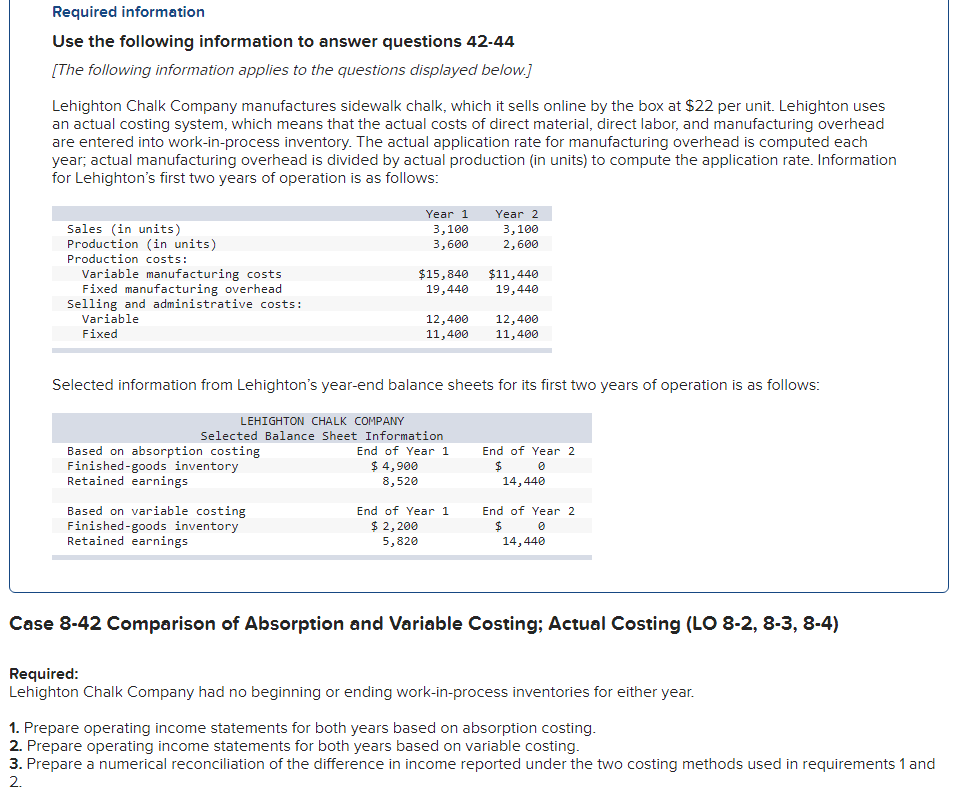

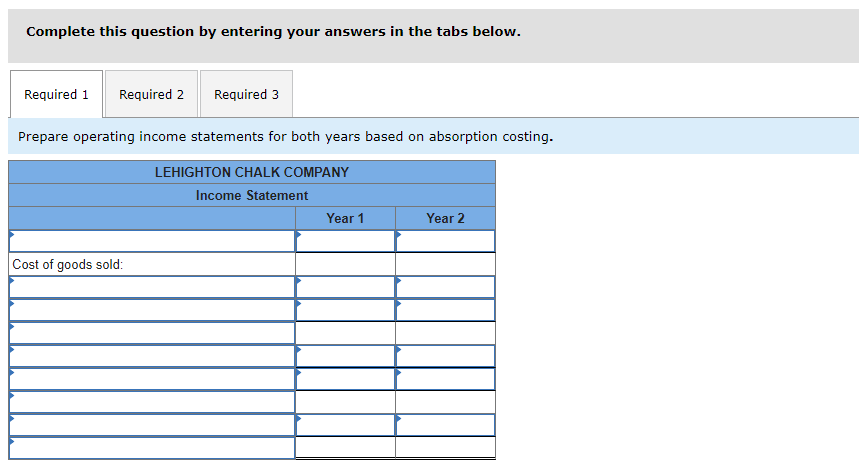

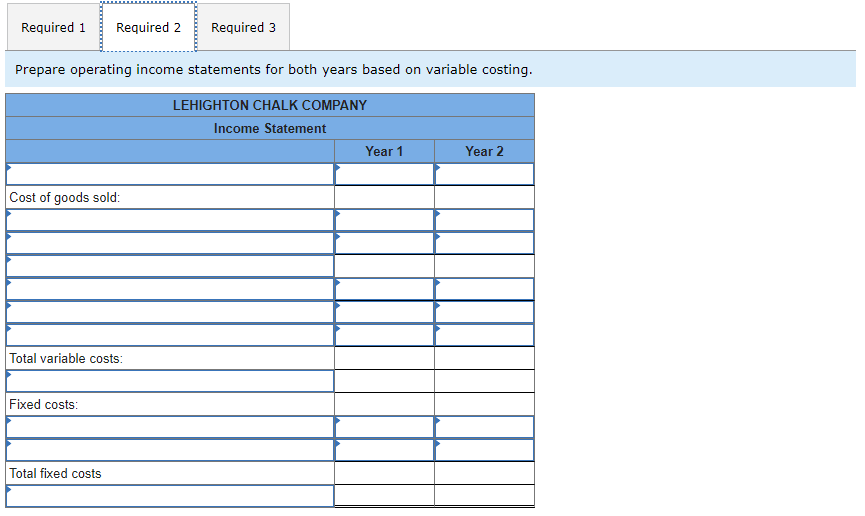

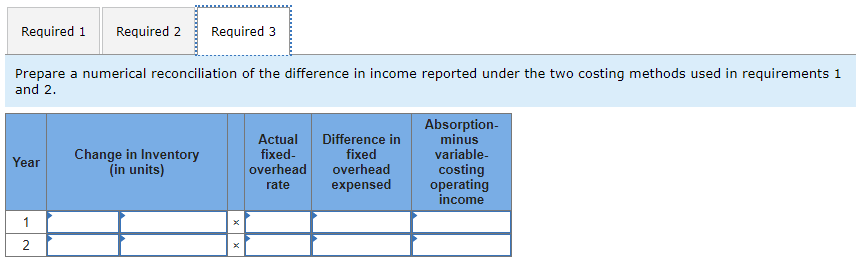

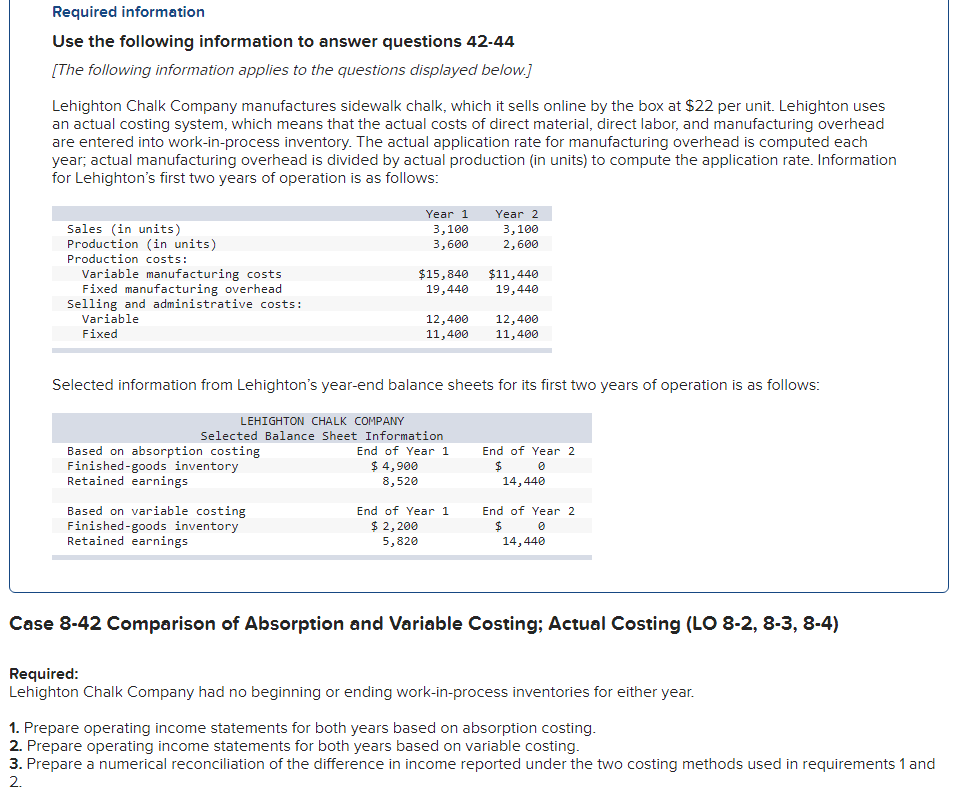

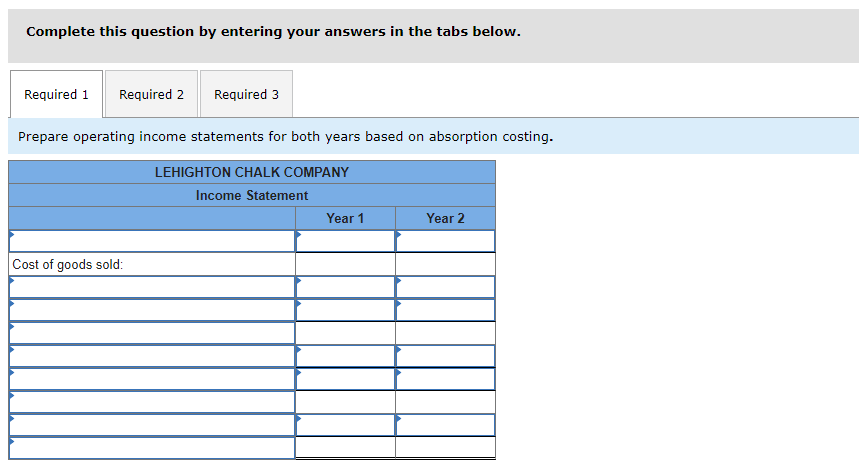

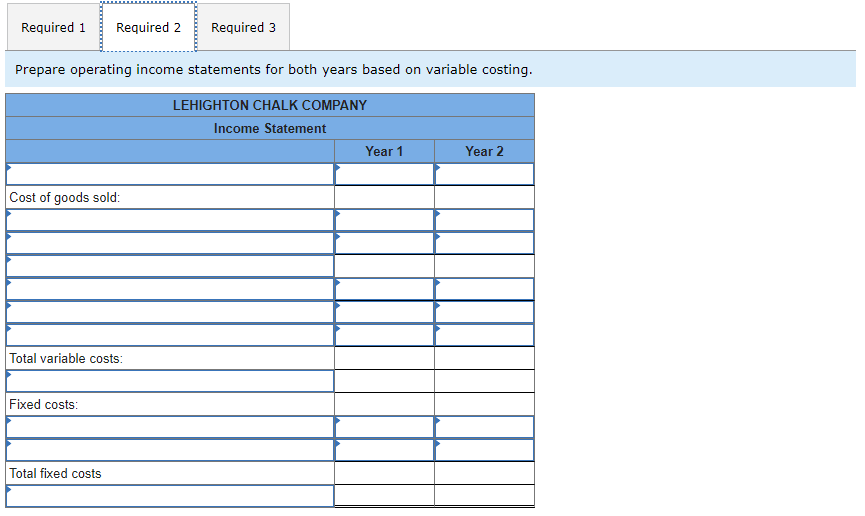

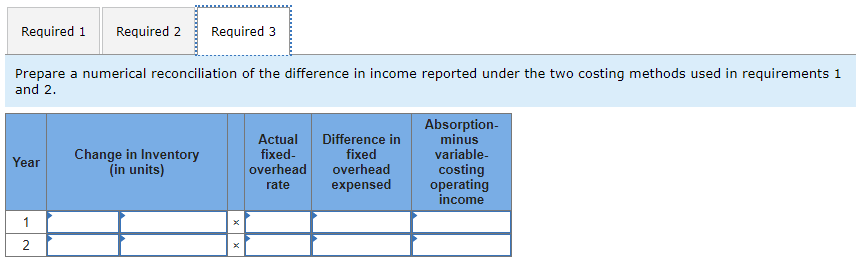

Required information Use the following information to answer questions 42-44 [The following information applies to the questions displayed below.) Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $22 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year, actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehighton's first two years of operation is as follows: Year 1 3,100 3,600 Year 2 3,100 2,600 Sales (in units) Production (in units) Production costs: Variable manufacturing costs Fixed manufacturing overhead Selling and administrative costs: Variable Fixed $15, 840 19,440 $11,440 19,440 12,400 11,400 12,400 11,400 Selected information from Lehighton's year-end balance sheets for its first two years of operation is as follows: LEHIGHTON CHALK COMPANY Selected Balance Sheet Information Based on absorption costing End of Year 1 Finished-goods inventory $ 4,900 Retained earnings 8,520 End of Year 2 $ 0 14,440 Based on variable costing Finished-goods inventory Retained earnings End of Year 1 $ 2,200 5,820 End of Year 2 $ 14,440 Case 8-42 Comparison of Absorption and Variable Costing; Actual Costing (LO 8-2, 8-3, 8-4) Required: Lehighton Chalk Company had no beginning or ending work-in-process inventories for either year. 1. Prepare operating income statements for both years based on absorption costing. 2. Prepare operating income statements for both years based on variable costing. 3. Prepare a numerical reconciliation of the difference in income reported under the two costing methods used in requirements 1 and 2. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare operating income statements for both years based on absorption costing. LEHIGHTON CHALK COMPANY Income Statement Year 1 Year 2 Cost of goods sold: Required 1 Required 2 Required 3 Prepare operating income statements for both years based on variable costing. LEHIGHTON CHALK COMPANY Income Statement Year 1 Year 2 Cost of goods sold: Total variable costs: Fixed costs: Total fixed costs Required 1 Required 2 Required 3 Prepare a numerical reconciliation of the difference in income reported under the two costing methods used in requirements 1 and 2. Year Change in Inventory (in units) Actual fixed- overhead rate Difference in fixed overhead expensed Absorption- minus variable- costing operating income 1 2 x IN