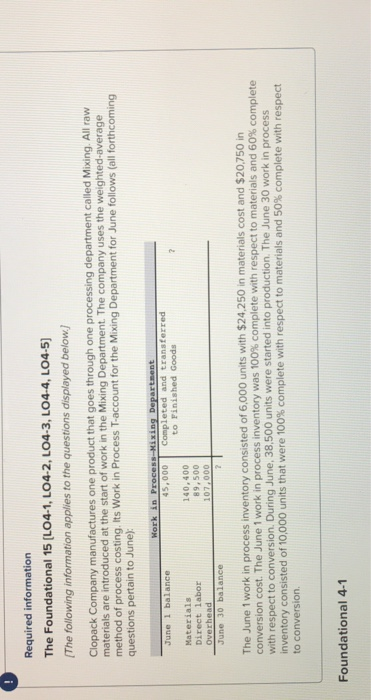

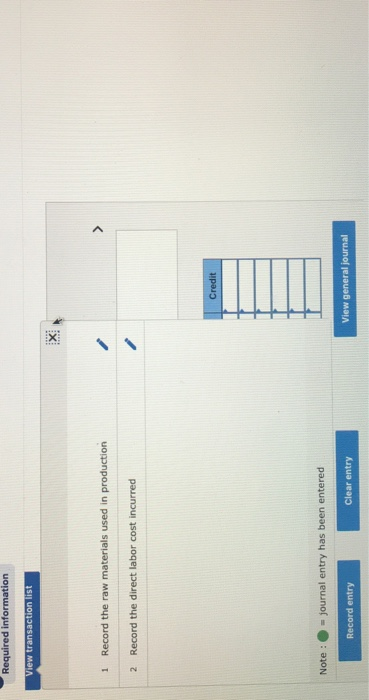

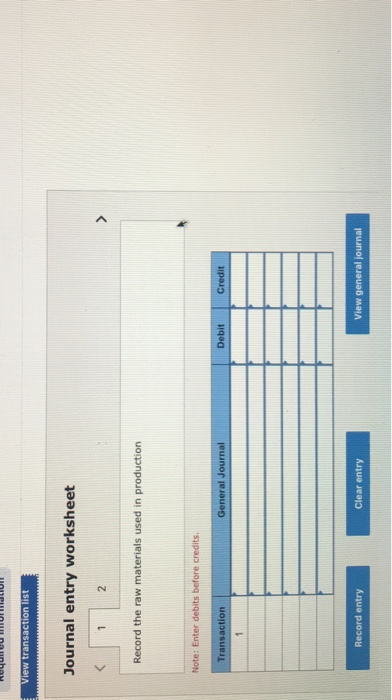

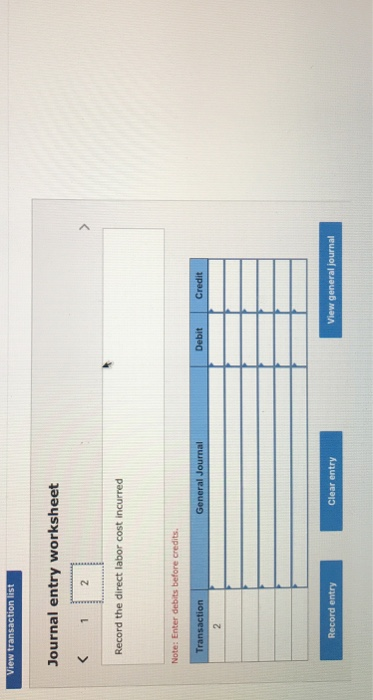

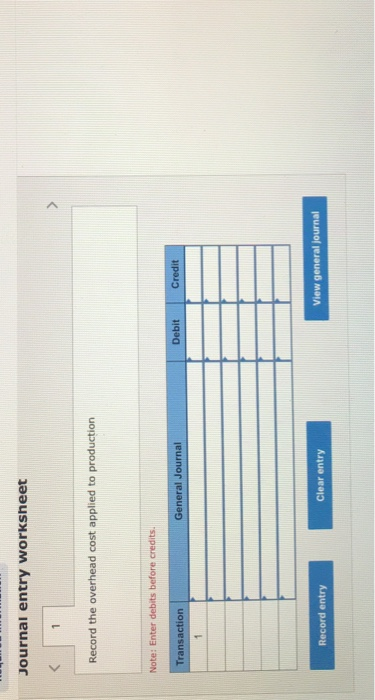

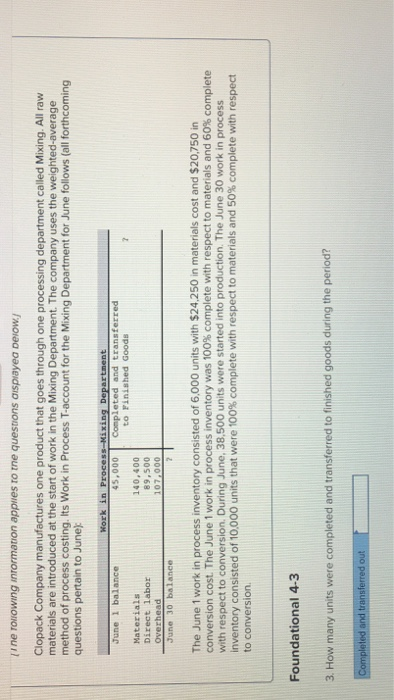

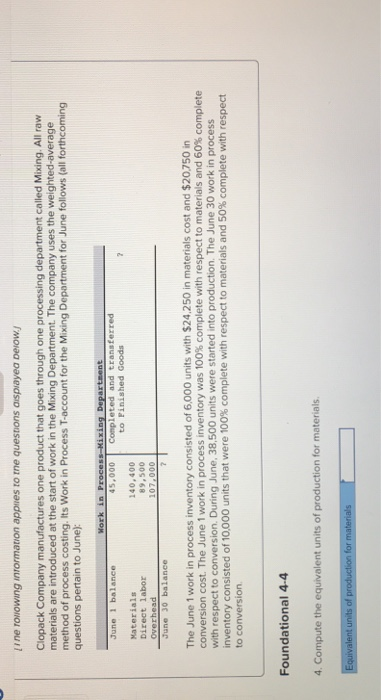

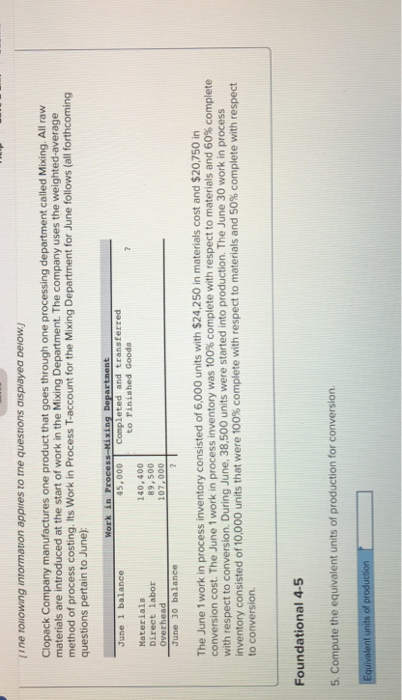

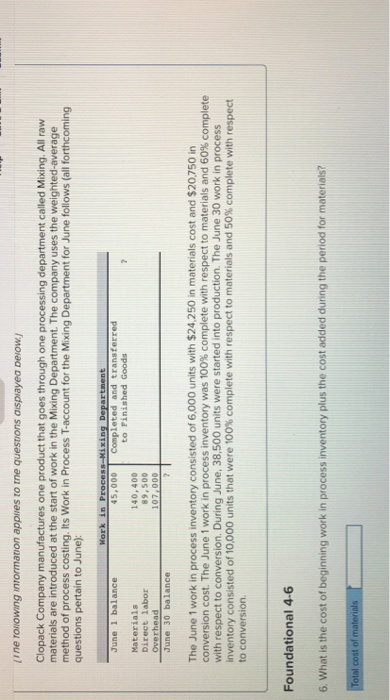

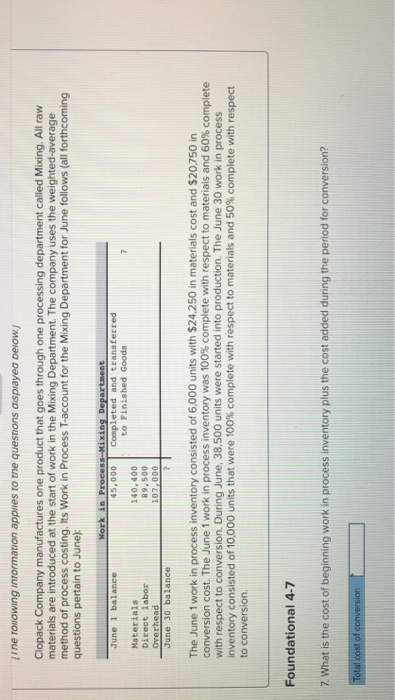

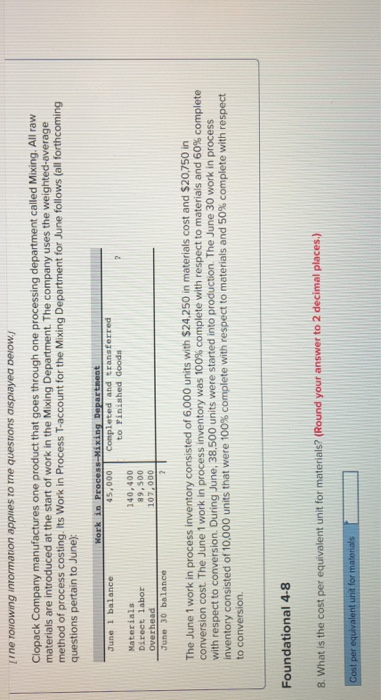

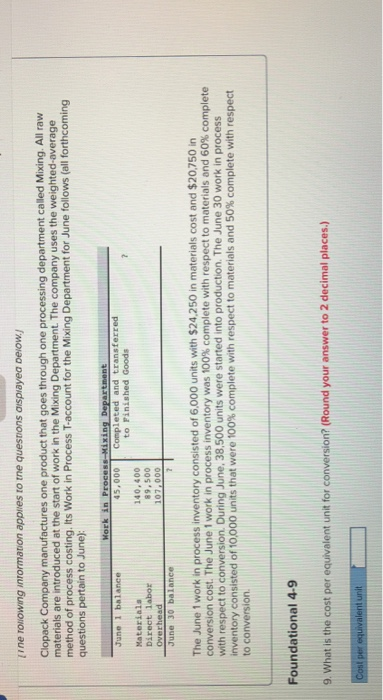

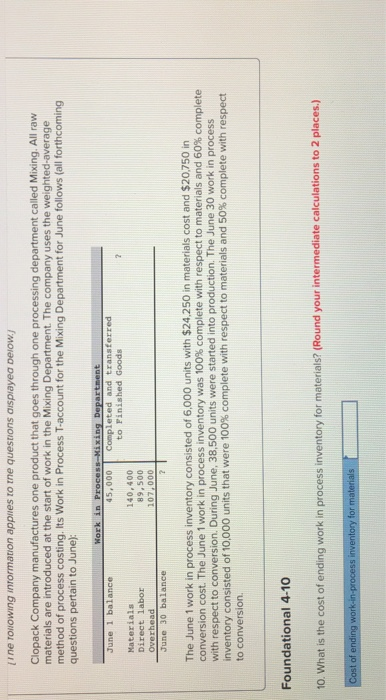

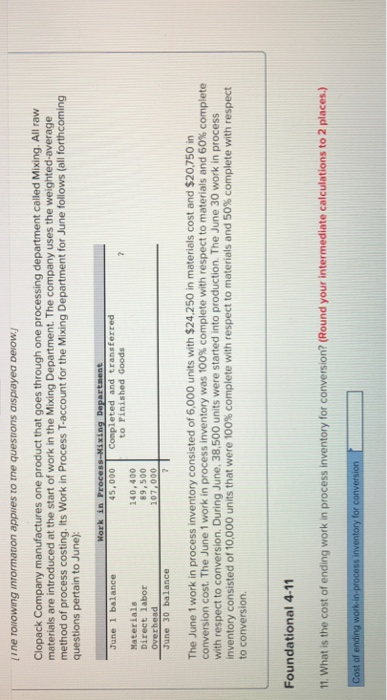

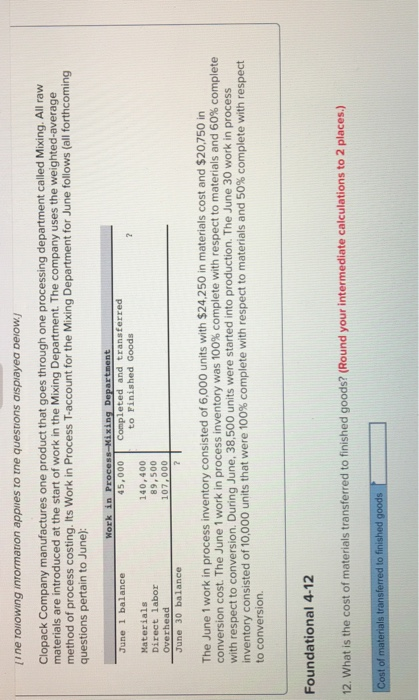

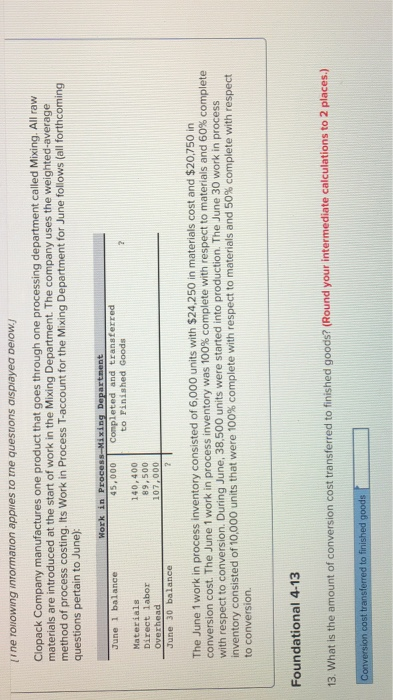

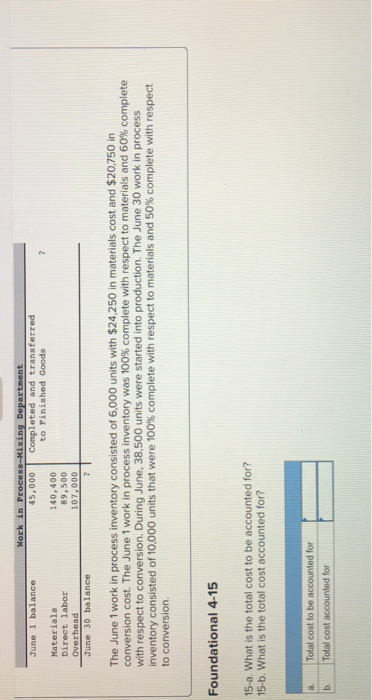

Required information The Foundational 15 [LO4-1, LO4-2, LO4-3, LO4-4, LO4-5) The following information applies to the questions displayed below Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. ts Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): June 1 balance 45,000Completed and transferred to Pinished Goods Materials Direct labor 140,400 89,500 107.000 June 30 balance The June 1 work in process inventory consisted of 6.000 units with $24.250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion Foundational 4-1 Journal entry worksheet Clear entry Journal entry worksheet Record the direct labor cost incurred General,J Debit Clear entry View general journal Journai entry worksheet Record the overhead cost applied to production Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal [Ine T010wing Inrormation apples tne questions aispiayea Deow. Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June 45,000Conpleted and transferred to Pinished Goods Materials 140,400 89,500 107,000 Direct labor overhead June 30 balance The June 1 work in process inventory consisted of 6,000 units with $24,250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion Foundational 4-3 How many units were completed and transferred to finished goods during the period? ine roiowing inrormation appies to tne questions aispiayea peiow Clopack Company manufactures one product that goes through one processing department called Mixing. All ravw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June June 1 balanee 45,000 to Pinished Goods Materials Direct labor Overhead June 30 balance 140.400 89,500 107,000 The June 1 work in process inventory consisted of 6,000 units with $24.250 in materials cost and $20750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion Foundational 4-4 4. Compute the equivalent units of production for materials ii ne ronowing inrormation appies to tne questions aispiayea Delow. Clopack Company manufactures one product that goes through one processing department called Mixing. All ravw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): 45,000 to Finished Goods Materials Direct labor Overhead June 30 balance 140,400 89,500 107,000 The June 1 work in process inventory consisted of 6,000 units with $24,250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-6 6. What is the cost of beginning work in process inventory plus the cost added during the period for materials? tine rouowing inrormation appies to tne questions aisprayea pelow. Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June) June 1 balance 45,000 Completed and transferred to Finished Goods Materials 140,400 89,500 107,000 Overhead June 30 balance The June 1 work in process inventory consisted of 6.000 units with $24,250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-7 7 What is the cost of beginning work in process inventory plus the cost added during the period for conversion? Lune rowowing inrormation appues ro tne questions aispiayea peiow Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): opleed andtransferred to rinished Gooda 45,000 140,400 89,500 107,000 Direct labor June 30 balance The June 1 work in process inventory consisted of 6,000 units with $24.250 in materials cost and $20750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and SO% complete with respect to conversion. Foundational 4-8 8. What is the cost per equivalent unit for materials? (Round your answer to 2 decimal places.) Cost ger ecuivalent une for matorials [Ine Torowing inormation appies to tne questions aspavea Deow. Clopack Company manufactures one product that goes through one processing department called Mixing. All ravw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June Work in Process-Mixin 45,000Completed and transferred to Pinished Goods 140,400 89,500 Direct labor Overhead The June 1 work in process inventory consisted of 6.000 units with $24.250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-9 9 What is the cost per equivalent unit for conversion? (Round your answer to 2 decimal places.) l per equivalent tine rouowing inrormation appies to tne questions aispiayea beiow. Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June Work in to Finished Goods Materials Direct labor Overhead June 30 balance 140,400 89,500 107 000 The June 1 work in process inventory consisted of 6.000 units with $24.250 in materials cost and $20.750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-10 10. What is the cost of ending work in process inventory for materials? (Round your intermediate calculations to 2 places) Cost of ending work-in-process inventory for ma Il ne rollowing innormation appies to tne questions aispiayea Delow. Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June) June 1 balance 45,000 Conpleted and transferred to Pinished Goods Direct labor Overhead 240,400 89,500 107,000 The June 1 work in process inventory consisted of 6.000 units with $24,250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-11 11. What is the cost of ending work in process inventory for conversion? (Round your intermediate calculations to 2 places.) l ine roiiowing inrormation appies to tne questions aispiayea peiow.j Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to Junel June 1 balance 45,000Completed and transferred to Pinished Goods Materials Direct labor Overhead June 30 balance 140,400 89,500 107,000 The June 1 work in process inventory consisted of 6,000 units with $24.250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-12 12. What is the cost of materials transferred to finished goods? (Round your intermediate calculations to 2 places.) ost of materials transferred to finished goods Journal entry worksheet Record the transfer of costs from Work in Process to Finished Goods Clear entry Hork in P June 1 balance 45,000 to Finished Goods 140,400 89,500 107,000 Direct labor Overhead June 30 balance The June 1 work in process inventory consisted of 6,000 units with $24,250 in materials cost and $20750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Foundational 4-15 15-a-what is the total cost to be accounted for? 15-b. What is the total cost accounted for? a Total cost to be a ed for for