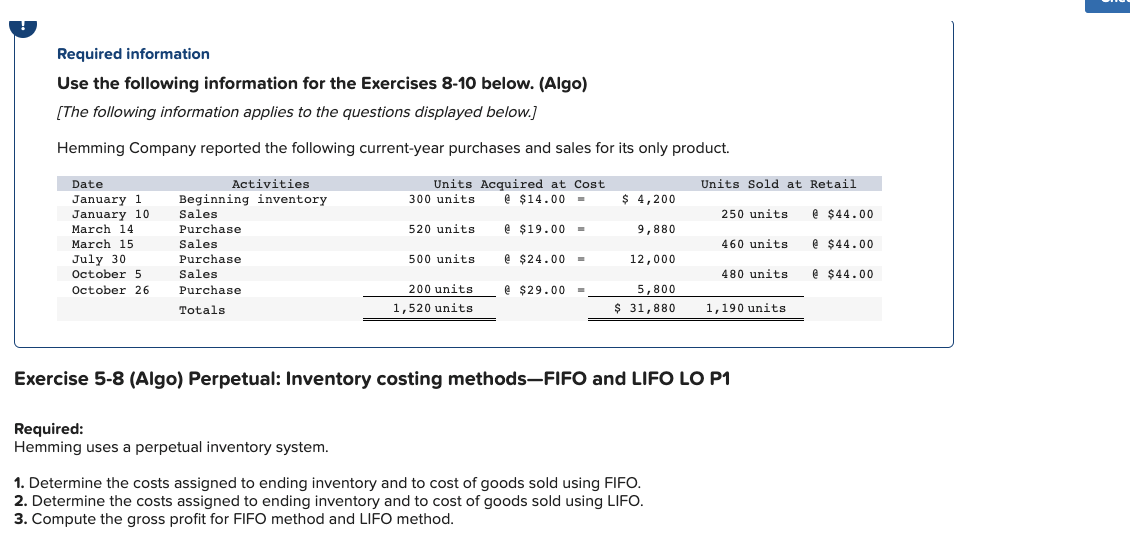

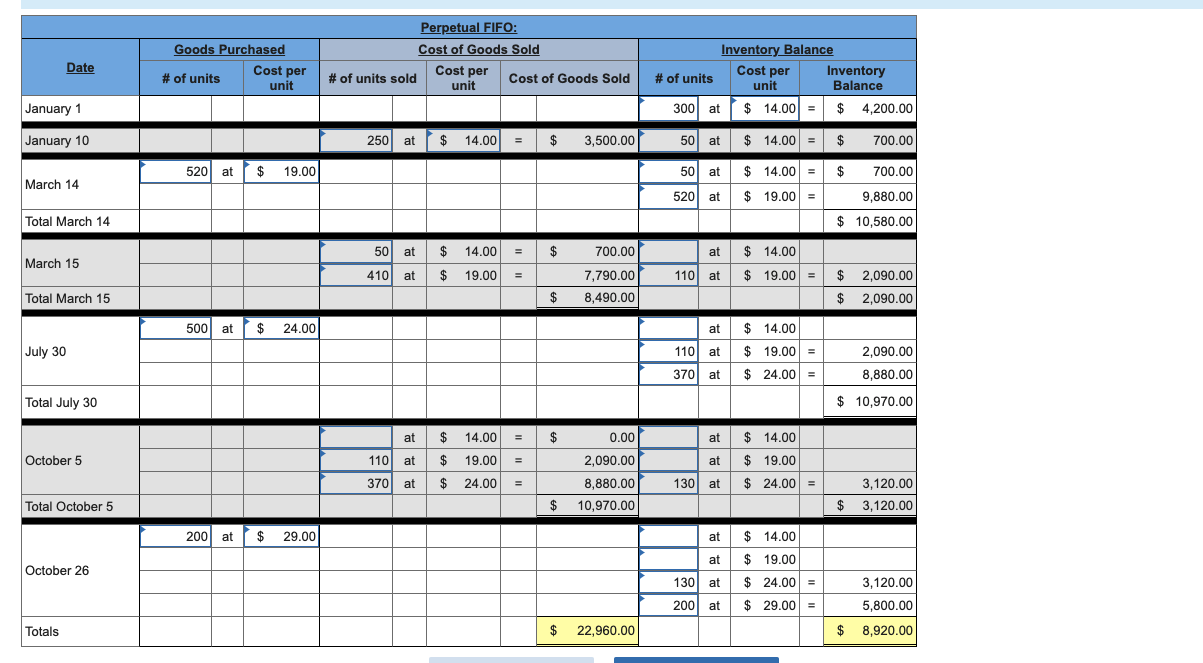

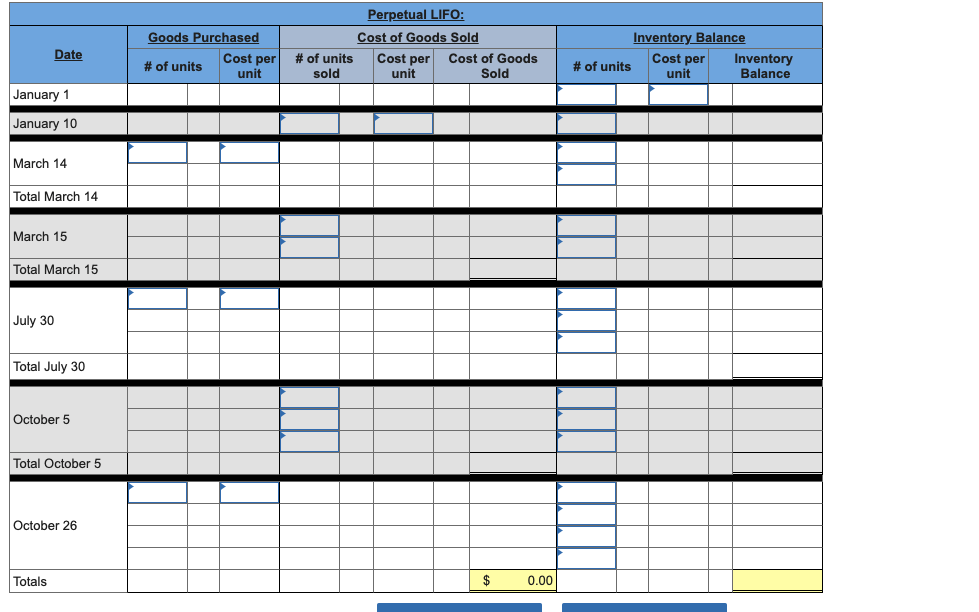

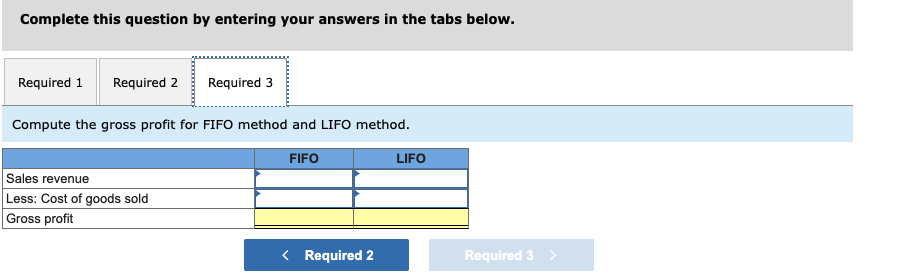

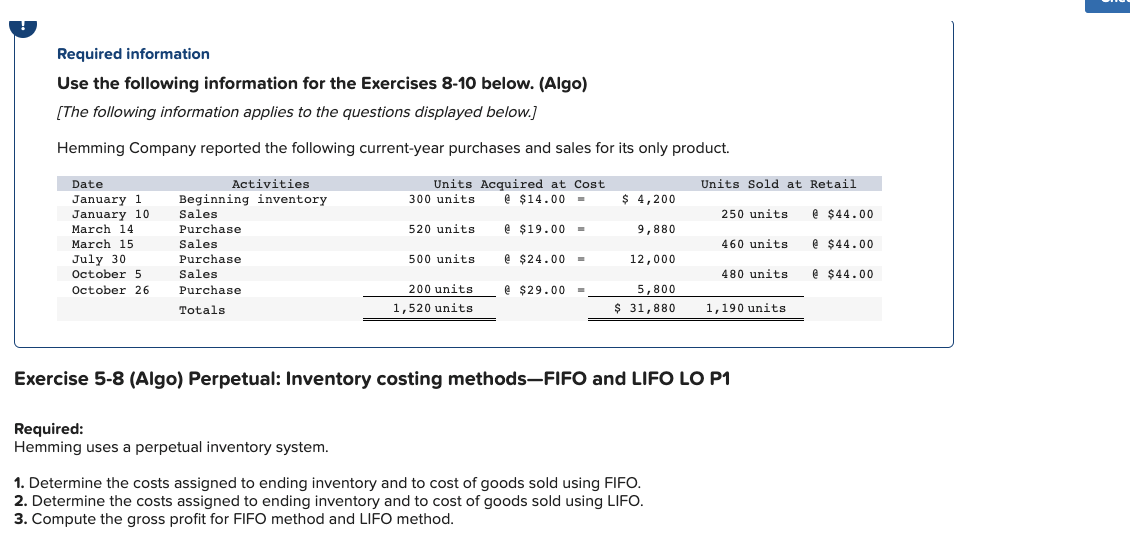

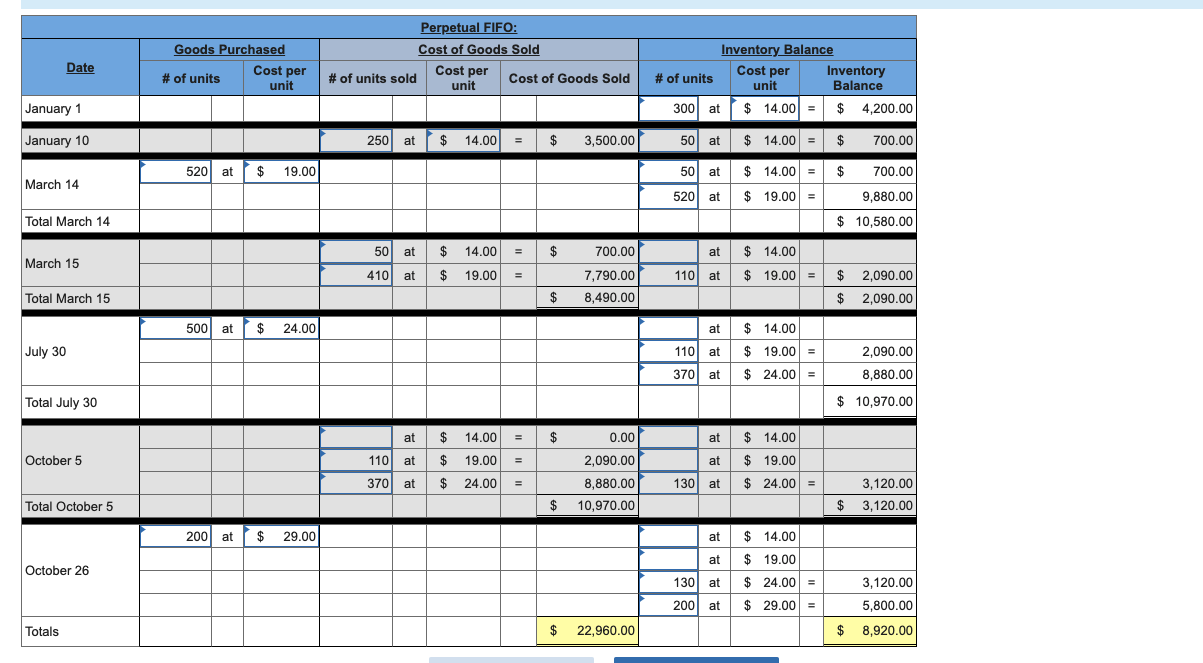

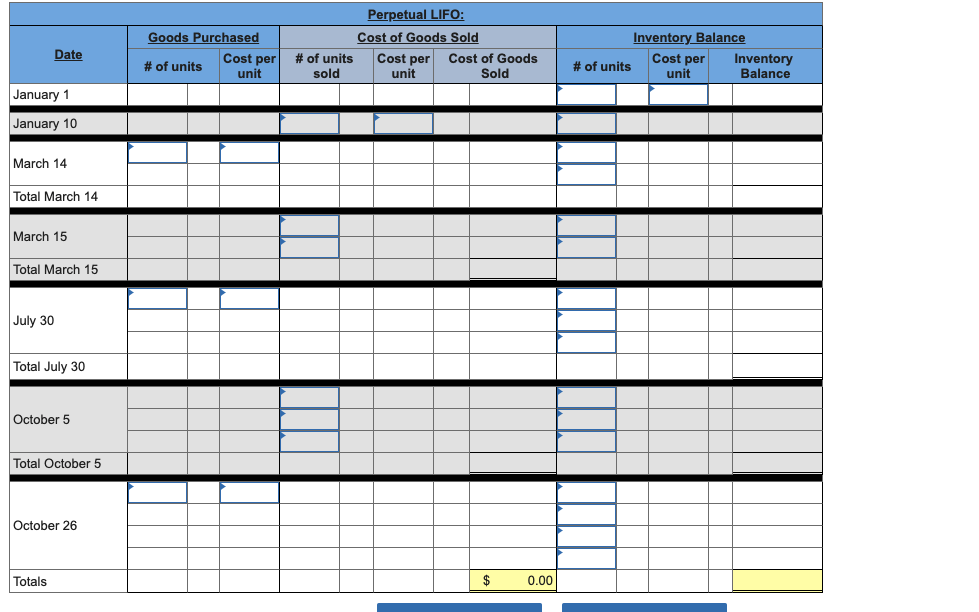

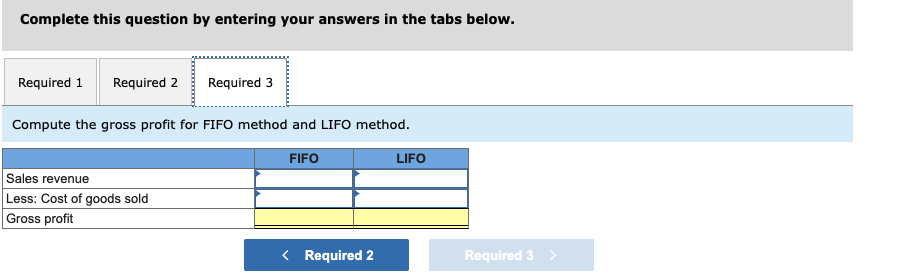

Required information Use the following information for the Exercises 8-10 below. (Algo) [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date Units Sold at Retail Activities Beginning inventory Sales Units Acquired at Cost @ $14.00 300 units January 1 January 10 March 14 $ 4,200 250 units @ $19.00 Purchase Sales 520 units 500 units 460 units @ $24.00- March 15 July 30 October 5 October 26 Purchase Sales Purchase 9,880 12,000 5,800 480 units @ $29.00 200 units 1,520 units Totals $ 31,880 1,190 units Exercise 5-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. @ $44.00 @ $44.00 @ $44.00 Date January 1 January 10 March 14 Total March 14 March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 October 26 Totals Goods Purchased # of units Cost per unit 520 at at $ 19.00 500 at $ 24.00 200 at $ 29.00 Perpetual FIFO: Cost of Goods Sold Cost per unit # of units sold 250 at $ 50 at $ 14.00 410 at $ 19.00 = at $ 14.00 110 at $ 19.00 370 at $ 24.00 Cost of Goods Sold 3,500.00 700.00 7,790.00 8,490.00 0.00 2,090.00 8,880.00 10,970.00 22,960.00 14.00 = $ $ $ $ $ $ = = # of units Inventory Balance Cost per unit $14.00 = $14.00 = $ 14.00 = $ 19.00 = $14.00 $ 19.00 = $14.00 $19.00 = $24.00 = $14.00 $ 19.00 $24.00 = $14.00 $19.00 $ 24.00 = $29.00 = 300 at 50 at 50 at 520 at at 110 at at 110 at 370 at at at 130 at at at 130 at 200 at Inventory Balance $ 4,200.00 $ 700.00 $ 700.00 9,880.00 $ 10,580.00 $ 2,090.00 $ 2,090.00 2,090.00 8,880.00 $ 10,970.00 3,120.00 $ 3,120.00 3,120.00 5,800.00 $ 8,920.00 Date January 1 January 10 March 14 Total March 14 March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 October 26 Totals Goods Purchased # of units Cost per unit # of units sold Perpetual LIFO: Cost of Goods Sold Cost per Cost of Goods unit Sold $ 0.00 # of units Inventory Balance Cost per Inventory unit Balance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the gross profit for FIFO method and LIFO method. FIFO LIFO Sales revenue Less: Cost of goods sold Gross profit