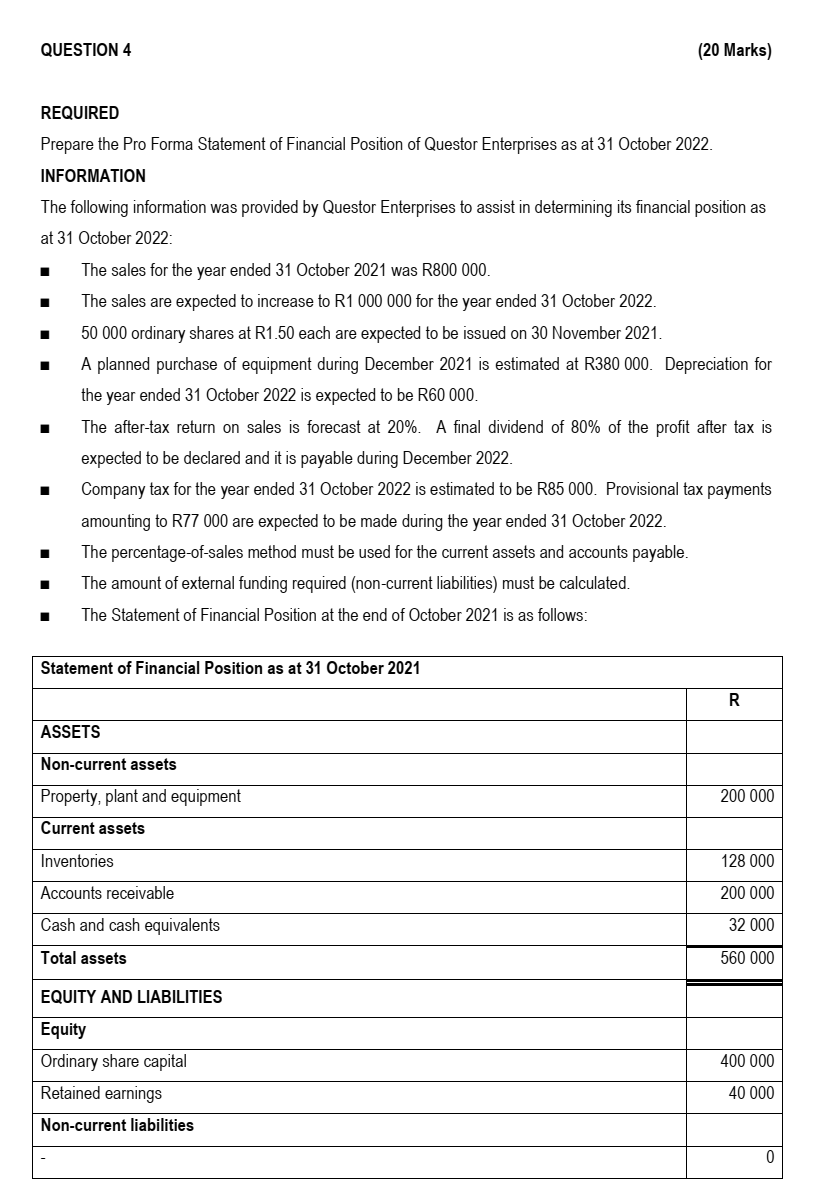

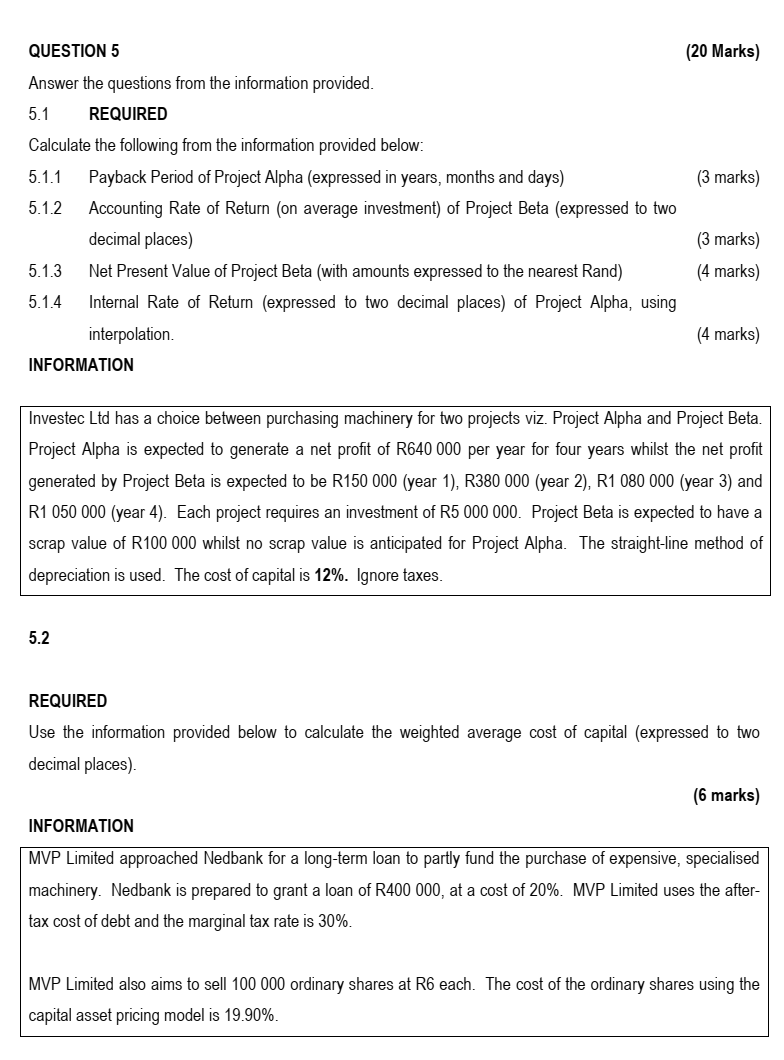

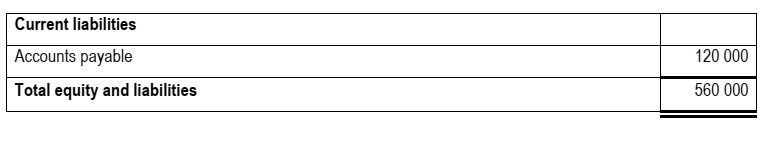

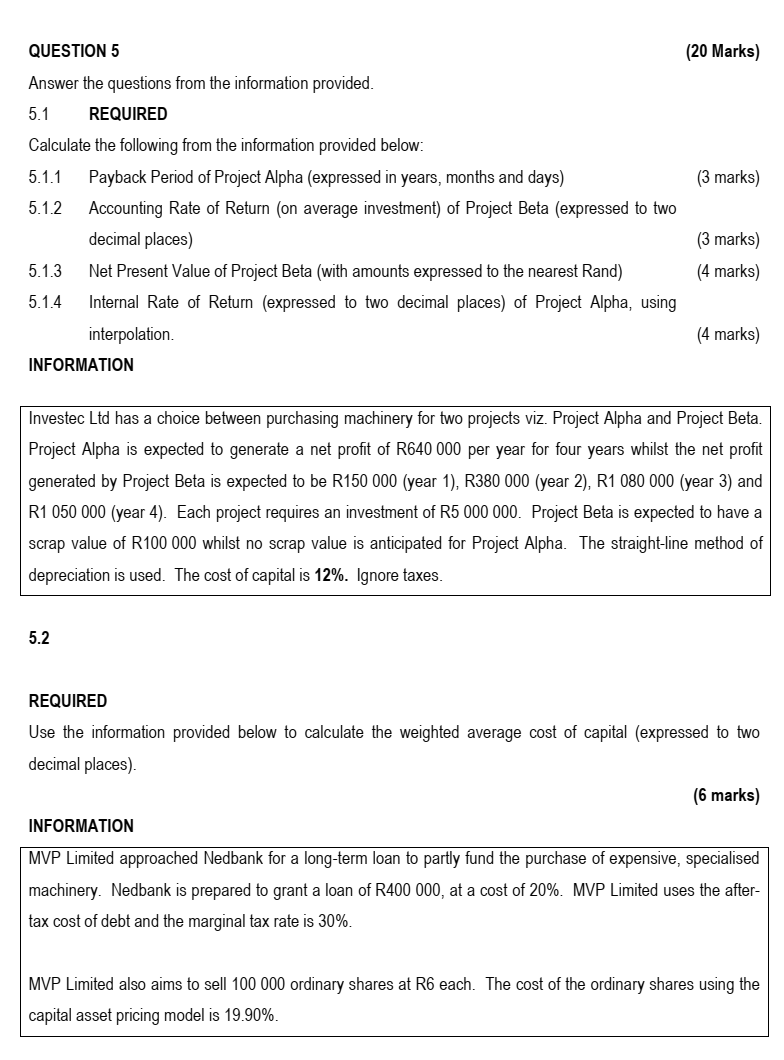

REQUIRED Prepare the Pro Forma Statement of Financial Position of Questor Enterprises as at 31 October 2022. INFORMATION The following information was provided by Questor Enterprises to assist in determining its financial position as at 31 October 2022: - The sales for the year ended 31 October 2021 was R800000. - The sales are expected to increase to R1 000000 for the year ended 31 October 2022. - 50000 ordinary shares at R1.50 each are expected to be issued on 30 November 2021. - A planned purchase of equipment during December 2021 is estimated at R380 000. Depreciation for the year ended 31 October 2022 is expected to be R60000. - The after-tax return on sales is forecast at 20%. A final dividend of 80% of the profit after tax is expected to be declared and it is payable during December 2022. Company tax for the year ended 31 October 2022 is estimated to be R85 000. Provisional tax payments amounting to R77 000 are expected to be made during the year ended 31 October 2022. The percentage-of-sales method must be used for the current assets and accounts payable. The amount of external funding required (non-current liabilities) must be calculated. The Statement of Financial Position at the end of October 2021 is as follows: \begin{tabular}{|l|r|} \hline Current liabilities & \\ \hline Accounts payable & 120000 \\ \hline Total equity and liabilities & 560000 \\ \hline \end{tabular} QUESTION 5 (20 Marks) Answer the questions from the information provided. 5.1 REQUIRED Calculate the following from the information provided below: 5.1.1 Payback Period of Project Alpha (expressed in years, months and days) (3 marks) 5.1.2 Accounting Rate of Return (on average investment) of Project Beta (expressed to two decimal places) (3 marks) 5.1.3 Net Present Value of Project Beta (with amounts expressed to the nearest Rand) (4 marks) 5.1.4 Internal Rate of Return (expressed to two decimal places) of Project Alpha, using interpolation. (4 marks) INFORMATION Investec Ltd has a choice between purchasing machinery for two projects viz. Project Alpha and Project Beta. Project Alpha is expected to generate a net profit of R640 000 per year for four years whilst the net profit generated by Project Beta is expected to be R150 000 (year 1), R380 000 (year 2), R1 080000 (year 3) and R1 050000 (year 4). Each project requires an investment of R5 000000 . Project Beta is expected to have a scrap value of R100 000 whilst no scrap value is anticipated for Project Alpha. The straight-line method of depreciation is used. The cost of capital is 12%. Ignore taxes. 5.2 REQUIRED Use the information provided below to calculate the weighted average cost of capital (expressed to two decimal places). (6 marks) INFORMATION MVP Limited approached Nedbank for a long-term loan to partly fund the purchase of expensive, specialised machinery. Nedbank is prepared to grant a loan of R400 000, at a cost of 20%. MVP Limited uses the aftertax cost of debt and the marginal tax rate is 30%. MVP Limited also aims to sell 100000 ordinary shares at R6 each. The cost of the ordinary shares using the capital asset pricing model is 19.90%