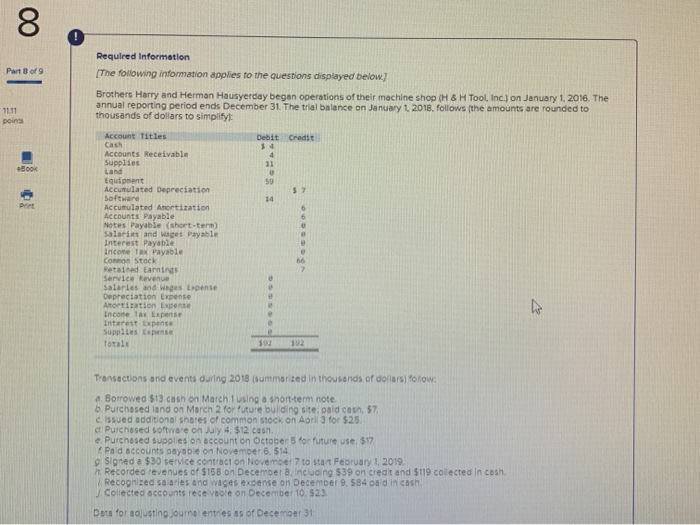

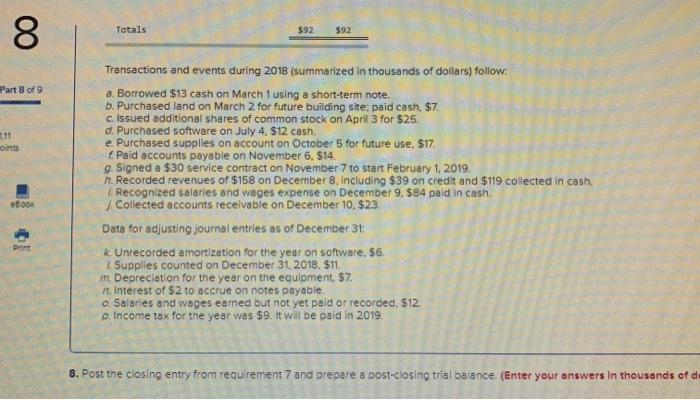

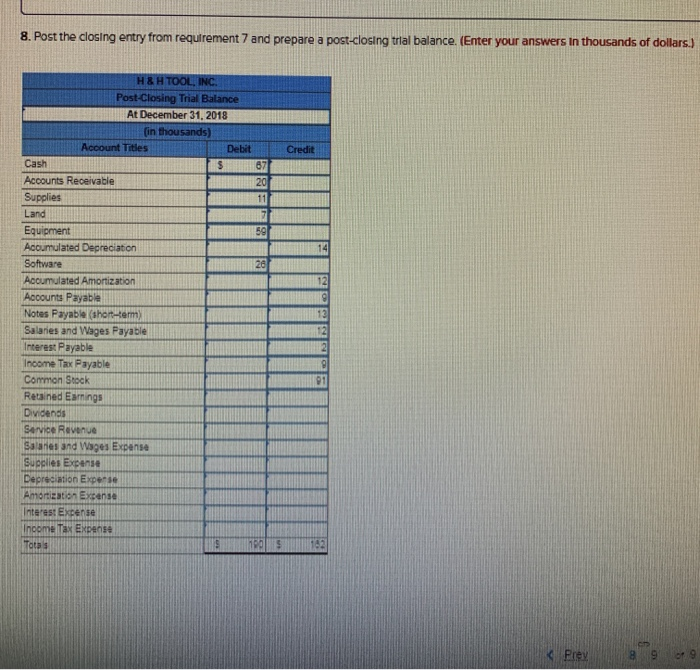

Required Information (The following information applies to the questions displayed below.) Part of Brothers Harry and Herman Hausyerday began operations of their machine shop (H&H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 2018, follows the amounts are rounded to thousands of dollars to simplifyt 1111 poi Debit Credit Accounts Receivable Supplies Land Equipment Accumulated Depreciation software Accumulated Amortization counts Payable Notes Payable (short-tere) Salaries and ages Payable Interest Payable Income Tax Payable Common Stock watained Earnings service Ravenue! Salaries wages Lente Depreciation Experte Sortiration Experte Income Tax Expense Interest i nte Supplies Expanse Total 392 392 Transactions and events during 2018 marted in thousands of dollars fotow. Borrowed 513 cash on March using a short-term note . Purchased land on March 2 for future bulding site paid cash. 57 cissued additional shares of common stock on April 3 for $25 c Purchased software on July 4, 512 cash. e Purchased supplies on account on October 5 for future use. $17 Pald accounts payable on Novemoer 6. $14 o signed a $30 service contact on November 7 to start February 1, 2019 Recorded revenues of $158 on December 8, ncucing $39 on credt and $119 colected in cos Recognized Barles and w e expense on December 9.584 din cash Colected accounts recevole on December 10.523 Dua for adjusting Journal entries of December 31 Transactions and events during 2018 (summarized in thousands of dollars) follow. Part 8 of 9 a. Borrowed $13 cash on March 1 using a short-term note. b. Purchased land on March 2 for future building site: paid cash. $7. c. Issued additional shares of common stock on April 3 for $25. d. Purchased software on July 4. $12 cash. e Purchased supplies on account on October 5 for future use, $17. f. Paid accounts payable on November 6, $14. 9. Signed a $30 service contract on November 7 to start February 1, 2019 h. Recorded revenues of $158 on December 8, including $39 on credit and $119 collected in cash. Recognized salaries and wages expense on December 9. $84 paid in cash . Collected accounts receivable on December 10, $23. BOOK Data for adjusting journal entries as of December 31: k Unrecorded amortization for the year on software. $6. Supplies counted on December 31, 2018. $11. m. Depreciation for the year on the equipment, $7. n. Interest of $2 to accrue on notes payable. O. Salaries and wages earned but not yet paid or recorded, $12 p. Income tax for the year was $9. It will be paid in 2019. 8. Post the closing entry from requirement and prepare a post-closing trial balance (Enter your answers in thousands of de 8. Post the closing entry from requirement 7 and prepare a post-closing trial balance. (Enter your answers in thousands of dollars.) Credit H&H TOOL, INC. Post-Closing Trial Balance At December 31, 2018 (in thousands) Account Titles Debit Cash Accounts Receivable Supplies Land Equipment Accumulated Depreciation Software Accumulated Amortization Accounts Paya Notes Payable (short-term) Salaries and Wages Payable Interes: Payable Income Tax Payable Common Stock Roined Earrings Dvideos Service Revenue Sales and Wages Expense Guelles Eye AMORES Expense Frey 8 99