Answered step by step

Verified Expert Solution

Question

1 Approved Answer

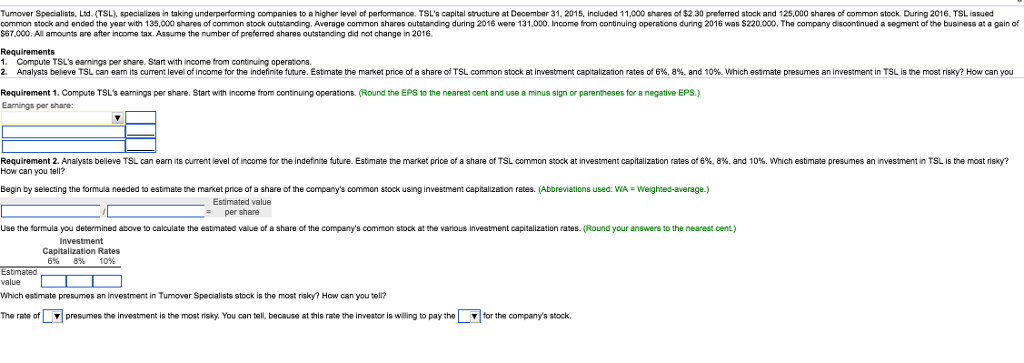

Requirement 1: compute TSL's earnings per share, Start with income from continuing operations. (Round the EPS to the nearest cent and use a minus sign

Requirement 1: compute TSL's earnings per share, Start with income from continuing operations. (Round the EPS to the nearest cent and use a minus sign or parentheses for a negative EPS.)

Requirement 2. Analysts believe TSL can earn its current level of income for the indefinite future. Estimate the market price of a share of TSL common stock at investment capitalization rates of 6% , 8%, and 10%.  Which estimate presumes an investment in TSL is the most risky? How can you tell?

Which estimate presumes an investment in TSL is the most risky? How can you tell?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started