Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Prepare all the relevant journal entries in the records of Cooks Ltd to record the acquisition of Walls Ltd, in accordance with IFRS 3

Required: Prepare all the relevant journal entries in the records of Cooks Ltd to record the acquisition of Walls Ltd, in accordance with IFRS 3 Business Combinations. Show all workings. (15 marks)

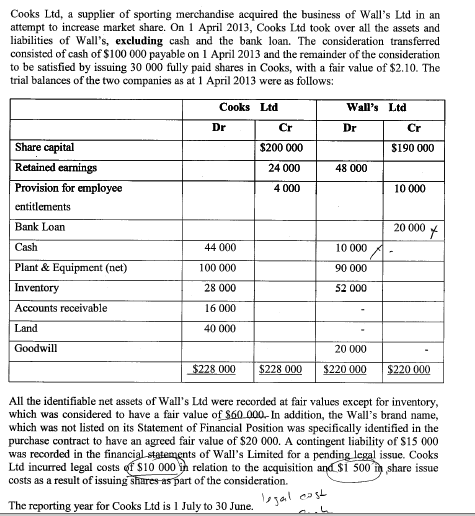

Cooks Ltd, a supplier of sporting merchandise acquired the business of Wall's Ltd in an attempt to increase market share. On 1 April 2013, Cooks Ltd took over all the assets and liabilities of Walls, excluding cash and the bank loan. The consideration transferred consisted of cash of $100 000 payable on 1 April 2013 and the remainder of the consideration to be satisfied by issuing 30 000 fully paid shares in Cooks, with a fair value of $2.10. The trial balances of the two companies as at 1 April 2013 were as follows: Cooks Ltd Wall's Ltd Dr Cr Dr Cr Share capital $200 000 $190 000 Retained earnings 24 000 48 000 Provision for employee 4 000 10 000 entitlements Bank Loan 20000 44 000 10 000 100 000 90 000 Cash Plant & Equipment (net) Inventory Accounts receivable 52 000 28 000 16 000 40 000 Land Goodwill 20 000 $228 000 $228 000 $220 000 $220 000 All the identifiable net assets of Wall's Ltd were recorded at fair values except for inventory, which was considered to have a fair value of $60.000.- In addition, the Wall's brand name, which was not listed on its Statement of Financial Position was specifically identified in the purchase contract to have an agreed fair value of $20 000. A contingent liability of S15 000 was recorded in the financial statements of Wall's Limited for a pending legal issue. Cooks Ltd incurred legal costs of $10 000 th relation to the acquisition and $1 500 in share issue costs as a result of issuing shares as part of the consideration. The reporting year for Cooks Ltd is 1 July to 30 June. legal cast

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started