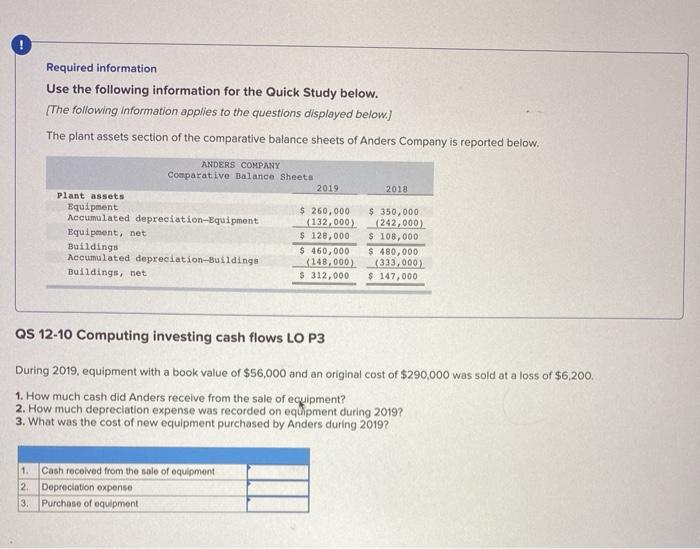

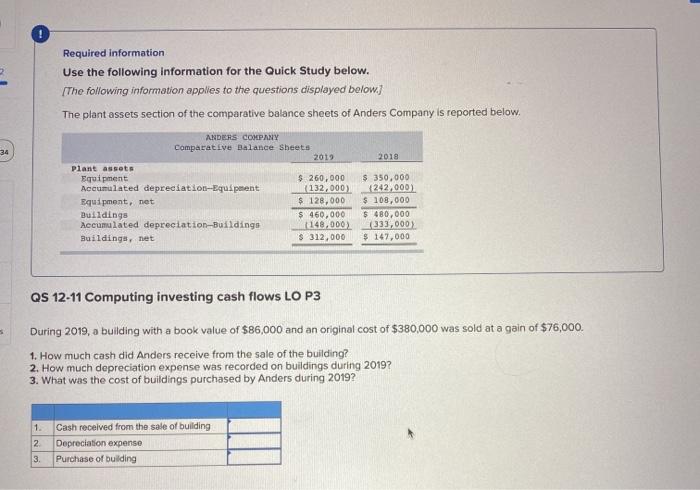

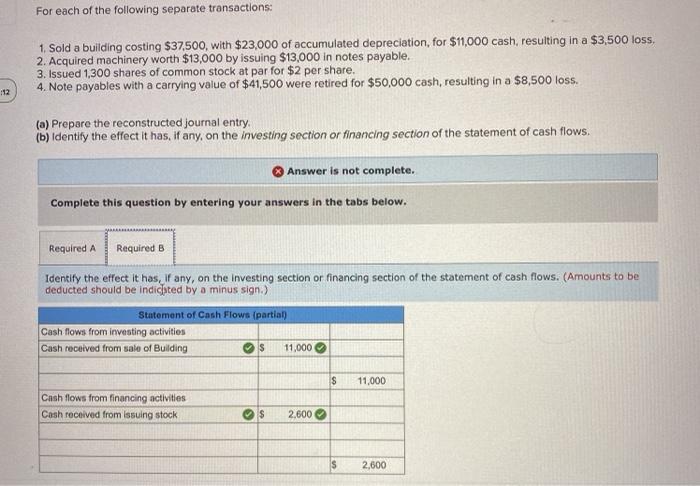

Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.) The plant assets section of the comparative balance sheets of Anders Company is reported below. 2018 ANDERS COMPANY Comparative Balance Sheets 2019 Plant assets Equipment $ 260,000 Accumulated depreciation-Equipment (132,000) Equipment, net $ 128,000 Buildings $ 460,000 Accumulated depreciation-Buildings (148,000) Buildings, net $ 312,000 $ 350,000 (242,000) $ 108,000 $ 480,000 (333,000) $ 147,000 QS 12-10 Computing investing cash flows LO P3 During 2019, equipment with a book value of $56,000 and an original cost of $290,000 was sold at a loss of $6,200. 1. How much cash did Anders receive from the sale of equipment? 2. How much depreciation expense was recorded on equipment during 2019? 3. What was the cost of new equipment purchased by Anders during 2019? 1. Cash received from the sale of equipment 2. Depreciation expense 3. Purchase of equipment Required information Use the following information for the Quick Study below. The following information applies to the questions displayed below.) The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment $ 260,000 $ 350,000 Accumulated depreciation Equipment (132,000) (242,000) Equipment, net $ 128,000 $ 108,000 Buildings $ 460,000 $ 480,000 Accumulated depreciation-Buildings 148.000 (333,000) Buildings, net $ 312,000 $ 147,000 34 QS 12-11 Computing investing cash flows LO P3 5 During 2019, a building with a book value of $86,000 and an original cost of $380,000 was sold at a gain of $76,000. 1. How much cash did Anders receive from the sale of the building? 2. How much depreciation expense was recorded on buildings during 2019? 3. What was the cost of buildings purchased by Anders during 2019? 1. 2 3. Cash received from the sale of building Depreciation expenso Purchase of building For each of the following separate transactions: 1. Sold a building costing $37,500, with $23,000 of accumulated depreciation, for $11,000 cash, resulting in a $3,500 loss, 2. Acquired machinery worth $13,000 by issuing $13,000 in notes payable. 3. Issued 1,300 shares of common stock at par for $2 per share. 4. Note payables with a carrying value of $41,500 were retired for $50,000 cash, resulting in a $8,500 loss. 112 (a) Prepare the reconstructed journal entry (b) Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. (Amounts to be deducted should be indicated by a minus sign.) Statement of Cash Flows (partial) Cash flows from investing activities Cash received from sale of Building os 11,000 $ 11,000 Cash flows from financing activities Cash received from issuing stock $ 2,600 . 2,600 Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.) The plant assets section of the comparative balance sheets of Anders Company is reported below. 2018 ANDERS COMPANY Comparative Balance Sheets 2019 Plant assets Equipment $ 260,000 Accumulated depreciation-Equipment (132,000) Equipment, net $ 128,000 Buildings $ 460,000 Accumulated depreciation-Buildings (148,000) Buildings, net $ 312,000 $ 350,000 (242,000) $ 108,000 $ 480,000 (333,000) $ 147,000 QS 12-10 Computing investing cash flows LO P3 During 2019, equipment with a book value of $56,000 and an original cost of $290,000 was sold at a loss of $6,200. 1. How much cash did Anders receive from the sale of equipment? 2. How much depreciation expense was recorded on equipment during 2019? 3. What was the cost of new equipment purchased by Anders during 2019? 1. Cash received from the sale of equipment 2. Depreciation expense 3. Purchase of equipment Required information Use the following information for the Quick Study below. The following information applies to the questions displayed below.) The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment $ 260,000 $ 350,000 Accumulated depreciation Equipment (132,000) (242,000) Equipment, net $ 128,000 $ 108,000 Buildings $ 460,000 $ 480,000 Accumulated depreciation-Buildings 148.000 (333,000) Buildings, net $ 312,000 $ 147,000 34 QS 12-11 Computing investing cash flows LO P3 5 During 2019, a building with a book value of $86,000 and an original cost of $380,000 was sold at a gain of $76,000. 1. How much cash did Anders receive from the sale of the building? 2. How much depreciation expense was recorded on buildings during 2019? 3. What was the cost of buildings purchased by Anders during 2019? 1. 2 3. Cash received from the sale of building Depreciation expenso Purchase of building For each of the following separate transactions: 1. Sold a building costing $37,500, with $23,000 of accumulated depreciation, for $11,000 cash, resulting in a $3,500 loss, 2. Acquired machinery worth $13,000 by issuing $13,000 in notes payable. 3. Issued 1,300 shares of common stock at par for $2 per share. 4. Note payables with a carrying value of $41,500 were retired for $50,000 cash, resulting in a $8,500 loss. 112 (a) Prepare the reconstructed journal entry (b) Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. (Amounts to be deducted should be indicated by a minus sign.) Statement of Cash Flows (partial) Cash flows from investing activities Cash received from sale of Building os 11,000 $ 11,000 Cash flows from financing activities Cash received from issuing stock $ 2,600 . 2,600