Question: Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance

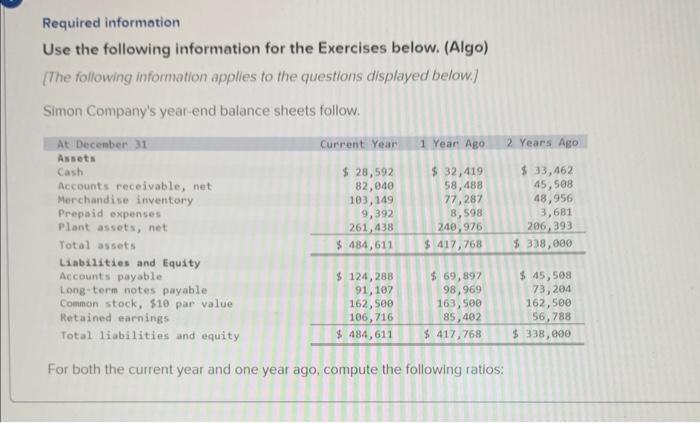

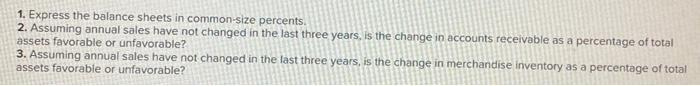

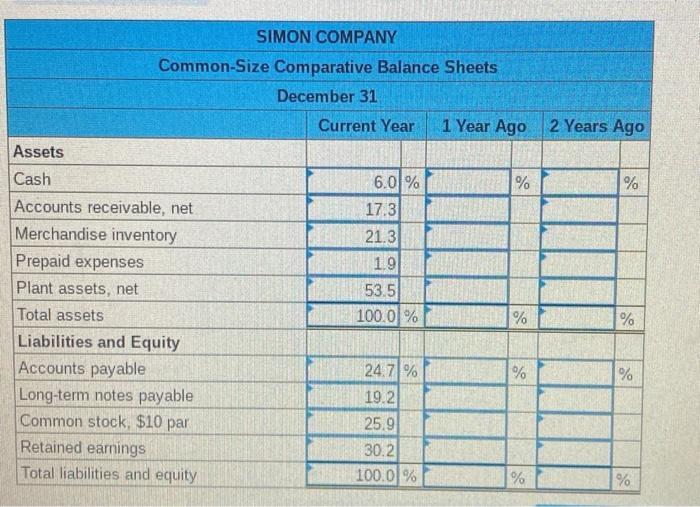

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Current Year $ 28,592 82,040 103,149 9,392 261,438 $ 484,611 1 Year Ago $ 32,419 58,488 77,287 8,598 240,976 $ 417,768 $ 124,288 91, 107 162,500 106,716 $ 484,611 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For both the current year and one year ago, compute the following ratios: 2 Years Ago $ 69,897 98,969 163,500 85,402 $ 417,768 $ 33,462 45,508 48,956 3,681 206,393 $ 338,000 $ 45,508 73,204 162,500 56,788 $ 338,000 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Assets Cash SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par Retained earnings Total liabilities and equity Current Year 1 Year Ago 2 Years Ago 6.0 % 17.3 21.3 1.9 53.5 100.0 % 24.7% 19.2 25.9 30.2 100.0 % % % % % % % % %

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

1 CommonSize comparative Balance Sheet SIMON COMPANY CommonSize Comparaive Balance Sheets December 3... View full answer

Get step-by-step solutions from verified subject matter experts