Question

Required information [The following information applies to the questions displayed below.] Following is information on an investment considered by Hudson Co. The investment has zero

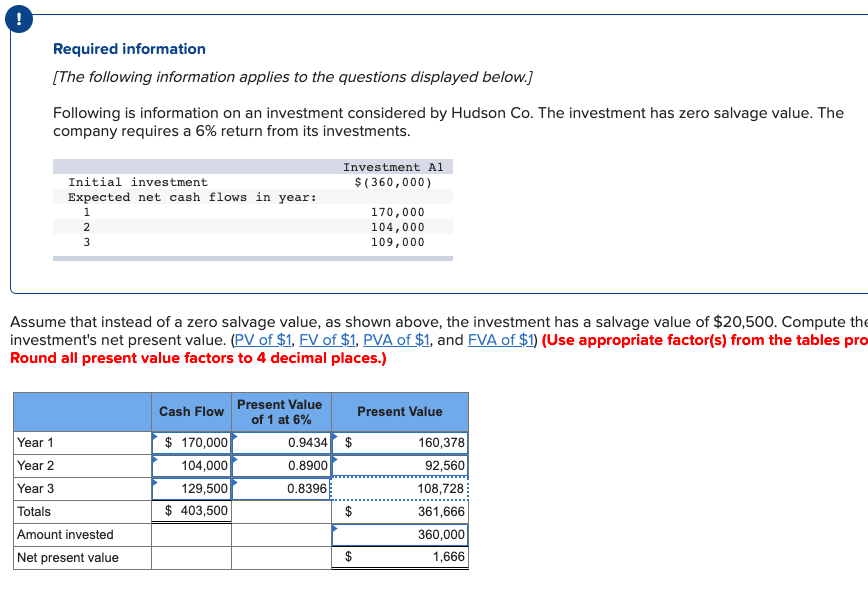

Required information [The following information applies to the questions displayed below.] Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 6% return from its investments. Investment A1 Initial investment $ (360,000 ) Expected net cash flows in year: 1 170,000 2 104,000 3 109,000 Assume that instead of a zero salvage value, as shown above, the investment has a salvage value of $20,500. Compute the investment's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started