Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Please consider the three independent scenarios provided below. You are required to: 1. Provide the relevant accounting journal entries in the books of

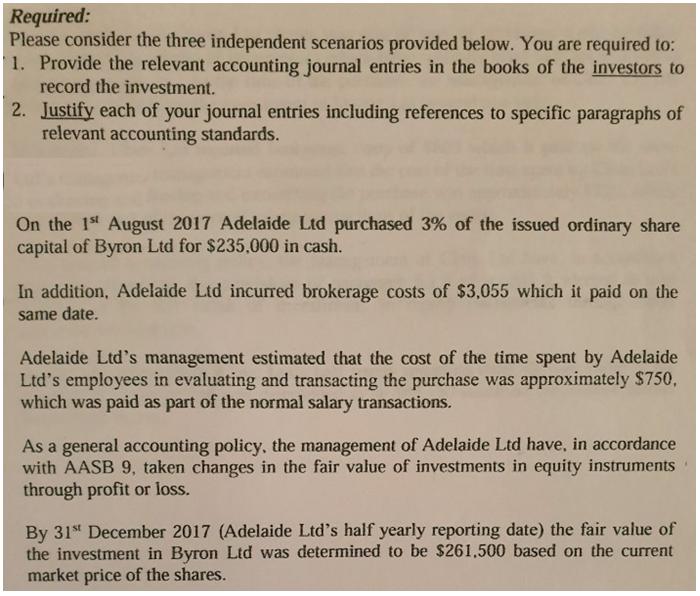

Required: Please consider the three independent scenarios provided below. You are required to: 1. Provide the relevant accounting journal entries in the books of the investors to record the investment. 2. Justify each of your journal entries including references to specific paragraphs of relevant accounting standards. On the 1s August 2017 Adelaide Ltd purchased 3% of the issued ordinary share capital of Byron Ltd for $235,000 in cash. In addition, Adelaide Ltd incurred brokerage costs of $3,055 which it paid on the same date. Adelaide Ltd's management estimated that the cost of the time spent by Adelaide Ltd's employees in evaluating and transacting the purchase was approximately $750, which was paid as part of the normal salary transactions. As a general accounting policy, the management of Adelaide Ltd have, in accordance with AASB 9, taken changes in the fair value of investments in equity instruments through profit or loss. By 31" December 2017 (Adelaide Ltd's half yearly reporting date) the fair value of the investment in Byron Ltd was determined to be $261,500 based on the current market price of the shares.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

aJournal entries for the said transactions 11817 Investment in equity sharesByron Ac Dr 235000 To Cash Ac 235000 Purchase Of shares 21817 Investment i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started