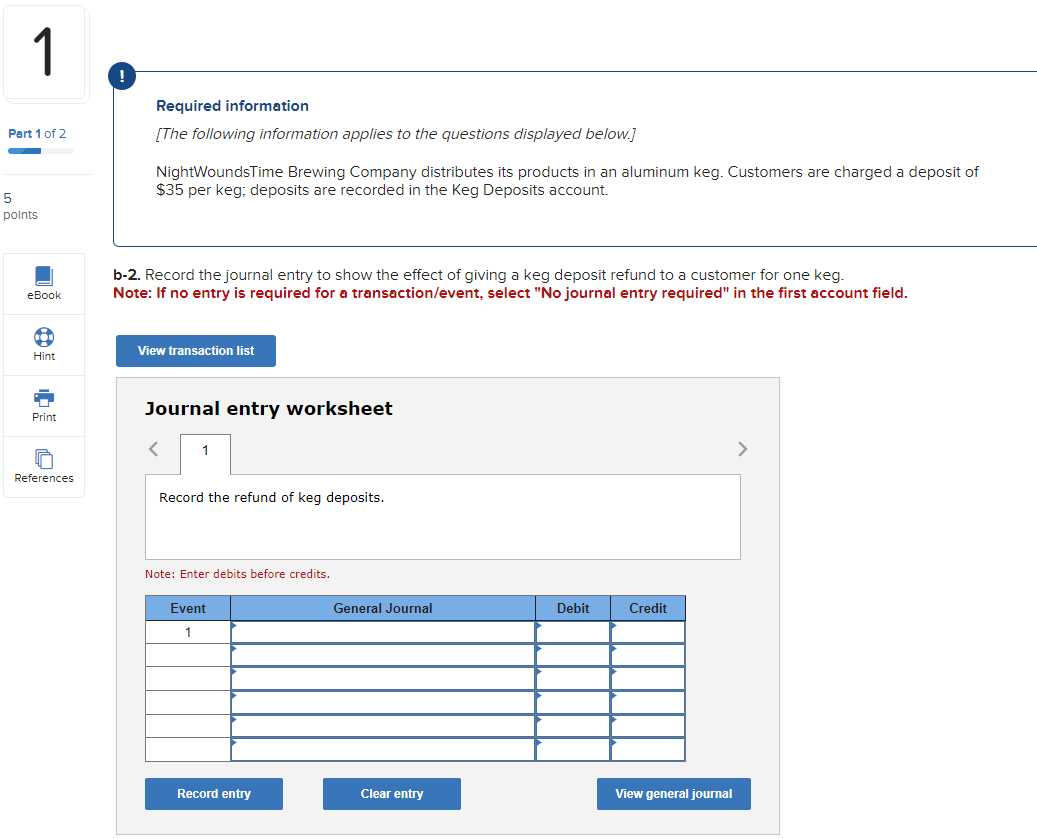

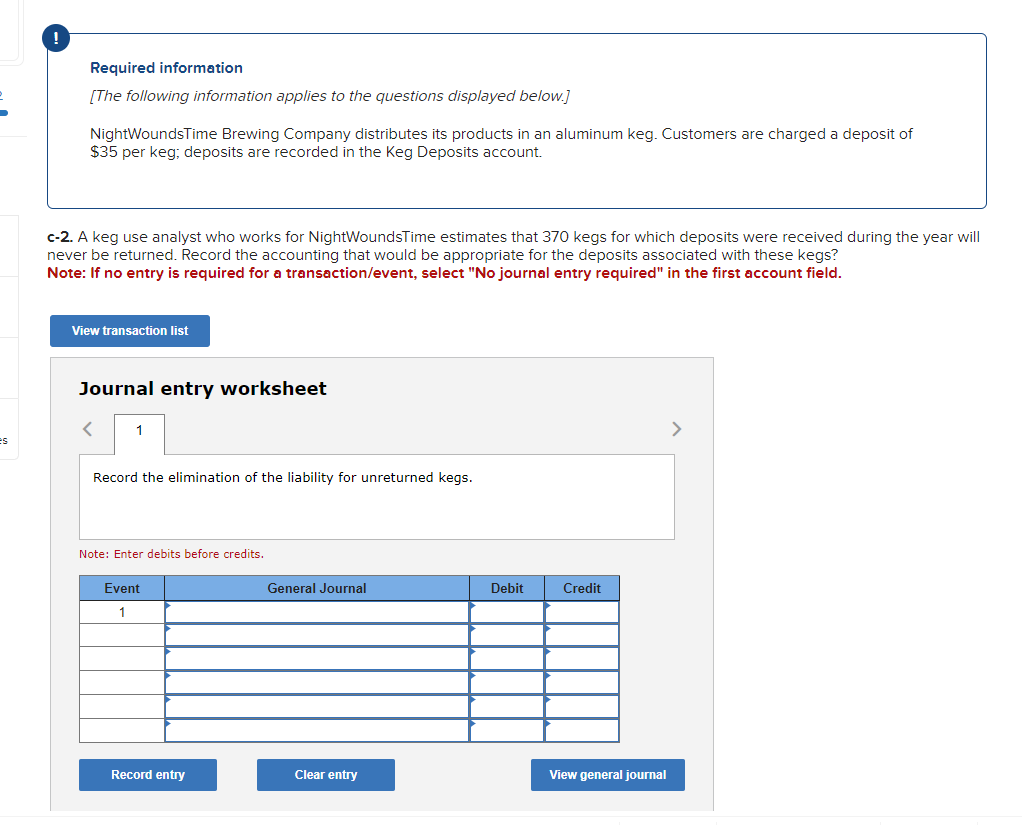

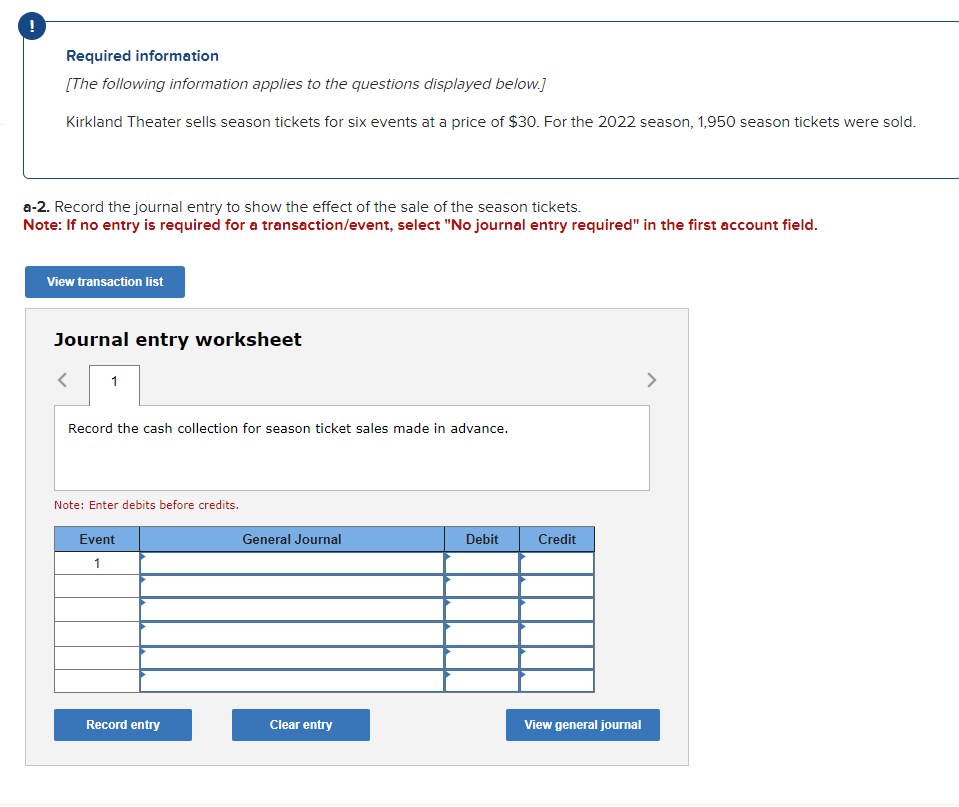

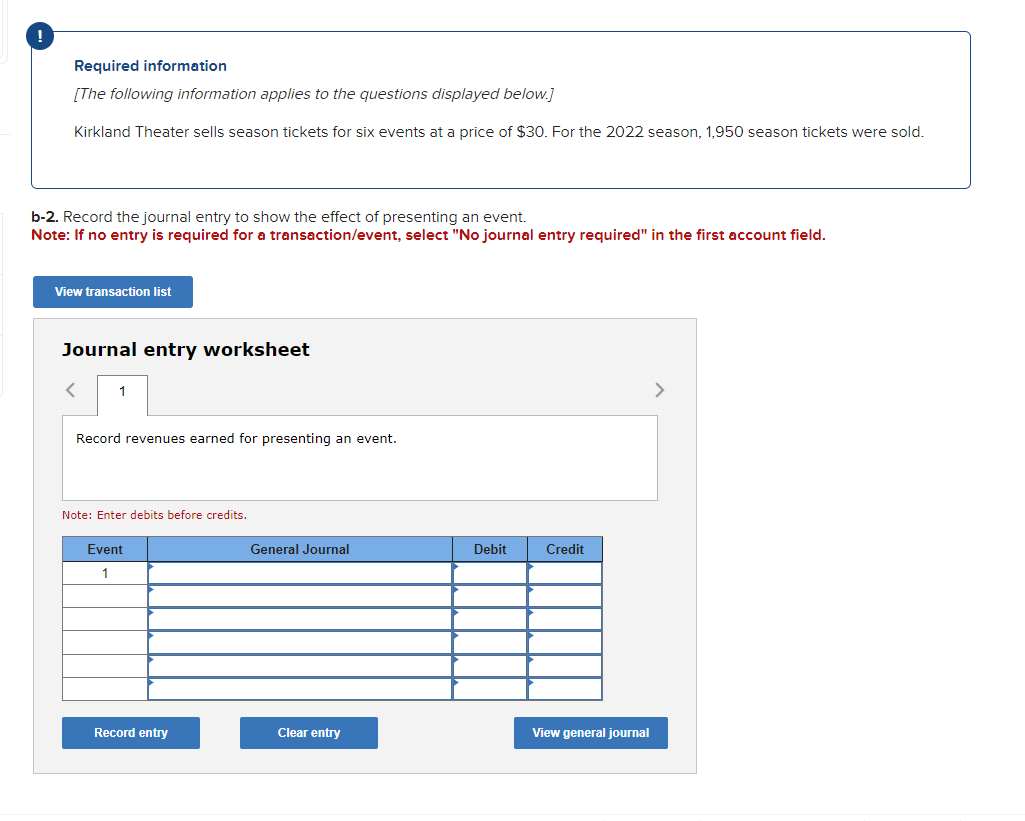

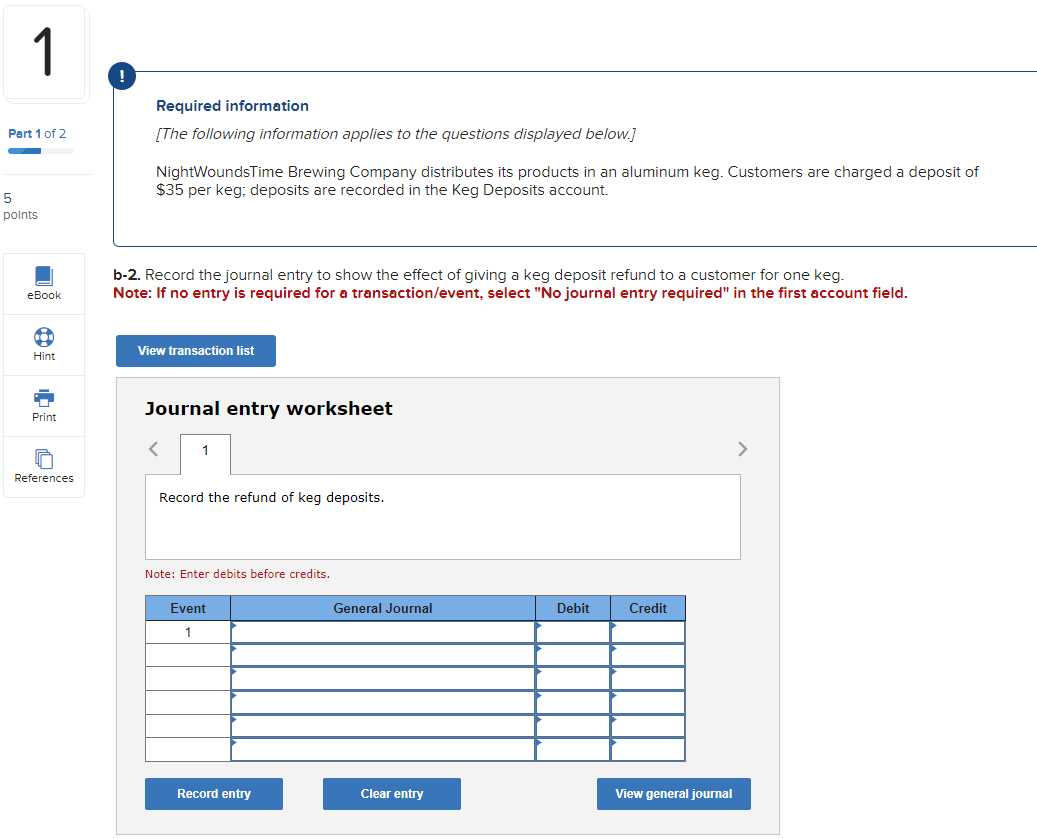

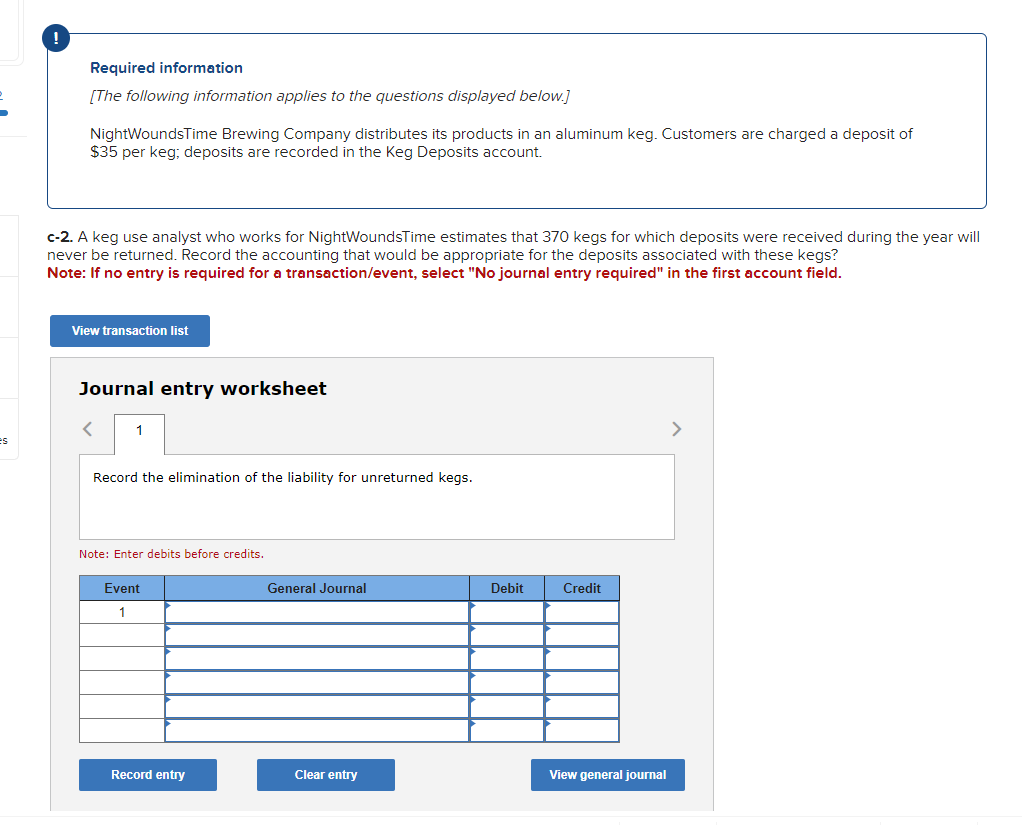

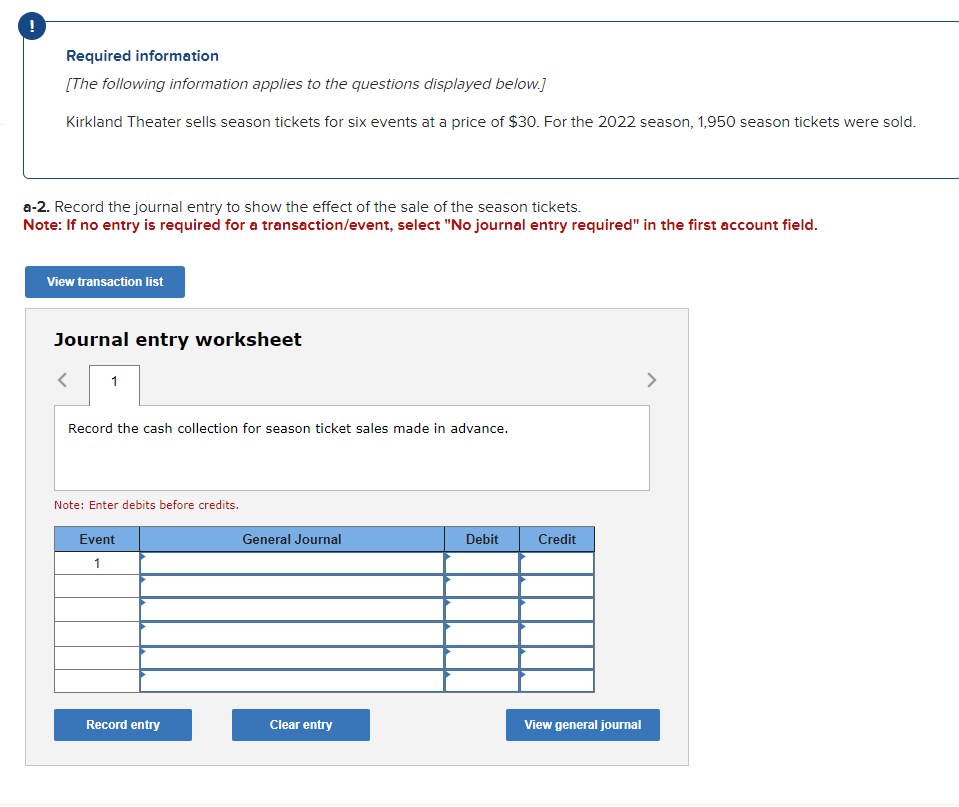

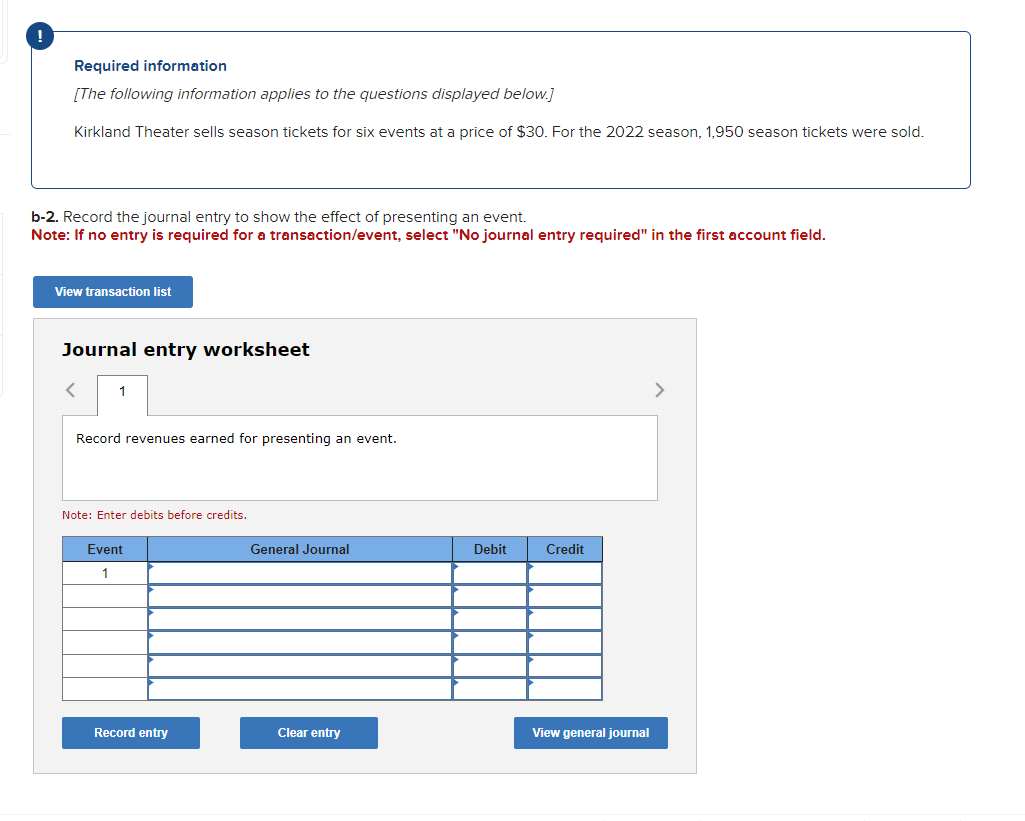

Required information [The following information applies to the questions displayed below.] NightWoundsTime Brewing Company distributes its products in an aluminum keg. Customers are charged a deposit of $35 per keg; deposits are recorded in the Keg Deposits account. b-2. Record the journal entry to show the effect of giving a keg deposit refund to a customer for one keg. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] NightWoundsTime Brewing Company distributes its products in an aluminum keg. Customers are charged a deposit of $35 per keg; deposits are recorded in the Keg Deposits account. c-2. A keg use analyst who works for NightWoundsTime estimates that 370 kegs for which deposits were received during the year will never be returned. Record the accounting that would be appropriate for the deposits associated with these kegs? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the elimination of the liability for unreturned kegs. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Kirkland Theater sells season tickets for six events at a price of $30. For the 2022 season, 1,950 season tickets were sold. a-2. Record the journal entry to show the effect of the sale of the season tickets. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the cash collection for season ticket sales made in advance. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Kirkland Theater sells season tickets for six events at a price of $30. For the 2022 season, 1,950 season tickets were sold. o-2. Record the journal entry to show the effect of presenting an event. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] NightWoundsTime Brewing Company distributes its products in an aluminum keg. Customers are charged a deposit of $35 per keg; deposits are recorded in the Keg Deposits account. b-2. Record the journal entry to show the effect of giving a keg deposit refund to a customer for one keg. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] NightWoundsTime Brewing Company distributes its products in an aluminum keg. Customers are charged a deposit of $35 per keg; deposits are recorded in the Keg Deposits account. c-2. A keg use analyst who works for NightWoundsTime estimates that 370 kegs for which deposits were received during the year will never be returned. Record the accounting that would be appropriate for the deposits associated with these kegs? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the elimination of the liability for unreturned kegs. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Kirkland Theater sells season tickets for six events at a price of $30. For the 2022 season, 1,950 season tickets were sold. a-2. Record the journal entry to show the effect of the sale of the season tickets. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the cash collection for season ticket sales made in advance. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Kirkland Theater sells season tickets for six events at a price of $30. For the 2022 season, 1,950 season tickets were sold. o-2. Record the journal entry to show the effect of presenting an event. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits