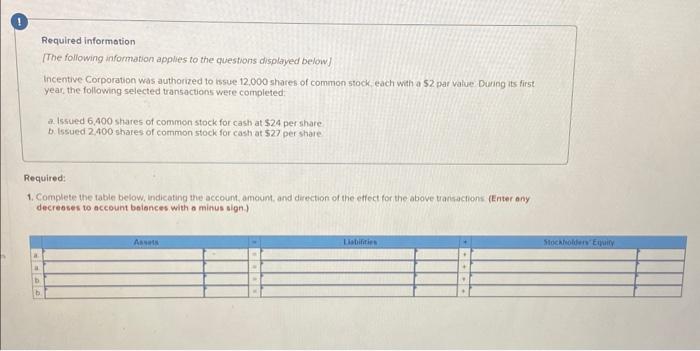

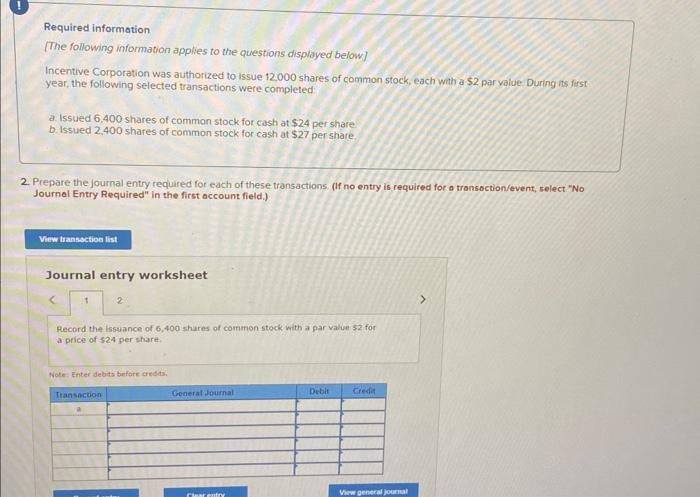

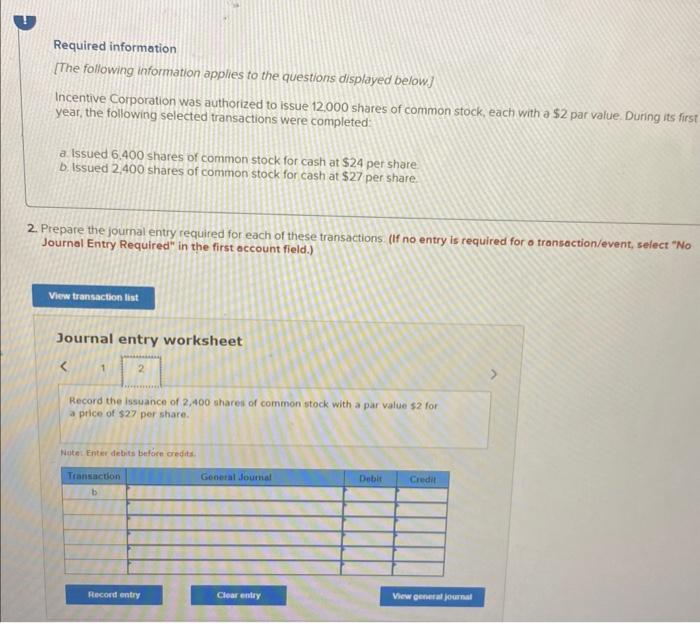

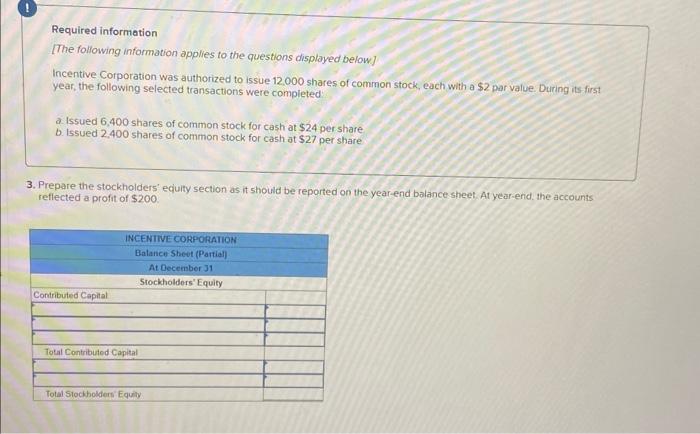

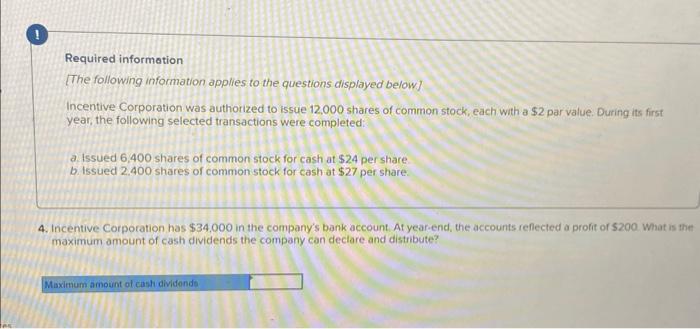

Required informetion [The following information applies to the questions displtived below] Incentive Corporawon was authorized to issue 12.000 shares of common stock each with a 52 par value. Bering its first year, the following selected transactions were completed. a. Issued 6,400 shares of common stock for cash at $24 per share b. issued 2,400 shares of common stock for cash at $27 per shaie Required: 1. Complete the table below, lindicating the account, amount, and direction of the effect for the above tansactions (Enter any decresses to account boionces with o minus sign! Required information [The following information applies to the questions displayed below] Incentive Corporation was authorized to issue 12000 shares of common stock, each with a $2 par value. During is first year, the following selected transactions were completed a. Issued 6.400 shares of common stock for cash at $24 per share b. Issued 2,400 shares of common stock for cash at $27 per share. 2. Prepare the journal entry required for each of these transactions. (If no entry is required for a tronsoction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Record the issyance of 6,400 shures of common stock with a par value 32 for a price of $24 per share. Note Enter debut brfare credasi Required information [The following information applies to the questions displayed below.] Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $2 par value During its first year, the following selected transactions were completed: a. Issued 6.400 shares of common stock for cash at $24 per share b. Issued 2,400 shares of common stock for cash at $27 per share. 2. Prepare the journal entry required for each of these transactions. (If no entry is required for o transaction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Hecord the issuance of 2,400 shares of common stock with a par value $2 for a price of $27 per share. Wute Enter detits befce credits. Required information [The following information applies to the questions displayed below] Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $2 par value. During its first year, the following selected transactions were completed a. Issued 6,400 shares of common stock for cash at $24 per share b. Issued 2.400 shares of common stock for cash at $27 per share Prepare the stockholders' equity section as it should be reported on the year-end balance sheet. At year-end. the accounts reflected a profit of $200. Required information [The following information applies to the questions displayed below] Incentive Corporation was authorized to issue 12.000 shares of common stock, each with a $2 par value. During its first year, the following selected transactions were completed: a. Issued 6,400 shares of common stock for cash at $24 per share b. Issued 2.400 shares of common stock for cash at $27 per share. 4. Incentive Corpotation has $34,000 in the company's bank account. At year-end, the accounts reflected a profit of $200. What is the maximum amount of cash dividends the company can deciare and distribute