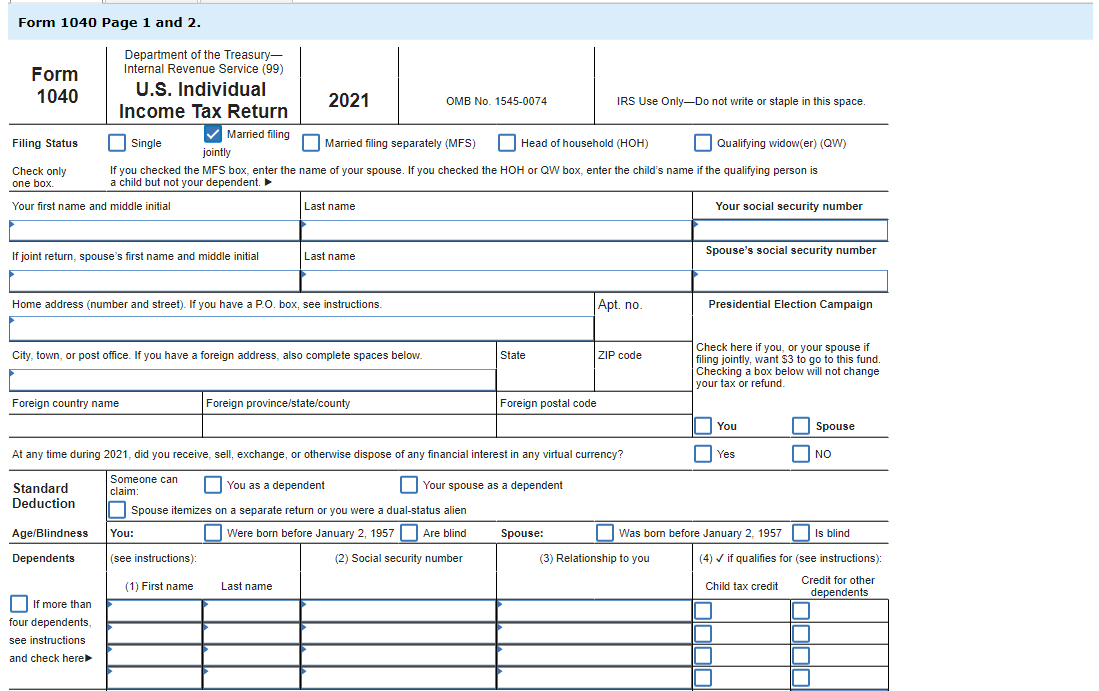

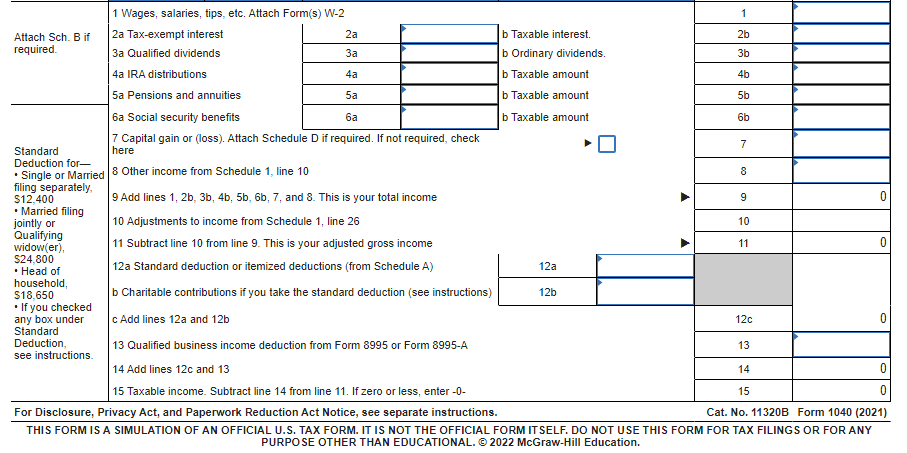

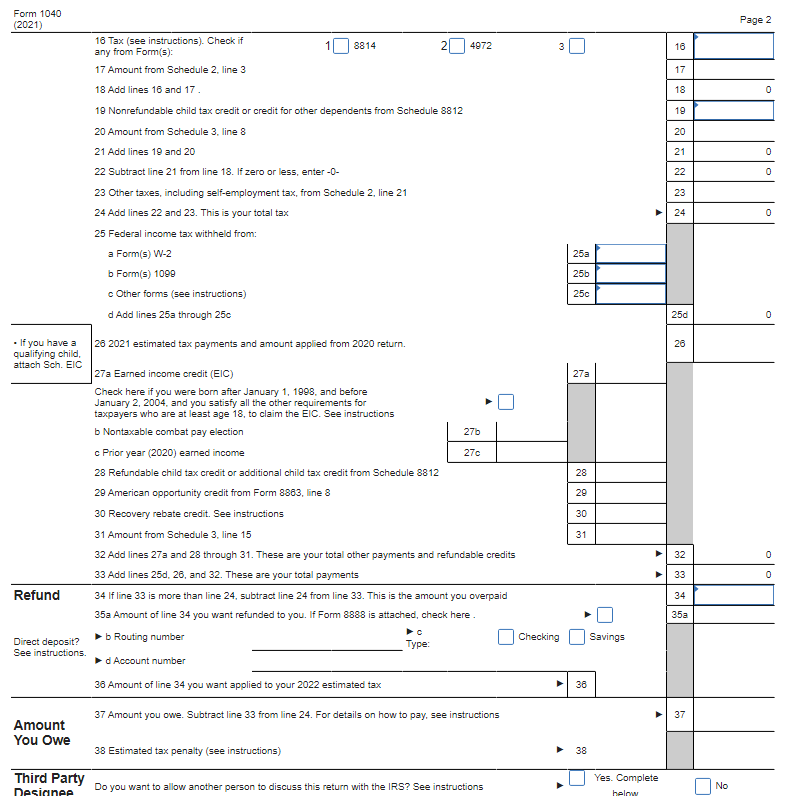

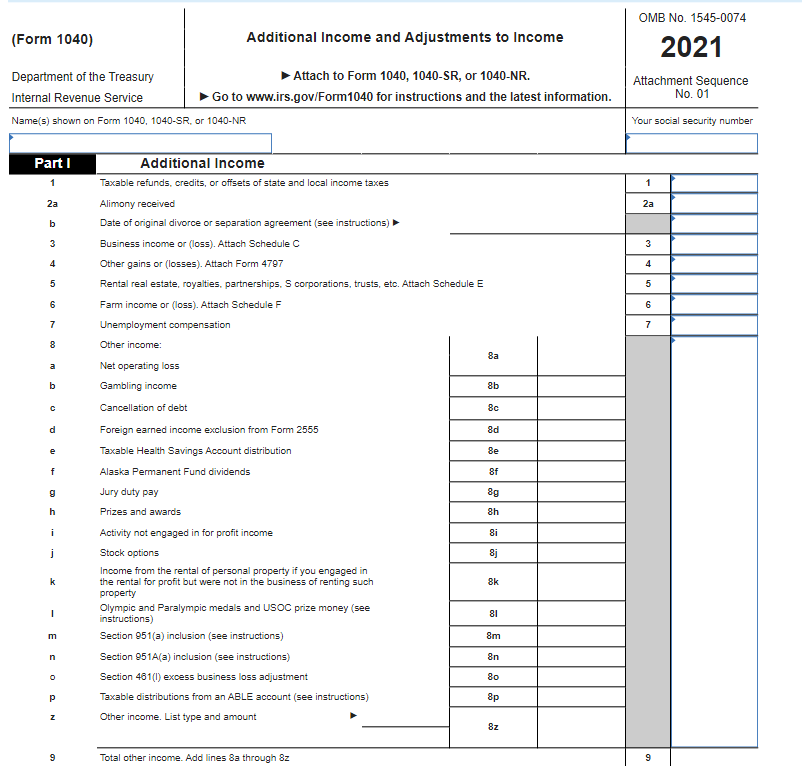

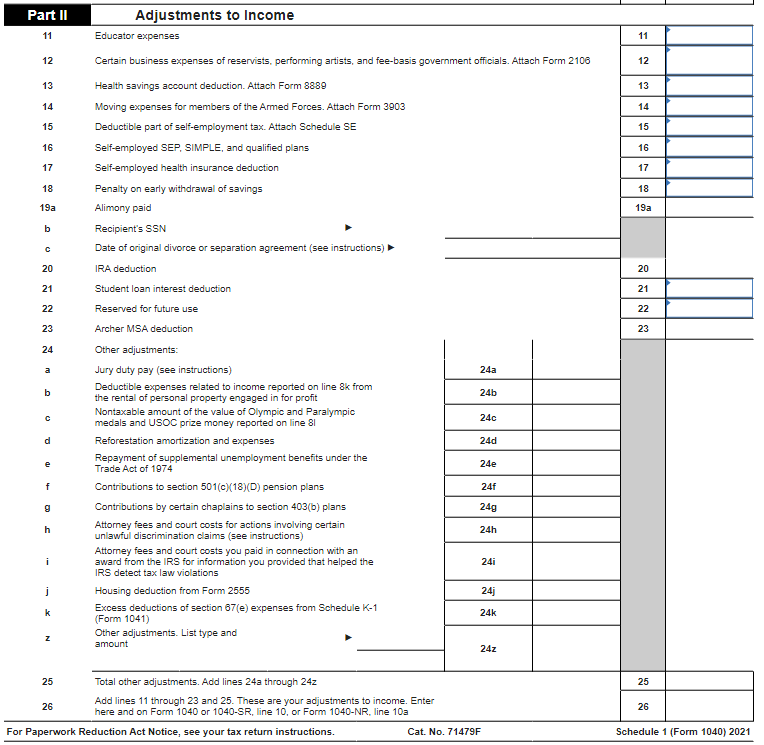

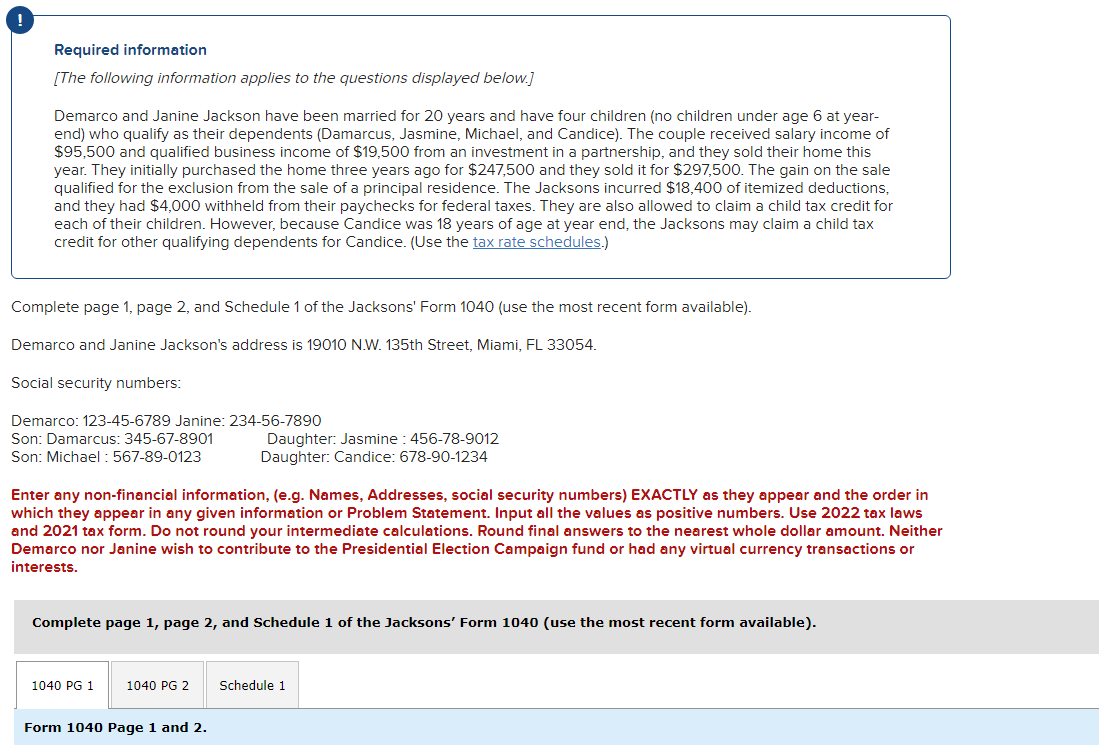

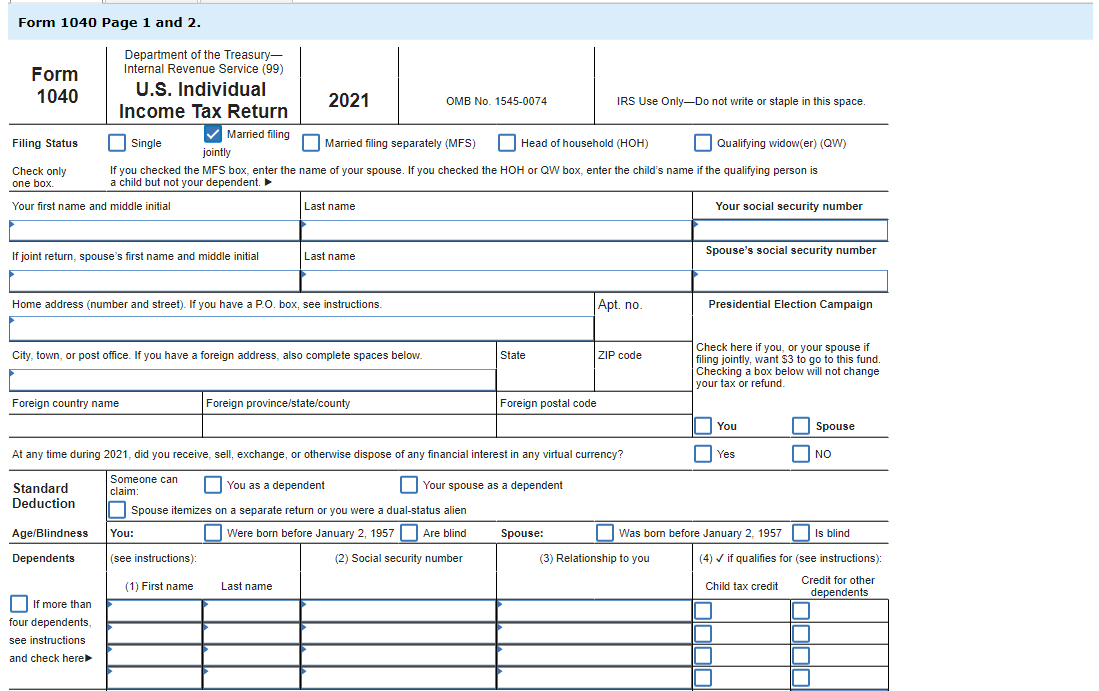

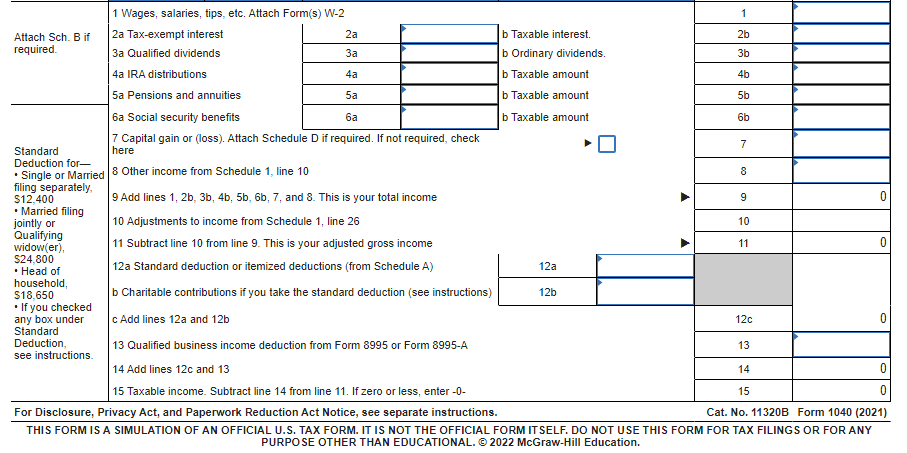

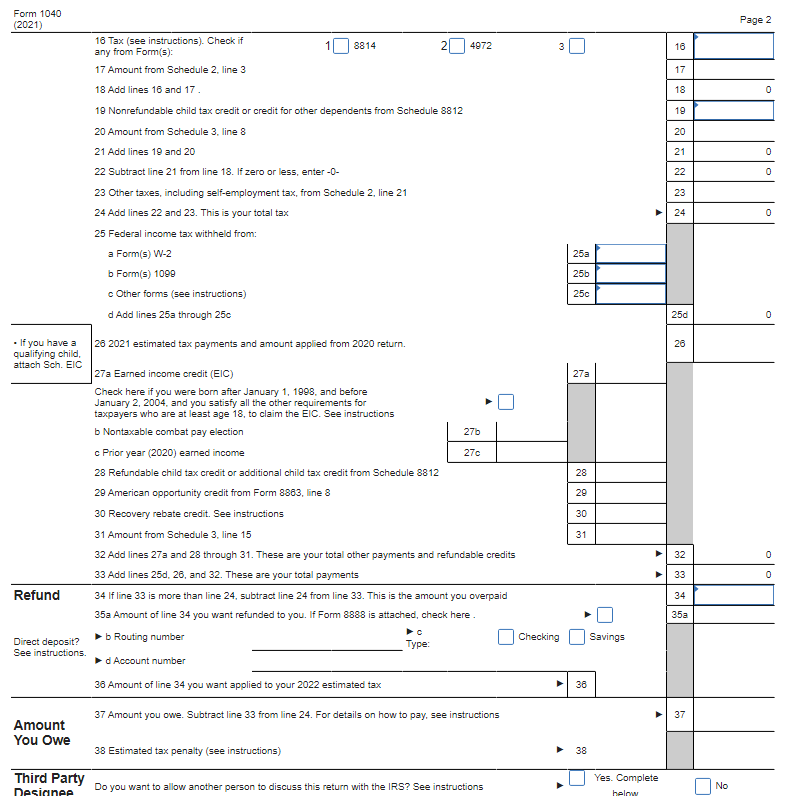

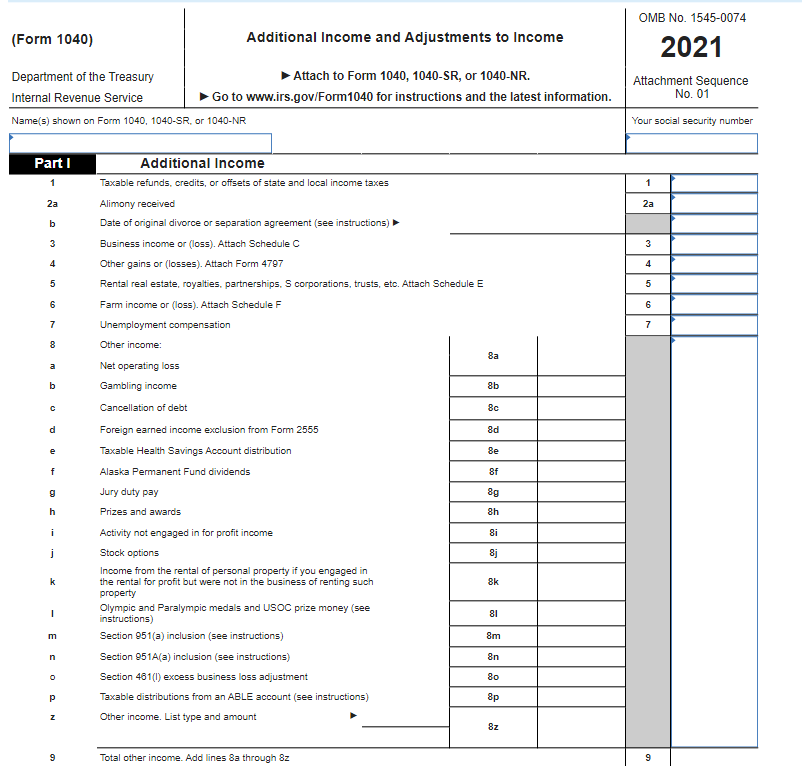

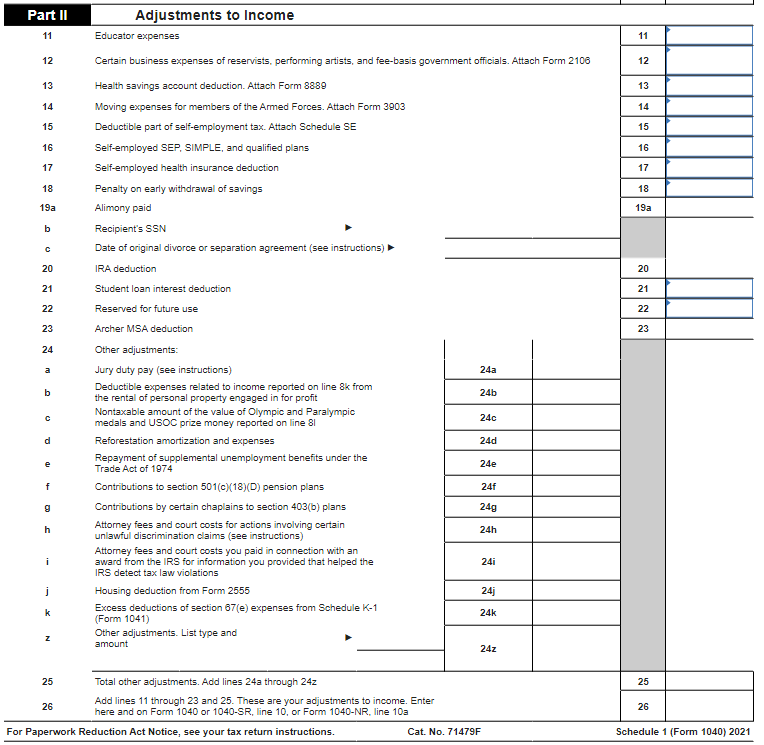

Required information [The following information applies to the questions displayed below.] Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at yearend) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $95,500 and qualified business income of $19,500 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $247,500 and they sold it for $297,500. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $18,400 of itemized deductions, and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the tax rate schedules.) Complete page 1, page 2, and Schedule 1 of the Jacksons' Form 1040 (use the most recent form available). Demarco and Janine Jackson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Demarco: 123-45-6789 Janine: 234-56-7890 Son: Damarcus: 345-67-8901 Daughter: Jasmine : 456-78-9012 Son: Michael : 567-89-0123 Daughter: Candice: 678-90-1234 Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear and the order in which they appear in any given information or Problem Statement. Input all the values as positive numbers. Use 2022 tax laws and 2021 tax form. Do not round your intermediate calculations. Round final answers to the nearest whole dollar amount. Neither Demarco nor Janine wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete page 1, page 2, and Schedule 1 of the Jacksons' Form 1040 (use the most recent form available). Form 1040 Page 1 and 2. Form 1040 Page 1 and 2. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040(2021) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPO SE OTHER THAN EDUCATIONAL. (c) 2022 McGraw-Hill Education. Form 1040 (2021) Page 2 16 Tax (see instructions). Check if any from Form(s): 17 Amount from Schedule 2, line 3 18 Add lines 16 and 17 . 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20 22 Subtract line 21 from line 18 . If zero or less, enter 0 - 23 Other taxes, including self-employment tax, from Schedule 2 , line 21 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withheld from: a Form(s) W-2 b Form(s) 1099 c Other forms (see instructions) d Add lines 25 a through 25c - If you have a 262021 estimated tax payments and amount applied from 2020 return. qualifying child, attach Sch. EIC 27 a Earned income credit (EIC) Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18 , to claim the EIC. See instructions b Nontaxable combat pay election c Prior year (2020) eamed income 28 Refundable child tax credit or additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863 , line 8 30 Recovery rebate credit. See instructions 31 Amount from Schedule 3, line 15 32 Add lines 27a and 28 through 31 . These are your total other payments and refundable credits 33 Add lines 25d,26, and 32 . These are your total payments 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . Direct deposit? b Routing number co 3 \begin{tabular}{|l|l|} \hline 16 & \\ \hline \end{tabular} See instructions. Type: d Account number \begin{tabular}{l|l|l|l|} \hline 36 Amount of line 34 you want applied to your 2022 estimated tax & 36 \\ \hline Amount & 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions \\ \hline You OWe & 38 Estimated tax penalty (see instructions) & 37 & \\ \hline \end{tabular} Third Party Desirinep Do you want to allow another person to discuss this return with the IRS? See instructions Checking Savings