Answered step by step

Verified Expert Solution

Question

1 Approved Answer

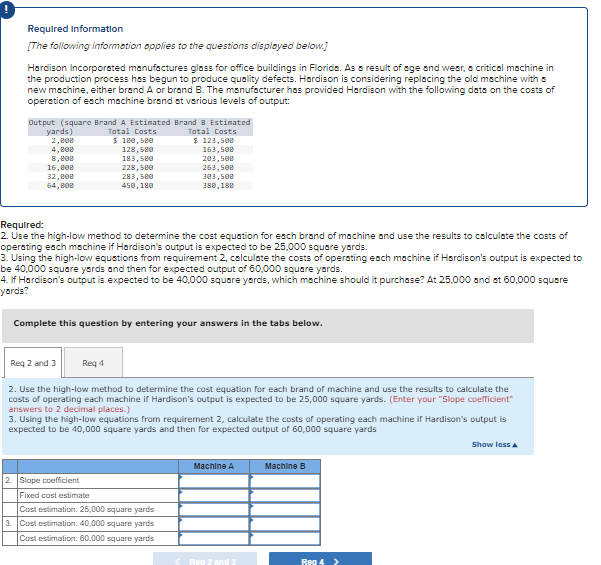

Required Information [ The following informotion opplies to the questions clisployed below. ] Hardison Incorporated manufactures glass for office buildings in Florids. As a result

Required Information

The following informotion opplies to the questions clisployed below.

Hardison Incorporated manufactures glass for office buildings in Florids. As a result of age and wesr, a critical machine in

the production process has begun to produce quality defects. Hardison is considering replacing the old machine with

new machine, either brand or brond The manufocturer has provided Hardison with the following date on the costs of

operation of each machine brand at various levels of output:

Required:

Use the highlow method to determine the cost equation for each brand of machine and use the results to calculate the costs of

operating each machine if Hardison's output is expected to be square yords.

Using the highlow equations from requirement calculate the costs of operating each mochine if Hardison's output is expected to

be square yords and then for expected output of square yords.

If Hardison's output is expected to be square yords, which machine should it purchsse? At and st square

yords?

Complete this question by entering your answers in the tabs below.

Req and

Use the highlow method to determine the cost equation for each brand of machine and use the results to calculate the

costs of operating each machine if Hardison's output is expected to be square yards. Enter your "Slope coelficient"

answers to decimal places.

Using the highlow equations from requirement calculate the costs of operating each machine if Hardison's output is

expected to be square yards and then for expected output of square yards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started