Required:

- Manufacturing Account for the year ended 31st March (5 marks)

- Income Statement for the year ended 31st March 2017 (5 marks)

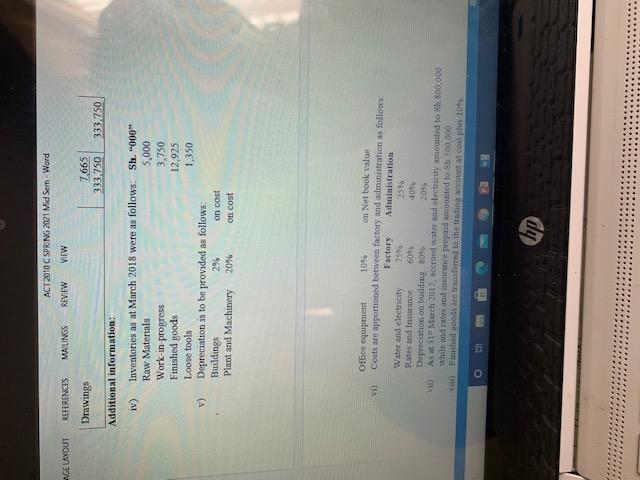

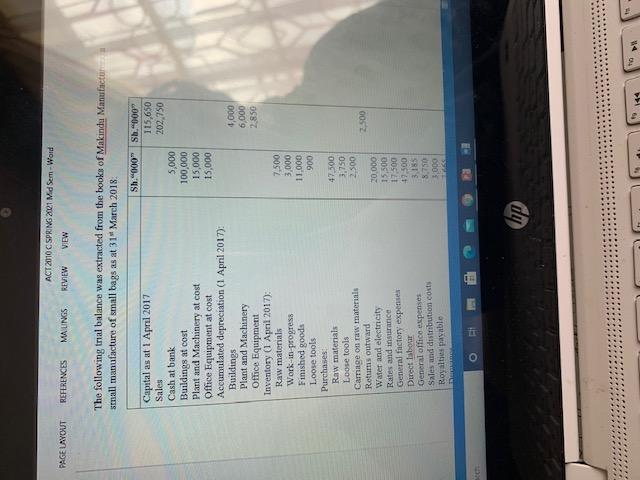

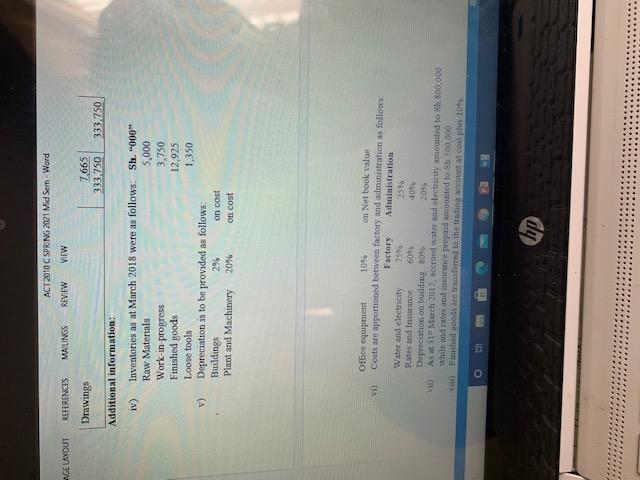

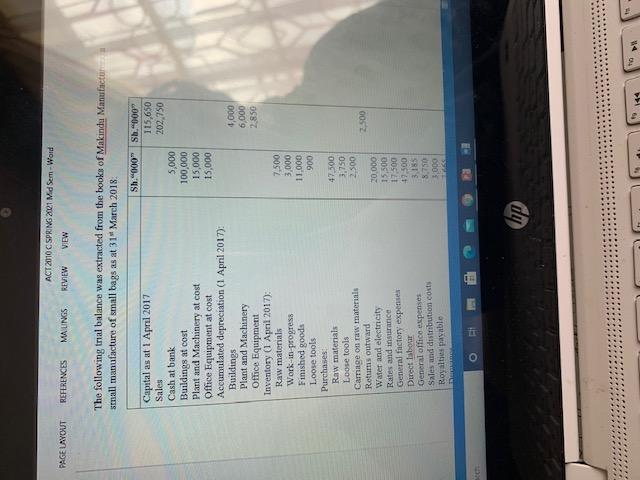

AGE LAYOUT ACT 2010 C SPRING 2021 Mid Sem - Word REFERENCES MAILINGS REVIEW VIEW Drawings 7.665 333.750 333.750 Additional information: IV) Inventories as at March 2018 were as follows: Sh."000" Raw Materials 5,000 3.750 Finished goods 12,925 Loose tools 1,350 v) Depreciation is to be provided as follows: Buildings 2% on cost Plant and Machinery 20% on cost Work-in-progress Office equipment 10% on Netbook value Costs are apportioned between factory and administration as follows: Factory Administration Water and electricity 7596 254 Rates and Insurance 50% 4096 Depreciation on building 8096 2014 As at 31 March 2017 accred water and electricity amounted to Sh 800,000 While and rates and insurance prepaid mounted to Sh 500.000 Vul) Finished goods are transferred to the trading account a cost plus 10. 0 hp ACT 2010 C SPRING 2001 Mid Sem-Word PAGE LAYOUT REFERENCES MAUNGS RIVIEW VIEW The following trial balance was extracted from the books of Makindu Manufacture small manufacture of small bags as at 31 March 2018 Sh."000" Sh.1000" 115,650 202.750 5,000 100,000 15,000 15,000 4,000 6,000 2,850 Capital as at 1 April 2017 Sales Cash at bank Buildings at cost Plant and Machinery at cost Office Equipment at cost Accumulated depreciation (1 April 2017): Buildings Plant and Machinery Office Equipment Inventory (1 April 2017): Raw materials Work-in-progress Finished goods Loose tools Purchases Raw materials Loose tools Camage on raw materials Reums outward Water and electricity Rates and insurance General factory expenses Direct Labour General office expenses Sales and distribution costs Royalties payable 7,500 3,000 11.000 900 2 500 47,500 3.750 2.500 20,000 15,500 17,500 47.500 3,185 3.750 3,000 O PE hp *** AGE LAYOUT ACT 2010 C SPRING 2021 Mid Sem - Word REFERENCES MAILINGS REVIEW VIEW Drawings 7.665 333.750 333.750 Additional information: IV) Inventories as at March 2018 were as follows: Sh."000" Raw Materials 5,000 3.750 Finished goods 12,925 Loose tools 1,350 v) Depreciation is to be provided as follows: Buildings 2% on cost Plant and Machinery 20% on cost Work-in-progress Office equipment 10% on Netbook value Costs are apportioned between factory and administration as follows: Factory Administration Water and electricity 7596 254 Rates and Insurance 50% 4096 Depreciation on building 8096 2014 As at 31 March 2017 accred water and electricity amounted to Sh 800,000 While and rates and insurance prepaid mounted to Sh 500.000 Vul) Finished goods are transferred to the trading account a cost plus 10. 0 hp ACT 2010 C SPRING 2001 Mid Sem-Word PAGE LAYOUT REFERENCES MAUNGS RIVIEW VIEW The following trial balance was extracted from the books of Makindu Manufacture small manufacture of small bags as at 31 March 2018 Sh."000" Sh.1000" 115,650 202.750 5,000 100,000 15,000 15,000 4,000 6,000 2,850 Capital as at 1 April 2017 Sales Cash at bank Buildings at cost Plant and Machinery at cost Office Equipment at cost Accumulated depreciation (1 April 2017): Buildings Plant and Machinery Office Equipment Inventory (1 April 2017): Raw materials Work-in-progress Finished goods Loose tools Purchases Raw materials Loose tools Camage on raw materials Reums outward Water and electricity Rates and insurance General factory expenses Direct Labour General office expenses Sales and distribution costs Royalties payable 7,500 3,000 11.000 900 2 500 47,500 3.750 2.500 20,000 15,500 17,500 47.500 3,185 3.750 3,000 O PE hp ***