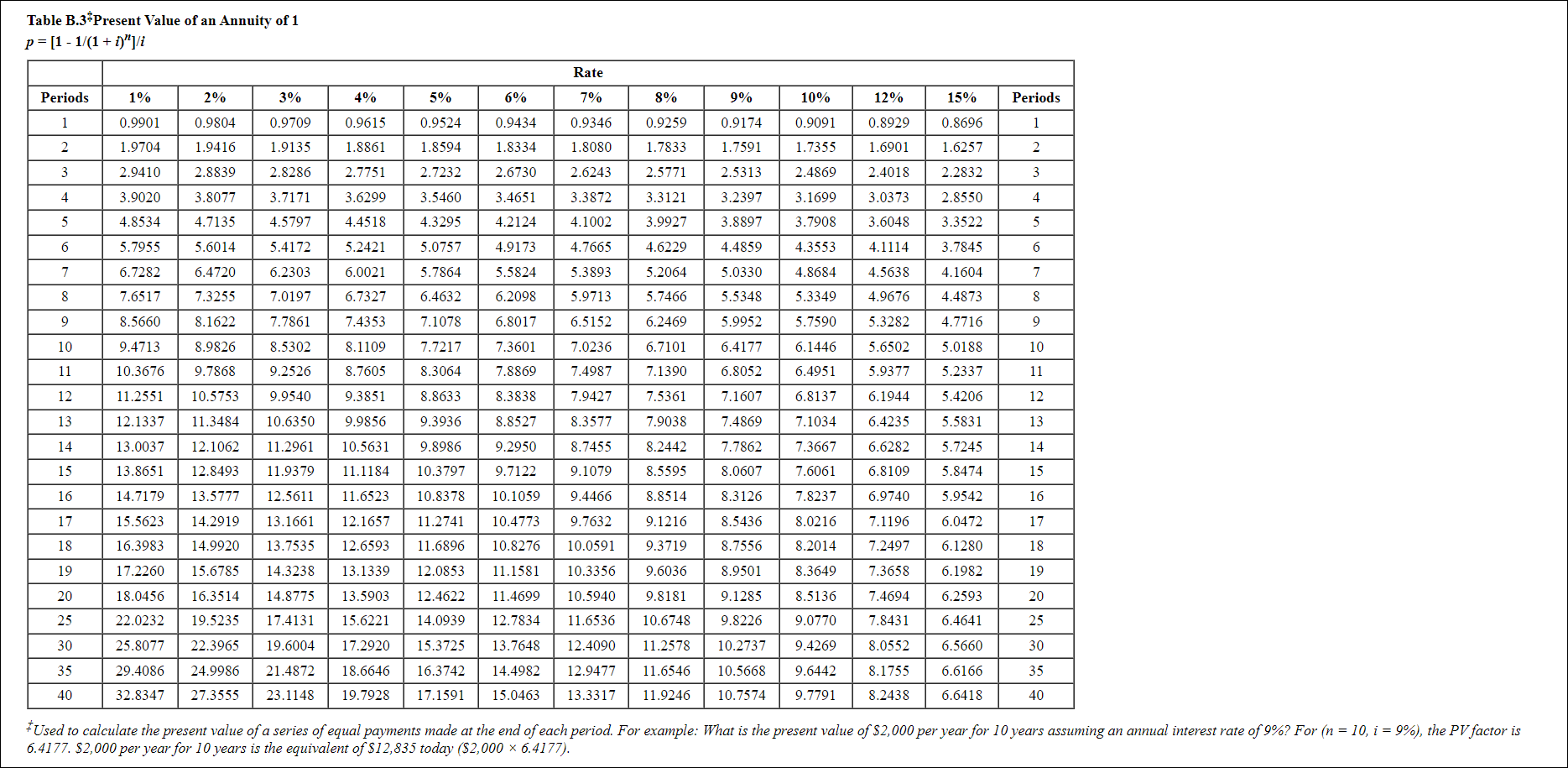

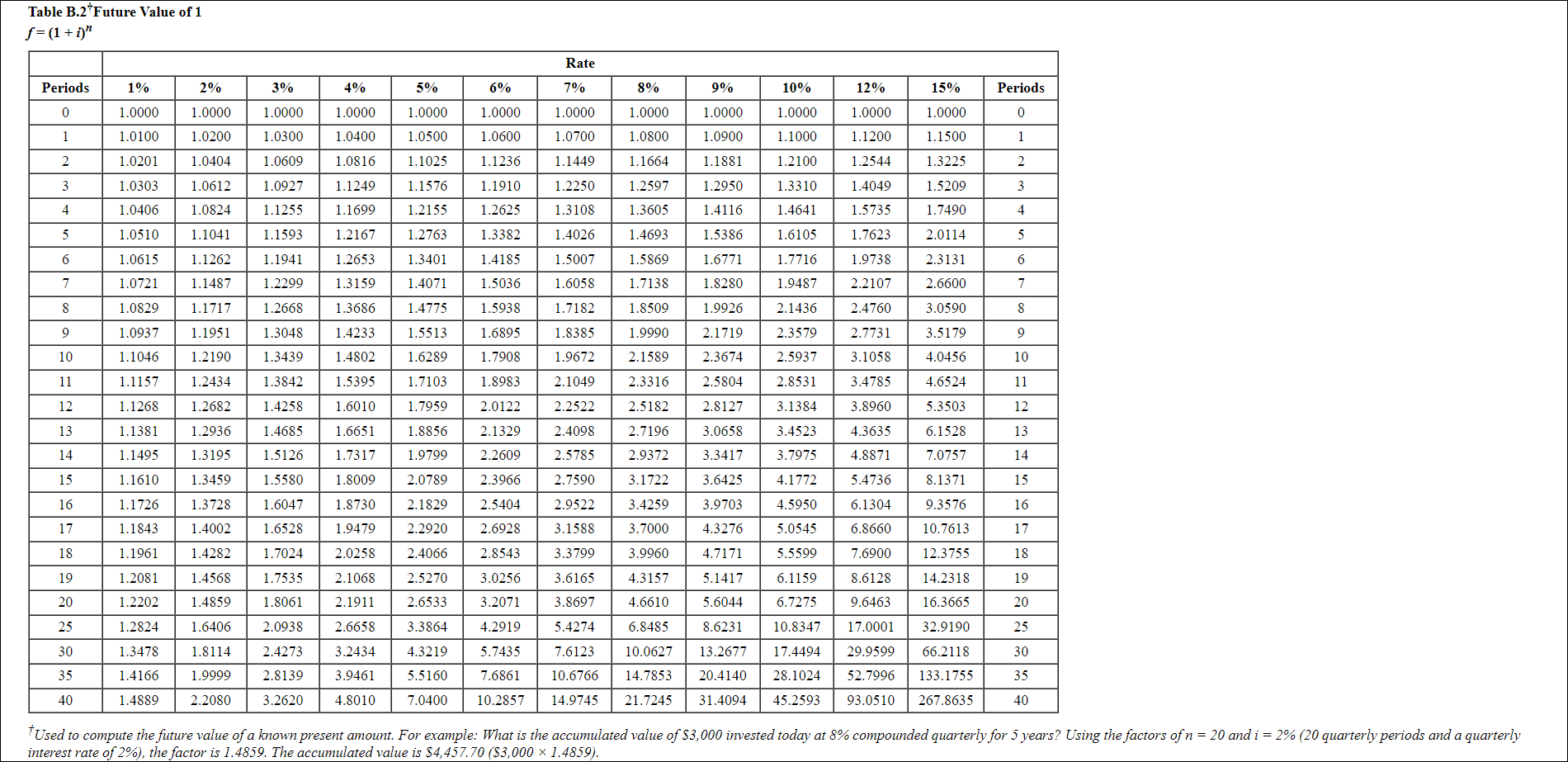

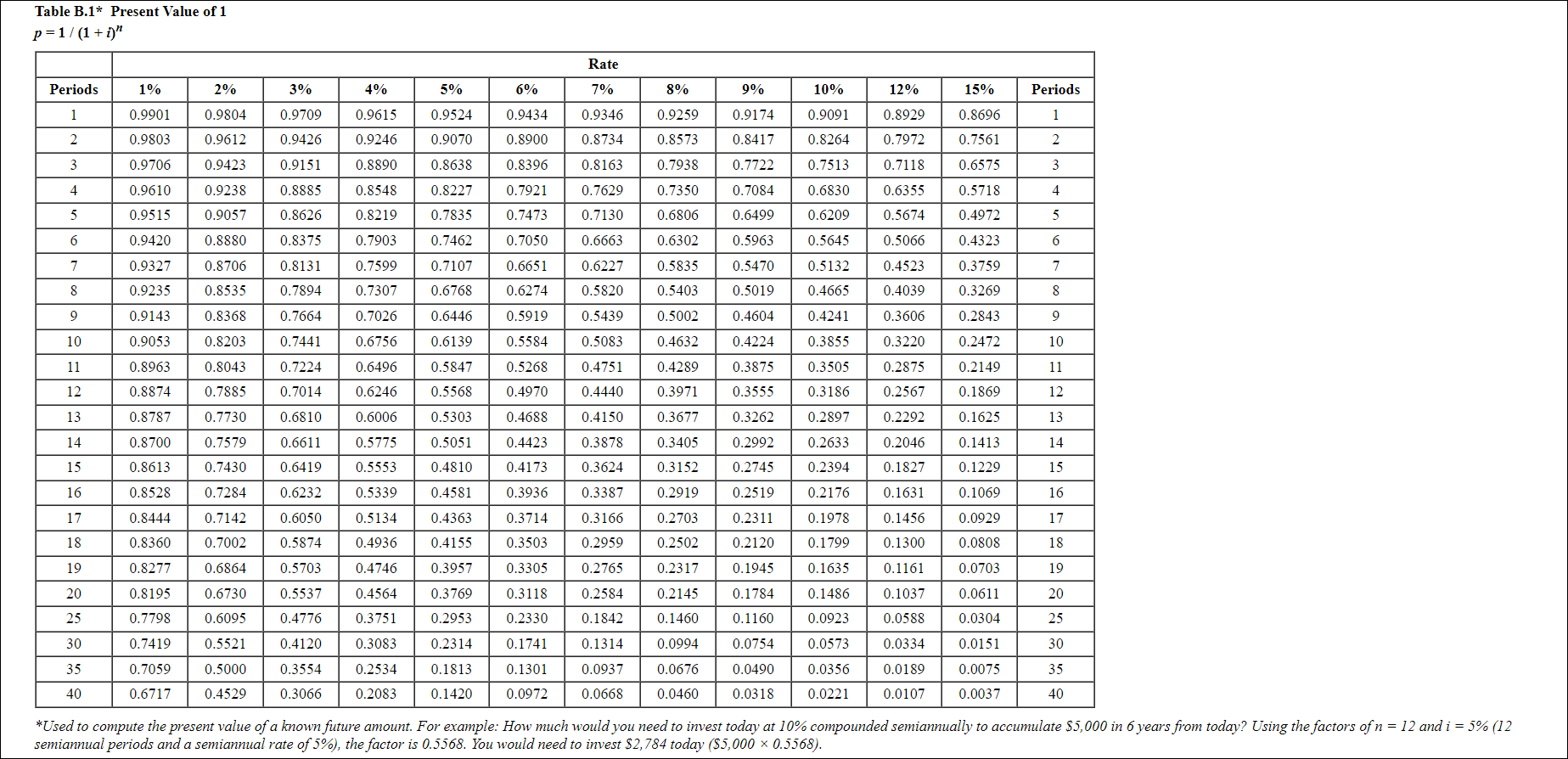

Required Information [The following information applies to the questions displayed below.] Following is information on an Investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. ompute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use approprlate factor(s) from the tables ovided. Round all present value factors to 4 declmal places. Round present value amounts to the nearest dollar.) Table B.4 Future Value of an Annuity of 1 f=[(1+i)n1]/i Table B.3 PresentValueofanAnnuityof1 p=[11/(1+i)n]/i Table B. 2 Future Value of 1 f=(1+i)n Table B.1* Present Value of 1 p=1/(1+i)n *Used to compute the present value of a known future amount. For example: How much would you need to invest today at 10% co semiannual periods and a semiannual rate of 5% ), the factor is 0.5568 . You would need to invest $2,784 today (\$5,000 0.5568)

Required Information [The following information applies to the questions displayed below.] Following is information on an Investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. ompute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use approprlate factor(s) from the tables ovided. Round all present value factors to 4 declmal places. Round present value amounts to the nearest dollar.) Table B.4 Future Value of an Annuity of 1 f=[(1+i)n1]/i Table B.3 PresentValueofanAnnuityof1 p=[11/(1+i)n]/i Table B. 2 Future Value of 1 f=(1+i)n Table B.1* Present Value of 1 p=1/(1+i)n *Used to compute the present value of a known future amount. For example: How much would you need to invest today at 10% co semiannual periods and a semiannual rate of 5% ), the factor is 0.5568 . You would need to invest $2,784 today (\$5,000 0.5568) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started