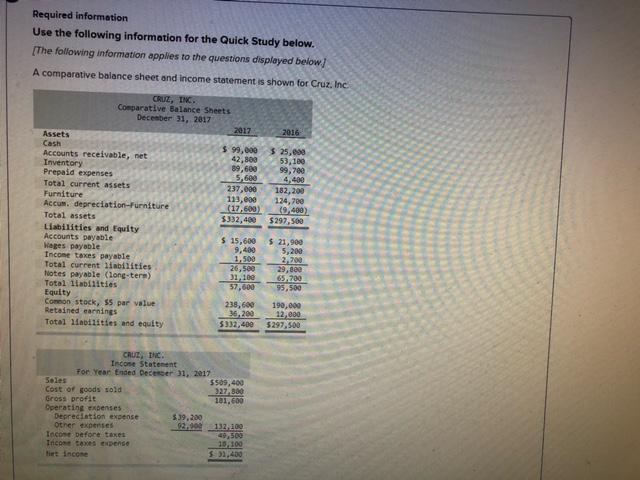

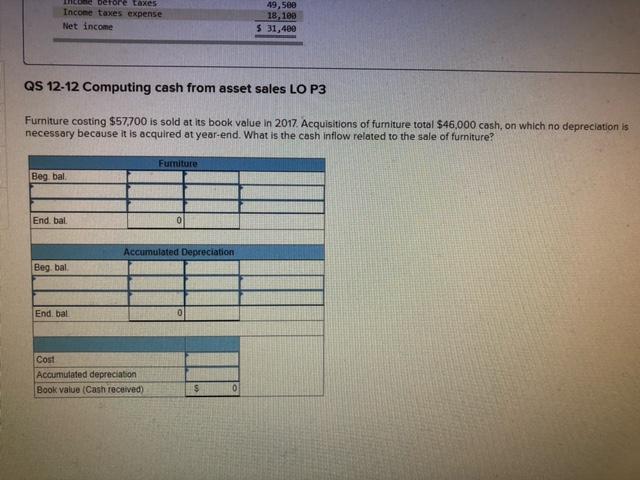

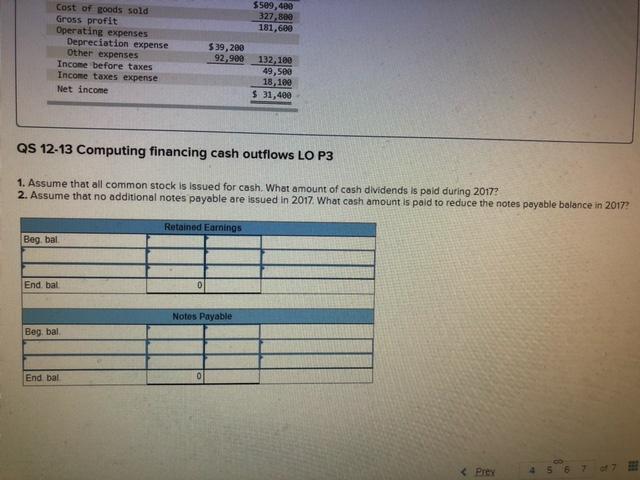

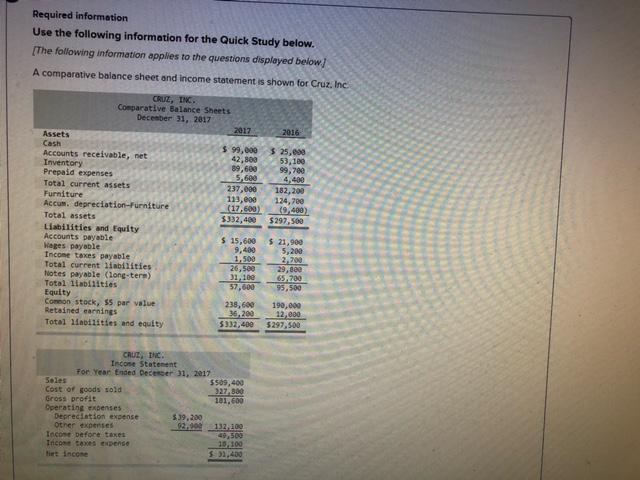

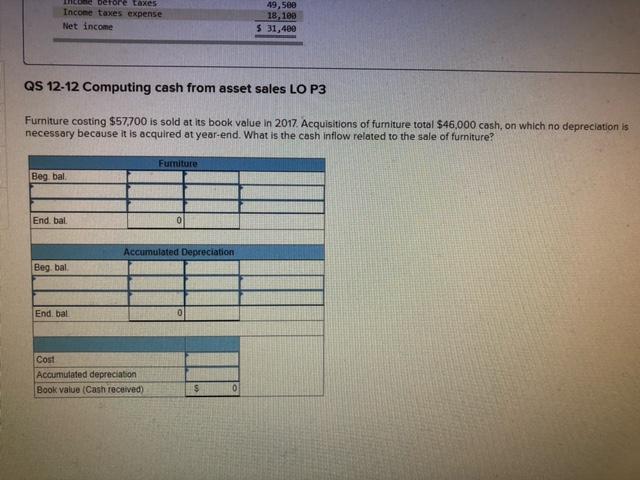

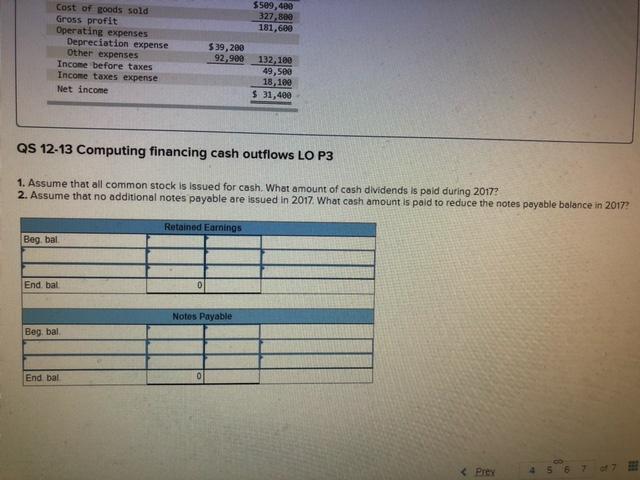

Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below! A comparative balance sheet and income statement is shown for Cruz, Inc 2016 $ 25,00 53,100 99,700 CRUE, INC. Comparative Balance Sheets December 31, 2017 2017 Assets Cash $ 99,000 Accounts receivable, net 42,800 Inventory 89,600 Prepaid expenses 5.600 Total current assets 237,000 Furniture 113,000 Accum. depreciation Furniture 17,600) Total assets $332,400 Liabilities and Equity Accounts payable $ 15,600 veges payable 9,480 Income taxes payable 1,500 Total current liabilities 26,500 Notes payable (long-term) 31, 10e Total liabilities 57,600 Equity Common stock, 55 par value 238,600 Retained earnings 36,200 Total liabilities and equity 5332,400 182,200 124,700 (9.400) $297,500 $ 21,900 5,200 2,700 29,800 65.780 95,500 190,000 12,080 5297,500 CRUE, DC Income Statement For Year Ended December 31, 2017 Soles 5509,400 Cost of goods sold 327 880 Gross profit 101.600 Operating expenses Depreciation expense 539,200 Other expenses 92.000 132.100 Tacone before taxes Income taxes expense 10.100 1,400 The before taxes Income taxes expense Net income 49,500 18,100 $ 31,400 QS 12-12 Computing cash from asset sales LO P3 Furniture costing $57,700 is sold at its book value in 2017. Acquisitions of furniture total $46,000 cash, on which no depreciation is necessary because it is acquired at year-end. What is the cash inflow related to the sale of furniture? Furniture Beg bal End. bal Accumulated Depreciation Beg bal End, bal Cost Accumulated depreciation Book value (Cash received) $ 0 5509,400 327,80 181,600 Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Income before taxes Income taxes expense Net income 539,200 92,900 132, 100 49, seg 18,100 $ 31,400 QS 12-13 Computing financing cash outflows LO P3 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2017 2. Assume that no additional notes payable are issued in 2017. What cash amount is paid to reduce the notes payable balance in 2017? Retained Earnings Beg bal End, bal Notos Payable Beg, bal End bal 0 E