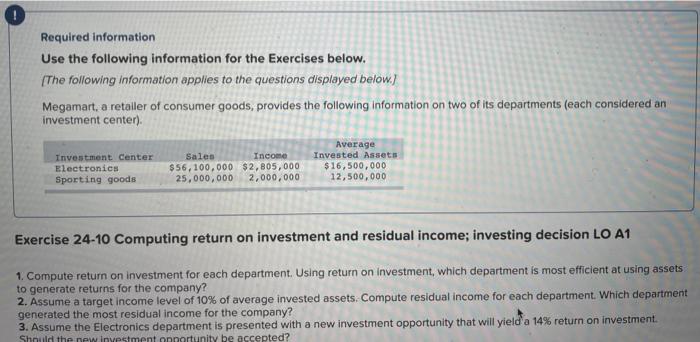

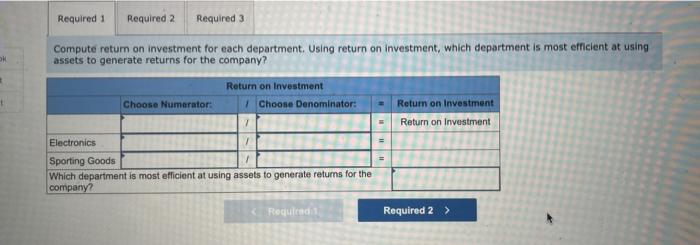

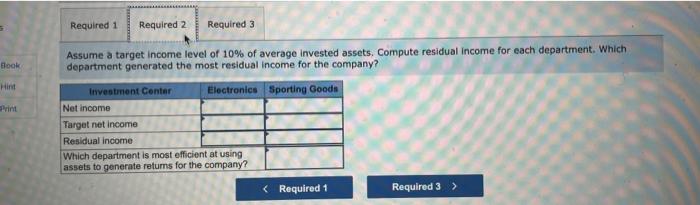

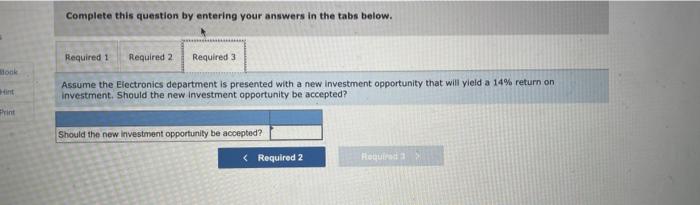

Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below.) Megamart , a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center) Investment Center Electronics Sporting goods Sales Income $56,100,000 $2,805,000 25,000,000 2,000,000 Average Invested Assets $16,500,000 12,500,000 Exercise 24-10 Computing return on investment and residual income; investing decision LO A1 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 10% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment annartunity be accepted? Required 1 Required 2 Required 3 OK Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? + Choose Numerator: Return on Investment Choose Denominator: Return on Investment Return on Investment Electronics 1 Sporting Goods 1 Which department is most efficient at using assets to generate returns for the company Required 1 Required 2 Required 3 Book Assume a target income level of 10% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? Hint Investment Center Electronics Sporting Goods Net income Target net income Residual income Which department is most efficient at using assets to generate returns for the company? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on Investment. Should the new Investment opportunity be accepted? Should the new investment opportunity be accepted?