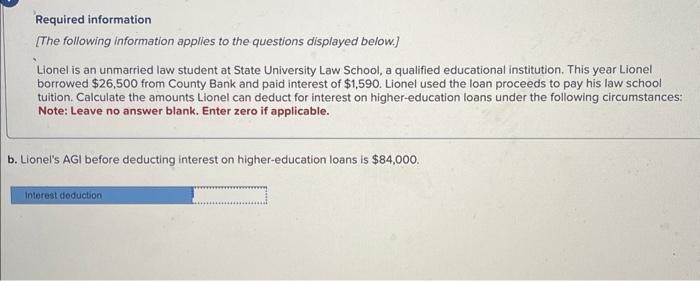

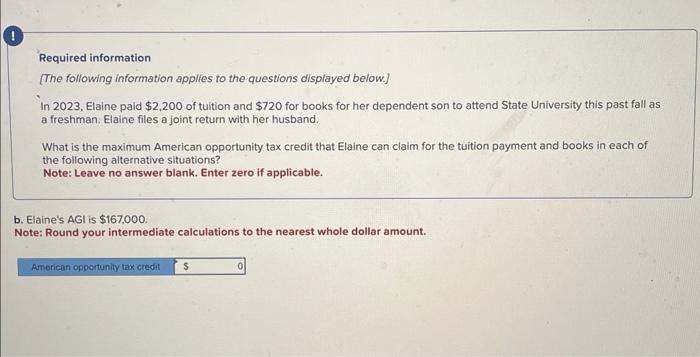

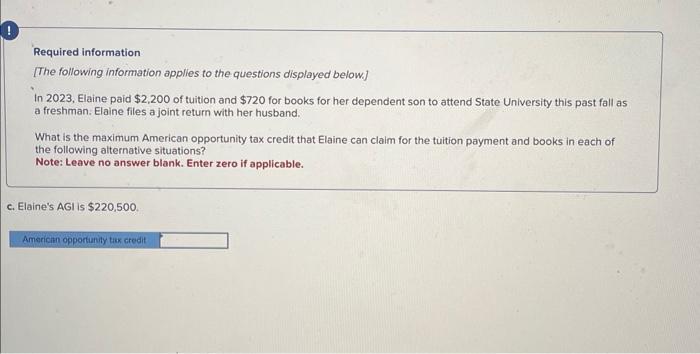

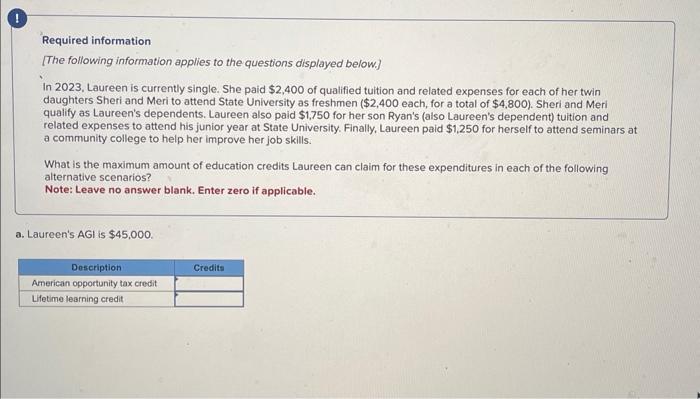

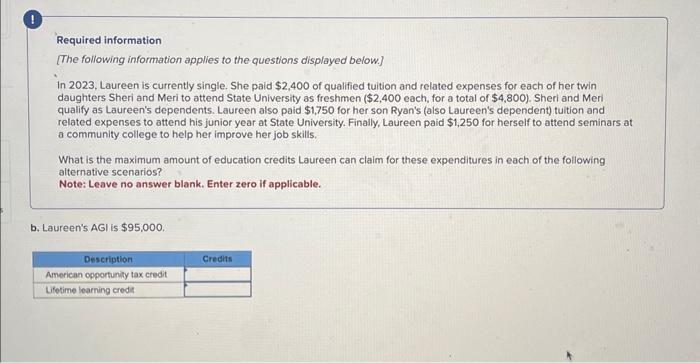

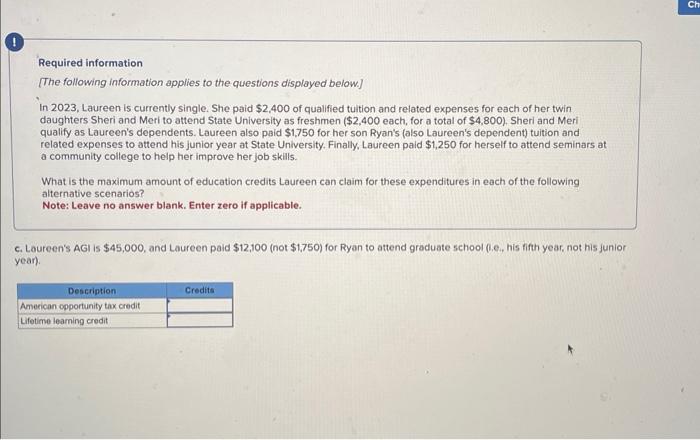

Required information [The following information applies to the questions displayed below.] Lionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $26,500 from County Bank and paid interest of $1,590. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for interest on higher-education loans under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. b. Lionel's AGI before deducting interest on higher-education loans is $84,000. Required information [The following information applies to the questions displayed below.] In 2023, Elaine paid $2,200 of tuition and $720 for books for her dependent son to attend State University this past fall as a freshman: Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? Note: Leave no answer blank. Enter zero if applicable. b. Elaine's AGI is $167,000. Note: Round your intermediate calculations to the nearest whole dollar amount. Required information [The following information applies to the questions displayed below] In 2023, Elaine paid $2,200 of tuition and $720 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? Note: Leave no answer blank. Enter zero if applicable. c. Elaine's AGI is $220,500. Required information [The following information applies to the questions displayed below.] In 2023, Laureen is currently single. She paid $2,400 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,400 each, for a total of $4,800). Sheri and Meri qualify as Laureen's dependents. Laureen also paid \$1,750 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid \$1,250 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. a. Laureen's AGI is $45,000. Required information [The following information applles to the questions displayed below] In 2023, Laureen is currently single. She paid $2,400 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,400 each, for a total of $4,800). Sheri and Meri qualify as Laureen's dependents. Laureen also paid \$1,750 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,250 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. b. Laureen's AGI is $95,000. Required information [The following information applies to the questions displayed below.] In 2023, Laureen is currently single. She paid $2,400 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,400 each, for a total of $4,800). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,750 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,250 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. E. Loureen's AGI is $45,000, and Laureen paid $12,100 (not $1,750 ) for Ryan to attend graduate school (0,e, his fifth year, not his junior jear)