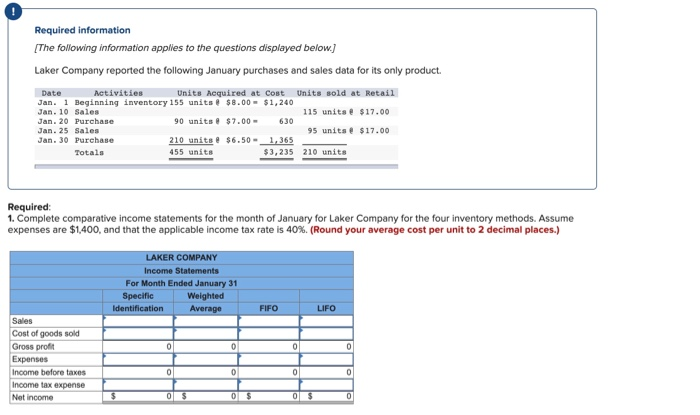

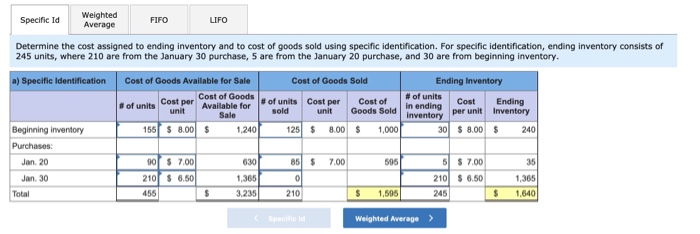

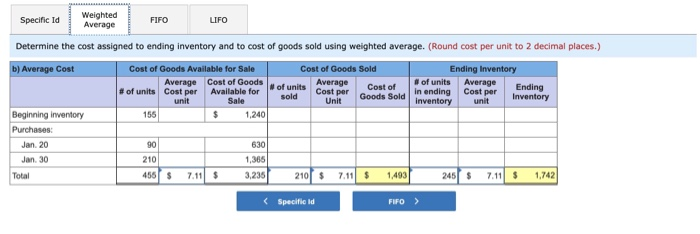

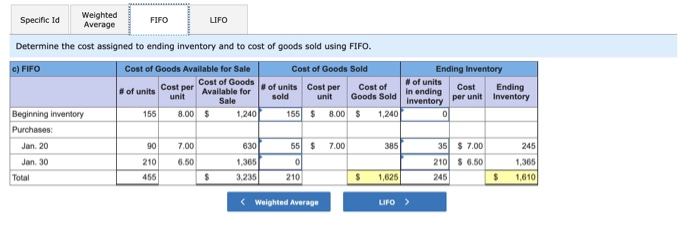

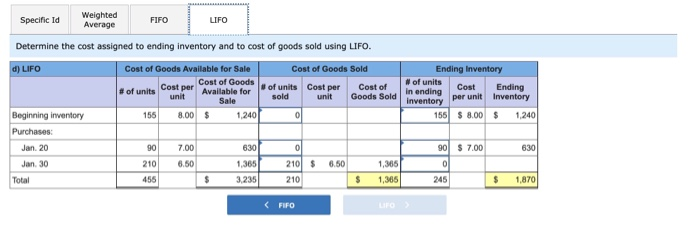

Required information The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Beginning inventory 155 units $8.00 - $1,240 Jan. 10 Sales 115 units $17.00 Jan. 20 Purchase 90 units $7.00 - 630 Jan. 25 Sales 95 units $17.00 Jan. 30 Purchase 210 units @ $6.50 - 1,365 Totala 455 units $3,235 210 units Required: 1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,400, and that the applicable income tax rate is 40% (Round your average cost per unit to 2 decimal places.) LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO L IFO 0 0 0 Sales Cost of goods sold Gross profit Expenses Income before taxes Income tax expense Net income 0 0 0 $ 0 $ 0 $ Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using specific identification. For specific identification, ending inventory consists of 245 units, where 210 are from the January 30 purchase, 5 are from the January 20 purchase, and 30 are from beginning inventory. a) Specific Identification Cost of Goods Available for Sale of units Cost per Cost of Goods Available for Cost of Goods Sold Ending Inventory of units Cost per Cost of Wof units Cost Ending in ending sold unit unit Goods Sold Goods Sold Inventor per unit Inventory 125 $ 8.00 $ 1.0001 300 $ 8.00 $ 240 1 unit 156 $ 8.00 $ Sale 1,2407 Beginning inventory Purchases: Jan. 20 $ 7.00 506 90 210 455 $ 7.00 $ 6.50 Jan 30 Total 6301 85 1,365 0 3.2352 10 5 210 245 $ 7.00 $ 6.50 1,365 1,640 $ $ 1.5951 $ Specific id Weighted Average > Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) b) Average Cost Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Average Costa Average Ending Average Cost of Goodsad # of units Cost per Available for unit Sold Cost per Unit Cost of of units Goods Sold in ending Sale Inventory Cost per unit Inventory 156 $ 1,240 Beginning inventory Purchases: 630 Jan. 20 Jan. 30 90 210 456$ 1,365 3,235 Total 7.11 $ 210 $ 7.11 $ 1,493 245$ 7.11 $ 1742 Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. c) FIFO Cost of Goods Available for Sale Cost of Goods # of units unit Cost per Available for Sale Cost of Goods Sold of units Cost per Cost of sold unit Goods Sold 155 $ 8.00 $ 1,240 Ending Inventory # of units Cost Ending in ending per unit Inventory Inventory Beginning inventory 156 8.00 $ 1,240 Purchases: Jan. 20 $ 7.00 385 90 210 456 7.00 6.50 Jan 30 630 1,365 3.2351 55 01 210 35 210 245 $ 7.00 $ 6.50 245 1,365 1610 Total $ 1,625 $ Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. d) LIFO Cost of Goods Available for Sale Cost of Goods Sold of units Available for Cost per Cost of unit sold unit Goods Sold Sale 156 8.00 $ 1.2400 1.2407 of units Cost per cost of Goods Ending Inventory # of units Cost Ending in ending Inventory per unit Inventory 1551 $ 8.00 $ 1.240 Beginning inventory Purchases: Jan. 20 90 $ 7.00 630 90 210 456 7.00 6.50 Jan. 30 6300 1,365 210 3.235 2 10 $ 6.50 1 1,365 1,365 0 Total $ $ 245 $ 1,870 ( FIFO