During 2019 High Tech Luxury Appliances sold 400 appliances worth $2,000,000. Each appliance comes with a three-year warranty, which High Tech estimates will cost

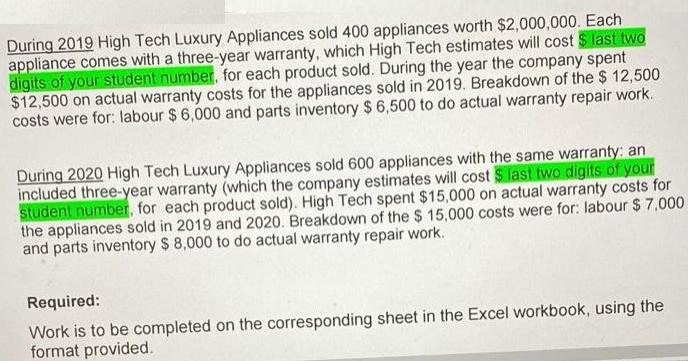

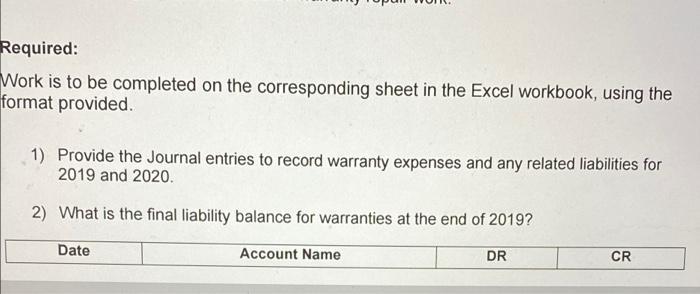

During 2019 High Tech Luxury Appliances sold 400 appliances worth $2,000,000. Each appliance comes with a three-year warranty, which High Tech estimates will cost $ last two digits of your student number, for each product sold. During the year the company spent $12,500 on actual warranty costs for the appliances sold in 2019. Breakdown of the $ 12,500 costs were for: labour $ 6,000 and parts inventory $ 6,500 to do actual warranty repair work. During 2020 High Tech Luxury Appliances sold 600 appliances with the same warranty: an included three-year warranty (which the company estimates will cost $ last two digits of your student number, for each product sold). High Tech spent $15,000 on actual warranty costs for the appliances sold in 2019 and 2020. Breakdown of the $ 15,000 costs were for: labour $ 7,000 and parts inventory $ 8,000 to do actual warranty repair work. Required: Work is to be completed on the corresponding sheet in the Excel workbook, using the format provided. Required: Work is to be completed on the corresponding sheet in the Excel workbook, using the format provided. 1) Provide the Journal entries to record warranty expenses and any related liabilities for 2019 and 2020. 2) What is the final liability balance for warranties at the end of 2019? Date Account Name DR CR

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

G H student No taken as 50 1 Account Title and Description Debit Credit Date Year 201...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started