Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Prepare statement of changes in equity for Rainbow Berhad as at 30 June 20x6. You are now required to consider all situations 1 to

Required:

Prepare statement of changes in equity for Rainbow Berhad as at 30 June 20x6. You are now required to consider all situations 1 to 7 together. References: Frank Wood's business accounting : an introduction to financial accounting, 2021, 15th ed., Pearson (Chapter 35)

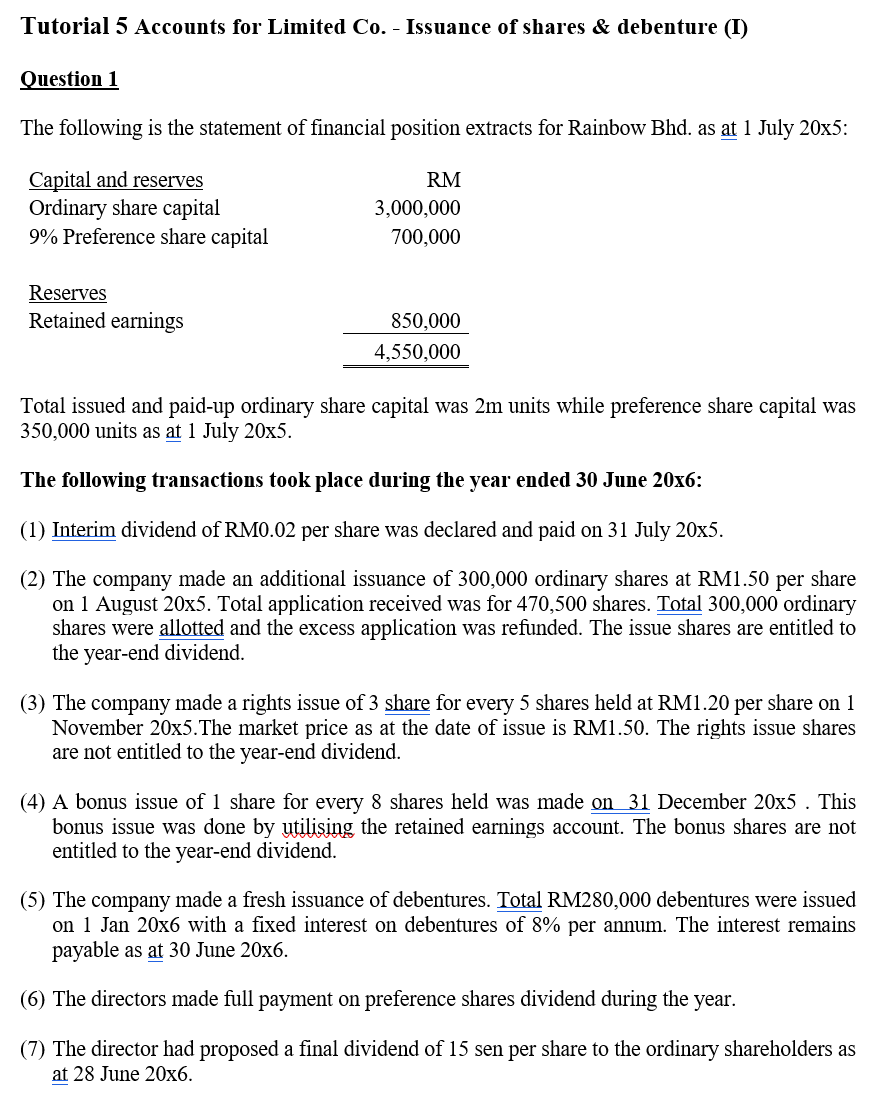

Tutorial 5 Accounts for Limited Co. - Issuance of shares \& debenture (I) Question 1 The following is the statement of financial position extracts for Rainbow Bhd. as at 1 July 205 : Total issued and paid-up ordinary share capital was 2m units while preference share capital was 350,000 units as at 1 July 205. The following transactions took place during the year ended 30 June 20x6: (1) Interim dividend of RM0.02 per share was declared and paid on 31 July 20x5. (2) The company made an additional issuance of 300,000 ordinary shares at RM1.50 per share on 1 August 20x5. Total application received was for 470,500 shares. Total 300,000 ordinary shares were allotted and the excess application was refunded. The issue shares are entitled to the year-end dividend. (3) The company made a rights issue of 3 share for every 5 shares held at RM1.20 per share on 1 November 205. The market price as at the date of issue is RM1.50. The rights issue shares are not entitled to the year-end dividend. (4) A bonus issue of 1 share for every 8 shares held was made on 31 December 205. This bonus issue was done by utilising the retained earnings account. The bonus shares are not entitled to the year-end dividend. (5) The company made a fresh issuance of debentures. Total RM280,000 debentures were issued on 1 Jan 206 with a fixed interest on debentures of 8% per annum. The interest remains payable as at 30 June 20x6. (6) The directors made full payment on preference shares dividend during the year. (7) The director had proposed a final dividend of 15 sen per share to the ordinary shareholders as at 28 June 206Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started