Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required:- Using the information provided, prepare a statement of cash flows for the year ended December 31, 2020. Saved Help Laura's Fresh Cooking Inc. began

Required:- Using the information provided, prepare a statement of cash flows for the year ended December 31, 2020.

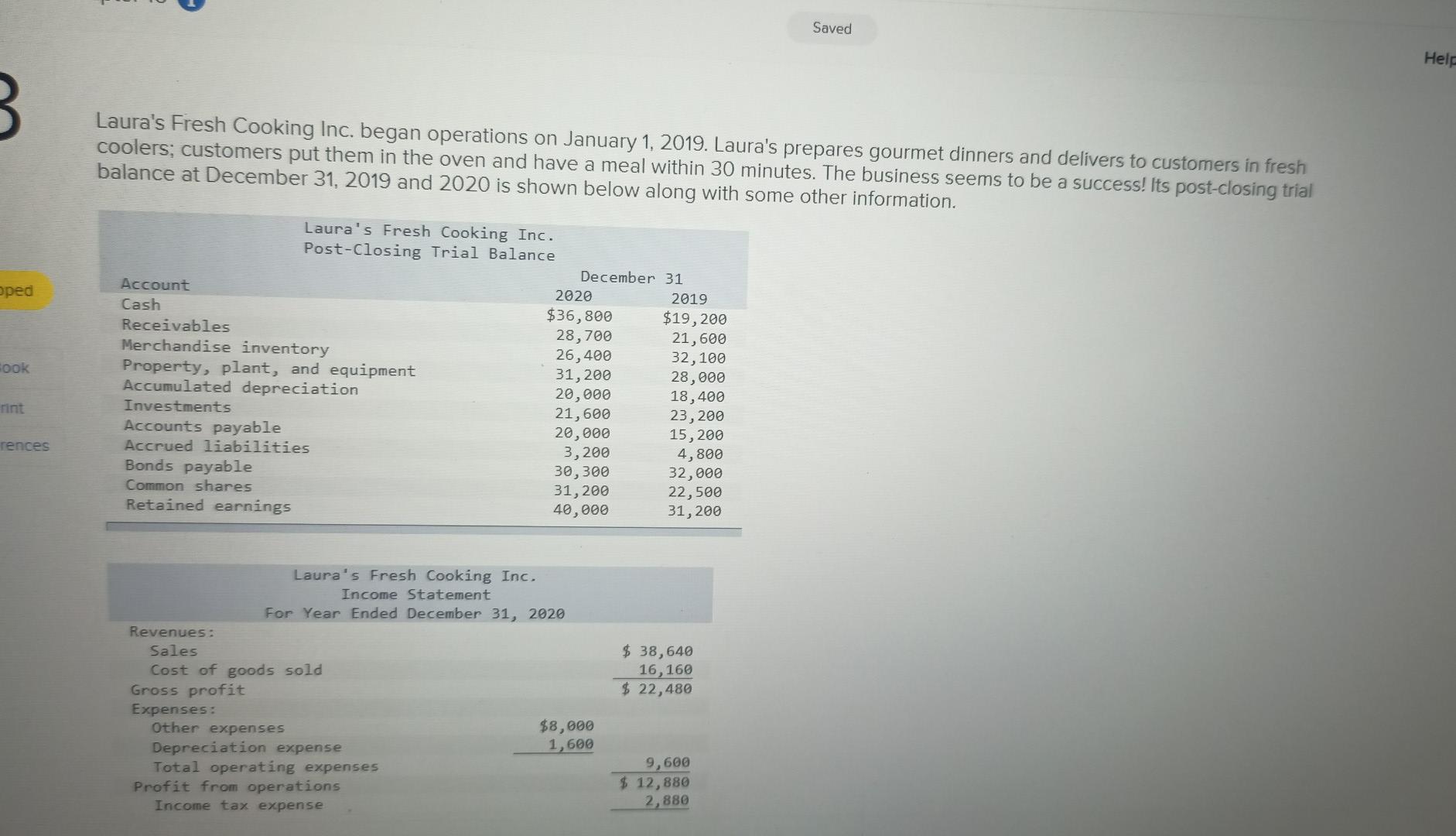

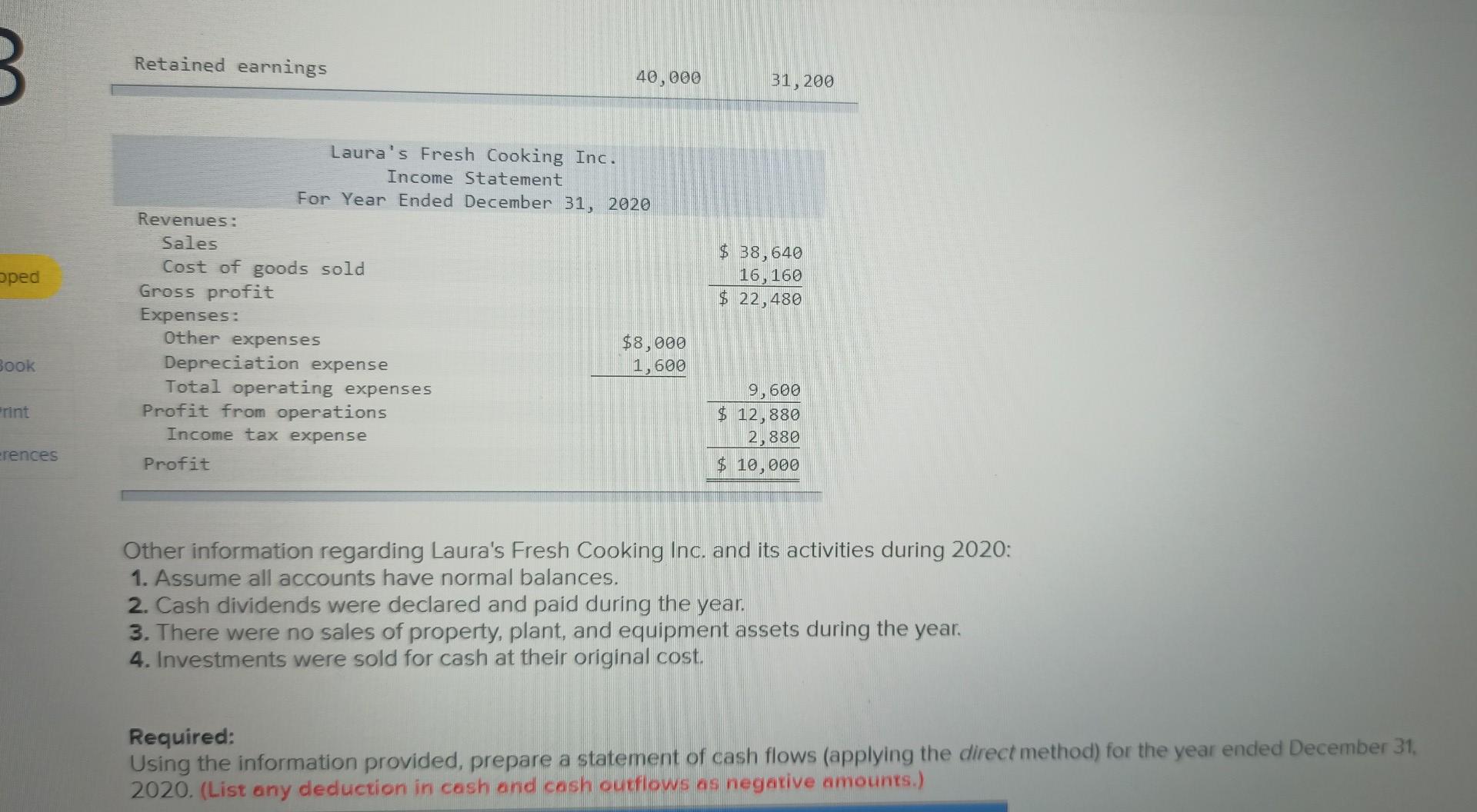

Saved Help Laura's Fresh Cooking Inc. began operations on January 1, 2019. Laura's prepares gourmet dinners and delivers to customers in fresh coolers, customers put them in the oven and have a meal within 30 minutes. The business seems to be a success! Its post-closing trial balance at December 31, 2019 and 2020 is shown below along with some other information. oped ook Laura's Fresh Cooking Inc. Post-Closing Trial Balance December 31 Account 2020 2019 Cash $36,800 $19,200 Receivables 28,700 21,600 Merchandise inventory 26,400 32,100 Property, plant, and equipment 31,200 28,000 Accumulated depreciation 20,000 18,400 Investments 21,600 23,200 Accounts payable 20,000 15, 200 Accrued liabilities 3,200 4,800 Bonds payable 30,300 32,000 Common shares 31,200 22,500 Retained earnings 40,000 31,200 rint rences Laura's Fresh Cooking Inc. Income Statement For Year Ended December 31, 2020 Revenues: Sales Cost of goods sold Gross profit Expenses : Other expenses $8,000 Depreciation expense 1,600 Total operating expenses Profit from operations Income tax expense $ 38,640 16,160 $ 22,480 9,600 $ 12,880 2,880 Retained earnings 40,000 31,200 oped Laura's Fresh Cooking Inc. Income Statement For Year Ended December 31, 2020 Revenues: Sales Cost of goods sold Gross profit Expenses: Other expenses $8,000 Depreciation expense 1,600 Total operating expenses Profit from operations Income tax expense $ 38,640 16,160 $ 22,480 Book Erint 9,600 $ 12,880 2, 880 $ 10,000 erences Profit Other information regarding Laura's Fresh Cooking Inc. and its activities during 2020: 1. Assume all accounts have normal balances. 2. Cash dividends were declared and paid during the year. 3. There were no sales of property, plant, and equipment assets during the year, 4. Investments were sold for cash at their original cost. Required: Using the information provided, prepare a statement of cash flows (applying the direct method) for the year ended December 31, 2020. (List any deduction in cash and cash outflows as negative amounts.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started