Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required (please ignore already answered because it is from another question) fill in blanks Forrester Fashions has monthly credit sales of 28,000 units with an

required (please ignore already answered because it is from another question) fill in blanks

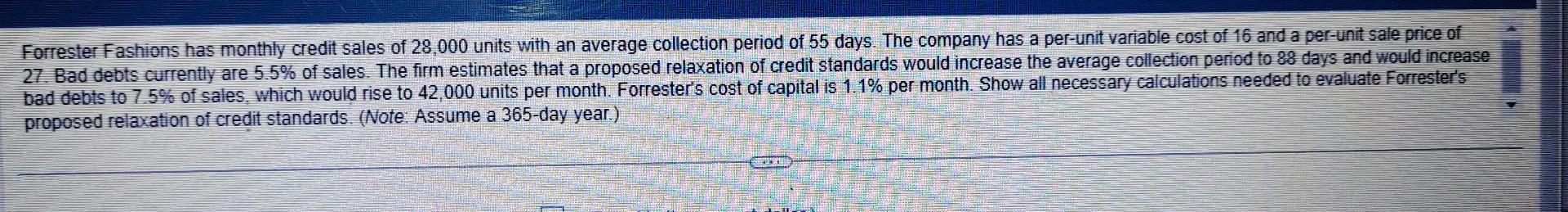

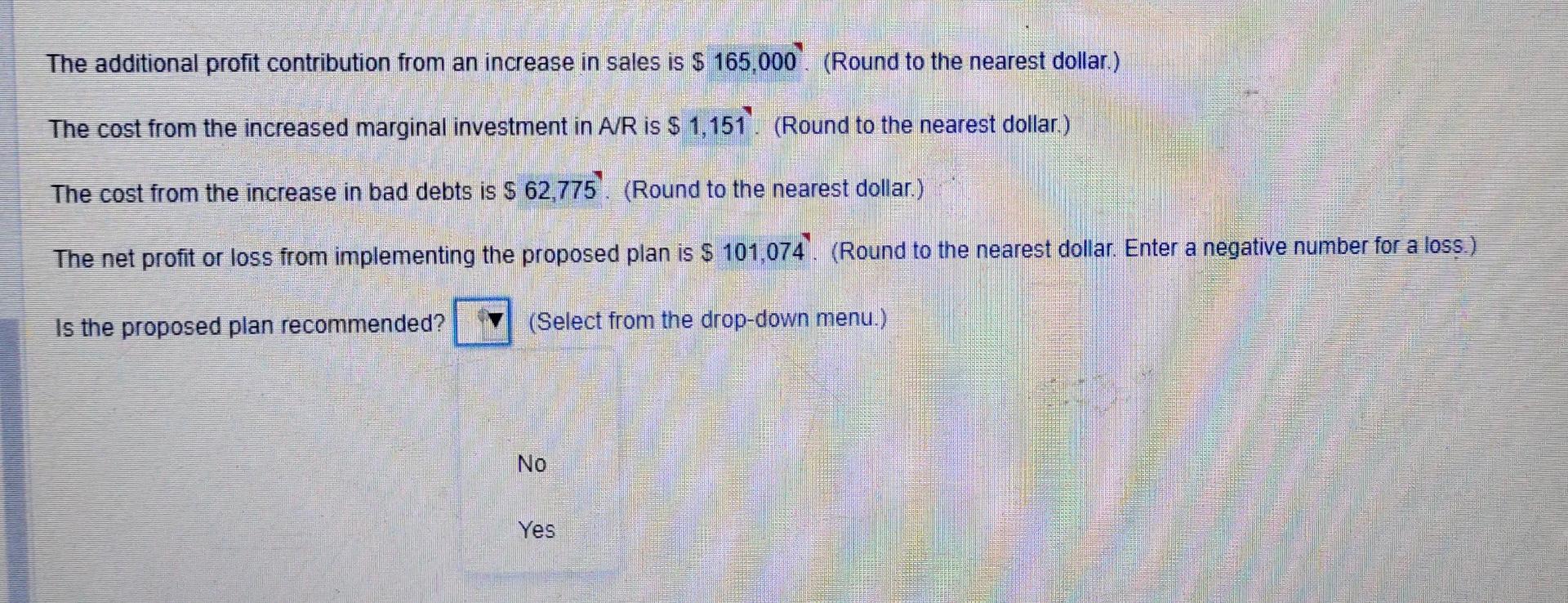

Forrester Fashions has monthly credit sales of 28,000 units with an average collection period of 55 days. The company has a per-unit variable cost of 16 and a per-unit sale price of 27. Bad debts currently are \5.5 of sales. The firm estimates that a proposed relaxation of credit standards would increase the average collection period to 88 days and would increase bad debts to \7.5 of sales, which would rise to 42,000 units per month. Forrester's cost of capital is \1.1 per month. Show all necessary calculations needed to evaluate Forrester's proposed relaxation of credit standards. (Note: Assume a 365-day year.) The additional profit contribution from an increase in sales is \\( \\$ 165,000^{\\circ} \\). (Round to the nearest dollar.) The cost from the increased marginal investment in A/R is \\( \\$ 1,151^{\\dagger} \\). (Round to the nearest dollar.) The cost from the increase in bad debts is \\( \\$ 62,775^{\\circ} \\). (Round to the nearest dollar.) The net profit or loss from implementing the proposed plan is \\( \\$ 101,074 ` \\). (Round to the nearest dollar. Enter a negative number for a loss.) Is the proposed plan recommended? (Select from the drop-down menu.) No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started