Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: Record the following transactions on the books of Hope Hospital, which follows FASB (not-for-profit) and AICPA standards. The year is 2020. (If no entry

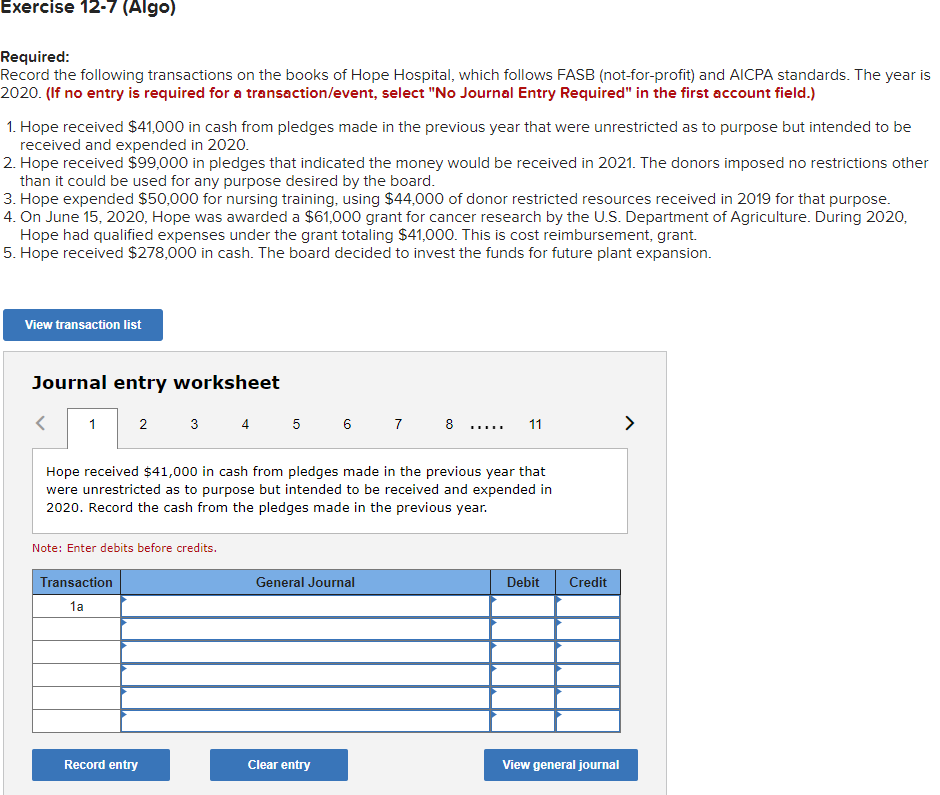

Required: Record the following transactions on the books of Hope Hospital, which follows FASB (not-for-profit) and AICPA standards. The year is 2020. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 1. Hope received $41,000 in cash from pledges made in the previous year that were unrestricted as to purpose but intended to be received and expended in 2020 . 2. Hope received $99,000 in pledges that indicated the money would be received in 2021 . The donors imposed no restrictions other than it could be used for any purpose desired by the board. 3. Hope expended $50,000 for nursing training, using $44,000 of donor restricted resources received in 2019 for that purpose. 4. On June 15, 2020, Hope was awarded a $61,000 grant for cancer research by the U.S. Department of Agriculture. During 2020, Hope had qualified expenses under the grant totaling $41,000. This is cost reimbursement, grant. 5. Hope received $278,000 in cash. The board decided to invest the funds for future plant expansion. Journal entry worksheet 34567811> Hope received $41,000 in cash from pledges made in the previous year that were unrestricted as to purpose but intended to be received and expended in 2020. Record the cash from the pledges made in the previous year. Note: Enter debits before credits

Required: Record the following transactions on the books of Hope Hospital, which follows FASB (not-for-profit) and AICPA standards. The year is 2020. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 1. Hope received $41,000 in cash from pledges made in the previous year that were unrestricted as to purpose but intended to be received and expended in 2020 . 2. Hope received $99,000 in pledges that indicated the money would be received in 2021 . The donors imposed no restrictions other than it could be used for any purpose desired by the board. 3. Hope expended $50,000 for nursing training, using $44,000 of donor restricted resources received in 2019 for that purpose. 4. On June 15, 2020, Hope was awarded a $61,000 grant for cancer research by the U.S. Department of Agriculture. During 2020, Hope had qualified expenses under the grant totaling $41,000. This is cost reimbursement, grant. 5. Hope received $278,000 in cash. The board decided to invest the funds for future plant expansion. Journal entry worksheet 34567811> Hope received $41,000 in cash from pledges made in the previous year that were unrestricted as to purpose but intended to be received and expended in 2020. Record the cash from the pledges made in the previous year. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started