Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: (a) Calculate the expected return on VS Bhd.'s portfolio of instruments. (b) Calculate the portfolio beta and the required rate of return for VS

Required:

(a) Calculate the expected return on VS Bhd.'s portfolio of instruments.

(b) Calculate the portfolio beta and the required rate of return for VS Bhd.'s portfolio.

(c) Discuss whether the dividend growth model is a superior valuation of the cost of equity compared to the capital asset pricing model.

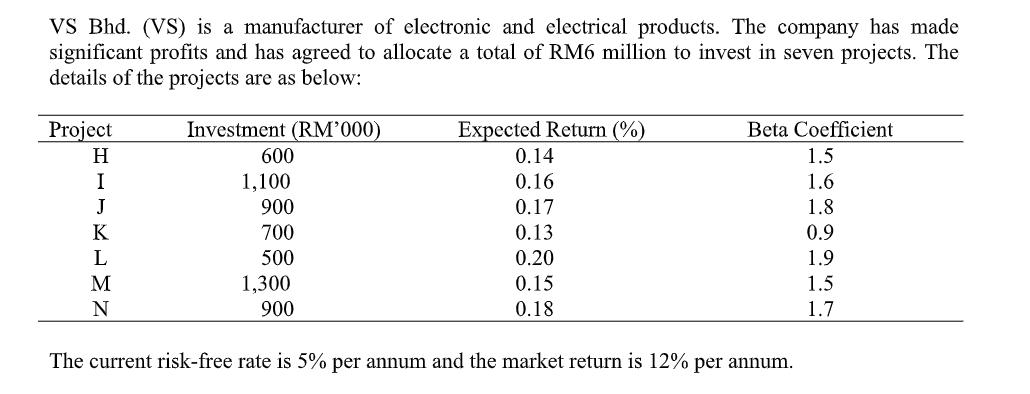

VS Bhd. (VS) is a manufacturer of electronic and electrical products. The company has made significant profits and has agreed to allocate a total of RM6 million to invest in seven projects. The details of the projects are as below: Investment (RM'000) Project H I J K L M N 600 1,100 900 700 500 1,300 900 Expected Return (%) 0.14 0.16 0.17 0.13 0.20 0.15 0.18 Beta Coefficient 1.5 1.6 1.8 0.9 1.9 1.5 1.7 The current risk-free rate is 5% per annum and the market return is 12% per annum.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A The expected return is calculated by multiplying the weight of each asset by its expected return Then add the values for each investment to g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started