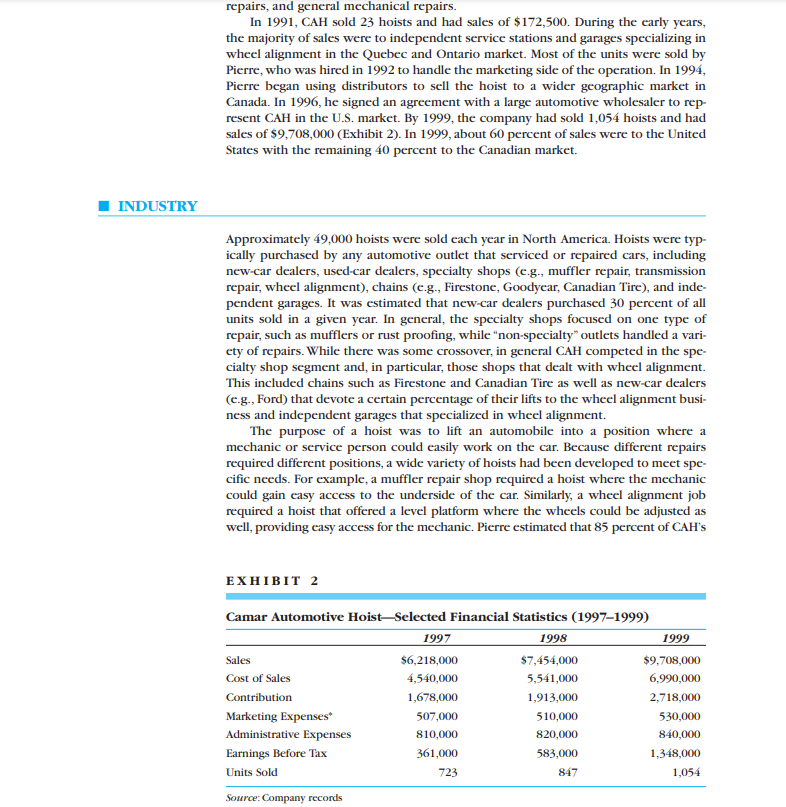

Calculate Camar's Break-even (B/E)1, should it decide to enter the

Northeastern U.S.What could you comment about the contribution?

(Tip: The info for the B/E, which is Fixed Costs divided by Contribution or Contribution

Margin, is found in the Exhibit 2 and the footnote under it).

3.If Camar decided to enter the European market, what entry strategy would

you recommend?

List the pros and cons of:

- Licensing

- Joint Venture (JV), and,

- Direct investment

4.What is the investment that Camar would have to undertake in the European

market?Is a B/E analysis possible?

(Tip: The info for the B/E is found on page 114).?

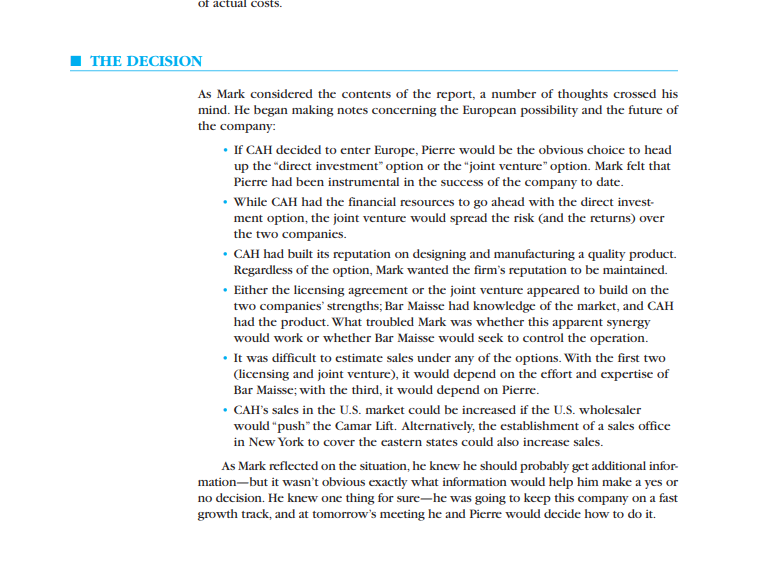

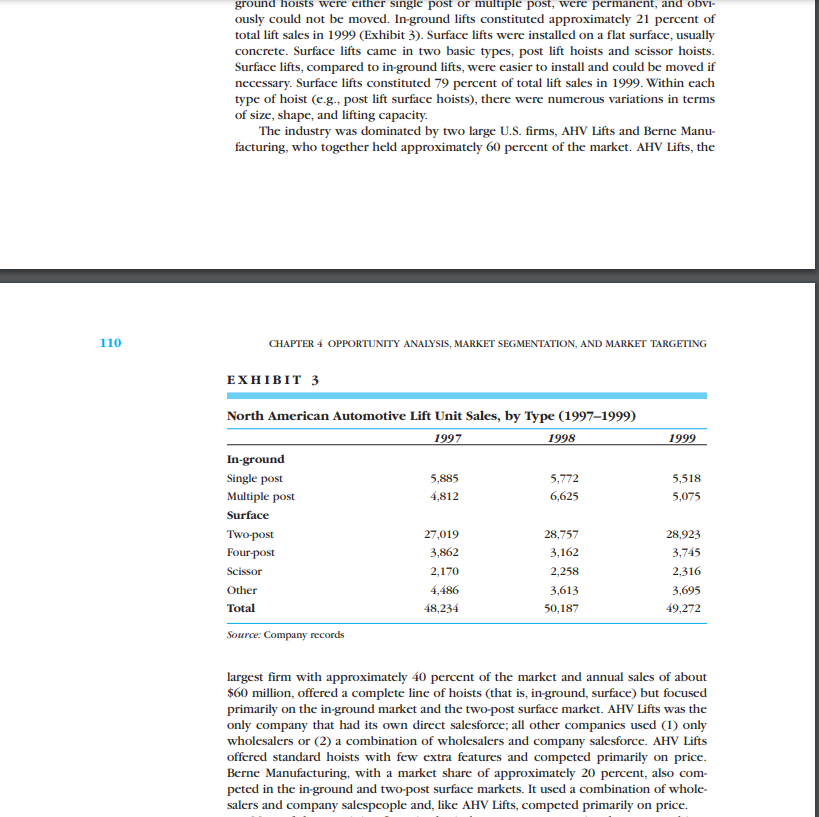

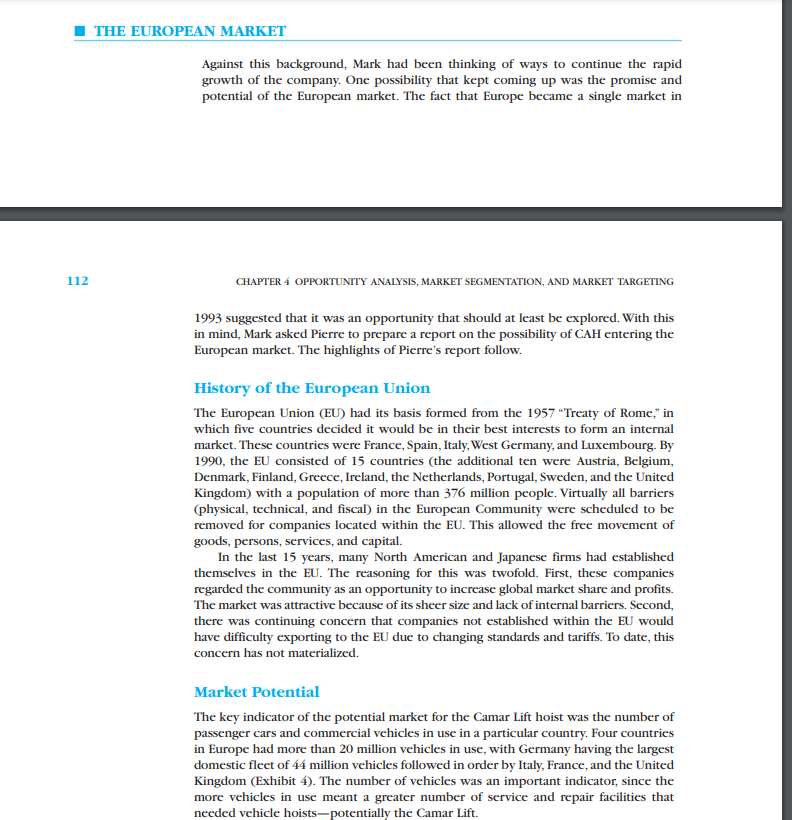

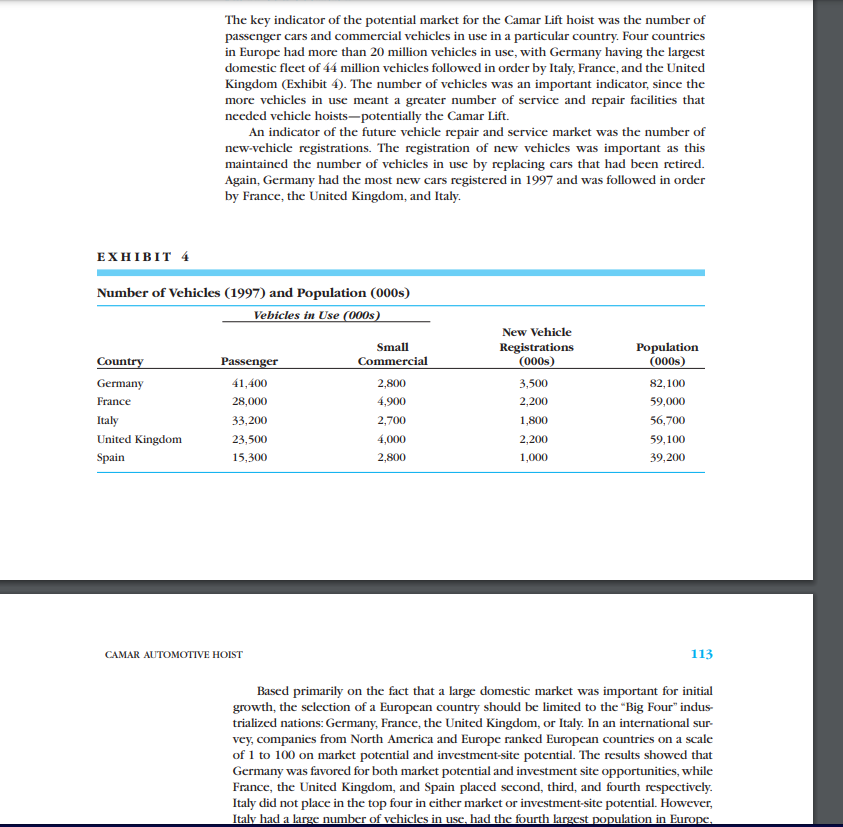

Camar Automotive Hoist In September 2000, Mark Camar, President of Camar Automotive Hoist (CAH), had just finished reading a feasibility report on entering the European market in 2001. CAH manufactured surface automotive hoists, a product used by garages, service sta- tions, and other repair shops to lift cars for servicing (Exhibit 1). The report, prepared by CAH's marketing manager, Pierre Gagnon, outlined the opportunities in the European Union and the entry options available. Mark was not sure if CAH was ready for this move. While the company had been successful in expanding sales into the U.S. market, he wondered if this success could be repeated in Europe. He thought that, with more effort, sales could be increased in the United States. On the other hand, there were some positive aspects to the European idea. He began reviewing the information in preparation for the meeting the following day with Pierre. CAMAR AUTOMOTIVE HOIST Mark, a design engineer, had worked for eight years for the Canadian subsidiary of a U.S. automotive hoist manufacturer. During those years, he had spent considerable time designing an above ground (or surface) automotive hoist. Although he was very enthusiastic about the unique aspects of the hoist, including a scissor lift and wheel alignment pads, senior management expressed no interest in the idea. In 1990, Mark left the company to start his own business with the express purpose of designing and manufacturing the hoist. He left with the good wishes of his previous employer, who had no objections to Mark's plans to start a new business. Over the next three years, Mark obtained financing from a venture capital firm, opened a plant in Lachine, Quebec, and began manufacturing and marketing the hoist, called the Camar Lift (Exhibit 1). From the beginning, Mark had taken considerable pride in the development and marketing of the Camar Lift. The original design included a scissor lift and a safety locking mechanism that allowed the hoist to be raised to any level and locked in place. As well, the scissor lift offered easy access for the mechanic to work on the raised vehicle. Because the hoist was fully hydraulic and had no chains or pulleys, it required little maintenance. Another key feature was the alignment turn plates that were an integral part of the lift. The turn plates meant that mechanics could accu- rately and easily perform wheel alignment jobs. Because it was a surface lift, it could be installed in a garage in less than a day. Mark continually made improvements to the product, including adding more safety features. In fact, the Camar Lift was considered a leader in automotive lift safety. Safety was an important factor in the automotive hoist market. Although hoists sel- dom malfunctioned, when they did it often resulted in a serious accident. This case was prepared by Professor Gordon H. G. Mcdougall, Wilfrid Laurier University, as the basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situa- tion. Certain names and data have been disguised and are not useful for research purposes. Used by rmission.growth, the a European country should trialized nations: Germany, France, the United Kingdom, or Italy. In an international sur- vey, companies from North America and Europe ranked European countries on a scale of 1 to 100 on market potential and investment-site potential. The results showed that Germany was favored for both market potential and investment site opportunities, while France, the United Kingdom, and Spain placed second, third, and fourth respectively. Italy did not place in the top four in either market or investment-site potential. However, Italy had a large number of vehicles in use, had the fourth largest population in Europe, and was an acknowledged leader in car technology and production Little information was available on the competition within Europe. There was, as yet, no dominant manufacturer as was the case in North America. At this time, there was one firm in Germany that manufactured a scissor-type lift. The firm sold most of its units within the German market. The only other available information was that 22 firms in Italy manufactured vehicle lifts. Investment Options Pierre felt that CAH had three options for expansion into the European market: licens- ing, joint venture, or direct investment. The licensing option was a real possibility, as a French firm had expressed an interest in manufacturing the Camar Lift. In June 2000, Pierre had attended a trade show in Detroit to promote the Camar Lift. At the show he met Phillipe Beaupre, the marketing manager for Bar Maisse, a French manufacturer of wheel alignment equipment. The firm, located in Chelles, France, sold a range of wheel alignment equipment throughout Europe. The best-selling product was an electronic modular aligner that enabled a mechanic to use a sophisticated computer system to align the wheels of a car. Phillipe was seek- ing a North American distributor for the modular aligner and other products manu- factured by Bar Maisse. At the show, Pierre and Phillipe had a casual conversation where both explained what their respective companies manufactured; they exchanged company brochures and business cards, and both went on to other exhibits. The next day, Phillipe sought out Pierre and asked if he might be interested in having Bar Maisse manufacture and market the Camar Lift in Europe. Phillipe felt the lift would complement Bar Maisse's product line and the licensing would be of mutual benefit to both parties. They agreed to pursue the idea. Upon his return to Lachine, Pierre told Mark about these discussions and they agreed to explore this possibility. Pierre called a number of colleagues in the industry and asked them what they knew about Bar Maisse. About half had not heard of the company but those who had commented favorably on the quality of its products. One colleague, with European experience, knew the company well and said that Bar Maisse's management had integrity and would make a good partner. In July, Pierre sent a letter to Phillipe stating that CAH was interested in further discussions; he enclosed various company brochures including price lists and technical information on the Camar Lift. In late August, Phillipe responded, stating that Bar Maisse would like to enter a three-year licensing agreement with CAH to manufacture the Camar Lift in Europe. In exchange for the manufacturing rights, Bar Maisse was prepared to pay a royalty rate of 5 per- cent of gross sales. Pierre had not yet responded to this proposal. A second possibility was a joint venture. Pierre had wondered if it might not be better for CAH to offer a counter proposal to Bar Maisse for a joint venture. He had not worked out any details, but Pierre felt that CAH would learn more about the European market and probably make more money if they were an active partner inlicensing agreement with CAH to manufacture the Camar Lift in Europe. In exchange for the manufacturing rights, Bar Maisse was prepared to pay a royalty rate of 5 per- cent of gross sales. Pierre had not yet responded to this proposal. A second possibility was a joint venture. Pierre had wondered if it might not be better for CAH to offer a counter proposal to Bar Maisse for a joint venture. He had not worked out any details, but Pierre felt that CAH would learn more about the European market and probably make more money if they were an active partner in Europe. Pierre's idea was a 50-50 proposal where the two parties shared the invest- ment and the profits. He envisaged a situation where Bar Maisse would manufacture 114 CHAPTER 4 OPPORTUNITY ANALYSIS, MARKET SEGMENTATION, AND MARKET TARGETING the Camar Lift in its plant with technical assistance from CAH. Pierre also thought that CAH could get involved in the marketing of the lift through the Bar Maisse dis- tribution system. Further, he thought that the Camar Lift, with proper marketing, could gain a reasonable share of the European market. If that happened, Pierre felt that CAH was likely to make greater returns with a joint venture. The third option was direct investment, where CAH would establish a manufac turing facility and set up a management group to market the lift. Pierre had contacted a business acquaintance who had recently been involved in manufacturing fabricated steel sheds in Germany. On the basis of discussions with his acquaintance, he esti- mated the costs involved in setting up a plant in Europe at (1) $250,000 for capital equipment (welding machines, cranes, other equipment); (2) $200,000 in increment al costs to set up the plant; and (3) carrying costs to cover $1,000,000 in inventory and accounts receivable. While the actual costs of renting a building for the factory would depend on the site location, he estimated that annual building rent including heat, light, and insurance would be about $80,000. Pierre recognized that these esti- mates were guidelines, but he felt that the estimates were probably within 20 percent of actual costs. THE DECISION As Mark considered the contents of the report, a number of thoughts crossed his mind. He began making notes concerning the European possibility and the future of the company: . If CAH decided to enter Europe, Pierre would be the obvious choice to head up the "direct investment" option or the "joint venture" option. Mark felt that Pierre had been instrumental in the success of the company to date. While CAH had the financial resources to go ahead with the direct invest-of actual costs. THE DECISION As Mark considered the contents of the report, a number of thoughts crossed his mind. He began making notes concerning the European possibility and the future of the company: . If CAH decided to enter Europe, Pierre would be the obvious choice to head up the "direct investment" option or the "joint venture" option. Mark felt that Pierre had been instrumental in the success of the company to date. . While CAH had the financial resources to go ahead with the direct invest- ment option, the joint venture would spread the risk (and the returns) over the two companies. . CAH had built its reputation on designing and manufacturing a quality product. Regardless of the option, Mark wanted the firm's reputation to be maintained. . Either the licensing agreement or the joint venture appeared to build on the two companies' strengths; Bar Maisse had knowledge of the market, and CAH had the product. What troubled Mark was whether this apparent synergy would work or whether Bar Maisse would seek to control the operation. . It was difficult to estimate sales under any of the options. With the first two (licensing and joint venture), it would depend on the effort and expertise of Bar Maisse; with the third, it would depend on Pierre. . CAH's sales in the U.S. market could be increased if the U.S. wholesaler would "push" the Camar Lift. Alternatively, the establishment of a sales office in New York to cover the eastern states could also increase sales. As Mark reflected on the situation, he knew he should probably get additional infor- mation-but it wasn't obvious exactly what information would help him make a yes or no decision. He knew one thing for sure-he was going to keep this company on a fast growth track, and at tomorrow's meeting he and Pierre would decide how to do it.In-ground single-post hoist Surface four-post hoist O - -7 The Camar Lift (surface, scissor) The Camar Lift developed a reputation in the industry as the "Cadillac* of hoists; the unit was judged by many as superior to competitive offerings because of its design, the quality of the workmanship, the safety features, the case of installa- tion, and the five-year warranty. Mark held four patents on the Camar Lift, including the lifting mechanism on the scissor design and the safety locking mechanism. A number of versions of the product were designed that made the Camar Lift suitablerepairs, and general mechanical repairs. In 1991, CAH sold 23 hoists and had sales of $172,500. During the carly years, the majority of sales were to independent service stations and garages specializing in wheel alignment in the Quebec and Ontario market. Most of the units were sold by Pierre, who was hired in 1992 to handle the marketing side of the operation. In 1994, Pierre began using distributors to sell the hoist to a wider geographic market in Canada. In 1996, he signed an agreement with a large automotive wholesaler to rep- resent CAH in the U.S. market. By 1999, the company had sold 1,054 hoists and had sales of $9,708,000 (Exhibit 2). In 1999, about 60 percent of sales were to the United States with the remaining 40 percent to the Canadian market. INDUSTRY Approximately 49,000 hoists were sold each year in North America. Hoists were typ- ically purchased by any automotive outlet that serviced or repaired cars, including new-car dealers, used-car dealers, specialty shops (c.g., muffler repair, transmission repair, wheel alignment), chains (c.g., Firestone, Goodyear, Canadian Tire), and inde- pendent garages. It was estimated that new-car dealers purchased 30 percent of all units sold in a given year. In general, the specialty shops focused on one type of repair, such as mufflers or rust proofing, while "non-specialty" outlets handled a vari- ety of repairs. While there was some crossover, in general CAH competed in the spe- cialty shop segment and, in particular, those shops that dealt with wheel alignment. This included chains such as Firestone and Canadian Tire as well as new-car dealers (e.g., Ford) that devote a certain percentage of their lifts to the wheel alignment busi- ness and independent garages that specialized in wheel alignment. The purpose of a hoist was to lift an automobile into a position where a mechanic or service person could easily work on the car. Because different repairs required different positions, a wide variety of hoists had been developed to meet spe- cific needs. For example, a muffler repair shop required a hoist where the mechanic could gain easy access to the underside of the car. Similarly, a wheel alignment job required a hoist that offered a level platform where the wheels could be adjusted as well, providing easy access for the mechanic. Pierre estimated that 85 percent of CAH's EXHIBIT 2 Camar Automotive Hoist-Selected Financial Statistics (1997-1999) 1997 1998 1999 Sales $6,218,000 $7,454,000 $9,708,000 Cost of Sales 4,540,000 5,541,000 6,990,000 Contribution 1,678,000 1,913,000 2,718,000 Marketing Expenses 507,000 510,000 530,000 Administrative Expenses 810,000 820,000 840,000 Earnings Before Tax 361,000 583,000 1,348,000 Units Sold 723 847 1,054 Source: Company recordssales were to the wheel alignment market in service centers like Firestone, Goodyear, and Canadian Tire, and independent garages that specialized in wheel alignment. About 15 percent of sales were made to customers who used the hoist for general mechani- cal repairs. Firms purchasing hoists were part of an industry called the automobile aftermarket. This industry was involved in supplying parts and service for new and used cars and was worth more than $54 billion at retail in 1999 while servicing the approximately 14 million cars on the road in Canada. The industry was large and diverse; there were more than 4,000 new-car dealers in Canada, more than 400 Canadian Tire stores, more than 100 stores in each of the Firestone and Goodyear chains, and more than 220 stores in the Rust Check chain. The purchase of an automotive hoist was often an important decision for the ser- vice station owner or dealer. Because the price of hoists ranged from $3,000 to $15,000, it was a capital expense for most businesses. For the owner/operator of a new service center or car dealership, the decision involved determining what type of hoist was required and then what brand would best suit the company. Most new service centers or car dealerships had multiple bays for servicing cars. In these cases, the decision would involve what types of hoists were required (for example, inground, surface). Often more than one type of hoist was purchased, depending on the service center/dealership needs. Experienced garage owners seeking a replacement hoist (the typical hoist had a useful life of 10 to 13 years) would usually determine what products were available and then make a decision. If the garage owners were also mechanics, they would probably be aware of two or three types of hoists but not very knowledgeable about the brands or products currently available. Garage owners or dealers who were not mechanics probably knew very little about hoists. The owners of car or service dealerships often bought the product that was recommended and/or approved by the parent company. COMPETITION Sixteen companies competed in the automotive lift market in North America: four Canadian and twelve U.S. firms. With the advent of the Free Trade Agreement in 1989, the duties on hoists between the two countries were phased out over a 10-year period; by 1999 exports and imports of hoists were duty-free. For Mark, the import duties had never played a part in any decisions-the fluctuating exchange rates between the two countries had a far greater impact on selling prices. In the past three years the Canadian dollar had fluctuated between $.65 and $.70 versus the U.S. dollar (e.g., CDN$1.00 buys US$.65) and forecast rates were expected to stay within this range. A wide variety of hoists were manufactured in the industry. The two basic types of hoists were in-ground and surface. As the names imply, in-ground hoists required a pit to be dug "in-ground," where the piston that raised the hoist was installed. In- ground hoists were either single post or multiple post, were permanent, and obvi- ously could not be moved. In-ground lifts constituted approximately 21 percent of total lift sales in 1999 (Exhibit 3). Surface lifts were installed on a flat surface, usually concrete. Surface lifts came in two basic types, post lift hoists and scissor hoists. Surface lifts, compared to in-ground lifts, were easier to install and could be moved if necessary. Surface lifts constituted 79 percent of total lift sales in 1999. Within each type of hoist (c.g., post lift surface hoists), there were numerous variations in terms of size, shape, and lifting capacity.ground ously could not be moved. In-ground lifts constituted approximately 21 percent of total lift sales in 1999 (Exhibit 3). Surface lifts were installed on a flat surface, usually concrete. Surface lifts came in two basic types, post lift hoists and scissor hoists. Surface lifts, compared to in-ground lifts, were easier to install and could be moved if necessary. Surface lifts constituted 79 percent of total lift sales in 1999. Within each type of hoist (e.g., post lift surface hoists), there were numerous variations in terms of size, shape, and lifting capacity. The industry was dominated by two large U.S. firms, AHV Lifts and Berne Manu- facturing, who together held approximately 60 percent of the market. AHV Lifts, the 110 CHAPTER 4 OPPORTUNITY ANALYSIS, MARKET SEGMENTATION, AND MARKET TARGETING EXHIBIT 3 North American Automotive Lift Unit Sales, by Type (1997-1999) 1997 1998 1999 In-ground Single post 5,885 5,772 5,518 Multiple post 4,812 6,625 5,075 Surface Two-post 27,019 28,757 28,923 Four-post 3,862 3,162 3,745 Scissor 2,170 2,258 2,316 Other 4,486 3,613 3,695 Total 48,234 50,187 49,272 Source: Company records largest firm with approximately 40 percent of the market and annual sales of about $60 million, offered a complete line of hoists (that is, in-ground, surface) but focused primarily on the in-ground market and the two-post surface market. AHV Lifts was the only company that had its own direct salesforce; all other companies used (1) only wholesalers or (2) a combination of wholesalers and company salesforce. AHV Lifts offered standard hoists with few extra features and competed primarily on price. Berne Manufacturing, with a market share of approximately 20 percent, also com- peted in the in-ground and two-post surface markets. It used a combination of whole- salers and company salespeople and, like AHV Lifts, competed primarily on price.Source: Company records largest firm with approximately 40 percent of the market and annual sales of about $60 million, offered a complete line of hoists (that is, in-ground, surface) but focused primarily on the in-ground market and the two-post surface market. AHV Lifts was the only company that had its own direct salesforce; all other companies used (1) only wholesalers or (2) a combination of wholesalers and company salesforce. AHV Lifts offered standard hoists with few extra features and competed primarily on price. Berne Manufacturing, with a market share of approximately 20 percent, also com- peted in the in-ground and two-post surface markets. It used a combination of whole- salers and company salespeople and, like AHV Lifts, competed primarily on price. Most of the remaining firms in the industry were companies that operated in a regional market (e.g., California, British Columbia) and/or that offered a limited prod- uct line (e.g., four-post surface hoist). CAH had two competitors that manufactured scissor lifts. AHV Lift marketed a scissor hoist that had a different lifting mechanism and did not include the safety locking features of the Camar Lift. On average, the AHV scissor lift was sold for about 20 percent less than the Camar Lift. The second competitor, Mete Lift, was a small regional company with sales in California and Oregon. It had a design that was very similar to the Camar Lift but lacked some of its safety features. The Mete Lift, regarded as a well-manufactured product, sold for about 5 percent less than the Camar Lift. MARKETING STRATEGY As of early 2000, CAH had developed a reputation for a quality product backed by good service in the hoist lift market, primarily in the wheel alignment segment. The distribution system employed by CAH reflected the need to engage in extensive personal selling. Three types of distributors were used: a company sales force, Canadian distributors, and a U.S. automotive wholesaler. The company sales force consisted of four salespeople and Pierre. Their main task was to service large "direct" accounts. The initial step was to get the Camar Lift approved by large chains and manufacturers, and then, having received the approval, to sell to indi- vidual dealers or operators. For example, if General Motors approved the hoist, then CAH could sell it to individual General Motors dealers. CAH sold directly to the individual dealers of a number of large accounts including General Motors, Ford, Chrysler, Petro-Canada, Firestone, and Goodyear. CAH had been successful inCAMAR AUTOMOTIVE HOIST 111 obtaining manufacturer approval from the big three automobile manufacturers in both Canada and the United States. As well, CAH had also received approval from service companies such as Canadian Tire and Goodyear. To date, CAH had not been rejected by any major account; however, in some cases, the approval process had taken more than four years. In total, the company sales force generated about 25 percent of the unit sales each year. Sales to the large "direct* accounts in the United States went through CAH's U.S. wholesaler. The Canadian distributors sold, installed, and serviced units across Canada. These distributors handled the Camar Lift and carried a line of noncompetitive automotive equipment products (for example, engine diagnostic equipment, wheel balancing equipment) and noncompetitive lifts. These distributors focused on the smaller chains and the independent service stations and garages. The U.S. wholesaler sold a complete product line to service stations as well as manufacturing some equipment. The Camar Lift was one of five different types of lifts that the wholesaler sold. Although the wholesaler provided CAH with extensive dis- tribution in the United States, the Camar Lift was a minor product within the whole- saler's total line. While Pierre did not have any actual figures, he thought that the Camar Lift probably accounted for less than 20 percent of the total lift sales of the U.S. wholesaler. Both Mark and Pierre felt that the U.S. market had unrealized potential. With a population of 264 million people and more than 146 million registered vehicles, the U.S. market was almost 10 times the size of the Canadian market (population of 30 million, approximately 14 million vehicles). Pierre noted that the six New England states (population over 13 million); the three largest mid-Atlantic states (population over 38 million), and the three largest mid-Eastern states (population over 32 million) were all within a day's drive of the factory in Lachine. Mark and Pierre had consid cred setting up a sales office in New York to service these states, but they were con- cerned that the U.S. wholesaler would not be willing to relinquish any of its territory. They had also considered working more closely with the wholesaler to encourage it to "push" the Camar Lift. It appeared that the wholesaler's major objective was to sell a hoist, not necessarily the Camar Lift. CAH distributed a catalogue-type package with products, uses, prices, and other required information for both distributors and users. In addition, CAH advertised in trade publications (for example, Autoinc.), and Pierre travelled to trade shows in Canada and the United States to promote the Camar Lift. In 1999, Camar Lifts sold for an average retail price of $10,990 and CAH received, on average, $9,210 for each unit sold. This average reflected the mix of sales through the three distribution channels: (1) direct (where CAH received 100 percent of the selling price), (2) Canadian distributors (where CAH received 80 percent of the sell- ing price) and (3) the U.S. wholesaler (where CAH received 78 percent of the selling price). Both Mark and Pierre believed that the company's success to date was based on a strategy of offering a superior product that was primarily targeted to the needs of spe- cific customers. The strategy stressed continual product improvements, quality work- manship, and service. Personal selling was a key aspect of the strategy; salespeople could show customers the benefits of the Camar Lift over competing products.THE EUROPEAN MARKET Against this background, Mark had been thinking of ways to continue the rapid growth of the company. One possibility that kept coming up was the promise and potential of the European market. The fact that Europe became a single market in 112 CHAPTER 4 OPPORTUNITY ANALYSIS, MARKET SEGMENTATION, AND MARKET TARGETING 1993 suggested that it was an opportunity that should at least be explored. With this in mind, Mark asked Pierre to prepare a report on the possibility of CAH entering the European market. The highlights of Pierre's report follow. History of the European Union The European Union (EU) had its basis formed from the 1957 "Treaty of Rome," in which five countries decided it would be in their best interests to form an internal market. These countries were France, Spain, Italy, West Germany, and Luxembourg. By 1990, the EU consisted of 15 countries (the additional ten were Austria, Belgium, Denmark, Finland, Greece, Ireland, the Netherlands, Portugal, Sweden, and the United Kingdom) with a population of more than 376 million people. Virtually all barriers (physical, technical, and fiscal) in the European Community were scheduled to be removed for companies located within the EU. This allowed the free movement of goods, persons, services, and capital. In the last 15 years, many North American and Japanese firms had established themselves in the EU. The reasoning for this was twofold. First, these companies regarded the community as an opportunity to increase global market share and profits. The market was attractive because of its sheer size and lack of internal barriers. Second, there was continuing concern that companies not established within the EU would have difficulty exporting to the EU due to changing standards and tariffs. To date, this concern has not materialized. Market Potential The key indicator of the potential market for the Camar Lift hoist was the number of passenger cars and commercial vehicles in use in a particular country. Four countries in Europe had more than 20 million vehicles in use, with Germany having the largest domestic fleet of 44 million vehicles followed in order by Italy, France, and the United Kingdom (Exhibit 4). The number of vehicles was an important indicator, since the more vehicles in use meant a greater number of service and repair facilities that needed vehicle hoists-potentially the Camar Lift.The key indicator of the potential market for the Camar Lift hoist was the number of passenger cars and commercial vehicles in use in a particular country. Four countries in Europe had more than 20 million vehicles in use, with Germany having the largest domestic fleet of 44 million vehicles followed in order by Italy, France, and the United Kingdom (Exhibit 4). The number of vehicles was an important indicator, since the more vehicles in use meant a greater number of service and repair facilities that needed vehicle hoists-potentially the Camar Lift. An indicator of the future vehicle repair and service market was the number of new-vehicle registrations. The registration of new vehicles was important as this maintained the number of vehicles in use by replacing cars that had been retired. Again, Germany had the most new cars registered in 1997 and was followed in order by France, the United Kingdom, and Italy. EXHIBIT 4 Number of Vehicles (1997) and Population (000s) Vebicles in Use (000s) New Vehicle Small Registrations Population Country Passenger Commercial (000s) (0009) Germany 41,400 2,800 3,500 82,100 France 28,000 4,900 2,200 59,000 Italy 33,200 2,700 1,800 56,700 United Kingdom 23,500 4,000 2,200 59,100 Spain 15,300 2,800 1,000 39,200 CAMAR AUTOMOTIVE HOIST 113 Based primarily on the fact that a large domestic market was important for initial growth, the selection of a European country should be limited to the "Big Four" indus- trialized nations: Germany, France, the United Kingdom, or Italy. In an international sur- vey, companies from North America and Europe ranked European countries on a scale of 1 to 100 on market potential and investment-site potential. The results showed that Germany was favored for both market potential and investment site opportunities, while France, the United Kingdom, and Spain placed second, third, and fourth respectively. Italy did not place in the top four in either market or investment-site potential. However, Italy had a large number of vehicles in use. had the fourth largest population in Europe