Question

Requirement 1. Show the amount of the 2017 advertising cost ($1,300,000) that would be allocated to each of the divisions under the following criteria: (a)

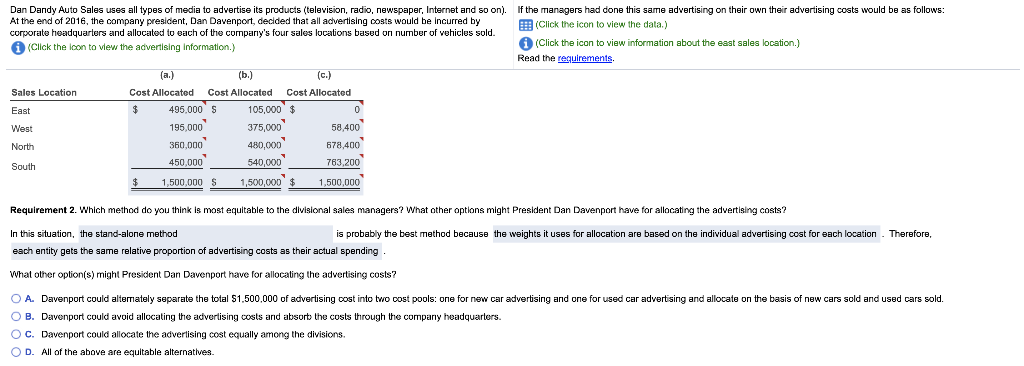

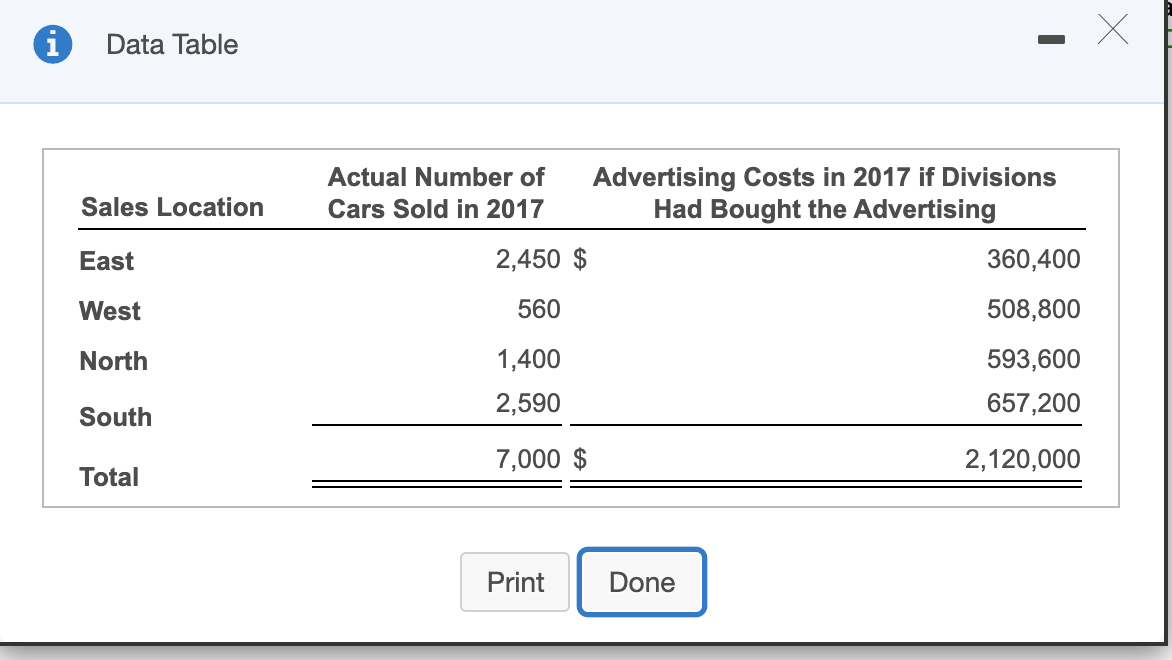

Requirement 1. Show the amount of the 2017 advertising cost ($1,300,000) that would be allocated to each of the divisions under the following criteria: (a) Dougherty's allocation method based on number of cars sold, (b) the stand-alone method if divisions had done their own advertising, (c) the incremental-allocation method, with divisions ranked on the basis of dollars they would have spent on advertising in 2017. (Do not round intermediary calculations. Round the final answer to the nearest whole dollar. Enter a "0" for amount with a zero values.)

NOTE: Please ignore the numbers in the first photos. The real data is from the other 2 photos.

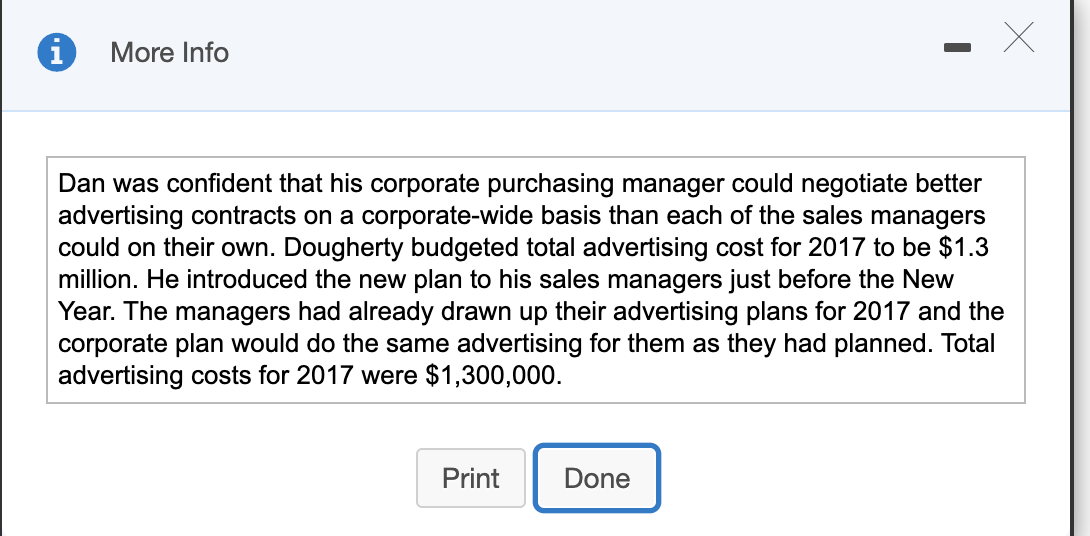

Dan Dandy Auto Sales uses all types of media to advertise its products (television, radio, newspaper, Internet and so on). If the managers had done this same advertising on their own their advertising costs would be as follows: At the end of 2016, the company president, Dan Davenport, decided that all advertising costs would be incurred by (Click the icon to view the data) corporate headquarters and allocated to each of the company's four sales locations based on number of vehicles sold. (Click the loon to view the advertising Information.) (Click the icon to view information about the east sales location.) Read the requirements (a.) a. (b.) . (c.) Sales Location Cost Allocated Cost Allocated Cost Allocated East $ 495.000 S 105,000 $ 0 West 195.000 375,000 58,400 North 360,000 480,000 678,400 450,000 South 540,000 763,200 $ 1,500,000 $ 1.500.000 $ 1,500,000 Requirement 2. Which method do you think is most equitable to the divisional sales managers? What other options might President Dan Davenport have for allocating the advertising costs? In this situation, the stand-alone method is probably the best method because the weights it uses for allocation are based on the individual advertising cost for each location. Therefore, each entity gets the same relative proportion of advertising costs as their actual spending What other option(s) might President Dan Davenport have for allocating the advertising costs ? O A Davenport could alterately separate the total $1,500,000 of advertising cost into two cost pools: one for new car advertising and one for used car advertising and allocate on the basis of new cars sold and used cars sold. OB. Davenport could avoid allocating the advertising costs and absort the costs through the company headquarters. OC. Davenport could allocate the advertising cost equally among the divisions. D. All of the above are equitable alternatives. i Data Table - Sales Location Actual Number of Advertising Costs in 2017 if Divisions Cars Sold in 2017 Had Bought the Advertising 2,450 $ 360,400 East West 560 508,800 North 1,400 2,590 593,600 657,200 South 7,000 $ 2,120,000 Total Print Done i X More Info Dan was confident that his corporate purchasing manager could negotiate better advertising contracts on a corporate-wide basis than each of the sales managers could on their own. Dougherty budgeted total advertising cost for 2017 to be $1.3 million. He introduced the new plan to his sales managers just before the New Year. The managers had already drawn up their advertising plans for 2017 and the corporate plan would do the same advertising for them as they had planned. Total advertising costs for 2017 were $1,300,000. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started