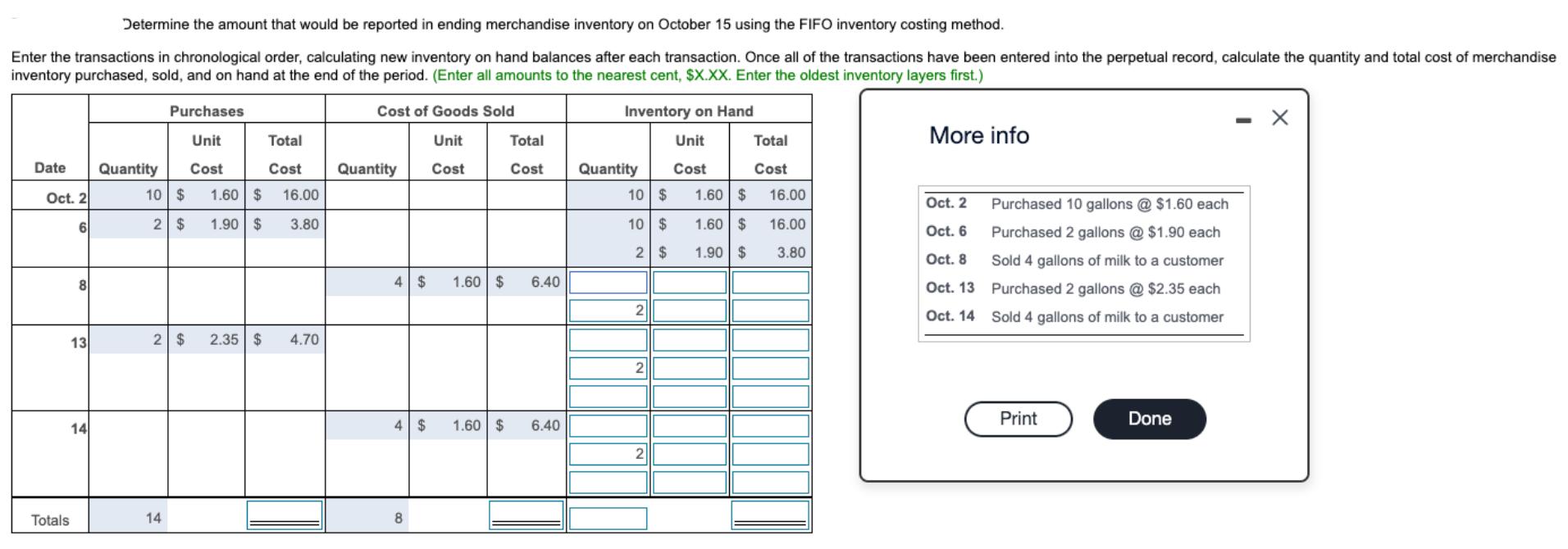

Determine the amount that would be reported in ending merchandise inventory on October 15 using the FIFO inventory costing method. Enter the transactions in

Determine the amount that would be reported in ending merchandise inventory on October 15 using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter all amounts to the nearest cent, $X.XX. Enter the oldest inventory layers first.) Purchases Cost of Goods Sold Inventory on Hand Unit Date Oct. 2 Quantity 10 $ Cost Total Cost Unit Total Unit Total More info Quantity Cost Cost Quantity Cost Cost 1.60 $ 16.00 10 $ 6 2 $ 1.90 $ 3.80 10 $ 2 $ 1.60 $ 16.00 1.60 $ 16.00 1.90 $ 3.80 Oct. 2 Oct. 6 Oct. 8 8 4 $ 1.60 $ 6.40 2 Oct. 13 Oct. 14 Purchased 10 gallons @ $1.60 each Purchased 2 gallons @ $1.90 each Sold 4 gallons of milk to a customer Purchased 2 gallons @ $2.35 each Sold 4 gallons of milk to a customer Totals 13 2 $ 2.35 $ 4.70 14 2 4 $ 1.60 $ 6.40 2 8 14 Print Done -

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

The image you sent is a practice problem on the FirstInFirstOut FIFO inventory costing method FIFO assumes that the first items purchased are the first items sold This can be contrasted with LastInFir...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started