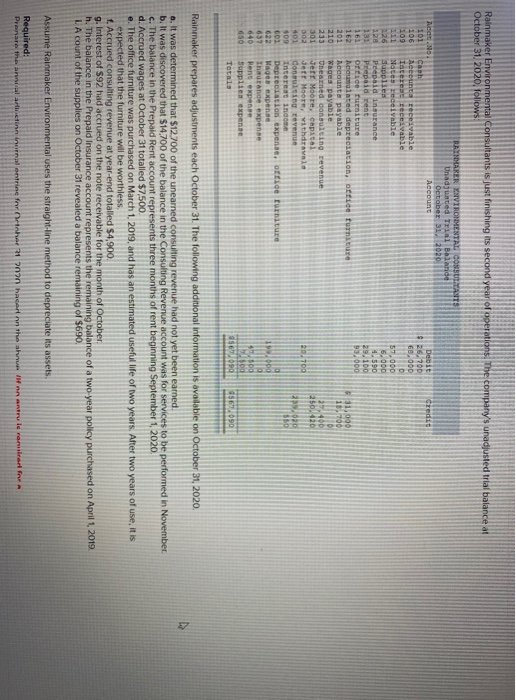

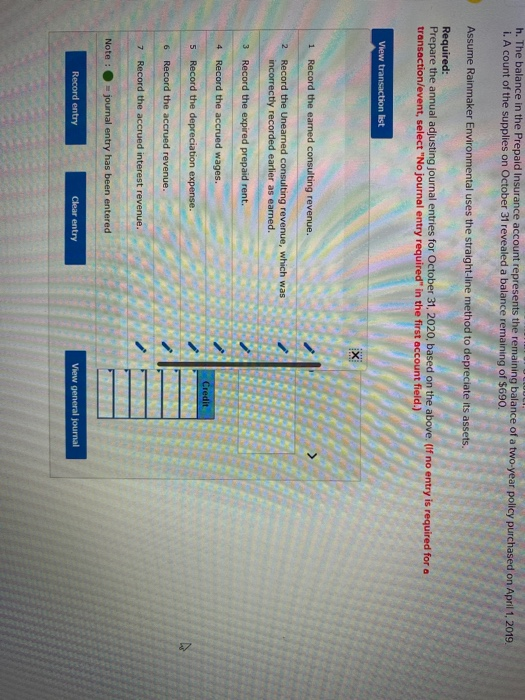

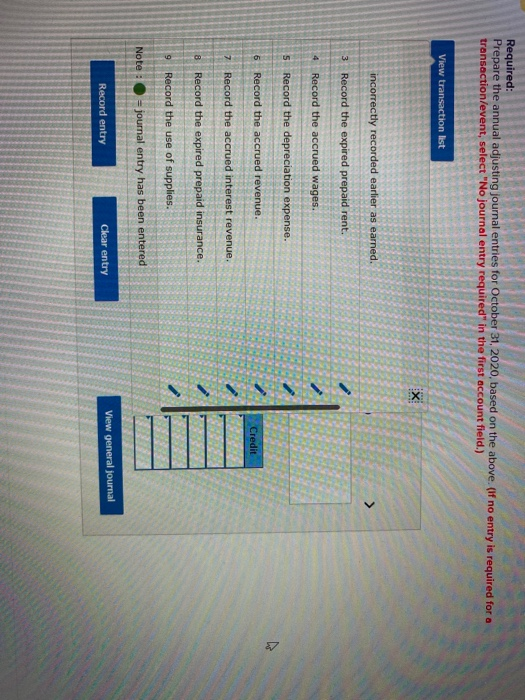

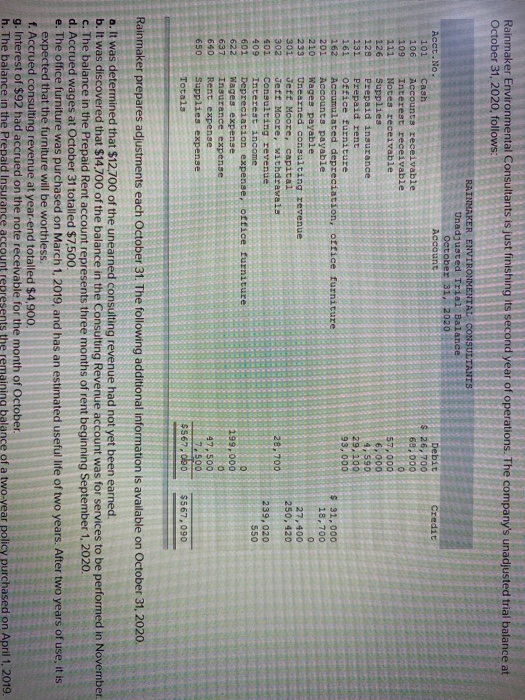

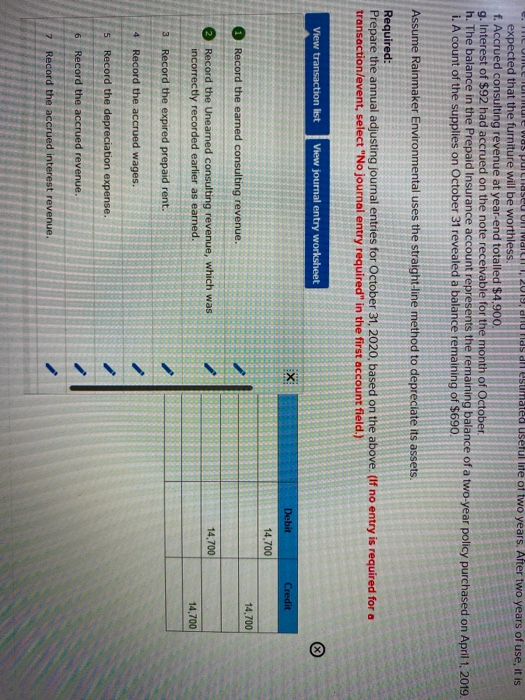

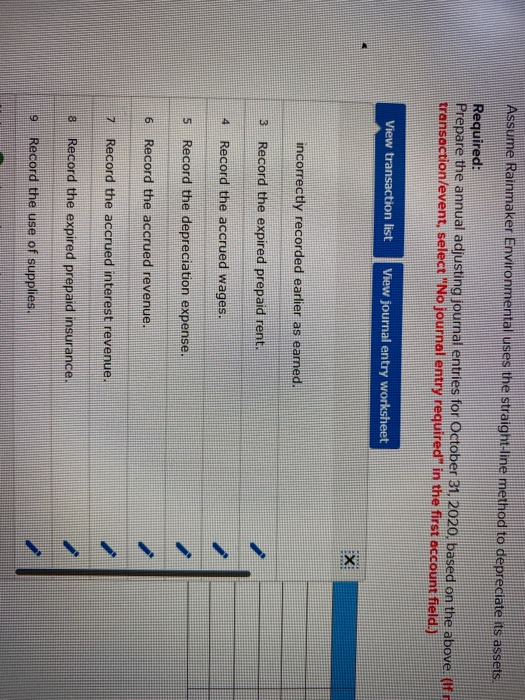

Required: Prepare the annual adjusting journal entries for October 31, 2020, based on the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X incorrectly recorded earlier as earned. 3 Record the expired prepaid rent. 4 Record the accrued wages. 5 Record the depreciation expense. 6 Record the accrued revenue. Credit 7 Record the accrued interest revenue. 8 Record the expired prepaid insurance. 9 Record the use of supplies. Note = journal entry has been entered View general journal Clear entry Record entry Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance at October 31, 2020, follows: Credit Debit $ 26,700 68,000 0 57,000 6,000 4,590 29,100 93,000 RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2020 Acct. No. Account 101 Cash 106 Accounts receivable 109 Interest receivable 111 Notes receivable 126 Supplies 128 Prepaid insurance 131 Prepaid rent 161 Office Furniture 162 Accumulated depreciation, office furniture 201 Accounts payable 210 Wages payable 239 Unearned consulting revenue 301 Jeff Moore, capital 302 Jeff Moore, withdrawals 401 Consulting revenue 409 Interest income 601 Depreciation expense, office furniture 622 Wages expense 637 Insurance expense 640 Rent expense 650 Supplies expense Totals $ 31,000 18,700 0 27,400 250, 420 28,700 239,020 550 0 199,000 0 47,500 7.500 $567, leo $567, 090 Rainmaker prepares adjustments each October 31. The following additional information is available on October 31, 2020. a. It was determined that $12,700 of the unearned consulting revenue had not yet been earned. b. It was discovered that $14.700 of the balance in the Consulting Revenue account was for services to be performed in November c. The balance in the Prepaid Rent account represents three months of rent beginning September 1, 2020. d. Accrued wages at October 31 totalled $7,500. e. The office furniture was purchased on March 1, 2019, and has an estimated useful life of two years. After two years of use, it is expected that the furniture will be worthless. f. Accrued consulting revenue at year-end totalled $4,900. g. Interest of $92 had accrued on the note receivable for the month of October h. The balance in the Prepaid Insurance account represents the remaining balance of a two-year policy purchased on April 1, 2019 Ilds all sumated useful life of two years. After two years of use, it is expected that the furniture will be worthless f. Accrued consulting revenue at year-end totalled $4,900. g. Interest of $92 had accrued on the note receivable for the month of October h. The balance in the Prepaid Insurance account represents the remaining balance of a two-year policy purchased on April 1, 2019. i. A count of the supplies on October 31 revealed a balance remaining of $690. Assume Rainmaker Environmental uses the straight-line method to depreciate its assets. Required: Prepare the annual adjusting journal entries for October 31, 2020, based on the above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet Debit Credit 14,700 14,700 Record the earned consulting revenue. 14,700 Record the Unearned consulting revenue, which was incorrectly recorded earlier as earned. 14,700 3. Record the expired prepaid rent. Record the accrued wages. 5 Record the depreciation expense. 6 Record the accrued revenue. 7 Record the accrued interest revenue. Assume Rainmaker Environmental uses the straight-line method to depreciate its assets Required: Prepare the annual adjusting journal entries for October 31, 2020, based on the above. (If transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet EX incorrectly recorded earlier as earned. 3 Record the expired prepaid rent. 4 Record the accrued wages. un Record the depreciation expense. 6 Record the accrued revenue. 7 Record the accrued interest revenue. 8 Record the expired prepaid insurance, 9 Record the use of supplies