Question

Required Journalize the September transactions and the adjusting entries. xxxx Prepare the T-accounts Prepare a trial balance at September 30. Close the Revenues and Expenses

Required

- Journalize the September transactions and the adjusting entries. xxxx

- Prepare the T-accounts

- Prepare a trial balance at September 30.

- Close the Revenues and Expenses accounts to Net Income and then, close Net Income to Retained Earnings account.

- Prepare an income statement and a balance sheet at September 30.

Note: The beginning balances of September 1 for each account should be added first in the T-Account, then you add the other values coming from journal entries.

Example: Cash Account

| Cash |

| |

| beg. Balance 4,828 | XXX | |

| XXX | XXX | |

|

| ||

|

| ||

|

| ||

Hints regarding adjustments:

- It is given the value in $ of supplies on Hand. You need to calculate Supplies expensed. The entry must be:

Supplies expense XXX

Supplies XXX

- Accrued means incurred but not yet paid, which according to definition is Unrecorded Liabilities (check the slides)

- Depreciation per month is $174. The adequate entry for accounting for depreciation is:

Depreciation expense 174

Accumulated Depreciation 174

General info regarding depreciation: Depreciation represents how much of an asset's value has been used up. The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the Accumulated Depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets). Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.

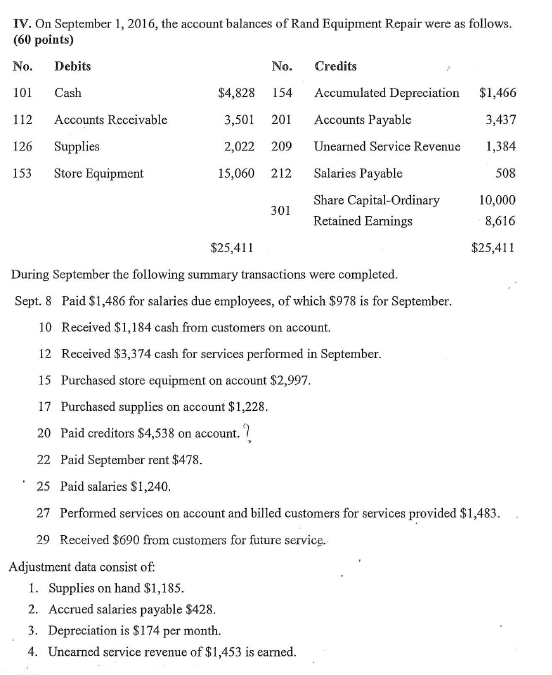

IV. On September 1, 2016, the account balances of Rand Equipment Repair were as follows. (60 points) No. Debits No. Credits 101 Cash $4,828 154 Accumulated Depreciation $1,466 112 Accounts Receivable 3,501 201 Accounts Payable 3,437 126 Supplies 2,022 209 Unearned Service Revenue 1,384 153 Store Equipment 15,060 212 Salaries Payable 508 Share Capital-Ordinary 10,000 301 Retained Earnings 8,616 $25,411 $25,411 During September the following summary transactions were completed. Sept. 8 Paid $1,486 for salaries due employees, of which $978 is for September. 10 Received $1,184 cash from customers on account. 12 Received $3,374 cash for services performed in September. 15 Purchased store equipment on account $2,997. 17 Purchased supplies on account $1.228. 20 Paid creditors $4,538 on account 22 Paid September rent $478. 25 Paid salaries $1,240. 27 Performed services on account and billed customers for services provided $1,483. 29 Received $690 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,185. 2. Accrued salaries payable $428. 3. Depreciation is $174 per month 4. Uncarned service revenue of $1,453 is earned. untStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started