Answered step by step

Verified Expert Solution

Question

1 Approved Answer

required solution . The company management is considering expansion of operations at a cost of 200,000. The expansion will result in additional sales of 450,000

required solution .

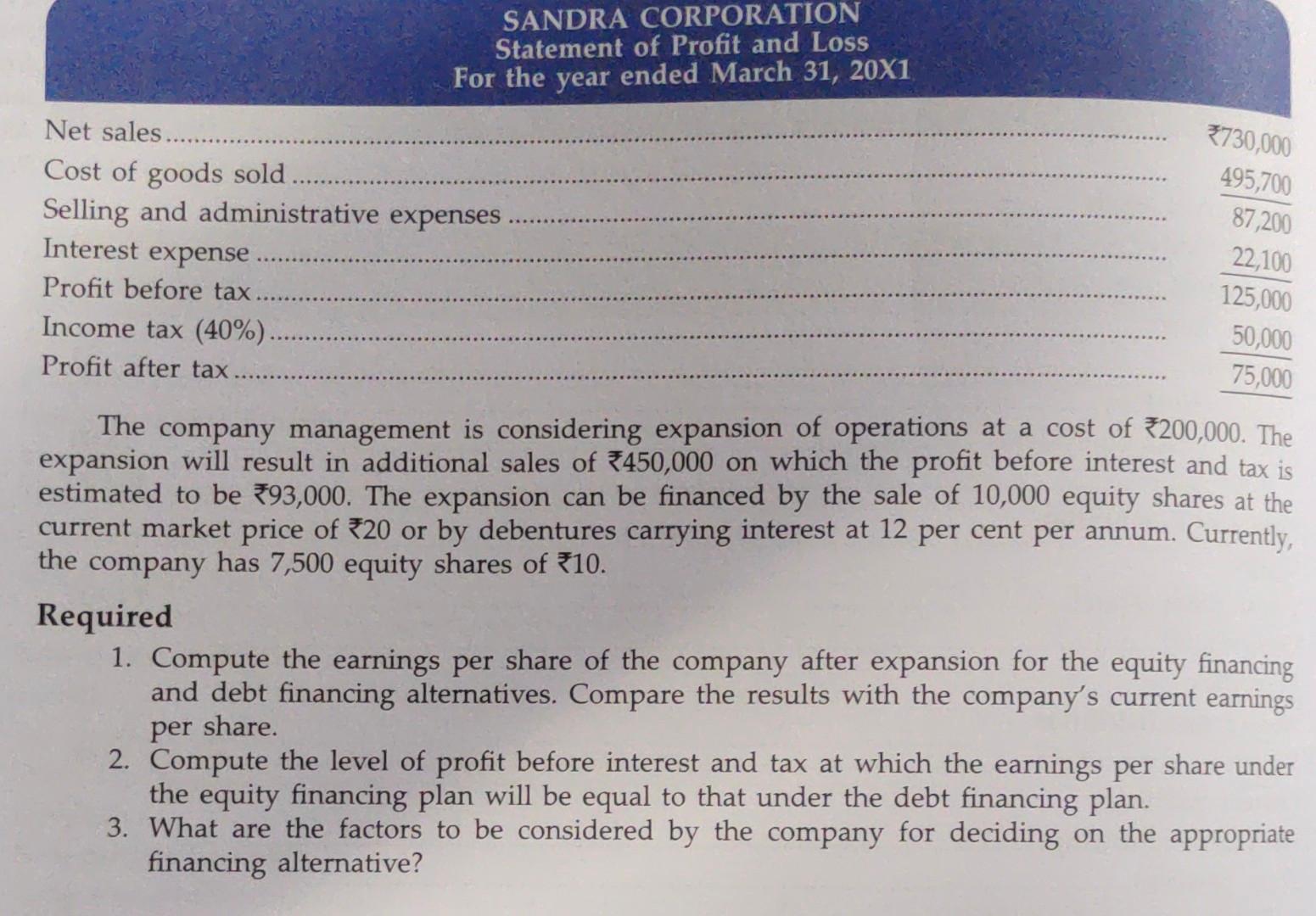

The company management is considering expansion of operations at a cost of 200,000. The expansion will result in additional sales of 450,000 on which the profit before interest and tax is estimated to be 93,000. The expansion can be financed by the sale of 10,000 equity shares at the current market price of 20 or by debentures carrying interest at 12 per cent per annum. Currently, the company has 7,500 equity shares of 10. Required 1. Compute the earnings per share of the company after expansion for the equity financing and debt financing alternatives. Compare the results with the company's current earnings per share. 2. Compute the level of profit before interest and tax at which the earnings per share under the equity financing plan will be equal to that under the debt financing plan. 3. What are the factors to be considered by the company for deciding on the appropriate financing alternativeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started